Unapplied cash payment and how to reconcile transactions

Reading Time: 3 minutesThis article will discuss an unapplied cash payment and how to reconcile such transactions.

Small business owners sometimes receive or make payments without keeping records of the invoices or bills. This results in the inaccurate reporting of income and expenses.

Let’s get into understanding how to deal with such situations.

What is an unapplied cash payment?

Unapplied cash payment is a transaction you receive or make that cannot be identified or associated with a specific outstanding invoice or bill.

The date of payment is usually before the invoice or bill date.

Several transactions could create an unapplied payment situation. Some of the common ones are;

- Customer payment for goods or services without an issued invoice.

- The customer makes installment payments for goods or services.

- You make a payment to a vendor without a recorded bill.

Situations 1 & 2 can be classified under accounts receivables and Unapplied cash payment income. Situation three is under accounts payable and unapplied vendor payments.

How to fix unapplied cash payments?

When recording a payment on your accounting software, you can create them manually or by auto-syncing your bank transactions with the Bank Feed app.

In cases where payments have no invoices, your choice of accounting software allows you to connect payments to invoices to capture income efficiently.

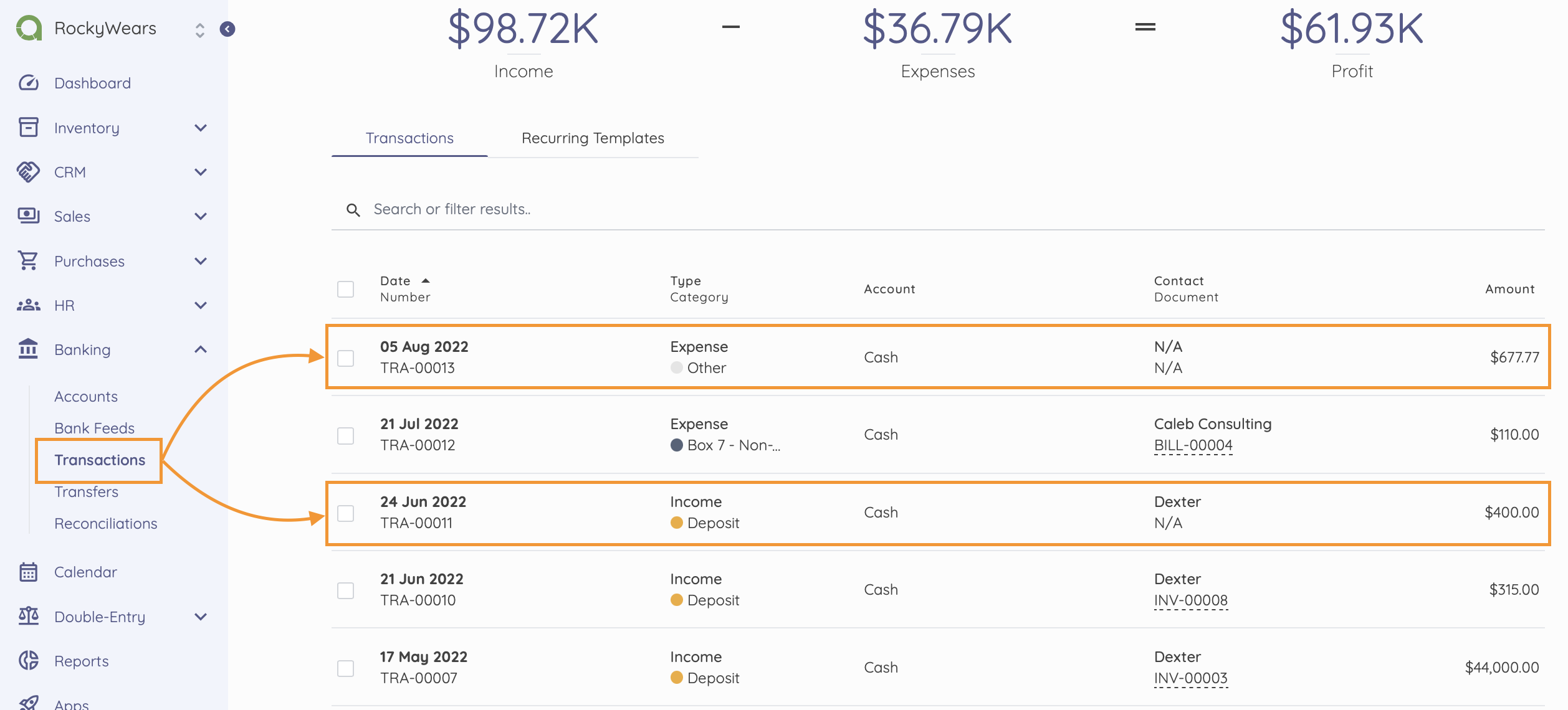

On Akaunting, users can see transactions (income or expense) that are not assigned invoices or bills.

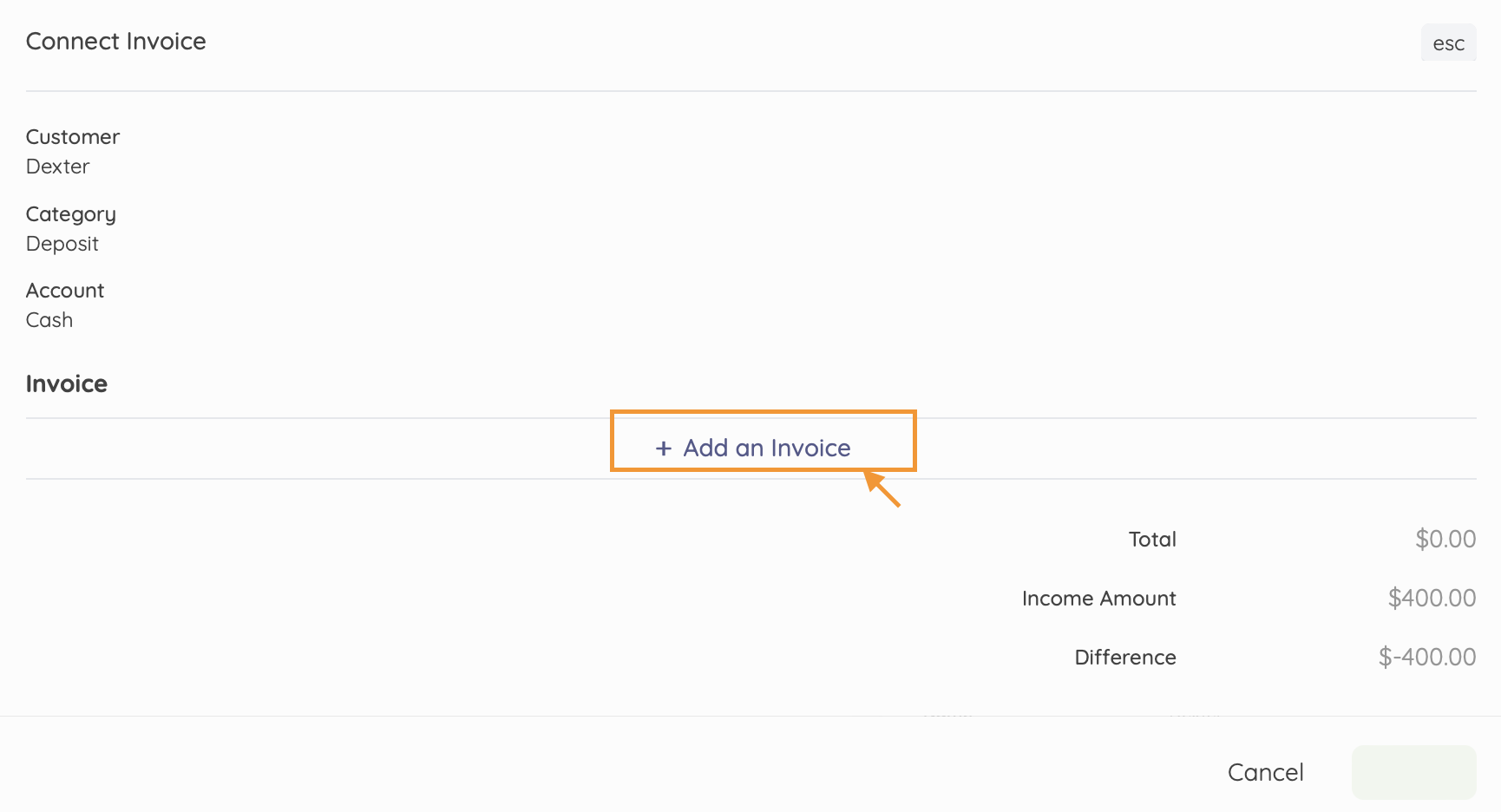

To connect an income transaction to an invoice;

- Go to Sales > Invoices.

- Create an invoice by clicking on the “New Invoice” button

- Enter invoice details using the income transaction details

- Save the new invoice

- Return to the Banking > Transactions page

- Click on the income transaction you want to connect

- From the three dots at the top page, click on Connect

- Connect the transaction to the new invoice.

This solves the challenges of unapplied cash payment income in accounts receivable.

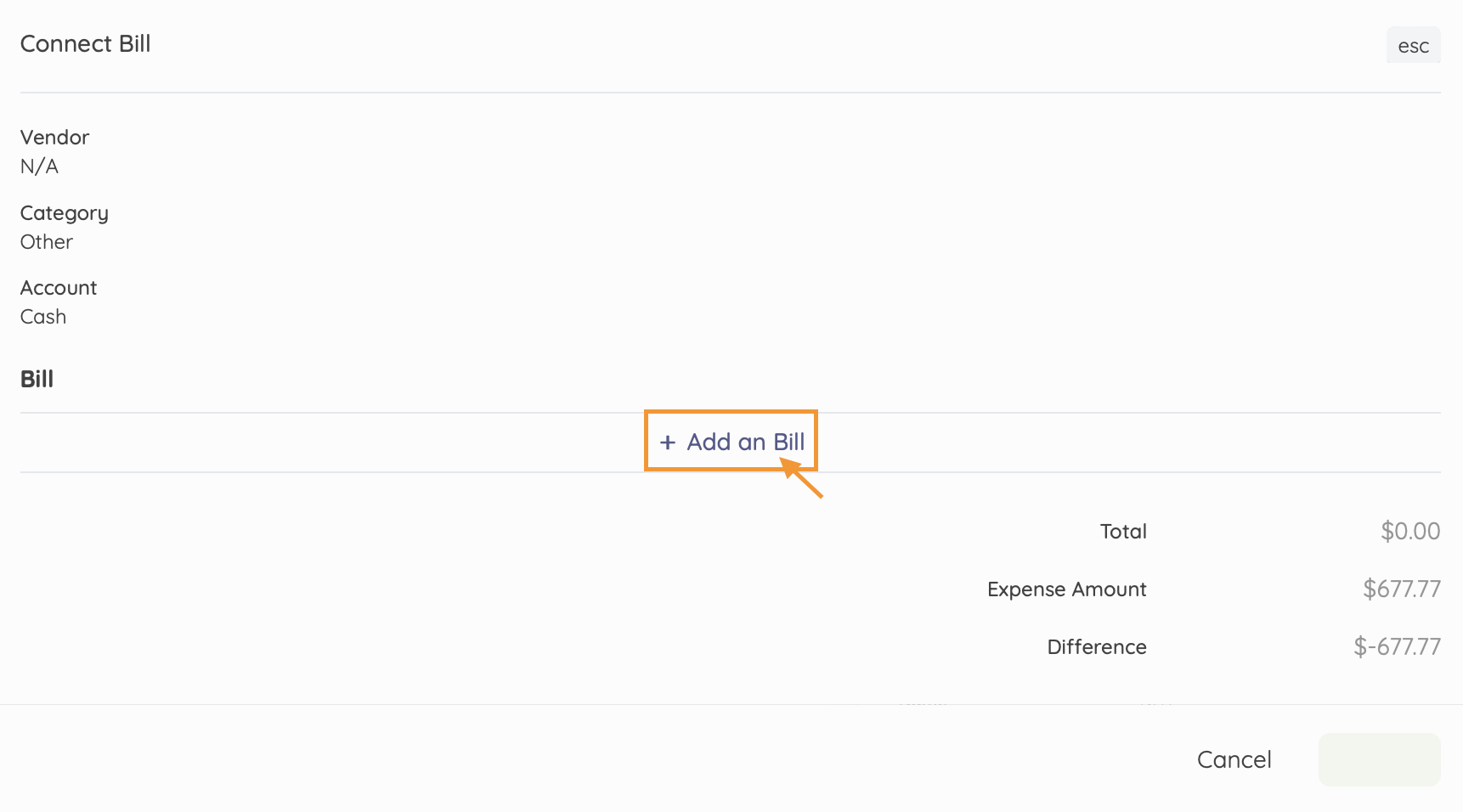

To connect a vendor payment transaction to a bill;

- Go to Purchases > Bills.

- Create a Bill by clicking on the “New Bill” button

- Enter Bill details using the expense transaction details

- Save the new bill

- Return to the Banking > Transactions page

- Click on the expense transaction you want to connect

- From the three dots at the top page, click on Connect

- Connect the transaction to the new bill.

This resolves unapplied vendor payments.

Final thoughts

Always ensure you capture every payment (income or expenses) with its associated invoice or bills.

Online accounting software such as Akaunting helps you resolve outstanding transactions that aren’t connected to any invoice or bills, ensuring you have detailed records on your balance sheet.