15 Key Factors Small Business Boards Need to Know About Financial Oversight and Transparency

Reading Time: 7 minutesYou help small businesses make decisions that keep the company moving forward.

You watch money flow and guide strategy to keep the business healthy.

The problem is that high profit numbers and unorganized processes can trick you into thinking everything is fine.

That’s why you need clear oversight and transparent financial reporting to understand the full picture.

This guide shows you how to keep finances transparent, enforce strong systems, and take action when it matters. Here’s how to make sure you and your fellow board members keep a company thriving. 👇

How Small Business Boards Can Watch and Manage Company Money (4 Essential Pillars)

Guide financial management and track money closely using the following four pillars:

Financial oversight

Make sure the company uses money correctly, follows budgets, and keeps accounts accurate. For example, review monthly budget reports, question unexpected expenses, and approve major purchases to make sure spending aligns with company goals.

You’ll also need to track revenue versus projections to spot trends early and prevent financial shortfalls.

Financial transparency

Share financial information clearly with owners, investors, and regulators.

Present quarterly financial statements in easy-to-understand formats, hold open discussions about financial risks, and communicate decisions that affect the company’s bottom line.

For instance, if the company takes on debt or makes a significant investment, document it clearly using a board resolution template and provide a clear explanation to stakeholders.

Always make sure the board documents key decisions and approvals. Every action needs a formal record to align with governance requirements and regulatory standards. (And to provide a clear reference for accountability and future audits.)

Financial checkpoints

Prioritize these important checkpoints:

- – Financial statements (including balance sheets and income statements)

- – Cash flow statements (check out the cash flow statement app on Akaunting)

- – Risk management

- – Legal compliance

- – Audit trails

Schedule independent audits to verify accuracy, monitor cash reserves to ensure the company can cover expenses, and review contracts and obligations to minimize legal risks. Maintain a clear audit trail for all financial activities, so that every transaction and approval is fully traceable.

Keep an extra eye out to identify potential financial threats. (Such as unpaid invoices or market shifts. And plan actions to mitigate them.)

Protecting Company Money

Make sure to also suggest ways to protect company money.

One way to do that is via umbrella insurance. It can help shield the business from lawsuits or claims that go beyond regular policies. (Adding this protection gives the company extra stability and shows that you’re staying on top of risks.)

Share a guide that explains what umbrella insurance is, so stakeholders understand how it works and why it matters. 👇

The following key points will focus on the above pillars. But before we get to them, bookmark this article and send it to other board members so they have this advice easily on hand.

15 Key Points To Prioritize As A Small Business Board Advisor

Here are 15 pivotal points to focus on as a small business board advisor:

1. Monitor cash flow as your truest KPI

Profit doesn’t pay bills or debt. Cash flow shows true business health, far beyond what profit numbers reveal.

Predict a rolling 13-week cash forecast every week and update it with real operational numbers.

How close are your predictions to the real numbers? Where did you go wrong and why?

Stress-test scenarios for delayed invoices, sudden revenue dips, or seasonal slowdowns. Use the forecast to decide on hiring, investments, and timing major expenses.

2. Separate responsibilities to prevent fraud

Assign billing, collections, and reconciliation to different people.

For small teams, consider implementing compensating controls, such as dual approvals, duty rotation, or cross-checks between departments. Same goes for tool logins and permissions — make sure only designated employees have access to certain software programs.

Test compliance every year and review anomalies closely. (Clear separation is how you prevent mistakes from snowballing and keep money under control without slowing down operations.)

Make sure to have a regulatory compliance guide easily accessible for every board member.

3. Test controls actively

Check sample transactions quarterly. Watch approvals occur in real-time and verify reconciliations.

Adjust processes immediately if you see gaps, and coach staff to follow them.

4. Close the books quickly to make informed decisions

Complete the monthly close in five business days.

Track delays, investigate why they happen, and fix root causes. Use close data to spot trends and adjust your forecasts. Fast closes turn raw numbers into actionable insights you can act on right away, instead of chasing stale financial reports that are no longer accurate.

5. Focus on KPIs that drive real value

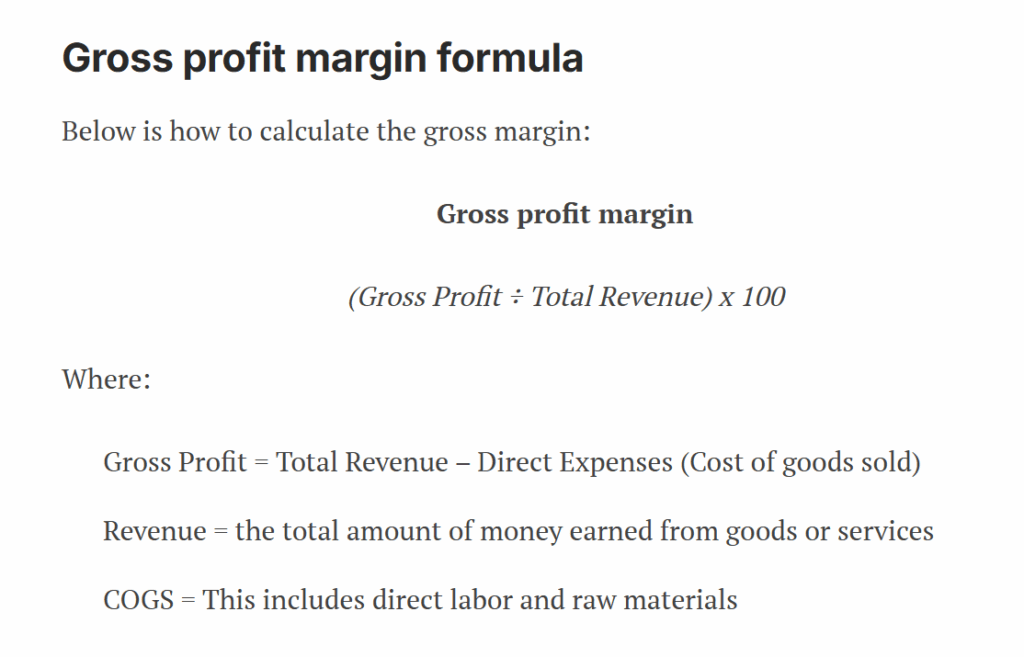

Skip metrics that look busy but don’t move the needle. Instead, track cash runway, gross margin by product, and unit economics.

Examine each metric monthly and dig into any outliers. Ask how each number leads to pricing, growth, or investment decisions.

Are they accurate? What adjustments would you recommend and why?

6. Build scenarios into forecasting

Create base, downside, and recovery scenarios each month.

Think about slow sales, late payments, unexpected costs, or other shocks. Share the plan with your team so everyone knows what steps to take if things go off track.

7. Govern expenses with clear approval rules

Set approval limits by role and dollar amount. Review expense report exceptions quarterly and follow patterns closely. Approve emergency spending only after documenting the reason and impact to prevent overspend.

Follow up on the emergency spending later. Was it really necessary? Did it deliver the intended result without creating new risks for the company?

8. Disclose related-party transactions and review them

Require teams to report any related-party deals or connections. Conduct independent reviews and require at least one independent director to sign off. This helps investors, regulators, and stakeholders feel more confident in your decisions.

9. Manage treasury actively

Review bank reconciliations, verify authorized signatures, and confirm liquidity headroom monthly. Track credit lines and interest rates — and adjust cash allocations as needed.

10. Review tax posture continuously

Analyze current and contingent exposures on a quarterly basis.

Approve structural tax moves before they touch cash. Track deferred liabilities and pre-pay obligations when possible. This is pivotal to preventing sudden cash drains and keeping your financial plan realistic.

11. Enforce clear accounting policies

Approve revenue recognition, capitalization, and reserve policies annually. Communicate policy changes and explain their impact on performance and cash flow.

12. Schedule independent audits regularly

Plan regular audits and reviews to uncover errors and increase credibility.

Review project estimates against final totals, invoices, and banking transactions.

Rotate auditors periodically and discuss findings with the board. Use their insights to improve processes. (Include financial reports and visual aids to help crystallize why these adjustments matter.)

13. Secure financial systems

Run penetration tests, enforce multi-factor authentication, and regularly review permissions. Track ERP systems, financial management software, and payment tools for vulnerabilities. Take immediate action to prevent fraud, data loss, or operational disruption.

14. Have a transparency and stakeholder communication protocol

Set a clear communication calendar and escalation protocol. Be sure to also share plain-language financial updates with key stakeholders each month.

Highlight major wins, explain performance changes, and flag risks early so everyone acts from the same page.

15. Implement whistleblower protection policies and ethics channels

Implement an anonymous reporting mechanism and make sure every issue receives timely reporting and resolution.

Publicize the channel widely, encourage employees to use it, and review patterns quarterly. Act quickly when you spot risks to keep minor problems from growing.

Wrap up

With the right board actions, you and your panel can encourage smarter financial decisions and protect company resources.

Remember to prioritize these key points:

- 1. Monitor cash flow as your truest KPI

- 2. Separate responsibilities to prevent fraud

- 3. Test controls actively

- 4. Close the books quickly to make informed decisions

- 5. Focus on KPIs that drive real value

- 6. Build scenarios into forecasting

- 7. Govern expenses with clear approval rules

- 8. Disclose related-party transactions and review them

- 9. Manage treasury actively

- 10. Review tax posture continuously

- 11. Enforce clear accounting policies

- 12. Schedule independent audits regularly

- 13. Secure financial systems

- 14. Have a transparency and stakeholder communication protocol

- 15. Implement whistleblower policies and ethics channels

And if you need a reliable financial reporting tool, try Akaunting, a free, open-source online accounting software for small businesses. (Where you can manage financial statements too).

FAQs: Small Business Boards and Financial Oversight

What does a small business board do?

A small business board advises leadership, tracks finances, and helps manage risks to keep the company healthy and growing.

Do board members get paid in small businesses?

Some small businesses pay their board members, but many serve voluntarily. Volunteers often join to share expertise, build networks, and shape the company’s success.

What is financial oversight for a small business board?

Financial oversight involves reviewing budgets, monitoring cash flow, checking accounts, and ensuring that funds are used properly. Boards also track KPIs and approve major financial decisions.

What are the key financial checkpoints boards focus on?

Boards track cash flow, financial statements, risk management, and regulatory compliance. They also lead audits and contingency planning to spot issues early and protect the company.

How does a board protect the company from risk?

Boards employ strategies such as umbrella insurance, scenario planning, and treasury controls to mitigate fraud and unexpected financial shocks. They also track financial movements against planning to make sure everything was approved and accounted for.

How often should a small business board review financials?

Most boards review key financials on a monthly or quarterly basis. These include cash forecasts, KPIs, expense approvals, and audits.

How does scenario planning help small business boards?

Scenario planning tests how the company handles slow sales, late payments, or cost spikes. Boards use it to make proactive decisions before problems escalate.

How do boards secure financial systems?

Boards mandate strong access controls, multi-factor authentication, and regular system checks to prevent fraud and operational disruptions.

About the Author

Kelly Moser is the co-founder and editor at Home & Jet, a digital magazine for the modern era. She’s also the content manager at Login Lockdown, covering the latest trends in tech, business and security. Kelly is an expert in freelance writing and content marketing for SaaS, Fintech, and ecommerce startups.