You Made $10K on TikTok—Now What? A Beginner’s Guide to Managing Creator Income

So you’ve just cashed in $10K from TikTok. That’s amazing! But here’s the twist: earning money is only half the story. The real...

Making Tax Digital for Income Tax: The Simple 2026 Guide for Sole Traders and Landlords

If you’re a sole trader or landlord in the UK, HMRC’s Making Tax Digital for Income Tax, often called MTD for IT or...

Accounting for the Algorithm: Tracking ROI on AI-Powered Content Creation vs. Custom Development Costs

As a marketing director or CMO, you’ve seen firsthand how AI has woven its way into most of the tools you use. And...

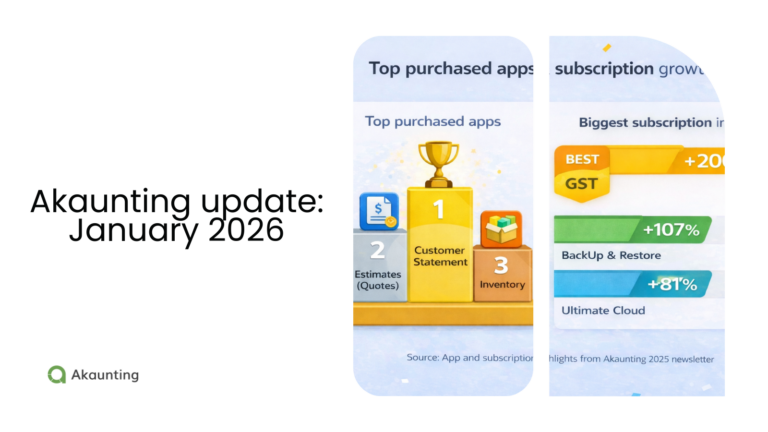

Akaunting Update: January User Insight🎉

January set the tone for the year: more teams joined Akaunting, more workflows were completed, and several countries posted standout growth across core...

How to Bridge the Gap Between Project Milestones and Profitability for Established Businesses

Hitting project milestones doesn’t mean you’re making profit. In fact, you can hit every deadline in your Gantt chart and still lose money. ...

How to Automate Rent Collection and Financial Reporting: Best Tips and Tricks

Managing a portfolio of rental properties brings freedom, scalability, and a steady stream of passive income. It also raises one big question: how...

What are VAT Returns in Accounting?

VAT returns are one of those “simple on paper, annoying in practice” admin jobs. A VAT return is the report that tells HMRC...

How Much is VAT in UK

Curious about the 2026 VAT rate in the UK? Same question as always, really: how much do you enjoy paying a little extra...

Akaunting Update: January 2026

56% of small businesses experienced late payments in 2025, with an average outstanding invoice balance of $17,500 (QB report). This shows that “Net...

Do You Need to Pay Taxes as a Content Creator? Here’s What You Should Know

Content creators must pay taxes on income from brand deals, platform payouts, affiliate links, and product sales. In most countries, creators are treated...