Accounting Software for Accountants: 9 Things to Consider

Reading Time: 5 minutesSo, you are a practicing accountant searching for the right accounting software for accountants.

Your focus is small to mid-size businesses needing your expert advice to manage their bookkeeping processes or serve as an advisor.

While some business owners would expect an accountant to suggest accounting software, others already use a solution and only want an expert to guide them on tax filing, expense/cash flow management, preparing financial statements, or meeting compliance.

In this article, we’ll address the following;

- – The Small business owner’s thoughts

- – Why do small businesses need an accountant

- – How do small businesses find accountants

- – 9 things to consider when choosing accounting software for accountants

Let’s start with,

The Small business owner’s thoughts

To understand why small businesses need your services, you should first understand the small business owner thought processes.

When budding entrepreneurs start a business, they try to minimize spending while maximizing profit from goods or services.

As such, most of the business operations are handled by the individual because hiring more hands would result in more expenses that could affect cash flow.

As the business grows with an increase in cash inflow, they realize the need to hire someone to take care of bookkeeping or act as an advisor.

That’s where you, an accountant, come in.

Let’s examine the following;

Why do small businesses need an accountant?

Below are three common reasons, among several others, depending on the business’s needs;

- – Save time

- – Avoid errors

- – Regulatory compliance

Save time

As a small business grows, there’s the need to manage accounts payable, accounts receivable, accounts payable, sales figures, payroll, and deal with tax and compliance processes.

All these cost time.

Having to deal with the expectations of clients/customers and maintaining accurate bookkeeping becomes a challenge.

To ease the stress, it makes the small business owner outsources accounting responsibilities to an expert and focuses on the core services to customers.

Avoid errors

Unforgivable accounting errors could occur due to stretching the business owner’s expertise limits.

They could overlook vital details as finances get more complex.

Accounting errors could be costly when compared to hiring an accountant.

Regulatory compliance

Small business owners understand that regulatory compliance is necessary to maintain business continuity and avoid problems with the local government.

They would hire an expert to help with complex stuff like economic uncertainties, changes in tax laws, and industry regulations.

Having decided to get an accountant, the business owner sets out to find one.

So,

Grow your practice with accounting software for accountants

How do small businesses find accountants?

Getting discovered by small businesses that need your expertise requires knowledge of the platforms they actively operate on, their search queries, and software preference.

Social media platforms with active small businesses

According to Meta, besides having 2.94 billion monthly active users, over 200 million small businesses are on Facebook.

These statistics also cover Instagram, which is a child company of Meta. Tiktok, Pinterest, and Twitter make up the top 5 list.

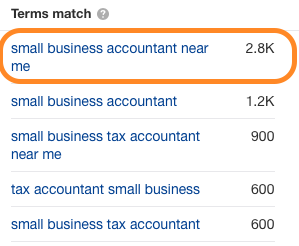

The search query

Ahref data reveals that the common search term small businesses in need of accountants is

“small business accountant near me,” with an average of 2,800 monthly searches.

Other popular searches are Small business accountants, Small business tax accountants near me, among other queries.

Localizing your practice website with key phrases like “Small business accountant in *insert your location” opens up the possibility of getting discovered by small businesses.

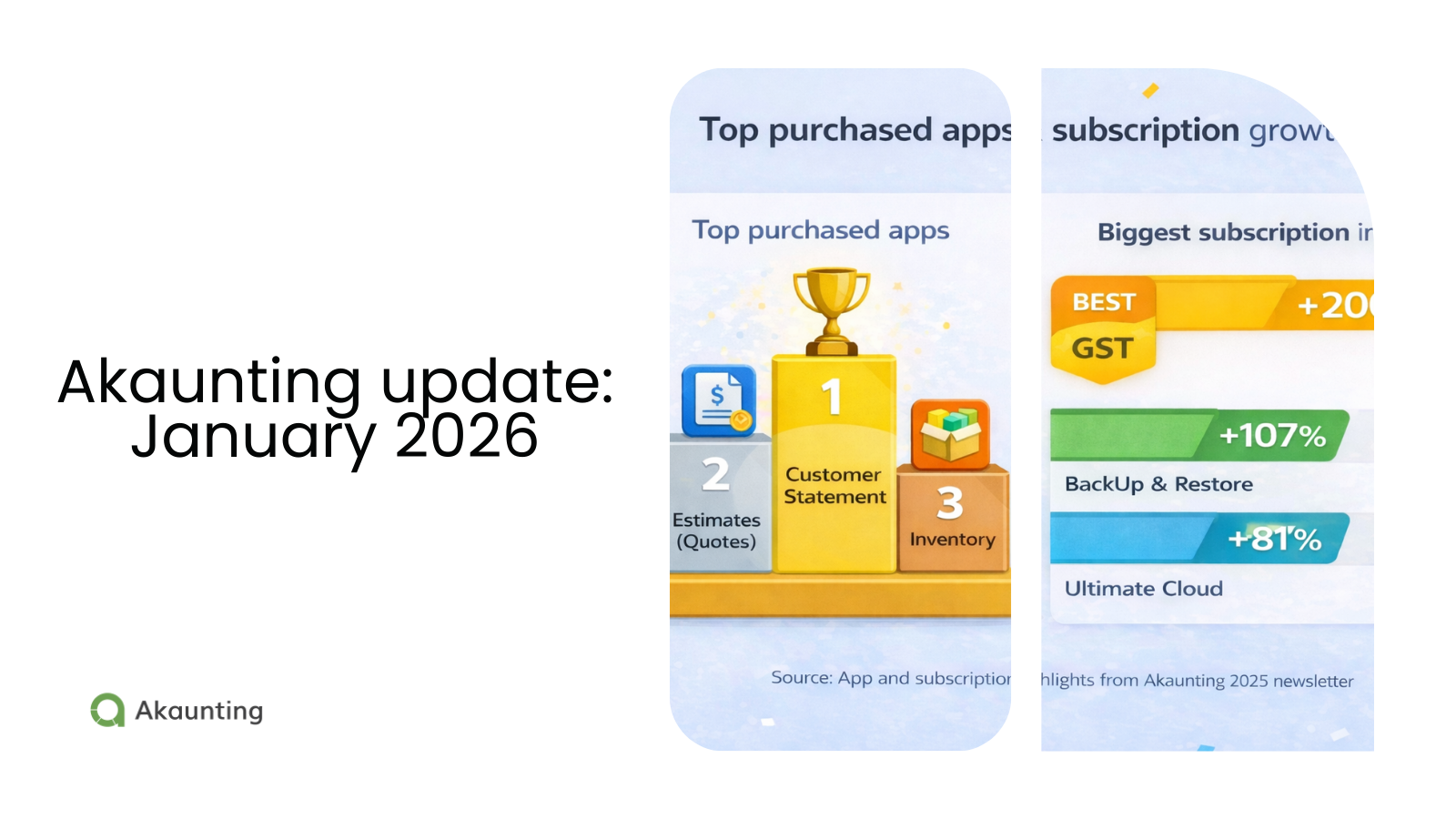

Software preference

As mentioned earlier, small businesses are always looking for potential ways to minimize expenses.

Hence, their choice of accounting software would help with little or no expenses and delivers the essential functions to handle daily bookkeeping processes.

Akaunting allows small businesses to send unlimited invoices and receive payments within 1 to 2 days.

With over 100k users worldwide, Akaunting is one of the choice accounting software for entrepreneurs and freelancers.

And now, let’s highlight;

9 things to consider when choosing accounting software for accountants

- – Ability to manage multiple companies

- – Keep up with compliance

- – Grow your practice

- – Collaboration with stakeholders

- – Scale client’s business

- – Automate processes

- – Support and upgrades

- – Add-on features to customize accounting services

- – Security of financial data

Ability to manage multiple companies

Because clients are likely to increase, accounting software that allows you to manage multiple companies with one login access is best.

You can track income/expenses, collaborate, reconcile transactions, and always keep your client’s books balanced by simply switching dashboards.

Keep up with compliance

Online accounting software should be compliant with local authorities to enable you to meet up with regulatory requirements.

Akaunting‘s business solution apps, such as the MDT, Form 1099, GST, and Double Entry, help you keep up with tax filing and reporting requirements.

You don’t miss out on anything.

Grow your practice

Small businesses worldwide need expert accounting services.

Some accounting software companies allow you to connect with small businesses through partnership programs.

With 100,000+ small businesses around the world using Akaunting, you spend less time scouting for clients and connect with those that need your expert accounting services to grow finances.

Collaboration with stakeholders

Managing your client’s bookkeeping process may require you to share dashboards or reports with them or team members.

Also, you may consider hiring more hands to handle the increasing number of clients and tasks.

Accounting software that allows you to add multiple stakeholders, collaborate, and define access levels for each, makes the job more convenient.

Scale client’s business

You should consider if the software limits the number of customers or vendors you can add.

Some accounting software limits the number of customers you can create. To get more customer or vendor slots, you’d have to pay more.

Akaunting allows you to add and manage an unlimited list of your client’s customers and vendors.

You don’t pay for simple functions that could represent growth for your client’s business.

Automate processes

Working with accounting software that removes most manual processes makes your job easier and more convenient.

You should be able to automate bills, invoices, and reports, which saves productive time to be more of an advisor to clients.

Support and upgrades

As technology evolves, accounting does as well.

It would help if you worked with up-to-date software with the latest technologies that keep up with regulatory changes.

Also, ensure that the software team has fantastic support.

Add-on features to customize accounting services

Some accounting softwares offer you the fundamental solutions you need to manage clients’ bookkeeping needs. This could be limiting.

As a practicing accountant, you are privy to clients from different sectors and countries that may require additional services.

Add-on features bring extra functionality to your accounting offering. For example, a client may want to accept payments online or manage an e-commerce platform with loads of inventory.

Some add-ons allow you to meet tax regulations in different countries.

Akaunting offers you the option of choosing from 100+ add-on apps that customize the client’s accounting experience.

Security of Financial Data

Security is a fundamental yet significant thing for businesses.

Securing your client’s financial data should be paramount to your practice.

It would serve you best to work with software that has a high-security level and does a great job at preventing unauthorized access with multi-factor authentication.

Final thoughts on accounting software for accountants

Before deciding on accounting software for your practice, you should understand your potential clients’ mindset.

Then, ask how your offerings would meet the need of businesses that need accountants.

When choosing accounting software, consider if it supports your goals and the dream of growing your practice without any limitations to your practice.

Become an Accounting Partner with Akaunting to enjoy access to over 20,000 small businesses in 100+ countries.