Personal Tax Allowance 2025/26: Am I Entitled?

Reading Time: 9 minutesPersonal Tax Allowance is the government’s way of saying: “Go ahead, make some money. We won’t bite…yet.”

Dreading the word “tax” doesn’t make it disappear, as it’s a constant that stays around, much like the reliable clock ticking or the ever-present force of gravity.

Taxes may not be fun, but a better understanding of them and how they work can help you save some money.

In this blog post, we’ll talk about:

- Personal Tax Allowance (PTA)

- Who is eligible for the personal allowance?

- UK Income Tax rates 2025/26

- Maximizing tax-free allowances

What is Personal Tax Allowance?

Imagine your income as a pie, where you enjoy a slice without sharing it with anyone else. The Personal Tax Allowance is like the slice of pie you eat tax-free. It’s the government saying, “Here’s a portion of your pie; enjoy it without worrying about us taking a bite!”

A personal tax allowance is the amount you can earn each year without paying income tax. It is one of the most critical factors that affect your tax bill.

For the tax year 2025/26, the personal allowance is £12,570. You do not have to pay any income tax if your income is below this threshold.

Keynote: The income tax personal allowance has been frozen at £12,570 since April 2022 and, under current rules, will stay at this level until April 2031. That means as your income rises, more of it is dragged into tax without the tax-free threshold increasing.

A frozen personal tax threshold means that if your income increases, you’ll have to pay more taxes based on the income tax brackets you fall into.

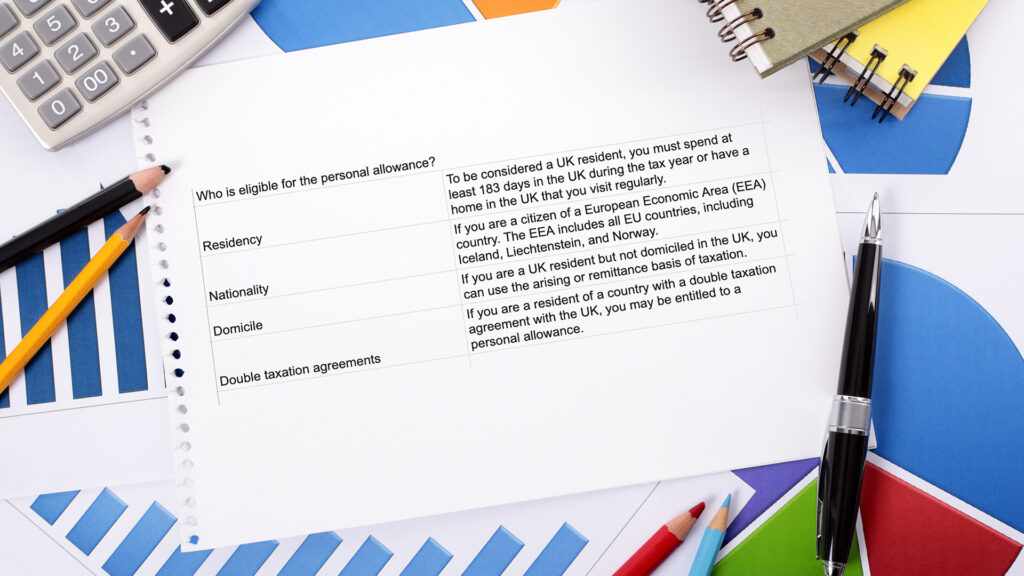

Who is eligible for the personal allowance?

Not everyone is entitled to a personal allowance. Eligibility depends on factors such as residency, nationality, domicile, and double taxation agreements.

Residency

As a UK resident, you may be entitled to a personal allowance. However, you must spend at least 183 days in the UK during the tax year or have a home in the UK that you visit regularly.

However, there are some exceptions to this rule. For example, if you are a non-domiciled UK resident who claims the remittance basis, you may not be entitled to the full personal allowance.

Non-domiciled residents are those born outside the UK and do not intend to make the UK their permanent home. If you are a non-domiciled resident and choose to claim the remittance basis, you will only pay tax on income brought into the UK.

Keynote: For non-UK residents, claiming the personal allowance is at the end of each tax year. You can send Form R43 to HM Revenue and Customs (HMRC).

Domicile

Your domicile is the country where you have your permanent home or where you intend to return to in the future. It differs from your residency, as you can reside in one country but be domiciled in another. Domicile affects your tax situation, especially if you have foreign income or assets.

If you are a UK resident but not domiciled in the UK, you have a choice of whether to use the arising basis of taxation or the remittance basis of taxation. Arising basis means you will pay UK tax on all your worldwide income and gains. A remittance basis means you will pay tax only on your UK income and gains and on your foreign income and gains that you bring to the UK.

Keynote: The arising basis taxes your worldwide income as it arises, while the remittance basis taxes your foreign income only if you bring it to the UK. The arising basis is the default method for UK residents who are also UK-domiciled. It gives you some tax-free allowances but may also cause double taxation. The remittance basis is an option for UK residents who are not UK-domiciled. It avoids double taxation but may also cost you some tax-free allowances and a remittance basis charge.

From 6 April 2025, the traditional remittance-basis regime is being replaced by a new residence-based system (often referred to as the Foreign Income and Gains regime). The previous rules, including the £30,000/£60,000 annual remittance basis charge, are being phased out.

Under the new regime, eligible new arrivals to the UK can receive 100% relief on foreign income and gains for their first four tax years of UK residence, provided they have not been UK tax-resident in any of the ten previous tax years.

If you’re considered domiciled in the UK due to meeting either Condition A or Condition B, you won’t be eligible for the remittance basis of taxation. Instead, you’ll be taxed on the arising basis.

- – Condition A: Applies if you were born in the UK with a UK domicile of origin and are a UK resident in the tax year.

- – Condition B: Applies if you’ve been a UK resident for at least 15 of the past 20 tax years.

These conditions ensure that individuals with strong ties to the UK are taxed on their worldwide income and gains.

Nationality

You are also entitled to a personal allowance if you are a citizen of a European Economic Area (EEA) country. The EEA is all EU countries, including Iceland, Liechtenstein, and Norway.

The EEA is an agreement that allows the free movement of goods, services, people, and capital within the participating countries. This means that if you are a citizen of an EEA country, you have the right to live, work, study, or retire in any other EEA country without needing a visa or a work permit. You can also access the same social and tax benefits as the host country’s citizens.

Double Taxation Agreements

These agreements are meant to prevent double taxation of income and determine which country has the right to tax certain types of income, such as pensions, dividends, or royalties.

If you are a resident of a country with a double taxation agreement with the UK, you may be entitled to a personal allowance, depending on the terms of the agreement. Check out the list of countries with double taxation agreements with the UK on the HMRC website.

In addition to the personal allowance, there are some other allowances that you may qualify for, such as:

- – Blind person’s allowance: For the 2024/25 tax year, the allowance increased to £3,070 from £2,520 in 2023/24. It rises again to £3,130 for 2025/26 and is scheduled to stay at that level through 2026/27. This extra allowance is available to anyone who is registered as blind or severely sight-impaired. And any unused amount can be transferred to a spouse or civil partner.

- – Marriage allowance: This lets you transfer 10% of your Personal Allowance to a spouse or civil partner (as long as they’re not a higher- or additional-rate taxpayer). With the Personal Allowance frozen at £12,570, the transferable amount is £1,260 for 2024/25, 2025/26, and, under current rules, will remain at this level through at least 2026/27.

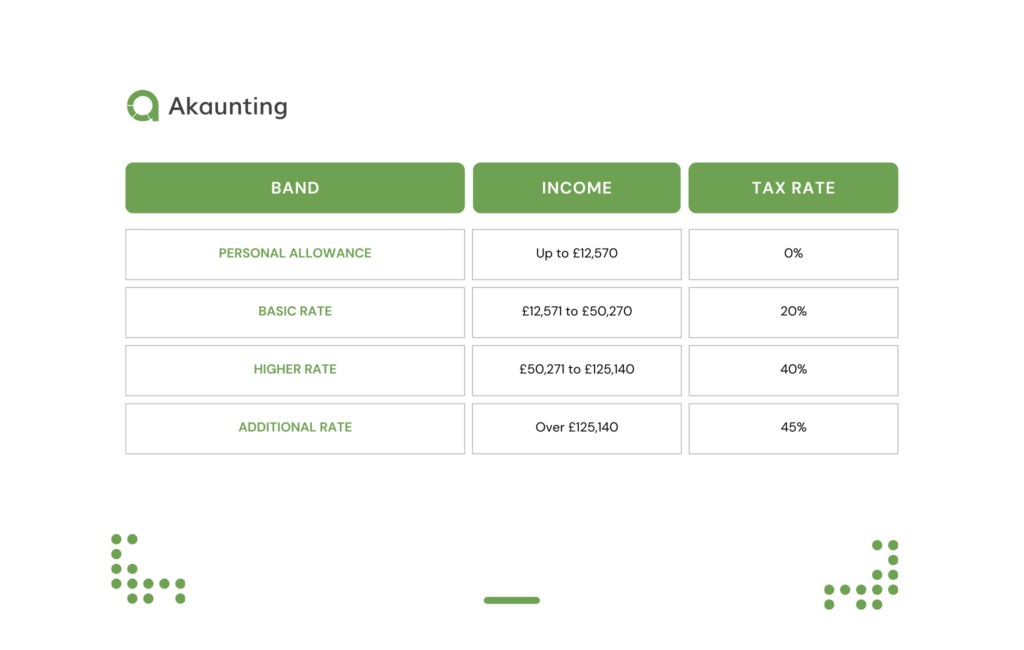

UK Income Tax Rates 2025/26

The personal allowance works with the income tax rates and brackets to determine how much tax you pay on your income. Below are the income tax rates and brackets for 2025/26:

You do not pay tax if your income is within the personal allowance. If your income exceeds the personal allowance, you pay tax at the rate that applies to each band.

For example, if your income is £40,000, you pay:

- No tax on the first £12,570

- 20% tax on the next £27,430 (40,000 – 12,570 x 20% = £5,486)

- Your income tax is £5,486 (excluding national insurance).

Another example for someone who earns £80,000

Personal Allowance:£12,570 (not subject to tax)

Basic Rate Tax: (£50,270 – £12,570) * 20% = £37,700 * 20% = £7,540

Higher Rate Tax: (£80,000 – £50,270) *40% = £29,730 40% = £11,892

Income Tax

Basic Rate Tax + Higher Rate Tax

£7,540 + £11,892 = £19,432

Your income tax estimate is £19,432. That amount excludes your National Insurance contribution, which you calculate separately and depends on employment status and earnings.

Also, you may be eligible for other tax deductions or allowances, such as pension contributions, charitable donations, or childcare costs.

To learn about monthly and daily income tax breakdowns, check out the HRMC estimate tax calculator.

Maximizing Tax-free allowances

There are numerous tax-free allowances that individuals can benefit from. These allowances can help significantly reduce your tax liability or even increase your tax refund.

Some of these allowances are automatic, meaning you don’t have to take action to use them.

By understanding the different types of tax-free allowances available to you, you can ensure that you are making the most of your tax situation.

General tax-free allowance

| Tax-free allowance | Amount | Do you need to apply for it? |

| The Personal Allowance | £12,570 | No |

| The Marriage Allowance | £1,260 | Yes |

| Blind Person’s Allowance | £3,130 | Yes |

Figures shown are for the 2025/26 tax year and are currently expected to remain unchanged to 2026/27 due to the threshold freeze.

Self-employment allowance

| Allowance | Amount | Do you need to apply for it? |

| The Trading Allowance | £1,000 | No – if you don’t earn more.Yes – if you don’t claim other expenses. |

| The Home Office Allowance | Between £10 – £26 per month | Only if you prefer it to claiming rent |

| The Mileage Allowance | 45p per mile for cars and vans up to 10,000 miles, 25p thereafter; 24p for motorcycles; 20p for bicycles | Only if you prefer it to claim fuel, etc. |

Property allowances

| Tax-free allowance | Amount | Do you need to claim it? |

| Property Income Allowance | £1,000 | Only if you don’t earn more or don’t claim expenses |

| Rent-a-Room Scheme (You can earn up to £7,500 a year tax-free from renting out a part of your home as long as you live there.) | £7,500 | If you meet the criteria. |

| Private Residence Relief | You don’t pay Capital Gains Tax when selling your home | If you did not reside in it throughout the entire period. |

The personal savings allowance allows you to earn up to £1,000 in interest from savings accounts without paying tax on it if you are a basic rate taxpayer or up to £500 if you are a higher rate taxpayer.

The dividend allowance lets you receive up to £500 of dividend income each tax year outside an ISA without paying income tax on it. This reduced allowance applies from the 2024/25 tax year onwards and remains unchanged for the 2025/26 and 2026/27 tax years.

Capital Gains Allowance

Capital Gains Tax (CGT) is the tax on profits when selling certain assets, such as property, stocks, or shares.

However, you can make a profit tax-free each year, known as the CGT allowance.

It’s worth noting that this allowance resets every tax year so you can benefit from it repeatedly. You only have to pay CGT on the profits above this tax-free amount.

The Capital Gains Tax (CGT) annual exempt amount was cut from £6,000 in 2023/24 to £3,000 from 6 April 2024. The £3,000 limit remains unchanged for the 2025/26 and 2026/27 tax years. You only pay CGT on gains above this annual exempt amount.

Check out: How Much is VAT in the UK?

Individual Savings Accounts (ISAs)

With an Individual Savings Account (ISA), you do not have to pay any tax on the interest, dividends, or capital gains you earn from your ISA.

However, there is a limit on how much you can save or invest in ISAs each tax year. The overall ISA allowance is £20,000 per tax year, and this limit remains in place for 2025/26 and 2026/27.

You can spread this £20,000 across cash ISAs, stocks & shares ISAs, innovative finance ISAs and Lifetime ISAs in any combination within the rules.

From April 2027, the government plans to restrict the cash ISA portion to £12,000 per year for adults under 65, while maintaining a £20,000 cash ISA limit for those aged 65 and over.

The overall £20,000 ISA allowance itself remains unchanged.

Pension Contributions

Pension contributions qualify you for tax-free allowance. This means you can get tax relief on the amount you put into your pension up to a specific limit.

The tax relief is based on your marginal rate of income tax, which is the highest rate of tax you pay.

For example, you get 20% tax relief on your pension contributions if you are a basic-rate taxpayer. If you are a higher-rate taxpayer, you get 40% tax relief; if you are an additional taxpayer, you get 45% tax relief.

The annual allowance limits how much you can contribute to your pension and receive tax relief.

For the 2024/25 tax year, the annual allowance increased to £60,000, or 100% of your earnings, whichever is lower, and is unchanged for 2025/26. It is expected to remain at that level in 2026/27 under current plans.

Charity Donations

Donating to charity can reduce your taxable income by the amount of your donations.

There are different ways to donate to charity and get tax relief, such as:

- – Gift Aid: This allows the charity to claim an extra 25p for every £1 donated if you are a UK taxpayer. You can also claim the difference between the essential and marginal tax rates if you are a higher or additional rate taxpayer.

- – Payroll Giving: You can donate directly from your wages or pension before deducting tax. This means you only pay tax on the amount left after your donation.

- – Donating land, property, or shares: You can donate these assets to charity without paying Capital Gains Tax. You can also claim Income Tax relief on the value of your donation.

- – Leaving gifts to charity in your Will: You can donate part or all of your real estate to charity after you die without paying any Inheritance Tax.

You can find more information on the GOV.UK website.

Wrapping up…

The personal allowance is not a one-size-fits-all concept but depends on various factors.

It is essential to keep up to date with the latest tax rules and guidance from HMRC. Also, check your tax code regularly to claim any tax reliefs or refunds you are eligible for.

If unsure about your tax situation, you can use the online tools and calculators HMRC provides or seek professional advice.