From Manual to Automated: How to Transform Your Small Business Payroll Using Software the Right Way

Reading Time: 7 minutes“Manual small business payroll is like using dial-up in a 5G world — upgrade already.”

Manual payroll might’ve worked when your team was tiny. But what happens when your company grows?

Manual payroll doesn’t scale. It’s too messy, slow, and full of risk.

That’s why more small businesses are ditching spreadsheets for automated payroll tools.

Automated payroll platforms help with everything (from tax filings to direct deposits) without the headaches.

Let’s take a closer look at why you might need to switch to automated solutions and how to pick a tool that suits your needs.

Why Automation Matters (and the Hidden Challenges of Manual Payroll)

Think manual payroll is “good enough” for now? Let’s break down why this mindset costs you more than you think.

Because here’s the thing. Paper, spreadsheets, and clunky tools require constant input and leave you prone to error.

The shift to automation helps solve these issues.

Here’s why that shift matters.

Manual Payroll Eats Up Time and Increases Errors

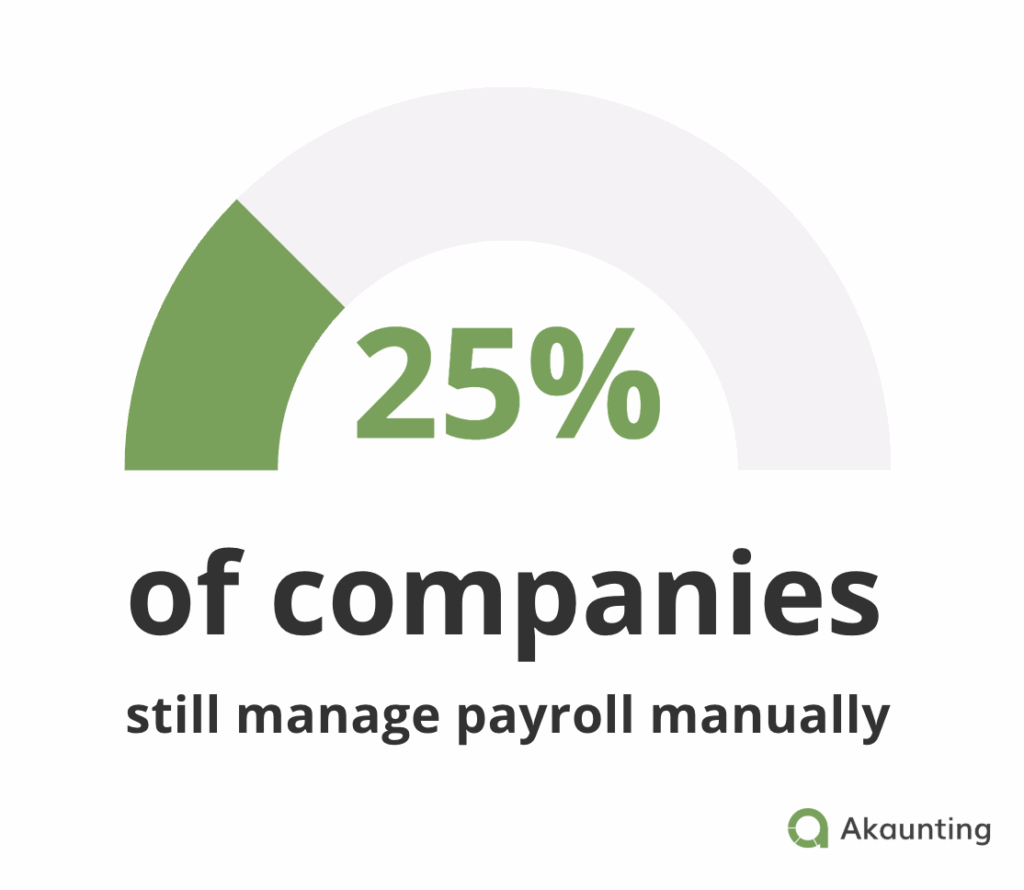

Payroll software is the most common HR technology that companies use. Despite this, a quarter of businesses still manage it manually.

(Image made by Ioana)

But here’s the issue. Digitization and automation aren’t the same.

If you’re still typing in hours, working out totals, and uploading forms, you’re in a high-effort loop. The system might be digital, but you’re still putting in a lot of manual effort.

This makes it an overwhelming time-suck. You have to do every payroll run yourself. You’re tracking employee hours, calculating overtime, and checking for mistakes every single time.

One wrong number in your payroll tax rate, and suddenly you’re in trouble.

And what’s worse is that manual processes aren’t scalable. While that one mistake might be manageable with five employees, it snowballs fast as your team grows.

The more people you hire, the harder it gets. With every new team member comes more paperwork, more variables, and more room for error.

Automation breaks the loop. It turns payroll into a background process that’s accurate, consistent, and fast.

Tax Filings and Compliance Are Too Easy to Get Wrong

Tax season is stressful. Beyond just the time it takes, there’s another layer of risk (taxes and compliance). Here’s where things get tricky fast.

You’re handling federal income tax, state income tax, and unemployment tax — often by hand. And don’t forget FUTA tax, Medicare tax, Social Security tax, and all the other federal payroll taxes.

Then there’s the paperwork — Form 941, Form 940, W-4, W-2, Form 944, and Form 1099-NEC. Managing all that manually means it’s dangerously easy to miss something.

And if you miss something, you might face penalties under IRS payroll guidelines or the Federal Unemployment Tax Act.

Many small business owners don’t even realize they’re missing something until they get a letter from the IRS. And by then, it’s too late.

Manual Processes Hurt Employee Experience and Retention

Delayed pay stubs. Confusion over employee wages. No access to benefits administration or time off balances.

The issues with manual payroll go beyond the enormous workload. Clunky processes affect your team too, impacting morale and retention.

Without an employee portal or self-service, your team is stuck waiting for answers. It’s frustrating and a fast track to high turnover.

Employees expect clarity. They want to know what’s coming in, what’s going out, and how their benefits stack up. A lack of transparency can create stress, especially when pay or benefits are at stake.

If you’re not delivering a straightforward payroll experience, your staff may look for an employer who does.

What to Look for in Automated Payroll Software

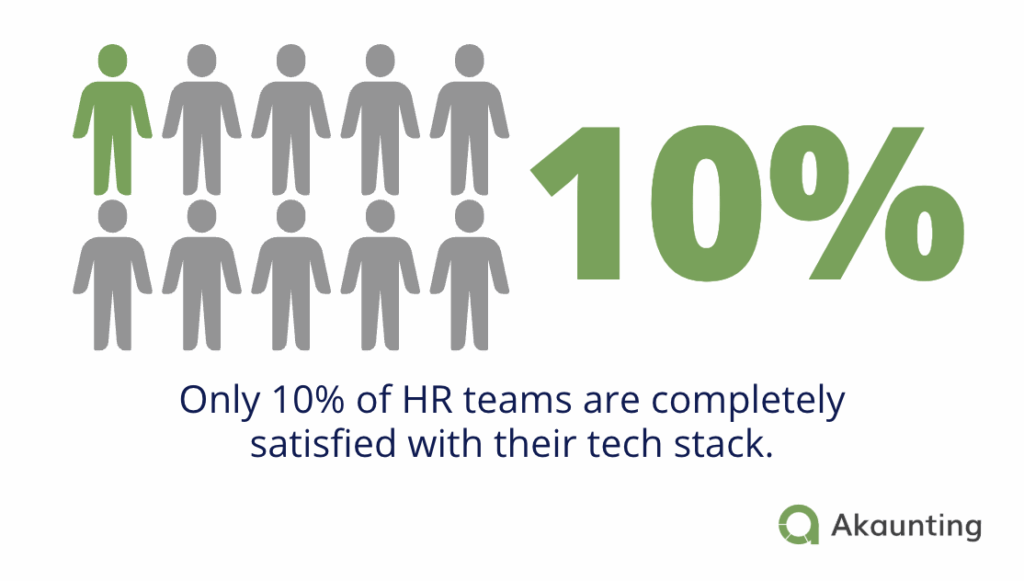

Only 10% of HR teams say they’re fully satisfied with their tech stack.

Image made by Ioana

That’s a problem. Without the right tools, even the best teams hit a wall.

Payroll software should make life easier, not harder.

So, what should you look for when picking the right payroll software? These features will help you future-proof your workflow:

Full Tax Automation and Compliance Support

A great tool handles your federal income tax withholding, tax deductions, FICA payroll taxes, and local taxes. All automatically.

It should generate the right tax forms and information returns, and then file them through the Electronic Federal Tax Payment System (EFTPS).

And once it’s filing your forms, your tool should also stay current on the latest tax code by automating compliance updates. It should integrate any new IRS payroll guidelines without manual programming.

Time-Saving Features and Smart Automation

Look for auto payroll. You set it up once, and then it runs on its own every pay period.

You want direct deposits to send money straight to employee accounts and built-in time tracking.

Make sure it can handle payroll deductions, 401(k) plans, income taxes, and employee withholding as well. A good system connects the dots between hours, pay, and benefits in one place.

Some platforms even flag errors before they happen. They check for missing hours, odd tax rates, or duplicate records. This helps you catch problems well before payday.

Employee-Facing Tools That Improve the Experience

Sure, modern payroll handles taxes. But you also need a tool that empowers your team. Your staff needs easy access to their information, pay, and time off without having to chase down HR every time.

Look for tools with employee self-service that provide staff with access to their pay stubs, request time off, or update their personal information at any time, from anywhere.

A secure employee portal should securely hold their Social Security information, benefit details, and downloadable payroll data and reports. This way, your team can find everything they need without having to dig through emails or call HR.

Employees like having control. And when they can help themselves, it saves you time, too.

Ease of Use and Integrations

Look for tools with freemium options or free trials, allowing you to test their usability. It should be easy to set up and simple to use, with employee support and onboarding guides.

This way, everyone can onboard quickly, and it’s a shorter time to value.

And while ease of use is important, so is integration. Your current systems should connect to your payroll platform so it fits into your workflow.

Consider the tools you already use, such as Square Payroll, or Block Advisors.

The payroll software you choose should integrate seamlessly with your existing tools. Look for native integrations or Zapier connections.

Appropriate Pricing

The right payroll tool for you shouldn’t leave you out of pocket. Know your budget and the value you need so you can find an affordable tool without overspending on features you don’t need.

If you’re worried about upfront costs, consider a personal loan to avoid disrupting your cash flow. Alternatively, consider an affordable platform like Akaunting, which offers flexible plans that scale with your business.

Best Practices for Implementing Automated Payroll Software

Once you’ve chosen your tool, it’s time to set it up the right way.

Here’s how to roll it out without the stress.

Audit Your Current Payroll System

Before you make changes, take stock of how you currently manage payroll.

Auditing your current payroll setup shows you what’s working, what’s slowing you down, and where errors happen. This’ll indicate the workflows you’ll need to improve or automate.

Start by mapping out how payroll flows through your business.

Look at:

- – Whether you use any outside payroll services or providers

- – When and how payroll runs are scheduled and approved

- – Where you store payroll information and employee data

- – Employee classification details (contractor vs. W-2)

- – How you collect and track employee hours

- – What tools or spreadsheets you rely on

- – How you calculate and submit tax forms

Set Up Your Software with Accurate Employee Data

Automation only works if it runs on accurate data. Therefore, it’s essential to input all employee data accurately from the outset.

Add details for each team member, such as their:

- – Personal information

- – Onboarding docs

- – Form W-4 details

- – Employee wages

- – Benefits settings

- – Tax withholding

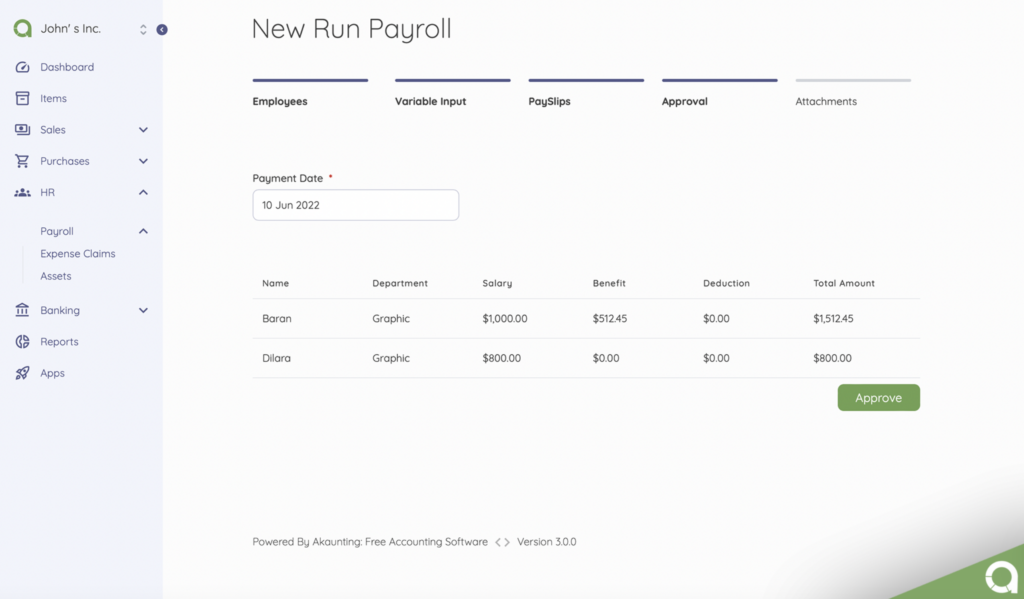

This part’s simple with Akaunting’s payroll app.

You can either input employee data, wages, and tax settings directly — or you can simply import them using Akaunting’s built-in tools. Everything’s stored securely in one place, ready for your first run.

Once you’ve put in basic employee data, connect to your time and attendance system. This logs hours accurately.

(The best payroll automation tools offer time tracking, so you don’t need to connect external tools.)

For example, Akaunting offers time-tracking add-ons through its App Store, so you can track hours and sync them automatically with payroll.

Don’t forget to verify everything before that first payroll run. Verifying details now means fewer corrections later. And a much smoother rollout.

Configure Tax Settings and Link to Authorities

Set your tool to auto-file payroll tax filings like Form 941, Form 940, W-2s, and so on.

Link the system to the IRS, Social Security Administration, and state or local tax offices. This keeps you compliant without the stress of manually submitting on time.

However, if you operate across state lines, things become more complicated. If your business works in more than one state, you must make sure your payroll system supports multi-state tax filings and the appropriate state unemployment taxes.

Test and Run your First Payroll

Give it a trial run.

Double-check employee hours, taxes, payroll deductions, and pay stubs. Use your system’s payroll analytics to flag any issues.

One clean test run can save you from major problems later.

Automate Payroll-Related Payments

Payroll covers more than wages. There are always additional costs, such as software subscriptions, contractor invoices, employee benefits, and tax preparation tools.

If you’re manually managing all of these, it’s just more admin work. Rather than juggling these payments by hand, you can automate them just like your pay runs.

Link a no-annual-fee business credit card to your payroll system. This way, you can automate recurring payroll-related payments and track expenses without thinking about them.

Provide Employee Access and Train Your Team

Show your team around the new employee portal.

Teach them how to use self-service features. Show them how to view pay stubs, download tax forms, and request time off. Send FAQs, quick-start guides, and links to employee support.

You could also hold a short Q&A or record a walkthrough. If the rollout is smooth, your team will adapt quickly.

Wrap Up

If you’re still on the fence, here’s the bottom line. Manual payroll is likely holding your business back.

It eats up your time, drains your resources, and it’s a risky business.

Switch the busywork for automation.

With tools like Akaunting, you can automate payroll management, stay on top of tax filings, and follow all the right labor laws—no more drowning in paperwork.

It’s easier for your team. And smarter for your business.

Start with Akaunting for free today and take the first step toward payroll that takes care of itself.

About the Author

Kelly Moser is the co-founder and editor at Home & Jet, a digital magazine for the modern era. She’s also the content manager at Login Lockdown, covering the latest trends in tech, business and security. Kelly is an expert in freelance writing and content marketing for SaaS, Fintech, and ecommerce startups.