Maximizing Your Business Vehicle Deductions Without Raising Red Flags

Reading Time: 7 minutesBusiness vehicle deductions are one of the most common ways for small businesses to reduce taxable income.

Every mile, fuel purchase, and eligible expense can add up to meaningful savings when tracked correctly.

So what’s the catch?

The IRS knows how tempting these write-offs are. And they’re quick to flag sloppy records or inflated claims.

The good news: By keeping accurate logs and applying the right deduction method, you can claim the full benefit of business vehicle deductions while staying compliant.

Let’s break down how these deductions actually work, why they matter, and the safest ways to maximize them.

Understanding Business Vehicle Deductions

Business vehicle deductions allow you to reduce taxable income by writing off the cost of using a car, truck, or other vehicle for business purposes.

Qualifying expenses can include fuel, maintenance, repairs, lease payments, insurance, registration fees, and depreciation.

To qualify, you must use the vehicle for business, not personal errands or commuting.

Accurate records are the key to making these small business tax deductions count. A mileage log, receipts, or accounting software can help you clearly separate personal driving from business use.

Standard Mileage vs. Actual Expenses

The IRS gives business owners two options for deducting vehicle use: the standard mileage rate and the actual expense method.

With the standard mileage method, you multiply business miles driven by the IRS-set rate. In 2025, the standard mileage rate for business use is 70 cents per mile.

For example, imagine that you drive 8,000 miles for business in 2025. You would multiply 8,000 x $0.70 = $5,600. The total becomes your deductible expense.

With the actual expenses method, you total all vehicle costs and then deduct the percentage tied to business use.

Suppose your total annual vehicle costs come to $9,000. If 60% of driving is for business, you can deduce 60% of $9,000, which equals $5,400.

An important note: If you use the standard mileage rate for a vehicle you own, you must use it in the first year that the car is placed in service. After that, you can choose either standard mileage or actual expenses.

Standard mileage method:

Pros

- – Simple to calculate with less record keeping

- – Works well for fuel-efficient cars with moderate business use

- – Easier to project deductions at the start of the year

Cons

- – May result in a smaller deduction if actual costs are high

- – Doesn’t capture all vehicle-related expenses like insurance or lease payments in detail

- – Requires careful mileage logs to prove business use

Actual expense method:

Pros

- – Captures all operating costs, which can increase the deduction

- – Useful for older cars with higher repair bills or heavy annual mileage

- – Provides a clear picture of total business operating expenses

Cons

- – Requires careful tracking of every expense throughout the year

- – More time-consuming and documentation-heavy at tax time

- – Once you start with actual expenses, you may be restricted from switching to mileage later

So, when do you choose the standard mileage method over the actual expense method, and vice versa?

Choose the mileage method if your car is fuel-efficient, your business miles are moderate, and you value simplicity in recordkeeping.

Opt for actual expenses if you drive an older car with high repair bills, put significant mileage on the vehicle, or want to capture every allowable deduction.

The right method for you will depend on your driving patterns, vehicle type, and how much time you want to spend tracking costs.

When you’re tracking mileage, maintenance, and fuel costs for deductions, don’t forget that expenses like auto insurance can also be part of your business vehicle write-offs. Use an online auto insurance comparison tool to shop smart, so your deductible coverage doesn’t come at a premium.

What Expenses Can You Deduct?

As a business owner, the IRS allows you to write off a range of operating costs, as long as these costs tie directly to business use. Knowing what qualifies and what doesn’t helps you avoid accounting mistakes and maximize deductions.

Common Deductible Expenses

Common deductible expenses include:

- – Fuel and oil: Gas, diesel, and oil changes are fully deductible when you use a vehicle for business purposes.

- – Maintenance and repairs: You can include routine services like tire rotations, brake replacements, or unexpected repairs in your deductions.

- – Insurance premiums: The business-use portion of your auto insurance premiums qualifies as a deductible expense. If you use the vehicle 70% for business, then you can deduct 70% of your premium.

- – Registration fees and taxes: You can also deduct state registration costs and certain property taxes on vehicles you use in business. The deductible amount depends on your business use percentage.

- – Lease payments or depreciation: If you lease your car, the business-use portion of lease payments is deductible. If you own your car, you can deduct depreciation based on IRS guidelines.

Expenses You Cannot Deduct

And this is what you can’t deduct:

- – Personal commuting costs: Driving from home to your regular office or worksite is considered commuting and isn’t deductible.

- – Non-business-related travel: You must carefully separate trips that mix personal and business. Only the miles or expenses directly tied to business qualify.

- – Fines and penalties: Tickets for speeding, parking violations, or other penalties are never deductible, even if they occur while driving for business.

Best Practices to Maximize Your Business Vehicle Deductions

Claiming vehicle deductions is only worthwhile if you can back them up. The IRS expects clear records, consistent methods, and accurate calculations.

Keep Detailed Mileage Logs

A mileage log includes the date, destination, business purpose of the trip, starting and ending odometer readings, and total distance.

Use a mileage-tracking app that can automatically record trips using GPS, sort them into business or personal categories, and export reports that match IRS requirements.

Separate Business and Personal Use Clearly

Vehicles that serve both personal and business roles are a common audit trigger. When the line between business and personal use is blurred, it raises questions about whether you’re overstating deductions.

One solution is to keep a dedicated vehicle for business purposes. If that’s not possible, detailed recordkeeping becomes essential. Document each business trip, avoid combining errands with client meetings, and calculate your business-use percentage with care.

The clearer the separation, the easier it is to justify your deductions.

Use Accounting Software to Track Expenses

Spreadsheets can track business mileage and expenses, but they leave too much room for error. That’s why 64.4% of small business owners now use accounting software to manage their financial records.

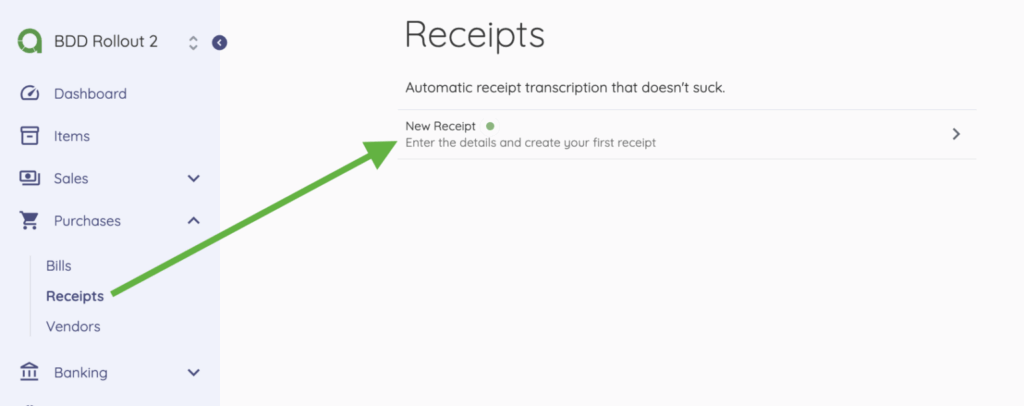

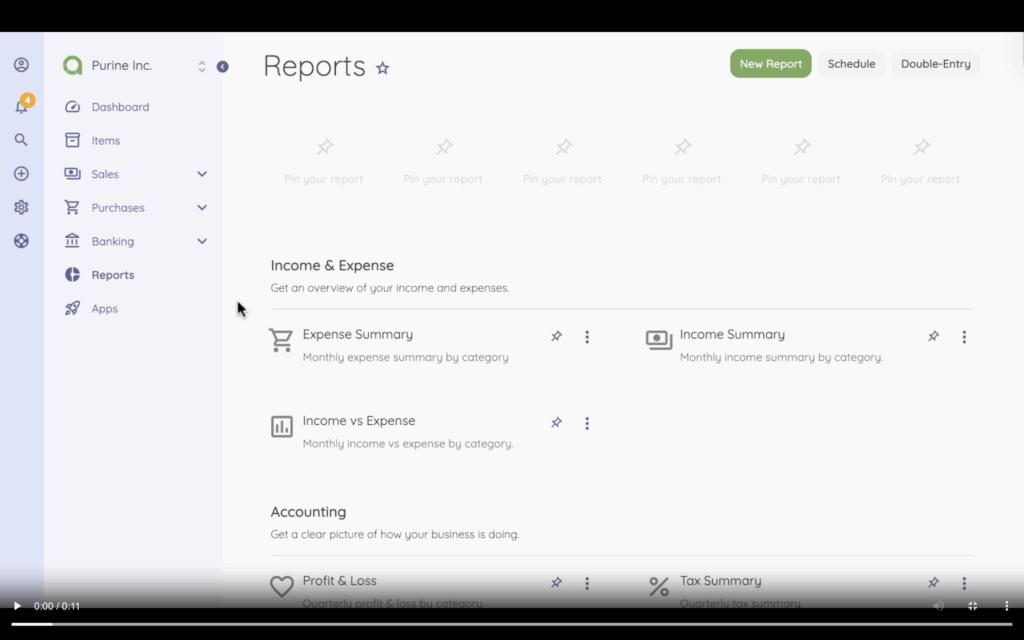

Free platforms like Akaunting allow you to categorize fuel, maintenance, insurance, and other costs in one place. You can store receipts digitally, link them to transactions, and export them into reports that match IRS documentation standards.

Plan Ahead for Depreciation and Leasing

Deciding whether to lease or own affects the way you deduct expenses. Leasing allows you to write off the business-use portion of lease payments, while owning opens the door to depreciation.

Leasing often works better for lower-mileage vehicles or businesses that want predictable costs. On the other hand, ownership with heavy use can help you maximize long-term deductions.

The IRS also allows accelerated deductions through Section 179 and bonus depreciation. Section 179 lets you deduct part or all of the purchase price of a qualifying vehicle in the year it’s placed in service. Bonus depreciation may allow even greater upfront deductions, depending on the vehicle type and year.

But what about when the vehicle no longer runs?

When it’s time to retire a business vehicle, the sale can be more than just a source of cash—it can also be a tax event. For instance, if you sell a non-running car that was previously used for business, the loss from that sale may be deductible. The key is to document the depreciated value and the final sale price to calculate the loss, ensuring compliance with IRS rules accurately.

Avoiding Red Flags That Trigger IRS Audits

The IRS pays close attention to vehicle deductions because people misuse them so often. A deduction that looks unrealistic compared to your business activity can raise questions and increase the likelihood of an audit.

Unless you use the vehicle exclusively for business and keep it off-limits for personal driving, a claim of 100% business can look suspicious.

So, to avoid this, use more realistic thresholds. Many small businesses report between 60% and 80% business use. These figures are often more defensible because they acknowledge the possibility of occasional personal miles.

It’s also important to keep deductions proportionate to your business’s size. For example, a one-person consulting firm likely won’t generate the same level of vehicle expenses as a delivery service or contractor with a fleet.

Deduction Benchmarks

Another thing you want to do is compare your deductions against industry benchmarks to confirm that your claims are reasonable. The IRS may see it as a red flag if your deductions look dramatically higher than those of your peers in similar businesses.

Perhaps the most important thing when calculating business vehicle deductions is being consistent across tax years. Large swings in reported mileage or expenses without explanation may signal errors or overstatements.

On the flip side, consistent reporting builds credibility.

Expert Tips for Smooth Tax Filing

Strong records and up-to-date knowledge make tax season less stressful and reduce your audit risk. Here’s how to ensure your deductions stand up to IRS scrutiny.

- – Consult a tax professional for complex cases: If you’re unsure which method to use, how to apply depreciation rules, or whether certain expenses qualify, professional advice can save you from costly mistakes.

- – Double-check IRS rules annually for updates: Standard mileage rates, Section 179 limits, and bonus depreciation rules change from year to year. Staying updated ensures you don’t miss out on deductions or accidentally apply outdated numbers.

- – Keep receipts and logs for at least 3–5 years: The IRS can review prior returns within the statute of limitations, so maintain mileage logs, receipts, and insurance records for several years. Having complete documentation is often the difference between smooth review and disallowed deductions.

Final Thoughts

Maximizing business vehicle deductions doesn’t end once you file your return.

True savings come from year-round habits, including clear records, accurate mileage logs, and consistent compliance with IRS rules.

Whether you’re tracking miles, calculating depreciation, or organizing receipts, your system should provide:

- – Detailed mileage logs

- – Categorized expense reports

- – Depreciation tracking tools

- – Audit-ready documentation

Ready to simplify your recordkeeping and take the stress out of tax season?

Use Akaunting’s expense tracking tools to stay compliant, save time, and make your deductions audit-proof. Get started for free today.

About the Author

Kelly Moser is the co-founder and editor at Home & Jet, a digital magazine for the modern era. She’s also the content manager at Login Lockdown, covering the latest trends in tech, business and security. Kelly is an expert in freelance writing and content marketing for SaaS, Fintech, and ecommerce startups.