Billing for Regulated Services: Adapting Your Accounting Workflow for Healthcare Compliance and Audit Readiness

Reading Time: 7 minutesBilling for regulated healthcare services can feel overwhelming. There are rules to follow, documents to organize, and auditors who want proof for every chart. One missing detail can slow payments or trigger questions you don’t want to answer.

Your accounting workflow plays a huge role in this process. Using it to support accounting for healthcare compliance enables you to track charges with confidence and respond to requests without having to scramble through folders.

Your team knows what to record, where to store it, and how to maintain the integrity of every claim. In this guide, you’ll learn what regulated billing requires, how your accounting process supports compliance, and steps to help you prepare for potential audits.

Accounting for Healthcare Compliance: Why Traditional Workflows Fall Short

Traditional accounting methods often struggle to keep pace with the level of documentation and reporting required by the healthcare industry.

- – Manual processes create room for error.

- – Disconnected systems make it harder to verify details.

- – Outdated workflows slow down the entire revenue cycle.

Today, up to 80% of medical claims contain errors. As a result, organizations are losing billions of dollars each year due to avoidable mistakes and missing documentation.

These gaps show up later in financial statements, which can lead to reconciliation during audits. If you don’t have clear documentation behind each charge, questions from regulatory agencies become more challenging to answer.

So, what’s the best way to move forward?

Build structure, strengthen documentation habits, and support every charge with a clean audit trail.

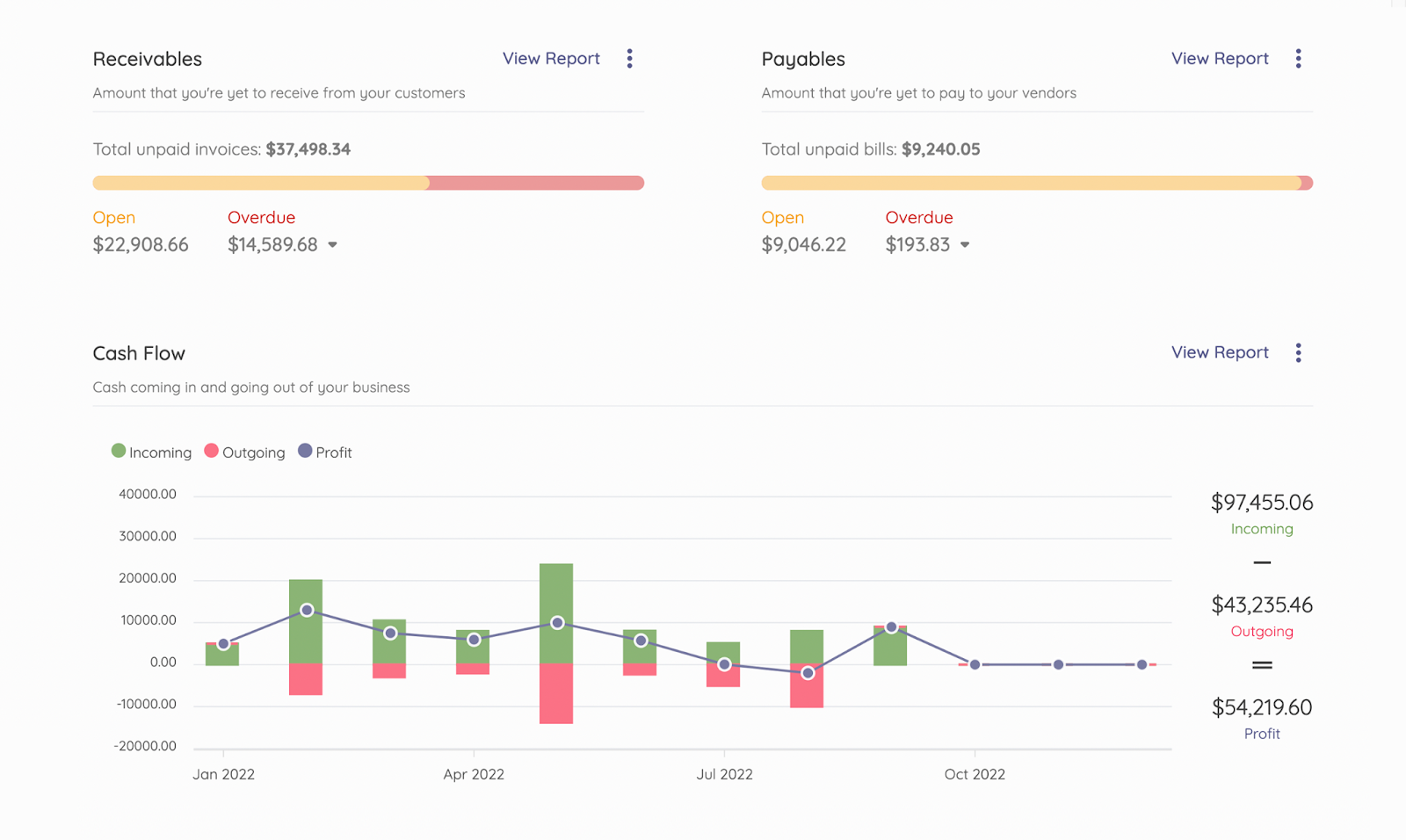

Accounting software gives you real-time visibility. Track billing activity and supporting documentation at a glance.

Signs Your Workflow Isn’t Compliance-Ready

How do you know your accounting workflows aren’t in compliance? These are the telltale signs:

- – Frequent claim denials for missing details

- – Delays in insurance reimbursements

- – Confusion around which department owns specific documentation

- – Difficulty locating charge support during reviews

- – Repeated questions for auditors or payers

If any of these sound familiar, your workflow may not support regulatory compliance as well as you think. A clean workflow improves visibility, accountability, and speed.

How to Adapt Your Healthcare Accounting Workflow for Regulated Billing

Upgrading your accounting workflow creates more control and helps you stay aligned with healthcare finance requirements.

The goal is to maintain consistency throughout the process, from charge entry to payment posting.

As you adjust workflows, take the time to map each step in your billing lifecycle.

Standardize Documentation Requirements

Standardizing documentation requirements helps your team capture important service details consistently, every time.

It also reduces confusion during coding audits and ensures that each charge has supporting notes attached to it.

Regulated services often involve much more complex billing cycles than fee-for-service models, requiring meticulous cost allocation.

This is especially true for facilities that offer long-term or comprehensive care. For example, a facility that offers residential treatment for adolescents must track all elements of a patient’s stay, including:

- – Changes in the level of care: Billing adjustments when a transition occurs from acute care to therapeutic services.

- – Per diem vs. bundled services: Separating fixed daily charges (room, board) from variable therapeutic services (individual counseling, medication management).

- – Insurance verification: Ongoing verification of patient eligibility with multiple payers for stays lasting several weeks or months.

Link supporting notes, treatment plans, and documents directly to each charge.

Automate Claims Tracking

Automation enables teams to monitor the status of every claim as it progresses through the billing lifecycle.

It creates visibility into payer requests, missing documentation, and adjustments tied to medical practice workflows.

In today’s healthcare landscape, billing accuracy depends heavily on seamless EMR-EHR integration services. When clinical and billing systems communicate effortlessly, errors decrease, compliance strengthens, and audits become smoother.

For instance, a multispecialty clinic using integrated EHR workflows saw a 25% reduction in claim denials by automating patient data flow from diagnosis to billing. Such integration not only ensures adherence to HIPAA and regulatory standards but also positions healthcare organizations for consistent audit readiness and financial transparency.

Automation frees your team up from manual checks and helps you respond to payer questions faster.

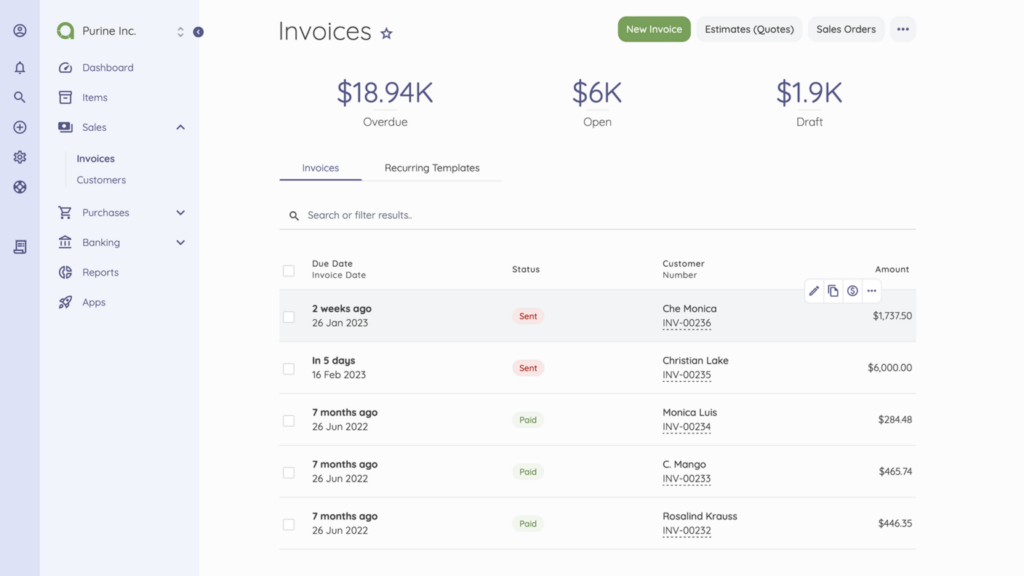

Track claim status from submission to reimbursement.

Strengthen Internal Controls

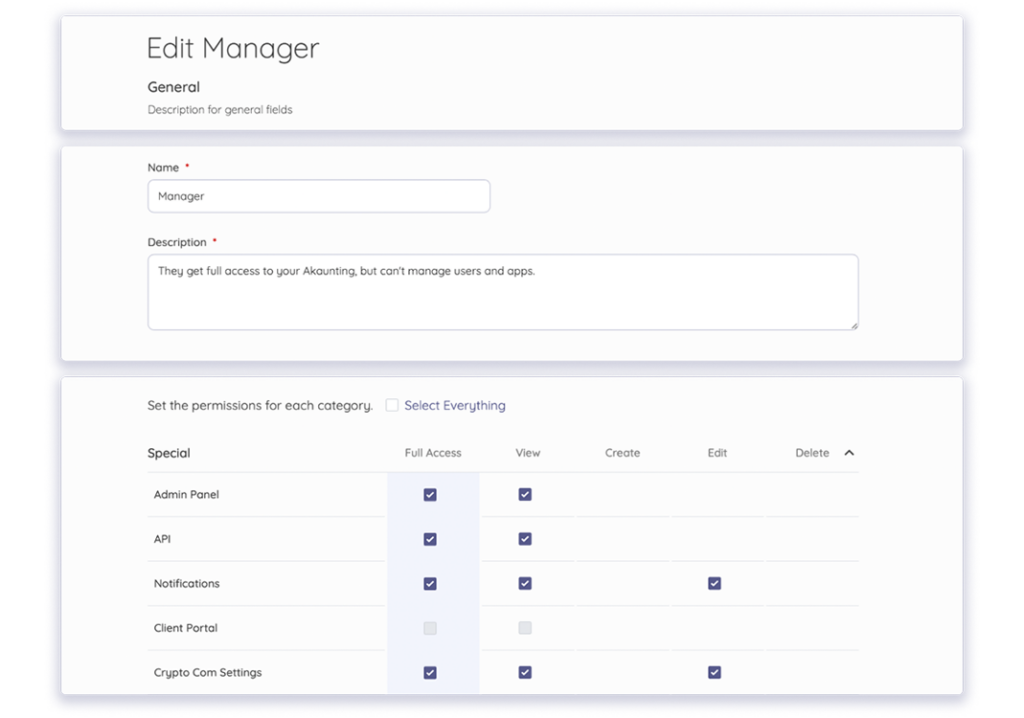

Internal controls create layers of protection around sensitive data and billing activity. Role-based permissions restrict unauthorized edits, while approval steps keep documentation clean.

This is especially important when handling protected health information (PHI) and charge-related edits.

You can improve oversight by reviewing:

- – Adjustment approvals

- – Write-off authorizations

- – Charge entry edits

These steps keep your revenue cycle clean and defensible.

Role-based access control helps you prevent unauthorized edits and maintain audit trails.

Align Chart of Accounts With Compliance Categories

Your chart of accounts should accurately reflect how regulated services are processed through your billing system.

Tying each category to a specific type of service, payer group, or billing requirement gives you more visibility into where revenue comes from and how it’s earned.

A clear setup also helps your team separate services tied to regulated programs, so your balance sheet stays accurate and easier to explain.

When categories align with billing activity, trends become easier to spot and act upon more quickly.

To create visibility:

- – Create categories for regulated services and payer types

- – Separate routine care from specialized interventions

- – Review categories annually to align with new rules

Require Coding + Documentation Training

Coding and documentation expectations change every year. Payers update coverage rules, regulatory compliance shifts, and terminology evolves.

Without regular training, documentation gaps start to grow.

Those sessions help your team document patient care clearly and justify services without confusion. They also reinforce how to structure notes to match payer requirements, which reduces follow-up questions and speeds up processing.

Focus your training on:

- – Capturing detailed procedure information

- – Describing medical necessity clearly

- – Linking documentation to each billed service

The stronger the documentation, the smoother the reimbursement cycle.

Use Compliant Accounting Software

Compliant accounting software supports data protection and keeps your records audit-ready. Look for software that securely stores documents, maintains role-based access, and records activity history.

These features protect PHI and show auditors how charges moved through your workflow.

The right platform can:

- – Store supporting documentation in one place

- – Track changes with time stamps and user IDs

- – Flag missing attachments automatically

This gives healthcare providers confidence that billing activity stays clean at every step.

Stay Audit-Ready Year-Round

Audit readiness is significantly easier when you review your documentation regularly, rather than waiting until auditors request information.

These quick check-ins help you catch minor issues before they grow into billing problems.

You can stay ready by reviewing:

- – Charge support notes

- – Service authorization details

- – Insurance responses and adjustments

- – Required signatures and timestamps

- – Missing attachments tied to billed charges

Consistent habits reduce stress and shorten review times. Having everything organized empowers you to respond to requests quickly and with confidence.

Common Compliance Mistakes to Avoid in Accounting for Healthcare Compliance

Some compliance issues may seem minor on the surface, but they can escalate into bigger problems when payers take a closer look.

Keeping an eye on these habits can save you time, stress, and reimbursement headaches.

Here are some key accounting mistakes to watch out for:

- – Skimming over documentation: If a service lacks clear documentation, payers may reject the claim. It doesn’t matter how obvious the care felt at the time. Your notes need to explain why it happened.

- – Copying old visit details: Repeated text can raise questions about accuracy and medical necessity. Sure, doing so might save a few seconds, but it can also create duplicate findings or outdated information.

- – Forgetting provider details: Missing dates, signatures, or provider details creates red flags during audits. That’s because auditors have less evidence to validate the claim. The more information you provide, the cleaner your documentation.

- – Editing charges without a process: Charge edits should follow a documented approval path. Random changes make it difficult to trace who updated the claim and why, which weakens your audit trail.

- – Waiting too long to record updates: Missing treatment plans, consent forms, or progress notes can delay insurance responses and block reimbursement.

- – Ignoring payer rule changes: Regulatory agencies adjust requirements often in the healthcare industry, and outdated habits create compliance gaps.

- – Skipping internal reviews: Small chart checks help teams catch missing attachments, incomplete notes, or incorrect insurance claims before submission.

Avoiding these issues comes down to consistent habits across your team. Everyone should follow the same guidelines. This helps you build stronger documentation, reduce denial risk, and protect your revenue cycle.

A structured workflow also creates better communication between billing, finance, and clinical staff. Make accounting for healthcare compliance part of your daily operations, and you gain more confidence in every audit and payer review.

Wrap Up

Building a workflow that supports regulated billing takes consistent documentation, routine checks, and clear communication between clinical and financial teams.

Accounting for healthcare compliance works best as part of daily operations, rather than in a rush during tax season or in response to an audit request. Treat each record as proof, each signature as validation, and each note as support for your next reimbursement.

Ready to protect your revenue, simplify documentation, and create cleaner reporting across your medical practice? Akaunting provides organized expense tracking, clear attachment storage, and reporting features that keep your workflow audit-ready throughout the year.

Get started with Akaunting today and support compliance with confidence.

About the Author

Kelly Moser is the co-founder and editor at Home & Jet, a digital magazine for the modern era. She’s also the content manager at Login Lockdown, covering the latest trends in tech, business and security. Kelly is an expert in freelance writing and content marketing for SaaS, Fintech, and ecommerce startups.