Account Reconciliation for Small Business Owners

Reading Time: 8 minutesFor small business owners, maintaining an accurate picture of your company’s finances is essential. One of the fundamental processes in financial management is account reconciliation. This practice—in which your bank transactions are matched against your recorded transactions in your accounting or bookkeeping software—is critical to ensuring the integrity of your books.

Poor reconciliation practices, however, can lead to significant challenges. Recent research indicates that discrepancies in account reconciliation are a primary cause of misreported cash flow, overlooked expenses, and even potential tax issues, costing businesses thousands of dollars annually.

In this article, we explore the root causes behind these challenges and provide a detailed, actionable guide to help you streamline your reconciliation process using modern accounting software.

Whether you use features like bank feeds or OFX import to import bank transactions, learning how to reconcile transactions efficiently can help safeguard your business against inaccuracies and financial missteps.

Table of Content

- The Cost of Poor Account Reconciliation

- Getting Started with Account Reconciliation

- Common Challenges and How to Overcome Them

- Best Practices for Long-Term Financial Health

- Conclusion

- FAQs

The Cost of Poor Account Reconciliation

Every day, small business owners actively verify that their financial records match their bank statements. However, manual reconciliation is often tedious and error‑prone.

When we fail to properly reconcile transactions, discrepancies arise that jeopardize the accuracy of financial statements and lead to poor decision-making. Some common challenges include:

- – Data Entry Errors: Manually inputting transactions increases the likelihood of human error.

- – Timing Differences: Transactions can occur at different times in the bank compared to the books.

- – Missing Records: Lost or unrecorded transactions can create gaps in your financial data.

- – Duplicate Entries: Repeatedly recording the same transaction leads to overstated balances.

The Financial Impact

The consequences of poor account reconciliation can be severe:

- – Cash Flow Issues: Inaccurate records often lead to mismanaged cash flow, making it difficult to predict upcoming expenses and plan for future growth.

- – Tax Compliance Risks: Errors in reconciliation can result in inaccurate tax filings, which can lead to penalties and interest from the IRS.

- – Increased Workload: Manual processes waste valuable time—time that you could invest in strategic activities.

- – Financial Loss: Studies show that businesses can lose 2–5% of their revenue due to reconciliation errors, which, for many small businesses, represents a significant financial burden.

Did you know? In the US, roughly 40% of small business owners struggle with reconciling transactions on a regular basis. Inefficient reconciliation methods not only waste time but can also cost businesses thousands in lost revenue and compliance penalties.

Streamlining your account reconciliation ensures that your financial statements are accurate, giving you the confidence to make informed business decisions. Learn more about how Akaunting’s solutions help you reconcile transactions effortlessly.

Getting Started with Account Reconciliation

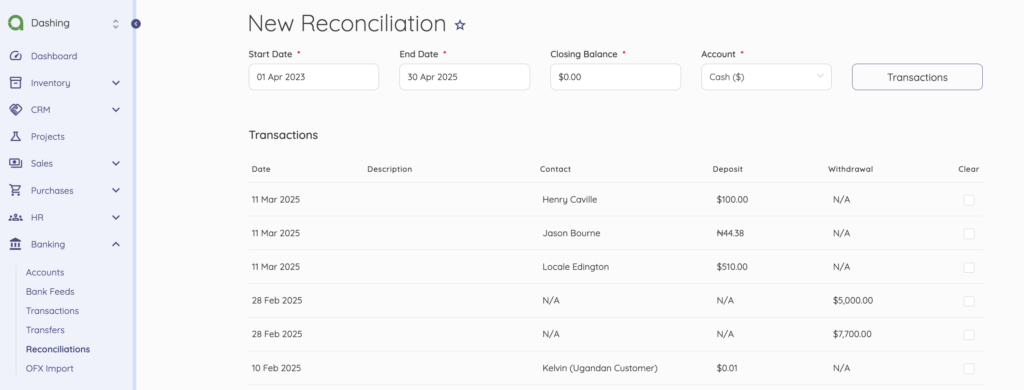

This guide walks you through every step of the reconciliation process, starting with importing bank transactions and matching them with the entries in your accounting software.

You can broadly divide the process into four main steps:

- – Importing Bank Transactions

- – Reviewing and Categorizing Entries

- – Matching Transactions

- – Finalizing the Reconciliation

Each step is crucial to the overall success of account reconciliation. Check out this YouTube short outlining the easy steps.

Step 1: Importing Bank Transactions

Ensure that you accurately import your bank transactions into your accounting software as the first step in effective account reconciliation.

Methods for Importing Transactions

- – Bank Feeds: Many modern accounting software offers automatic bank feeds. This feature links your bank account to your software so that you can import transactions in real-time. Akaunting’s bank feeds instantly bring your bank transactions into your dashboard.

- – OFX Import: If your bank doesn’t support live feeds, you can often download your transactions in an OFX (Open Financial Exchange) file format and import them manually. Learn how to use the OFX import feature for a seamless transaction import process on Akaunting.

Best Practices for Importing Transactions

- – Regular Imports: Schedule your bank transaction imports daily or weekly to keep your records current.

- – Backup Files: Always back up your bank statements before importing, in case you need to reference the original data.

- – Check for Completeness: Ensure that you verify every transaction has been imported, and note any discrepancies or omissions.

Key Insight: Using automated bank feeds and OFX import features can drastically reduce your reconciliation time by eliminating manual data entry and reducing errors.

Step 2: Reviewing and Categorizing Entries

Once your transactions are imported, the next step is to review them; therefore, ensure they are correctly categorized in your accounting software.

The Importance of Proper Categorization

Categorizing transactions correctly is vital for accurate financial reporting. Misclassified transactions can lead to errors in your income statement, balance sheet, and cash flow statements.

What to Look For

- Matching Transactions: Confirm that each imported transaction corresponds to an entry on your accounting software.

- Correct Categories: Ensure each transaction is allocated to the correct account (for example, expenses, revenue, assets, liabilities).

- Identify Duplicates: Look for and eliminate any duplicate entries.

- Flag Discrepancies: If a transaction’s amount doesn’t match your records, flag it for further review.

Tips for Efficient Review

- – Use Parameters: Many accounting software allow you to set up parameters that automatically categorize transactions based on specific criteria.

- – Leverage Reporting Tools: Generate preliminary reports to spot trends and identify miscategorized entries.

- – Work with Your Team: If you have a bookkeeper or accountant, collaborate with them to verify transactions.

Proper transaction categorization ensures your financial statements reflect true business performance. With Akaunting’s customizable dashboard, you can easily view categorized transactions and correct any discrepancies swiftly.

Step 3: Matching Transactions

The next critical step in account reconciliation is matching your imported bank transactions with the transactions recorded in your accounting system.

Understanding the Matching Process

Matching transactions involves verifying that every bank entry has a corresponding journal entry (or record) in your accounting software. This step is crucial to ensuring that your books are accurate.

Matching Strategies

- – Manual Matching: For businesses with fewer transactions, manual matching involves reviewing each bank entry and verifying it against your records.

- – Automated Matching: For a higher volume of transactions, automated matching features in your accounting software can streamline the process. These tools compare amounts, dates, and descriptions to suggest matches.

- – Partial Matches: In cases where a bank transaction corresponds to multiple entries (or vice versa), break the transaction down into its components and match accordingly.

Resolving Discrepancies

Even with automated tools, discrepancies can occur. Common issues include:

- – Timing Differences: Transactions recorded in one period may appear in the bank statement in another.

- – Data Entry Errors: Differences in amounts due to rounding errors or misentered figures.

- – Missing Entries: Transactions that have not been recorded in either system.

Step 4: Finalizing the Reconciliation

After all transactions have been matched, the final step is to finalize the reconciliation process.

Steps to Finalize

- – Review the Reconciliation Report: Most accounting software generates a reconciliation report summarizing the matched and unmatched transactions. Review this report for any remaining discrepancies.

- – Adjust Journal Entries: Make any necessary corrections—such as adjusting entries for fees, interest, or bank charges.

- – Document the Process: Save a copy of the reconciliation report and any related documentation for future reference, especially for audits or tax compliance reviews.

Best Practices

- – Regular Reconciliation: Aim to reconcile transactions frequently (daily or weekly) to minimize the backlog.

- – Stay Informed: Keep abreast of any changes in financial regulations and best practices in account reconciliation to ensure ongoing compliance.

Common Challenges and How to Overcome Them

Even with powerful tools at your disposal, many small business owners face common challenges when reconciling transactions. Let’s address a few of these issues:

Challenge 1: Inaccurate Data Imports

Issue:

Sometimes, due to formatting issues or connection problems, the imported bank transactions may not match your accounting entries perfectly.

Solution:

- – Review Import Settings: Regularly update and verify your bank feed settings or OFX import formats.

- – Manual Verification: Periodically verify a sample of the imported transactions manually to ensure accuracy.

- – Software Updates: Ensure your accounting software is up-to-date to avoid compatibility issues.

Challenge 2: Timing Differences

Issue:

A common problem in reconciliation is the timing difference between when transactions are recorded in your accounting software and when your bank posts them.

Solution:

- – Set Clear Cutoff Dates: Establish specific cutoff dates for recording transactions to avoid discrepancies.

- – Adjust for Timing Differences: In cases where timing differences are expected, prepare to adjust entries that account for these delays.

Challenge 3: Duplicate or Missing Transactions

Issue:

Duplicate entries or missing transactions can significantly throw off your books’ balance.

Solution:

- – Automated Matching: Use automated matching tools that flag duplicates or highlight missing entries.

- – Regular Audits: Conduct regular internal audits to verify that all transactions are present and correctly entered.

- – Backup Bank Statements: Always maintain backup copies of your bank statements to cross‑verify imports.

Challenge 4: Misclassification of Transactions

Issue:

Transactions that are incorrectly categorized may impact your financial reports and tax filings.

Solution:

- – Review and Edit Categories: Regularly review transaction categories and adjust as needed.

- – Feedback Loop: Collaborate with your accountant or bookkeeper to continuously improve categorization accuracy.

Akaunting features various apps—such as Bank Feeds, Expense Claims, and Payroll—ensuring that your financial data is always consistent and accurate, making account reconciliation convenient.

Best Practices for Long-Term Financial Health

Implementing an effective reconciliation process is not a one-time activity—it’s an ongoing effort that contributes to the overall financial health of your business. Here are some long-term best practices:

Consistent Record Keeping

Ensure that all financial transactions are recorded consistently and promptly. Furthermore, the more up-to-date your records are, the easier reconciliation becomes.

Regular Reviews

- – Weekly Check-Ins: For small businesses with a moderate number of transactions, a weekly reconciliation process can keep your data fresh.

- – Monthly Reviews: Conduct a comprehensive review at the end of each month to ensure accuracy before generating financial reports.

Documentation

Maintain thorough documentation of all reconciliation processes and any adjustments made. This practice is essential for audits, tax filings, and internal reviews.

Leverage Technology

Continuously explore new features and integrations offered by your accounting software. Staying current with technology can lead to further process automation and efficiency improvements.

Akaunting’s platform is built to evolve with your business needs. With an ever-growing list of features and integrations, Akaunting helps you stay ahead of potential reconciliation challenges, ensuring long-term financial stability.

Conclusion

Account reconciliation is one of the cornerstones of sound financial management. **Furthermore**, for small business owners in the US, the ability to efficiently import, review, match, and finalize bank transactions in your accounting software is not just a routine task—it’s vital to the health and growth of your business.

Poor reconciliation practices can lead to costly mistakes, mismanaged cash flow, and compliance issues, while an efficient process provides immediate benefits such as improved accuracy, better financial insights, and valuable time savings.

To summarize our key tips:

- – Automate Data Imports: Use features like bank feeds to bring in your bank transactions automatically.

- – Review and Categorize: Regularly verify the correct and complete categorization of transactions.

- – Match Transactions Accurately: Ensure that you account for every bank entry by utilizing both automated and manual matching.

- – Regularly Optimize Your Process: Continually refine your reconciliation methods by using advanced features, custom rules, and periodic reviews.

By implementing these practices—and leveraging the comprehensive features of modern accounting software like Akaunting—you set your business up for success. Not only will you save time and reduce errors, but you’ll also gain clearer financial insights that can support strategic decision-making and growth.

Ready to transform your reconciliation process? Visit Akaunting.com and explore our powerful features such as Bank Feeds, OFX app, and Real-Time Reporting to reconcile transactions effortlessly and improve your overall financial management.

Frequently Asked Questions (FAQs)

Q: What is account reconciliation?

A: Account reconciliation is the process of matching bank statement transactions with the entries recorded in your accounting system. This ensures accuracy in your financial records and helps identify discrepancies.

Q: How do bank feeds and OFX import work?

A: Bank feeds automatically import transactions directly from your bank into your accounting software. If bank feeds are not available, you can download transactions in OFX file format and import them manually.

Q: Why is proper account reconciliation important for my business?

A: Accurate reconciliation provides real‑time financial insights, improves cash flow management, ensures tax compliance, and reduces errors in financial reporting—ultimately saving you time and money.

Q: Can Akaunting help me automate reconciliation?

A: Yes. Akaunting’s powerful bank feeds feature make it easy to import and reconcile bank transactions.

Q: How frequently should I reconcile my accounts?

A: For optimal financial accuracy, reconcile your accounts daily or weekly. Regular reconciliation prevents errors from accumulating and ensures your financial data remains current.

Q: What should I do if I find discrepancies during reconciliation?

A: If discrepancies are found, review your entries, verify the imported data with your bank statement, adjust incorrect entries, and consult with your accountant if necessary.

Q: Is Akaunting suitable for US small business owners?

A: Absolutely. Akaunting is designed to meet the needs of small businesses around the world, including those in the US, and supports US tax regulations, bank feeds, OFX import, and more.