Accounting for Multi-Asset Trading: Keeping Clean Books for Crypto, Forex, and Commodities

Reading Time: 5 minutesIf you trade crypto, forex, and commodities as part of a broader investment strategy, your accounting needs are more complex than most. Each asset class follows different rules, pricing models, and tax treatments.

Trying to manage everything manually takes time and increases the chance of mistakes.

Accurate, organized records are important for your own tracking and for tax reporting and compliance.

This guide explains what makes accounting for multi-asset trading difficult, how to simplify it, and what you can do to stay consistent and accurate across every asset you manage.

Table of Contents

- The Unique Accounting Challenges for Different Assets (Crypto, Forex, and Commodities)

- Best Practices for Clean Multi-Asset Books

- Final Thoughts

The Unique Accounting Challenges for Different Assets

Each asset class in a multi-asset portfolio creates its own accounting problems. To maintain clean records, it’s essential to understand how crypto, forex, and commodities behave, as this affects your tracking, reconciliation, and reporting of activity.

Crypto

Crypto trading generates a large volume of micro-transactions, each of which often has tax consequences.

Swapping one token for another is a taxable event, even if you never cashed out to fiat. Every trade needs a timestamp, market value at the time of trade, and transaction fees recorded accurately.

Staking, yield farming, and DeFi activity introduce additional income sources that aren’t treated the same way as capital gains. Depending on where you live, these might be taxed as ordinary income, even if you never sold the asset.

This can have ripple effects on your overall asset allocation and portfolio management, especially when balancing digital holdings with traditional investments.

Then there’s the issue of inconsistent reporting. Many wallets and exchanges don’t use standardized formats. Some don’t track cost basis at all, while others can’t handle wallet-to-wallet transfers without flagging them as taxable. If you don’t have software that tracks across platforms and wallets, you’re likely to miss important data or double-count activity.

So, to sum up, the accounting challenges of crypto trading are:

- – High transaction volume and volatility

- – Cost basis, capital gains, and wallet tracking

- – Exchange variations and decentralized platforms

- – Tax treatment (e.g., staking, airdrops)

Forex

Forex accounting centers on gains and losses that are realized through constant currency conversion. Most trades involve leverage, so small price movements can lead to large P&L swings, which makes it critical to track both the trade size and the margin used.

You also need to track how exchange rate changes affect your holdings between the time you enter and close a trade. These fluctuations can create unrealized gains that affect financial reporting, especially for businesses that operate across borders.

Monitoring currency trends is also key, as shifts in global exchange rates can directly impact your returns and influence your overall multi-asset strategy.

Another layer of complexity is rollover interest (also called swap rates). These daily fees or credits are applied to open positions depending on the interest rate differential between the currency pairs. You must log them separately from trading profits, but still factor in your overall performance and taxes. Because forex accounts often involve margin, leverage, and multiple funding sources, it’s smart to monitor your broader financial activity, too. Tools like Aura’s credit monitoring services can help traders spot unusual activity early and protect accounts connected to their trading income.

For traders using forex to complement fixed income products or high-yield bonds, accurate logging of these changes is essential for clear regulatory reporting.

In a nutshell, the accounting problems you might run into when trading forex include:

- – Constant conversions and leverage risks

- – Recording realized vs. unrealized gains

- – Interest and swap fee accounting

- – Jurisdictional differences in rules

Commodities

Commodities like oil, gold, and agricultural products often involve trading in derivatives like futures or options rather than buying the physical product.

This creates a few accounting challenges. For example, you must track not only your entry points but also contract expiration dates, margin requirements, and mark-to-market pricing.

If you’re trading physical commodities, you also have to account for inventory, delivery fees, and insurance. Unlike digital assets, these often involve third-party logistics, which means coordinating your accounting with external records from brokers, warehouses, and delivery services.

And because commodity prices are heavily influenced by macroeconomic factors and market conditions, equity valuations may change drastically over short periods. That volatility needs to be reflected in how you handle revaluations or asset impairments in your bookkeeping.

During periods of market turbulence or when Federal Reserve policy changes affect commodity prices, tracking valuation changes promptly can help protect your diversified investments.

Here’s a quick summary of the issues you could run into when managing your books for commodities:

- – Spot vs. futures trading

- – Physical delivery vs. paper contracts

- – Price fluctuation tracking

- – Margin requirements and risk management

Best Practices for Clean Multi-Asset Books

To avoid errors and stay organized with your multi-asset books, you need a clear, consistent multi-asset strategy.

Use Multi-Asset Accounting Software

Choose accounting software that handles multiple asset class portfolios and syncs with your exchanges and wallets.

Also, make sure your trading platform of choice offers built-in tax reporting. The less manual entry you have to do, the more accurate and scalable your process will be.

Set Up Asset-Clear Ledgers or Sub-Accounts

When it comes to multi-asset investing, keep your records clean by separating asset classes into different ledgers or sub-accounts. This makes it easier to track performance, reconcile totals, ensure you’re applying the correct tax rules for each type of asset, and meet your overall investment goals.

Track Trades in Real Time

Delaying your accounting leads to incomplete records and missing context. Whenever possible, log trades as they happen or use software that does it for you.

Accurate accounting in multi-asset trading isn’t just about tracking numbers; it also involves recording the rationale behind trades.

Utilizing visual tools like bullish chart patterns can help traders log trade setups and technical signals that influenced their decisions. This not only improves clarity for audits and tax reporting but also helps identify consistent strategies across crypto, forex, and commodities.

Integrating pattern-based documentation supports cleaner books and better-informed financial oversight.

This also supports better cash and liquidity management across your holdings.

Reconcile Data Across Exchanges and Platforms

If you’re using multiple trading platforms, exchanges, or wallets, reconciling your records is critical. Discrepancies can arise from missed transactions, double entries, or fees you didn’t account for.

Set a regular schedule to review and reconcile all imported data against broker statements or platform exports. This keeps your books accurate and avoids end-of-year scrambling.

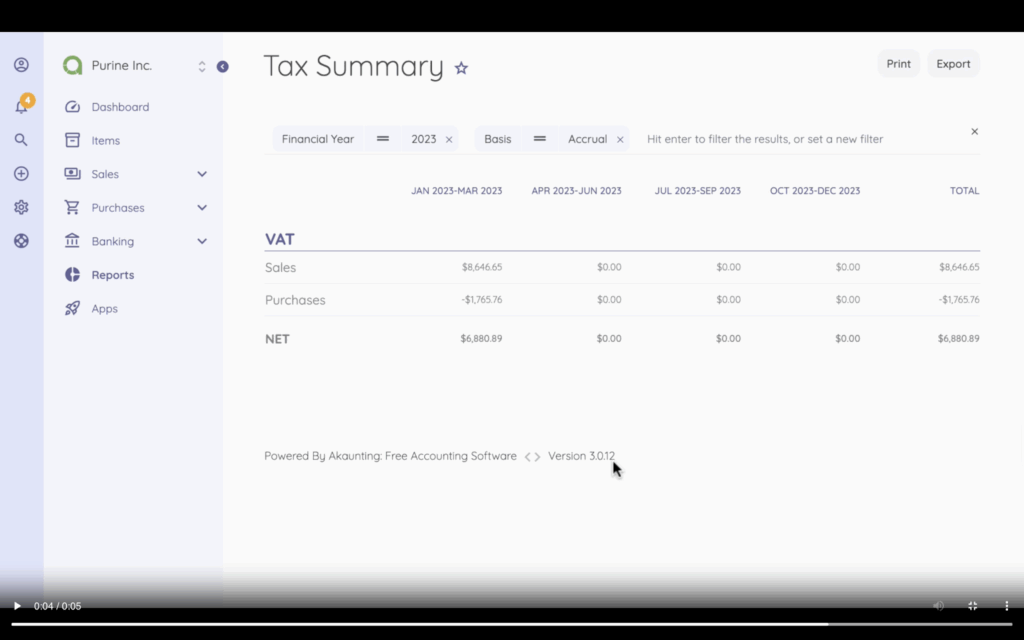

Track Short-Term vs. Long-Term Capital Gains

Not all gains are taxed the same. In many countries, short-term gains (assets held for under a year) are taxed at a higher rate than long-term gains.

To stay compliant and minimize tax liability, your system needs to distinguish between the two. This involves logging acquisition and sale dates for every asset, as well as understanding when a small timing adjustment could lead to a lower tax bill.

Maintain Detailed Records for Audits and Taxes

Keep detailed, timestamped records. You should be able to produce:

- – Transaction logs with trade amounts, prices, and fees

- – Wallet addresses and transaction IDs

- – Notes on trade rationale or strategies

- – Tax forms and calculation breakdowns

- – Exchange statements

Final Thoughts

Accounting for multi-asset trading shouldn’t be a manual process. It’s time-consuming, prone to mistakes, and only gets more complicated as your investment portfolio grows.

Switch to a system that keeps your books accurate across crypto, forex, and commodities without the extra effort.

With the right software and multi-asset strategies, you can track every trade, stay tax-ready, and have a clear view of your performance. And you’ll no longer have to spend hours buried in a spreadsheet.

Tired of doing things the hard way?

Get started with Akaunting and see how much smoother your books can be.

About the author:

Kelly Moser is the co-founder and editor at Home & Jet, a digital magazine for the modern era. She’s also the content manager at Login Lockdown, covering the latest trends in tech, business and security. Kelly is an expert in freelance writing and content marketing for SaaS, Fintech, and ecommerce startups.