Best Practices for Invoicing and Payment Management for Remote Team

Reading Time: 4 minutesThe ability to access talent from around the globe and the flexibility to adapt to different time zones and working styles can give small businesses a significant competitive edge.

However, managing invoicing and payment for remote teams can be a headache for small businesses. Issues like unclear payment terms, tracking time and expenses, inefficient processes, payment delays, reconciliation challenges, lack of automation, and tax compliance can cause problems.

By following best practices and using the right tools, small businesses can simplify invoicing and payment management processes, keeping their remote teams paid accurately and on time.

Embrace the right invoicing and payment management tools

Choosing the right tools is the first step in ensuring the smooth functioning of your remote team’s financial operations. Here are a few essential features to consider when selecting the perfect tools for your business:

Cloud-based Solutions

Cloud-based software allows you and your remote team to access financial information and collaborate on invoicing tasks from anywhere, anytime.

The cloud makes it easier to implement a segregation of duties (SoD) strategy, which can help prevent fraud and errors in financial transactions.

Automation

Opt for a tool that automates repetitive tasks like generating invoices, calculating taxes, and sending payment reminders.

Integration

Select software that integrates seamlessly with other tools used in your business, such as project management, time tracking, and CRM systems. This will help you maintain a centralized and organized workflow.

Establish clear invoicing and payment policies.

To avoid misunderstandings and conflicts, it’s essential to establish clear invoicing and payment policies for your remote team. These policies should cover aspects such as:

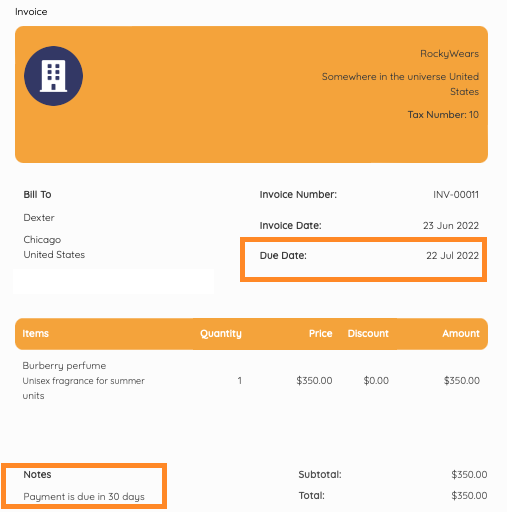

Payment Terms

Clearly state the payment terms, including invoice due dates, accepted payment methods, and any late payment fees or penalties.

Check out how to specify payment terms on Invoices.

Billing Cycles

Specify the billing cycle (e.g., monthly, bi-weekly) and the invoicing process for different types of services or projects.

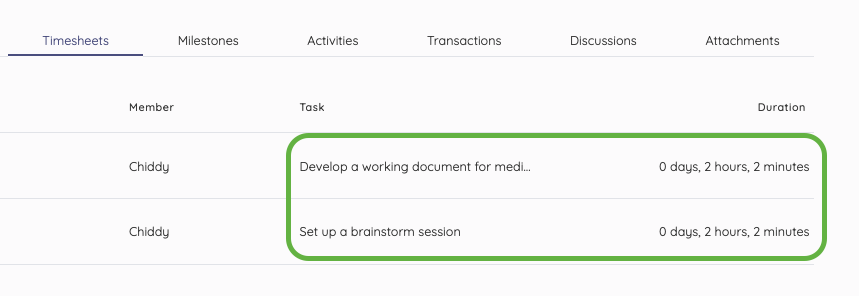

Time Tracking and Expenses

Set guidelines for tracking billable hours and reimbursable expenses, ensuring that your remote team members know what is expected of them.

Currency and Exchange Rates

For remote teams across different countries, establish a currency and exchange rate conversion policy to avoid confusion during invoicing and payments.

Address common invoicing and payment challenges.

Remote teams can face unique challenges when it comes to invoicing and payment management. Here are a few common problems and their solutions:

Late Payments

Late payments can significantly impact cash flow and hinder business growth. To mitigate this issue, send payment reminders, offer early payment discounts, and consider using an escrow service to secure funds.

Miscommunication

Remote teams may experience miscommunication due to time zone differences and language barriers. Encourage the use of project management tools, schedule regular check-ins, and offer language support to ensure clarity in invoicing and payment processes.

Currency Fluctuations

Currency fluctuations can affect your profit margins and create confusion in invoicing. Consider billing in your home currency or use a fixed exchange rate for a specified period.

Compliance and Taxation

Navigating tax laws and regulations across different jurisdictions can be challenging. Plus, there are various payroll retention rules you need to follow. Consult with a tax professional or use a tax compliance tool to ensure your business adheres to all applicable laws.

Check out how to avoid paying taxes.

Build trust and maintain transparency.

Building trust and maintaining transparency in financial transactions is crucial for remote teams. To foster trust, consider implementing the following practices:

Open Communication

Encourage open communication channels or mobile apps to address any concerns or questions related to invoicing and payment.

Provide Regular Updates

Keep your team members informed about the status of their invoices and payments. This transparency will reassure them that their financial concerns are being addressed promptly.

Set Expectations

Clearly outline your expectations regarding time tracking, billing, and expense management to avoid any ambiguity. This will help your remote team understand their responsibilities and work more efficiently.

Offer Support

Be available to support your remote team members in case they face any challenges related to invoicing or payment. This will show them you value their contribution and are committed to their success.

Monitor and optimize your invoicing and payment processes

To ensure the continuous improvement of your invoicing and payment management system, including incorporating data science techniques, it’s essential to monitor and optimize your processes regularly. Here are some tips to help you in this endeavor:

Analyze Performance Metrics

Keep track of key performance metrics, such as invoice processing time, days sales outstanding (DSO), and payment collection efficiency. This data will help you identify areas that require improvement.

Gather Feedback

Solicit feedback from your remote team members regarding the invoicing and payment processes. Their input can offer valuable insights into potential improvements and help you create a more efficient system.

Stay Updated

Keep yourself updated on the latest trends, technologies, and best practices in invoicing and payment management to make informed decisions and stay ahead of the curve.

Conclusion

By embracing the right tools, establishing clear policies, addressing common challenges, maintaining transparency, and continuously optimizing your processes, you can create a robust invoicing and payment management system that caters to your remote team’s needs.

By implementing these best practices, you’ll be well on your way to mastering invoicing and payment management for your remote team and ensuring the long-term success of your small business.

About Author

- Name: Polina Tibets

- Role: Head of Business Operations @ Pangea.ai

- LinkedIn URL: https://www.linkedin.com/in/polina1/

- Bio: As an engineering graduate from ITESM and Columbia University, she has spent the last 5+ years behind the algorithmic force of providing engineering talent to IT companies and innovation hubs to maximize their tech potential & technical growth.