Net 30 Payment Terms: What It Means, When To Use It, and How To Get Paid On Time

Reading Time: 7 minutesNet 30 looks like a harmless line on an invoice. In reality, it is a decision. You are choosing to deliver value today and collect the money later.

Sometimes that is exactly what helps you win a serious customer. Other times, it is the beginning of a slow, painful cycle where you keep working while your cash sits in someone else’s bank account.

So let’s keep this practical. This guide explains what Net 30 really means, how people interpret it in real life, and how to use it without turning your week into endless follow ups.

What Net 30 mean?

Net 30 means your customer has 30 calendar days to pay the full invoice amount.

That part is easy.

It does not automatically define:

- – when the clock starts (invoice issued vs received vs delivered vs accepted),

- – what happens if there’s a dispute,

- – whether weekends/holidays move the due date,

- – what penalties/interest apply if payment is late.

That ambiguity is why two businesses can both think they’re “using Net 30” and still end up arguing about when payment is actually due.

When does the “30” start?

Most payment issues come from this one detail.

Businesses typically start the Net 30 countdown from one of these three moments:

- – If you want the cleanest option, you start from the invoice date. It is simple, consistent, and easy to track.

- – If you sell physical goods, some companies prefer the clock to start from the delivery date, because they want proof they received the item before their finance team approves payment.

- – If you work with larger companies, they may push for Net 30 from acceptance, meaning someone must approve the work internally before the clock starts. This is common in procurement-driven environments, even when the customer is not intentionally being difficult.

Any option can work. The only rule is to pick one, write it clearly, and ensure your invoice displays the due date in plain sight.

The one sentence that stops disputes from delaying everything

Disputes happen. Sometimes it is a real issue. Sometimes it is a delay tactic.

If you do not plan for disputes, one question can hold your entire invoice hostage for weeks.

A simple rule keeps things fair and keeps your cash moving:

If only part of the invoice is disputed, the undisputed amount is still due on the original due date.

That one sentence reduces a lot of drama, as it prevents small issues from escalating into a full payment freeze.

Common Net 30 variations you will see

Net 30 vs “Due in 30 days”

In practice, they’re often used interchangeably. The key is not the label; it’s whether you define the trigger date.

Net 30 EOM (End of Month)

“Net 30 EOM” typically means the invoice is due 30 days after month-end, not 30 days after invoice date.

- – Example: invoice dated March 10 → month-end is March 31 → due April 30

This can stretch your cash conversion cycle more than you expect, especially for early-in-month invoices.

2/10 Net 30 (early-payment discount)

This means:

- – 2% discount if paid within 10 days

- – otherwise, full amount due in 30 days

This approach can be effective if you require quick cash and your profit margins can handle the discount. It motivates customers to pay early and incentivizes the desired behavior.

Net 30 with a deposit (often the best SMB default)

A simple hybrid that reduces your risk:

- – 30–50% upfront

- – remainder Net 30 (from invoice date or delivery)

If you’re still building predictable cash flow, this often dominates “pure Net 30.”

Why businesses offer Net 30

Net 30 reduces buying friction.

Some customers cannot pay upfront because their financial process does not allow it. They need an invoice, a due date, and time to run approvals. If you sell business-to-business, offering terms can be the difference between winning and losing the deal.

Net 30 can also increase order size. Buyers are often more comfortable committing when the payment does not hit them immediately. And in some industries, offering standard terms signals that you are established and operationally solid.

So yes, Net 30 can be a growth tool. It just needs structure.

When Net 30 is a bad idea

Net 30 becomes risky when it creates a cash gap you cannot carry.

If you have payroll, rent, subscriptions, suppliers, and tools to pay now, but your customers pay later, you can end up stressed even while sales look good.

It is also risky with brand-new customers with no payment history. Net 30 is trust. Trust is earned. If you provide full terms too early, you are the one taking on the risk first.

And if a customer is consistently late, Net 30 stops being a term and becomes a suggestion. That is not a customer you keep rewarding with flexible payment options.

A simple Net 30 policy that actually works

You do not need a credit department to do this well. You need rules you follow.

Start by deciding who qualifies. Repeat customers who pay on time are an easy yes. New customers should usually start with a deposit, or a small credit limit, until they prove they can be trusted with bigger terms.

Next, decide your comfort level. In plain terms, what is the maximum amount you can afford to have unpaid for 30 days without it affecting operations. That number is your starting limit.

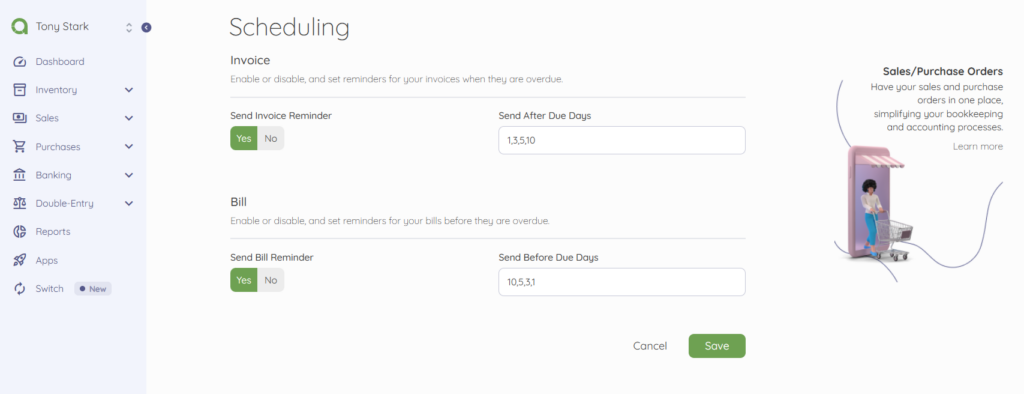

Then comes the part most businesses skip: reminders.

Net 30 works when your follow-up process is boring, consistent, and automatic. A simple schedule looks like this: send a friendly reminder a week before the due date, a quick heads-up the day before, and the moment it becomes overdue, you ask for a payment date. If it stays unpaid, you escalate in steps, and you do not negotiate with your own policy.

You are not being aggressive. You are being clear. People respect process.

What to write on your invoice and in your terms

You do not need complicated legal-sounding paragraphs. You need wording that removes confusion.

Below is a clean, safe template you can paste into your contract. It is written to work across different countries without accidentally overriding statutory late payment rights.

Payment terms Payment is due 30 calendar days from [invoice date / delivery date / acceptance date], as stated on the invoice. Due date clarity The invoice will show the exact due date. If you need a PO number or any extra info for processing, please request it early so payment is not delayed. Disputes If something looks wrong, please tell us within 7 days so we can fix it quickly. If only part of the invoice is disputed, the undisputed amount is still due on the original due date. Late payment If payment is late, we may charge late payment interest and any fixed compensation that applies under the law for this transaction. Where a separate contractual late payment rate is allowed and agreed in writing, that rate will apply instead. Pause rule (optional) If an invoice becomes past due, we may pause further work or delivery until the account is current.

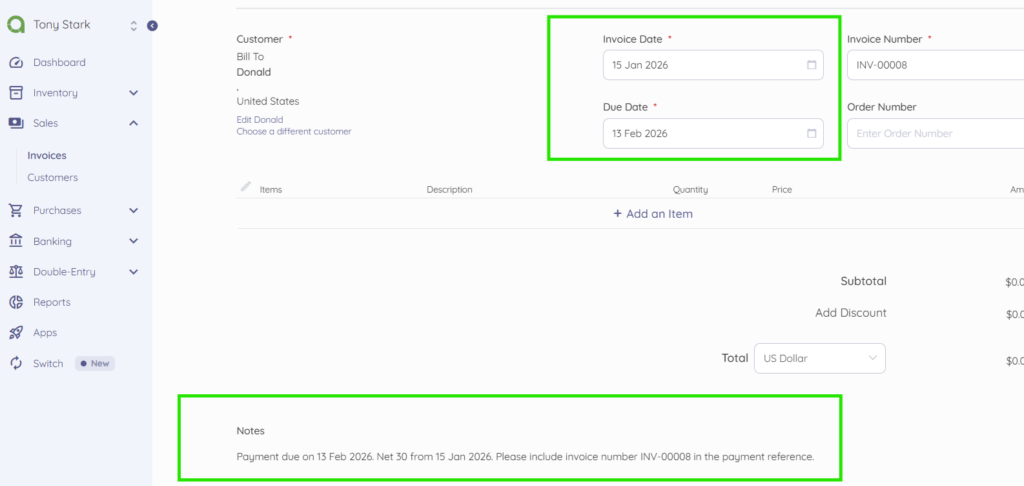

And here is a simple invoice note you can paste into your invoice “Note” field:

Payment due on [DUE DATE]. Net 30 from [TRIGGER DATE]. Please include invoice number [INVOICE NUMBER] in the payment reference.

This may look small, but it effectively removes friction. Customers pay faster when they do not have to calculate dates or guess what you want.

Should you charge late fees or interest?

You can, but do it the smart way.

Late fees and interest are less about “punishing” customers and more about setting expectations. The real win is that it makes overdue invoices feel official, not casual.

Here’s the important part: the rules vary depending on where your customer is located. In some places, the law already gives you a statutory interest rate you can charge when invoices are late. In other places, you can set your own rate, provided it is clearly stated in the contract. And in some places, writing your own rate can reduce what you can claim under the statutory option.

So instead of trying to force one global rate into your terms, keep it simple. Default to the statutory rate that applies to the transaction, and only use a separate contractual rate when you have intentionally chosen it and it is allowed where the customer is based.

That way, you stay protected, and you are not publishing advice that becomes “wrong” depending on the country.

What to do when a customer asks for longer terms

You will receive requests for Net 60 or Net 90 terms. You don’t have to accept it automatically, but you also don’t have to lose the deal immediately.

Instead of arguing about days, negotiate the structure.

Ask for a deposit up front. Split the invoice into milestones. Tie delivery to payment checkpoints. Or offer a small early payment discount if you’d like to bring forward the cash. These options give the customer flexibility while protecting your cash flow.

How Akaunting helps you manage Net 30 without stress

Net 30 is not just a line on an invoice; it is a workflow.

With Akaunting, you can set clear due dates on invoices, schedule reminders, track overdue invoices, and stay on top of what is coming in. That means you spend less time chasing and more time running the business.

If you want to offer Net 30 confidently, your system has to do two things well: keep due dates clear and keep follow-ups consistent. Akaunting helps you keep that process tight as you grow.

With the Retainers app, you can minimize bad debts. You could also request a credit history check on the customer.

Net 30 Terms Frequently Asked Questions (FAQs)

Does Net 30 include weekends and holidays?

Most of the time, yes, it is calendar days. If you want business days, say business days.

Can Net 30 start from the delivery date instead of the invoice date?

Yes. Just define it clearly so there is no confusion.

What if the due date falls on a weekend or public holiday?

Many businesses treat it as the next business day. If that matters to you, write the rule into your terms.

Is Net 30 good for small businesses?

It can be, if you set limits, use deposits for new customers, and stick to a reminder schedule.