How to Choose the Right POS System for Your Small Business (With Budget in Mind)

Reading Time: 7 minutesThink of a POS system as a computer-powered cash register for a small business, but smarter.

Every penny counts when you’re running a small business and you want to be sure that you’re keeping an eye on every outgoing. Spend too much on the wrong things, and it adds up fast. But you still want to be sure you’re investing where it matters. Because the truth is, cutting corners on the wrong things can cost you even more in the long run.

Now, one decision where this really shows up (particularly if you work in the retail or hospitality industry) is when choosing a point of sale (POS) system. Pick the best one for your business and you could end up streamlining, automating, and feeling completely in control. Don’t… and you’ll be stuck with tech that slows you down and drains your cash.

Today we’re going to run through how to get the best bang for your buck. How to choose smarter. How to get more, without paying more. Let’s get started.

What Is a POS?

To be able to choose the right one, you first need a really good understanding of what a POS system actually is.

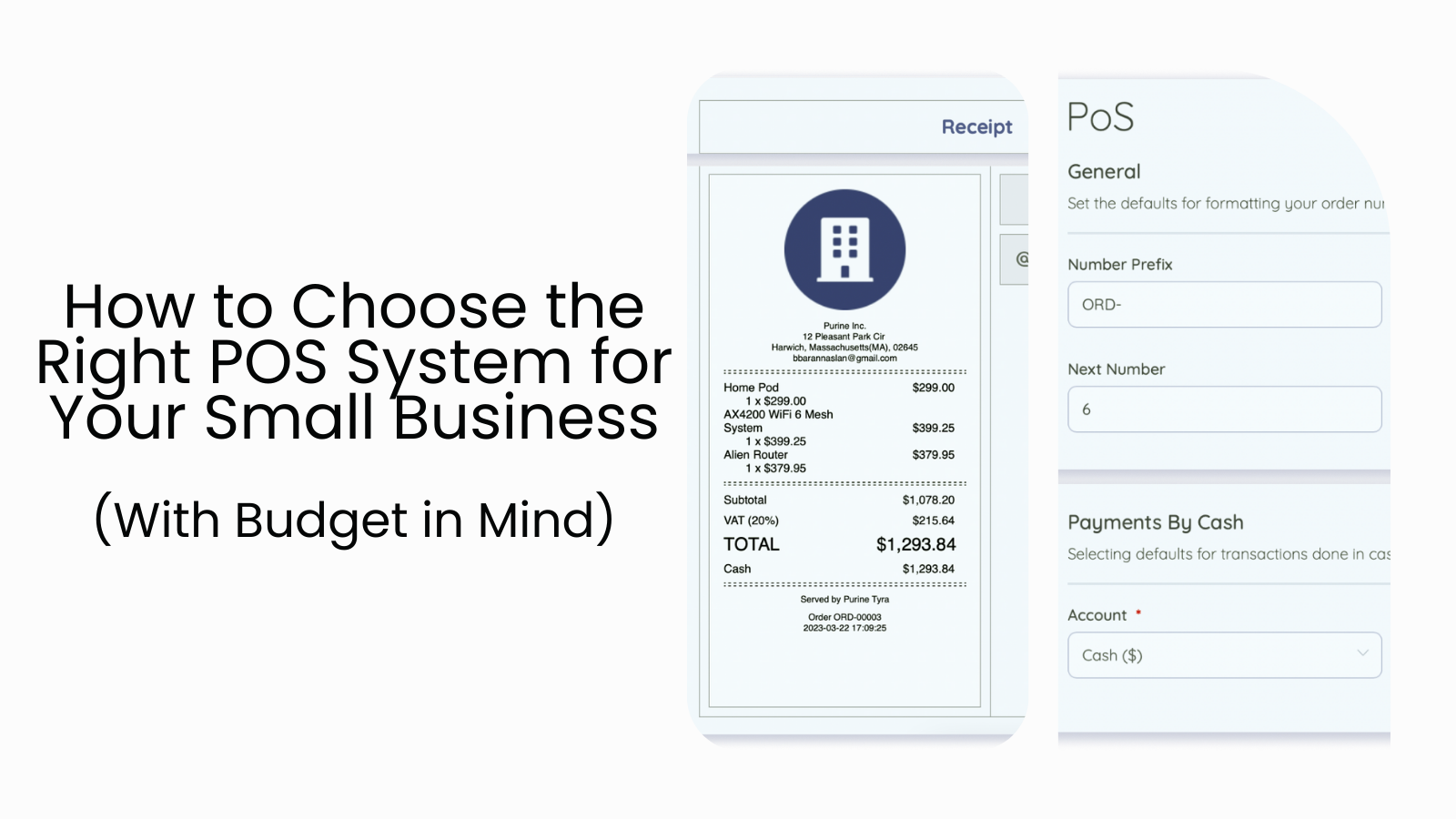

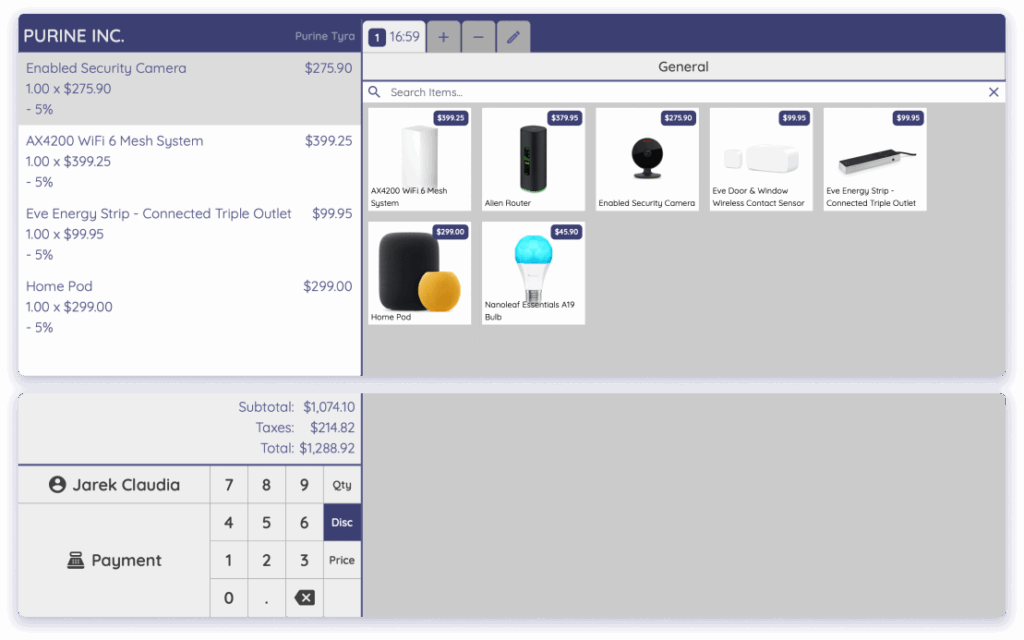

A POS is the system that lets you take payments and log sales. Think of it like a computer-powered cash register for small business, but smarter. Unlike the old-school cash registers you use to see in your local sweet shops, modern POS systems don’t just add up totals and print receipts. They can also track what you sell, watch your inventory, spot buying trends, create invoices, even help with your marketing.

Now, POS systems come in all different forms. Some are countertop machines you see in stores. Others are apps that turn your smartphone or tablet into a payment device. You can even opt for a hybrid option where you have a POS system in a physical shop and a virtual one at your online checkout. Either way, it’s the same idea: a simple, fast way to process sales and get paid.

Components of a POS System

There are three key ingredients to focus on: POS software, POS hardware, and payment processing.

- – POS software: This is the brain of your POS system. It can range from $0 to over $200 a month, depending on what you need. Sure, free software is great for starting out, but as your business grows, you’ll probably want to upgrade for those extra features.

- – POS hardware: Hardware is where the costs can really add up, depending on what you need. You’ve got everything from cash registers starting around $100, to high-end POS terminals costing upwards of $1,700. Plus, there’s the tablet stands, credit card readers, self-service kiosks, and all those fun gadgets. The good news is, many systems let you pay upfront or even offer monthly payment plans.

- – Payment processing: This is the glue that holds it all together. It’s how you get paid, whether it’s through cards, mobile payments, or contactless options. Payment processors charge in a few different ways – Interchange plus (where you pay a set rate on top of a base charge), flat rate (one consistent price per transaction), or sometimes even subscription models, where you pay a monthly or annual fee.

Features to Look For in a POS system

Even the simplest systems should be able to do a few key things really well. At the very least, your POS should:

- – Ring up sales quickly

- – Accept different types of payments (cash, card, contactless, mobile)

- – Print or email receipts

- – Keep track of daily sales and transactions

If a system can’t do those things easily and reliably, it’s absolutely not worth your time, or your money.

Now, the very best POS system for small business owners don’t just stop at those basic features listed above. Instead, they go above and beyond and take things a few steps further, giving you tools that actually help your business grow. Tools like:

- – Inventory management: Automatically track what’s selling and what’s running low in real time.

- – Customer management: Build a customer database so you can offer loyalty rewards or send promotions.

- – Employee management: Track staff hours, manage shifts, and see who’s making the most sales.

- – Real-time reporting: Get instant insights into what’s selling best, slow days vs. busy days, and more.

- – Multi-channel selling: Sell in-store, online, or even at pop-ups and markets, all from the same system.

- – App integrations: Connect easily with POS accounting software, marketing tools, loyalty apps, and more.

- – Secure payments: EMV chip readers, contactless payments, PCI compliance, and encryption to keep your customers safe.

- – Industry-specific features: Many POS systems offer tailored tools depending on your industry. For example, if you run a retail business, you’ll find retail POS systems that include advanced inventory tracking and customer loyalty programs.

You want a system that does more than just take money. You want one that saves you time, makes you smarter about your business, and helps you grow without adding a ton of extra work.

Tips for Choosing a POS (With Budget in Mind)

Once you’ve shortlisted your POS providers that have all of the features you need (the providers that offer multiple payment options, real-time reporting, marketin, and more) it’s time to do even more research. Because picking the right system isn’t just about what it can do. It’s about making sure it fits your budget. Here’s how to make the smartest choice:

Get a Demo

Always, always, always test it out first. Most providers will offer a free trial or live demo, take it. You want to see how easy (or complicated) the system really is before you sign anything.

- 1. How easy is it to ring up a sale?

- 2. How many steps does it take to refund or void a transaction?

- 3. Can you customize receipts and checkout options? Can you add your logo, tweak wording, or modify options based on your needs?

- 4. How easy is it to update inventory or pricing? If you’re managing a lot of different products or prices, updating them should be quick and painless. Can you make changes in bulk, or does each item require manual updates?

- 5. How long does it take to run reports? Reporting is key for business decisions. Does the system generate reports quickly, or is it sluggish?

You want to get hands-on if possible. See how many clicks it takes to complete basic tasks. If it feels clunky or confusing during the demo, it’ll only feel worse when you’re busy serving customers.

Ask About the Full Costs

Don’t just look at the monthly fee. Ask about everything like hardware, software upgrades, customer support, payment processing fees, contract cancellation fees… all of it.

Specifically ask:

- – Is there a setup fee?

- – Are software updates free or paid?

- – What percentage do you take per card transaction?

- – Are there minimum transaction requirements?

- – What happens if I want to cancel?

You don’t want a “cheap” POS that secretly bleeds you dry with hidden fees. Know what you’re signing up for from day one. Know exactly how much money you need to start a business and what ongoing expenses you’ll face. Make sure you’re clear on all the costs before you sign anything.

Check out G2’s POS pricing guide to get a clearer picture of what POS systems really cost (beyond the sticker price).

Negotiate

Yes, you can negotiate, and you absolutely should. Especially if you’re buying hardware, signing a longer-term contract, or opening multiple locations.

To do this effectively, be sure to ask for free hardware if you’re signing a 12- or 24-month deal. You could also ask them to match a competitor’s offer if you find a better deal elsewhere, or push for waived setup or training fees.

Remember: POS companies want your business and, because of that, you have more bargaining power than you think.

Check for 24/7 Support

Tech issues don’t care about office hours, and neither do customers. If, for any reason, you’re having trouble during a late-night dinner rush, a 2 am club night, or a holiday weekend sale, you need support on demand.

So make sure the provider you’re working with has support available by phone, chat, and email 24/7. On top of this, find out how fast is the average response time is and if there’s a separate fee for premium support.

Finally, take a good look at their self-help resources, like blog pages, video tutorials, or FAQs. These can save you time when you need quick fixes without waiting for a support agent.

Think About the Future

Don’t just buy a system for today. Think about where you want your business to be in 1–3 years. Ask yourself:

- – Can this POS add extra users, registers, or locations easily?

- – Can I sell online if I want to later?

- – Will I be able to add loyalty programs, delivery, or gift cards when I need them?

- – How expensive are upgrades?

Growing pains are real, but the right POS can make scaling up a lot easier (and cheaper).

Read Real Reviews

Every POS website says they’re “easy to use” and “built for growth.” The real story is in customer reviews. Look for:

- – Common complaints (especially about reliability or customer service)

- – How the company handles issues — are they responsive and helpful?

- – Feedback on hidden fees, downtime, or complicated setups

- – Positive reviews that match your kind of business (e.g., retail, café, salon)

A few bad reviews are normal. But if you see the same problems pop up over and over, don’t ignore them.

Final Thoughts

Choosing the right POS system for your small business doesn’t have to be a nightmare, especially if you keep your budget in mind. Every dollar counts, and you don’t want to waste money on something that doesn’t fit your needs. But, don’t go cutting corners where it matters most, because the Cheapest POS system for small business owners could end up costing you more in the long run.

Make sure to test, ask the tough questions, and always look into the details. A system that works well today will set you up for success tomorrow, but one that’s a pain to manage could slow you down and drain your profits. Do your homework, ask for demos, read reviews, and don’t shy away from negotiating. Happy small business POS hunting!

About Author

Brittany Lange | Epos Now

Brittany is the SEO Outreach Executive for Epos Now, specialising in building relationships and writing content focused on connecting small businesses with the tools and insights they need to grow. With a focus on digital strategy and content partnerships, she helps amplify expert voices across the retail and hospitality sectors. You can reach Brittany on LinkedIn for any comments or queries you might have.