What is Self Assessment?

Reading Time: 3 minutesHM Revenue and Customs (HMRC) employs a system known as Self Assessment for Income Tax collection. While taxes are usually deducted automatically from wages and pensions, individuals with income from other sources must declare it by completing a tax return.

Additional income, such as rental earnings, self-employment profits, or capital gains, may require you to file a self assessment tax return.

Table of Contents:

Who must send a self assessment tax return?

According to the HMRC, you must send self assessment tax return if, in the last tax year (6 April to 5 April), you met any of the listed criteria:

- you were self-employed as a ‘sole trader’ and earned over £1,000 (before deducting any amounts eligible for tax relief).

- you were a partner in a business partnership

- you had a total taxable income of more than £150,000 a year

- you had to pay Capital Gains Tax when you sold or ‘disposed of’ something that increased in value

- you had to pay the High Income Child Benefit Charge

- you receive interest from banks and building societies (more than £10,000) or dividends exceeding £10,000

You may also need to send a tax return if you have any untaxed income, such as:

- money from renting out a property

- tips and commission

- income from savings, investments and dividends

- foreign income

Make tax season a breeze. Easily file your taxes with Akaunting’s MTD for VAT

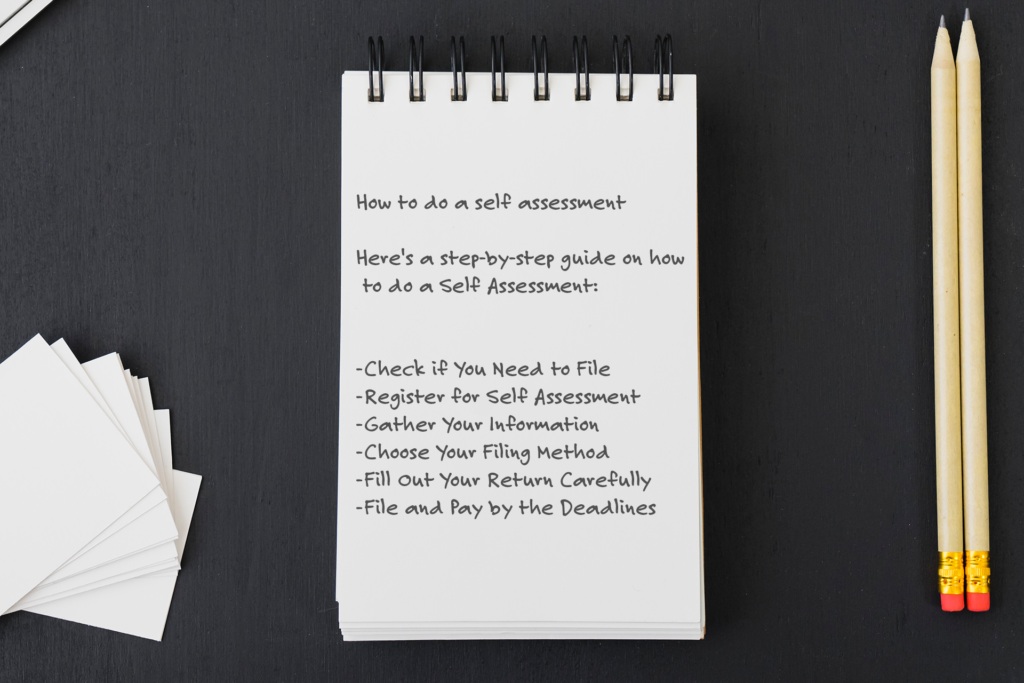

How to do a self assessment?

Here’s a step-by-step guide on how to do a Self Assessment in the UK, including explanations of key steps:

- Check if You Need to File

- Register for Self Assessment

- Gather Your Information

- Choose Your Filing Method

- Fill Out Your Return Carefully

- File and Pay by the Deadlines

Check if You Need to File

Use HMRC’s online tool to determine if you need to do a Self Assessment. Generally, you must file if you are:

- Self-employed

- A business partner

- A company director

- Receiving rental income

- Having other untaxed sources of income

- Calculate Your Tax

- File and Pay by the Deadlines

Check out the “Who must send a self assessment return” section above for details.

Register for Self Assessment

If you are self-employed, a business partner, or a company director, receive untaxed income or fall under certain criteria, you must register with HMRC.

The registration deadline is October 5th, after the end of the tax year you are filing for.

For instance, the 2023/24 tax year deadline would be October 5th, 2024. Upon registration, you will be assigned a Unique Taxpayer Reference (UTR) number.

Gather Your Information

- Self-employed: Income records with invoices

- Allowable business expenses

- Company directors:P60 and P11D forms

- Landlords: Rental income and expenses

- Other income: Records of untaxed income (investments, dividends, etc.)

Choose Your Filing Method

After the end of the tax year (April 5th), fill in your tax return online through the HMRC website. If you can’t file online, you can request form SA100 from HMRC.

Fill Out Your Return Carefully

Provide accurate details about your income and allowable deductions. You’ll need the following information:

- Your Unique Taxpayer Reference (UTR) number

- Records of business expenses and income, including invoices

- P60 and P11D forms if you are a company director

- Information on dividends if you hold shares in a company

File and Pay by the Deadlines

View your tax bill in your HMRC online account and pay for them before the deadlines.

- Online filing: January 31st, following the end of the tax year.

- Paper filing: October 31st, following the end of the tax year.

- Payment deadline: Same as the online filing deadline (January 31st). This includes your tax bill and the first payment on account for the next tax year.

What’s Next…

Understanding your tax status and following the guidelines for self-assessment returns is crucial to avoid penalties.

With Akaunting, you can file tax returns using the MTD feature, which simplifies the digital filing of taxes.