From Shoot to Payment: How Photographers Can Manage Invoices and Track Business Costs

Reading Time: 4 minutesPhotographer invoice software: for when you’d rather shoot clients than chase them for payment (Figuratively, of course.)

Managing your money might not be the most exciting part of being a photographer, but it’s one of the most important.

Between shooting golden hour portraits and wrestling with Lightroom presets, invoicing and expense tracking can feel like the dull side of the business. But the truth is that inconsistent billing and disorganized records can cost you real income.

The good news? Staying on top of your finances doesn’t have to be complicated or time-consuming.

With the right tools—like a good photographer invoice software—you can send polished invoices, track your spending, and understand where your money’s going.

Let’s break down how you can stay organized, get paid faster, and keep business costs for photographers in check.

Set Up a System That Works

Getting your financial system in order doesn’t mean building complex spreadsheets or hiring a full-time bookkeeper. It just means putting repeatable tools and habits in place—ones that save you time and keep your income predictable.

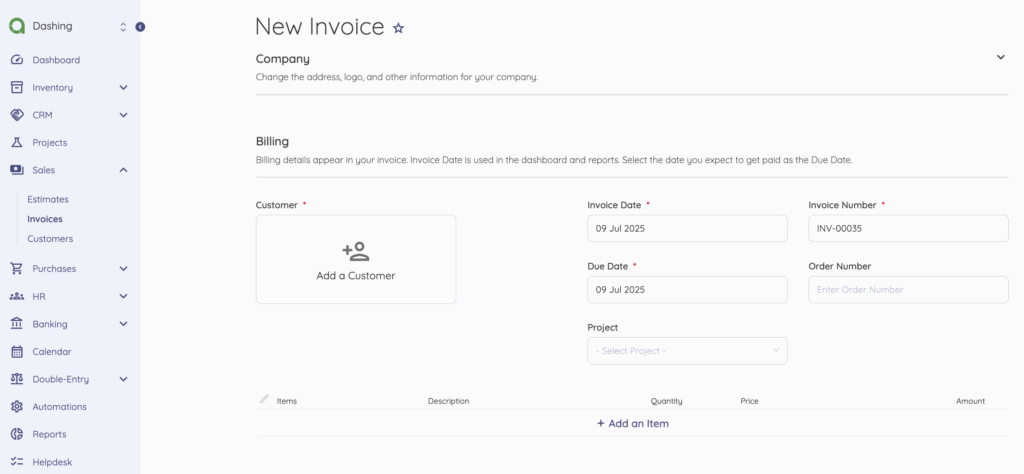

Choose the Right Invoicing Software

The best invoicing tools help you manage clients, track payments, and monitor your cash flow in real time.

As a professional photographer, you’ll want features like:

- – Customizable templates

- – Automated payment reminders

- – Integration with calendar bookings or CRMs

- – The ability to handle both service-based and product-based billing

This is where photographer invoice software shines—it’s built with creative businesses in mind, offering flexibility, ease of use, and a professional look that builds trust with your clients.

Create a Standardized Invoice Template

Every invoice you send should include the essentials: your photography business name, contact info, itemized services, due date, payment terms, and any tax or discount lines.

Standardizing your invoice is all about minimizing confusion and speeding up payments.

Depending on your workflow, you can save templates in your photographer invoice software or as a branded PDF to fill in manually.

Automate Where You Can

Time is money—especially when you’re bouncing between client shoots, edits, and admin. Automating your financial workflows reduces repetitive tasks and ensures smooth operations.

Consider automating:

- – Recurring invoices for retainer clients or monthly subscriptions

- – Payment reminders and late fees

- – Package pricing for preset offerings

- – Expense tracking via receipt scanning apps

As photographers look for ways to diversify their income and streamline services, offering digital tools like AI headshot generators can be a game-changer. And yes—photographer invoice software makes billing for these digital services incredibly simple.

Since the product is digital and standardized, you can create preset packages and automate your invoicing with tools like Akaunting. This reduces admin time and ensures faster payments—all while adding a scalable, passive income stream to your photography business.

Track Photography Business Expenses Like a Pro

Tracking expenses is how you protect your bottom line during tax time. From gear upgrades to editing software, small recurring business costs for photographers add up fast.

Knowing where your money goes helps you make better decisions, stay profitable, and prepare for tax season without the last-minute panic.

Categorize Your Expenses

Don’t let all your business expenses get lumped into “miscellaneous.” Create clear categories like:

- – Gear and equipment costs

- – Software and subscriptions

- – Advertising and marketing

- – Travel and lodging

- – Insurance

- – Client gifts or prints

- – Office supplies

Keep Receipts and Records Organized

Tossing receipts in a shoebox doesn’t cut it—especially when tax season rolls around. The easier it is to store and retrieve your records, the more likely you are to stay on top of your finances.

Use a digital system that fits your habits. Receipt scanner apps, your phone camera, or photographer invoice software that supports file uploads can help you snap, label, and store everything in one place.

Set up cloud folders by month, client, or category—and don’t forget digital receipts from online purchases. Email confirmations for gear or prints are just as important.

Understand Deductible Expenses

Below are the types of expenses photographers can often deduct for taxes:

- – Camera bodies and lenses

- – Memory cards and storage

- – Invoicing and accounting software

- – Editing tools

- – Travel to and from shoots

- – Website hosting and domains

- – Studio rent or home office space

Beyond the photo shoots themselves, many professional photographers diversify their income through complementary products and services. For example, offering customized wedding guest books to wedding clients tends to be a significant source of income. It’s essential to correctly invoice these sales and control the costs associated with them such as design, printing, and shipping), thus assessing profit accurately.

To make these product-based services worth your time, treat them like you would any shoot. Standardize your pricing, outline your costs, and keep everything documented.

Also, be sure to include these costs as business expenses for photographers in your records so your reporting reflects true margins. Tracking every input helps you evaluate whether these offerings are profitable or need to be adjusted. It also provides a more accurate picture of your business’s overall performance.

Schedule Regular Financial Check-Ins

Set a weekly or monthly time to sit down and review your income and spending. Even 15 minutes can help you spot late payments, track income trends, or update your budget.

Treat it like photo editing—it’s not glamorous, but it’s necessary for delivering your best.

Final Thoughts on Staying on Top of Your Photography Finances

When you take the time to build simple financial systems, you’re setting yourself up for long-term success. By organizing your invoices, tracking every expense, and building in a few automations, you’ll spend less time chasing payments and more time behind the lens.

The more control you have over your numbers, the more freedom you’ll have to focus on creative work and new income opportunities—with fewer surprises along the way.

With the right photographer invoice software, you don’t need to be a finance pro. Just consistent, smart, and a little more business-savvy.

About the author

Kelly Moser is the co-founder and editor at Home & Jet, a digital magazine for the modern era. She’s also the content manager at Login Lockdown, covering the latest trends in tech, business and security. Kelly is an expert in freelance writing and content marketing for SaaS, Fintech, and ecommerce startups.