Accounting Tips for Content Creators: How to Stay Profitable and Organized

Reading Time: 5 minutesYou create content like a pro—but managing money? That’s another story. These accounting tips for content creators will help you keep more of what you earn and stress less come tax season.

If you’re a content creator, you probably didn’t get into the business for the bookkeeping. But keeping your finances in order is just as important as hitting upload or landing your next brand deal.

Without a solid accounting system in place, even successful creators can encounter cash flow issues, tax headaches, or miss opportunities for business growth.

In this guide, we’ll walk you through practical accounting tips for content creators. Learn how to stay organized, track your income, prepare for taxes, and build a real financial footing behind the scenes.

7 Accounting Tips for Content Creators Who Want to Treat Their Brand Like a Business

Below are actionable accounting tips to help you stay organized, financially prepared, and ready to scale your content business with confidence.

1. Separate Your Finances

The creator economy has exploded, with over 207 million content creators worldwide. And that number’s only growing.

Whether you’re freelancing on the side or managing a full-time brand as a social media influencer, treating your content work like a business is what sets sustainable creators apart from hobbyists.

As your content creation business grows, keeping personal and business expenses separate is key, not just for income tax purposes but also for gaining a clearer view of profitability.

One practical approach is to use dedicated financial tools, such as startup business credit cards with no credit check, which help new creators build financial credibility while managing cash flow, even if they’re just getting started and have limited or no credit history.

These cards are often easier to qualify for and can provide access to essential credit without a hard inquiry, making them a smart early move for creators working to establish a business financial footprint.

Many also come with helpful features, such as expense categorization, cashback on business purchases, and integration with accounting software, which further simplify financial tracking and budgeting. Using the right card can also help you separate deductible business expenses, streamline year-end reporting, and potentially increase your business’s purchasing power as you grow.

2. Smooth Out Income Gaps With Flexible Funding

Managing irregular income can be challenging for content creators, especially when payments are delayed or expenses accumulate. That’s where a small business line of credit can be a game-changer.

It provides flexible access to funds when you need them, which is ideal for covering equipment upgrades, software subscriptions, or even outsourcing tasks during busy seasons. Pairing this with effective bookkeeping ensures you stay organized, maintain cash flow, and focus more on content and less on financial stress.

3. Track Every Income Stream

Between brand deals, ad revenue, affiliate links, merchandise, and digital products, content creators often juggle multiple taxable income sources.

Without a system to track them, it’s easy to lose sight of how much you’re earning or forget to report income during tax season.

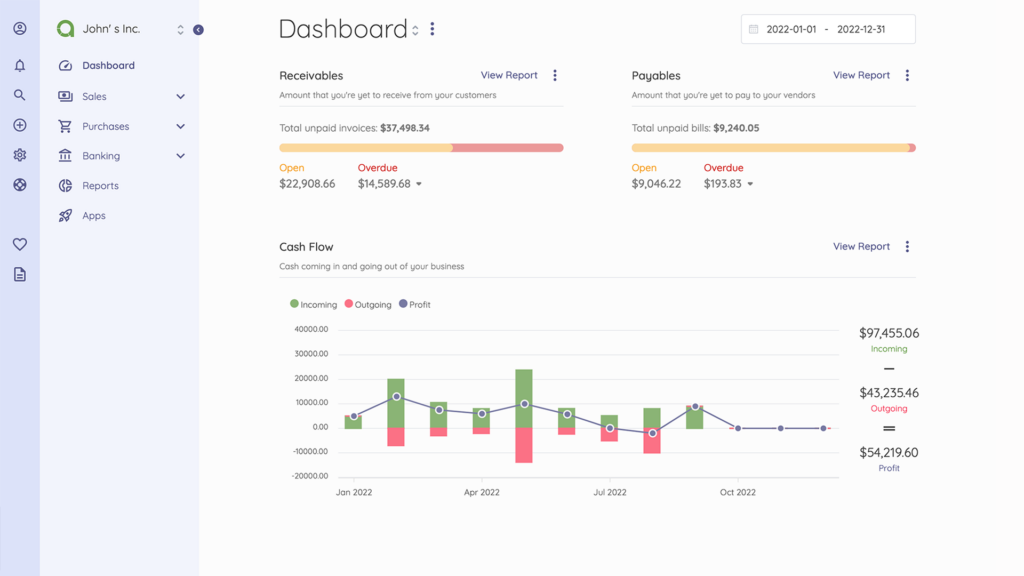

Use accounting software like Akaunting to keep detailed records, log every payment, match it to your client or platform, and track what’s outstanding. Alternatively, You can create a simple spreadsheet if you’re starting out.

Either way, the goal is to know what’s coming in and where it’s from so you can spot trends, project future earnings, and catch missing payments early.

4. Know What You Can Write Off

You might be leaving money on the table if you’re not taking full advantage of deductions. As a content creator, many of your business expenses are tax-deductible. This includes things like:

- – Camera gear, lighting, tripods, and editing software

- – Website hosting and domain registration

- – Subscriptions to design tools, stock photo sites, or project management software

- – Home office expenses (a portion of rent, utilities, internet)

- – Travel and meals related to business trips or events

Keep digital or physical receipts organized by category. Many accounting apps allow you to upload and tag receipts instantly, making tax season far less painful.

5. Prepare for Taxes Before Tax Season

Unlike salaried employees, content creators don’t have taxes withheld automatically. That means you’re responsible for estimating and paying them throughout the year.

Set aside a portion of each payment. This helps you avoid a tax surprise bill (or penalties). A safe range is 20–30%, depending on your location and income level. Deposit this into a separate tax savings account so you don’t accidentally spend it.

You may also need to file quarterly taxes, depending on your country’s tax requirements and income level. Consult a tax pro if you’re unsure when and how much to pay.

6. Automate the Boring Stuff

Your energy should go into creating, not chasing invoices or manually logging expenses. That’s why automation is a content creator’s best friend.

Use tools that can handle repetitive financial tasks, such as:

- – Recurring invoices for regular clients

- – Auto-categorizing transactions

- – Reminders for unpaid invoices or upcoming tax deadlines

- – Mileage tracking apps (applicable if you drive for business)

- – Integration between your payment processor and accounting software

7. Know When to Call in a Pro

DIY accounting works…until it doesn’t. If your income is growing, you’re forming an LLC. If you’re unsure about tax regulations, it may be best to hire a bookkeeper or an accountant to save you time and money in the long run.

A reputable financial professional will help you:

- – Set up systems that scale your business

- – Maximize deductions without red flags

- – File your taxes correctly and on time

- – Plan ahead for business growth

Final Words

You don’t need to be an accountant to be a profitable content creator, but you do need a system. From separating your finances to tracking your income, managing taxes, and building credit, these accounting tips for content creators can help you stay organized so you can focus on creating in front of the camera (or keyboard).

Start with the basics. Build smart habits early. And as a business owner, don’t be afraid to lean on tools or professionals when things get more complex. Because the more intentional international you are with your finances, the more room you’ll have to grow, create, and thrive.

Keep your finances organized with Akaunting. Let’s get started.

About the author

Kelly Moser is the co-founder and editor at Home & Jet, a digital magazine for the modern era. She’s also the content manager at Login Lockdown, covering the latest trends in tech, business and security. Kelly is an expert in freelance writing and content marketing for SaaS, Fintech, and ecommerce startups.