Teletherapy and Taxes: How to Prepare Financial Records Year-Round

Reading Time: 5 minutesTelehealth visits have become more popular in recent years. In 2023, 58% of all telehealth appointments were for mental health or behavioral health care.

This means remote therapy is a significant part of healthcare. It also means more therapists earn income from multiple platforms, states, and pay/business structures.

With this growth comes the responsibility of managing your clinical work and financial records.

Creating a straightforward system to track income and business expenses throughout the year will help you stay organized and ease the burden of tax season.

This guide will walk you through simple steps to be tax-ready and maintain a clean financial record.

Table of Content

- – Understanding the Tax Responsibilities of Teletherapy Professionals

- – Essential Financial Records Therapists Should Keep

- – How to Set Up a Year-Round Financial Tracking System

- – Use a Separate Business Bank Account

- – Choose Reliable Accounting Software

- – Keep Digital and Paper Records Organized

- – Set a Monthly Reminder to Review Your Finances

- – Final Thoughts

Understanding the Tax Responsibilities of Teletherapy Professionals

As a teletherapy provider, your tax situation is a bit different from someone with a regular paycheck. You’re usually considered self-employed, which means you’re responsible for reporting your income and paying taxes yourself, often without the help of a tax expert.

Here’s what you need to know:

- – Self-employment tax: This covers your Social Security and Medicare contributions. You pay this on top of your regular income tax.

- – Multiple income sources: You might get paid by clients directly through teletherapy platforms or insurance companies. Each source may issue tax forms like the 1099-NEC if you earn over $2000. The reporting threshold for Form 1099-NEC (and 1099-MISC) is increasing from $600 to $2,000 per payer per year, under the “One Big Beautiful Bill” / Section 70433 changes.

- – Reporting your income: You’ll use Schedule C (Form 1040) to report both your income and expenses.

- – Quarterly estimated taxes: Because taxes aren’t withheld automatically, you might need to send estimated payments every few months to avoid surprises.

- – State and local taxes: If you work with clients in different states, you may have additional tax rules to follow.

Essential Financial Records Therapists Should Keep

Good recordkeeping is ensuring you pay the right amount in taxes and claim all the small business tax deductions you qualify for.

Here’s what you should be tracking:

- – Income records:

- Payment confirmations and invoices from clients and platforms

- Bank statements showing deposits

- Any 1099 forms you receive

- – Expenses:

- Software and platform subscriptions (e.g., telehealth software, practice management software)

- Office costs (e.g., internet, phone, equipment) for the home office deduction

- Licensing fees and continuing education

- Marketing and advertising expenses

- Teletherapy equipment

- – Contracts and agreements:

- Copies of agreements with clients and teletherapy services

- – Mileage logs:

- If you travel for business, keep a detailed log

- – Bank and credit card statements:

- Especially if you use a separate account for your business

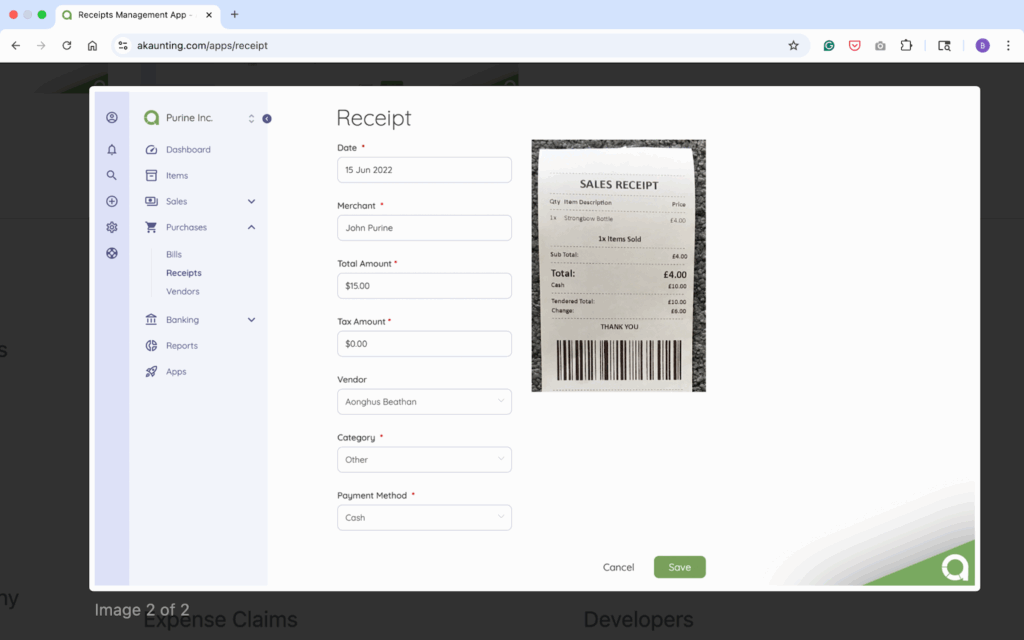

Keeping these documents organized as you go means tax season won’t catch you off guard. Using a receipt management app can make scanning and storing receipts easy.

How to Set Up a Year-Round Financial Tracking System

Setting up a system you use consistently will save you time, reduce stress, and make tax season way easier.

Use a Separate Business Bank Account

Mixing your personal and business money is a quick way to create confusion. Opening a separate bank account just for your therapy practice helps you:

- – Clearly track your business income and expenses

- – Simplify reconciliation at tax time

- – Maintain professionalism (some clients may prefer paying into a business account)

- – Protect your personal assets by keeping finances separate

Most banks offer free or low-cost business checking accounts. Choose one that fits your needs and that you can easily use online or via a mobile app.

Choose Reliable Accounting Software

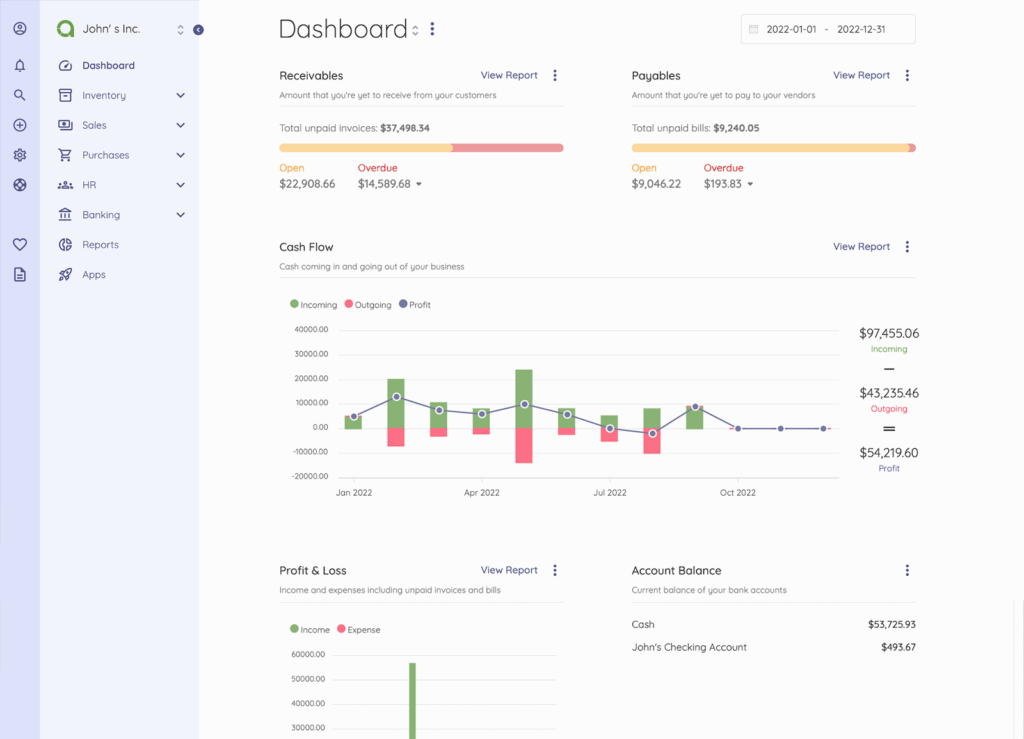

If you feel overwhelmed with tracking your money, free accounting software can do the heavy lifting by:

- – Automatically importing transactions from your bank

- – Categorizing expenses and income

- – Generating reports like profit and loss statements

- – Helping you prepare for tax deadlines

Many accounting tools offer plans designed for small businesses or freelancers and also provide mobile apps for tracking on the go. Easy-to-use dashboards are also a nice feature. They give you a clear overview of your income, expenses, and cash flow anytime, anywhere.

Keep Digital and Paper Records Organized

Good bookkeeping helps keep everything tidy and easy to find. Follow these tips to stay organized:

- – Create folders on your computer or cloud storage labeled by month and year.

- – Scan paper receipts and save them digitally to avoid losing important documents.

- – Use receipt scanning apps to snap photos of receipts and categorize them instantly.

- – Back up your records regularly, so you don’t lose anything if your device fails.

This ensures you spend less time hunting for documents when tax season comes around or when questions arise.

When preparing financial records for your teletherapy practice, clarity and accuracy are key, especially if you’re documenting expenses, client communications, or notes for tax season. An online grammar checker ensures your records, emails, and logs are free of ambiguity or errors that could lead to misunderstandings or tax missteps.

By maintaining clean, professional language year-round, you enhance your credibility and make audits and deductions easier to navigate when it’s time to file.

Clear, well-organized records give you peace of mind and more time to focus on what matters. And that’s providing quality care to your clients.

Set a Monthly Reminder to Review Your Finances

It’s easy to let bookkeeping slide when you’re busy with clients—setting a recurring calendar reminder once a month to review your income and expenses helps you spot mistakes early and stay on top of your records.

During this quick monthly check-in, you can:

- – Confirm all payments and invoices are recorded

- – Categorize any uncategorized transactions

- – Scan and file any new receipts

- – Confirm that your bank and credit card statements are accurate

Final Thoughts

Managing a teletherapy practice might look straightforward on the surface, but behind every session is a business that thrives on good habits, smart planning, and well-thought-out financial choices.

Whether your payments come from clients, platforms, or insurance, knowing exactly where your money comes from and where it goes gives you control and helps avoid tax-time surprises.

Sync your bank transactions regularly, review your financial reports monthly, and set aside money for taxes as you go. Treat your teletherapy practice with the same care and professionalism you give your clients.

PS: Simplify your financial management and keep your records organized annually with Akaunting software—no accountant needed.

About the author:

Kelly Moser is the co-founder and editor at Home & Jet, a digital magazine for the modern era. She’s also the content manager at Login Lockdown, covering the latest trends in tech, business and security. Kelly is an expert in freelance writing and content marketing for SaaS, Fintech, and ecommerce startups.