What are Asset Accounts in accounting?

Reading Time: 4 minutesWithout Assets, making a case for an active and healthy business is challenging. Asset Accounts show a list of your company’s resources, created or acquired, with an economic lifetime value.

Assets Accounts are one of the three major classifications of balance sheet accounts – Assets, Liabilities, and Stockholders’ equity (or owner’s equity).

Assets = Liability + Owner’s equity

As a small business owner, your starting capital falls under an asset as it is a resource that births your business idea and helps you manage daily operations.

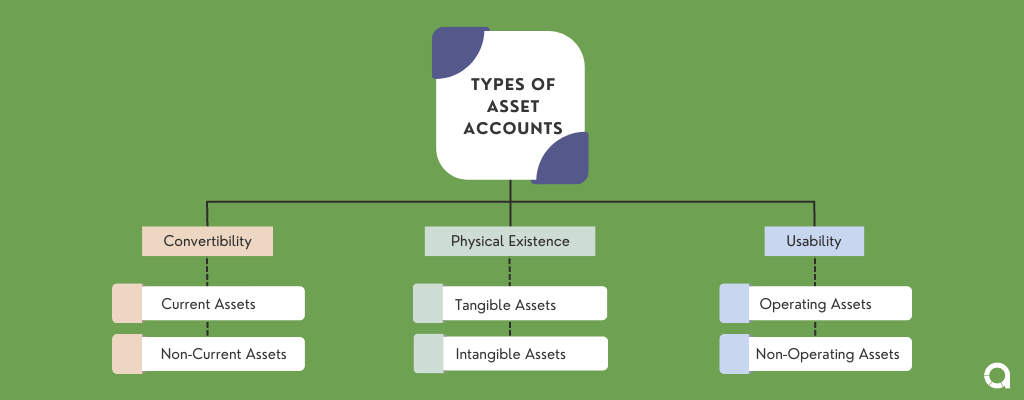

Types of asset accounts

Your Asset Accounts can be classified into three:

- Convertibility: These are assets that can either be current or non-current.

- Physical existence: Assets that are tangible or non-tangible

- Usability: These are operating or non-operating assets

List of Asset Accounts

- Current Assets

- Non-current assets

- Tangible assets

- Intangible assets

- Operating assets

- Non-operating assets

Current Assets

These short-term resources can be converted into cash or valuable within a business year. While inventory is listed as a current asset, it could become obsolete and be written off depending on the situation.

Examples of current assets include but are not limited to cash, bank deposits, notes receivables, inventory, supplies, prepaid expenses, and marketable securities.

Non-current assets

These are your company’s long-term investments whose total value can’t be realized within an accounting year and can’t be easily converted into cash.

They are generally valued at their acquisition cost and may only be convertible into cash at a discount. Examples include but are not limited to land, life insurance, long-term investments, trucks, and others. Tangible fixed and intangible fixed assets also make up the non-current assets—more on that.

Tangible Assets

These assets have physical substance, clearly defined monetary value, and can be bought or sold to increase your company’s financial capacity.

There are two types of tangible assets:

- Inventory: This comprises raw materials, goods in process, and finished products

- Fixed assets: These are pieces of equipment – printers and copiers, office space – property being leased by the company as the lessee, buildings, land, pieces of furniture, etc.

Intangible Assets

These are non-monetary assets with no physical substance (i.e., can’t be seen or touched).

They can be either amortized or tested for impairment each year.

Examples include patents, trademarks, copyrights, domain names, broadcast licenses, and goodwill.

Operating Assets

These are assets required to handle your day-to-day business operations. They serve as revenue-generating assets.

Examples of operating assets include cash, prepaid expenses, accounts receivable, inventory, and fixed assets. Some intangible assets are also recognized as operating assets – such as technology licenses needed to manufacture goods.

Non-operating Assets

Business resources that are not needed to handle your day-to-day operations are non-operating assets. A company’s non-operating assets may be unused land, spare equipment, investment securities, etc. Income from non-operating assets contributes to the non-operating income of a company.

Other Examples of non-operating assets are short-term investments, marketable securities, and interest income from fixed deposits.

Is Accounts Receivable an asset?

Accounts receivable are contractual monies owed to a company and are usually expected to be claimed within an accounting year.

As a result, they are considered a current asset.

When a receivable takes over one year to convert, it can be recorded as a long-term asset.

Accounts receivable are often misunderstood to be current/long-term liabilities or equity.

However,

It isn’t. It’s money with a mutual agreement of payment to a company for a service or product and reflects on the balance sheet.

Is Accounts Payable an asset?

Accounts Payable (AP) is not an asset.

These are monies your company owes to vendors or creditors and are expected to pay off within an accounting year. They represent short-term debts, so you report AP on the balance sheet as current liabilities.

Furthermore, Accounts Payable can be recorded as Debit or Credit on your company’s balance sheet. When a service is paid for, accounts payable are recorded as a credit; however, if a vendor provides goods or services without immediate payment or cash up front, Accounts Payable are recorded as Debit.

Assets and liability accounts

Assets and Liabilities are both categories of accounts in your company, serving different functions.

While Assets show a list of your company’s resources that could add economic value to your company in the short or long term, Liabilities are obligations—either money owed or services – your company is yet to perform.

Furthermore,

Your company needs to have more assets than liabilities to have enough cash to handle daily operations and pay debts.

If a small business has more liabilities than assets, that represents poor financial health and a sign of trouble.

Liabilities aren’t always bad; they can assist the growth of a business through loans.

However,

it is important that liabilities mustn’t grow faster than assets.

Assets vs. Liabilities

| Assets | Liabilities |

| Accounts receivable | Accounts payable |

| Can be converted into cash | A business risks bankruptcy by having more liabilities than Assets. |

| The business owns the items. | It can be used to purchase assets. |

| Fixed assets and current assets | Current and non-current liabilities |

| Increase in Assets – Debited Decrease in Assets – Credited | Increase in Liability – Credited Reduction in Liability – Debited |

| Inflow of cash | Decrease cash balance |

Final thoughts

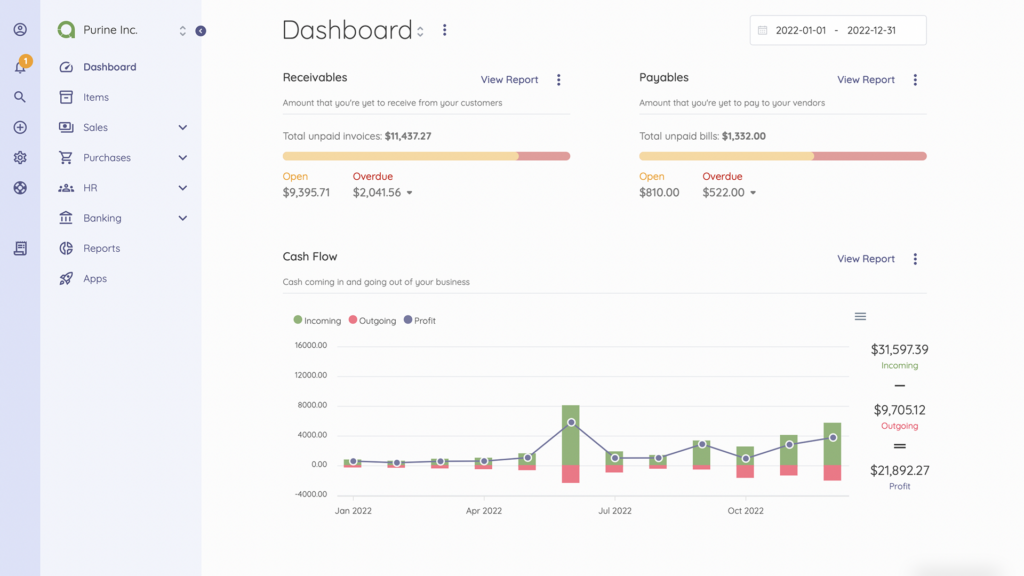

Keeping tabs on your business asset accounts gives insights into your company’s financial status.

As you would discover,

These insights are valuable to interested parties, such as investors, especially when planning to secure loans for business expansion or stability.

Akaunting lets you efficiently manage your Asset Accounts – seeing what you earn or owe in the simplest form. Get started.