What is a Trial Balance in Accounting?

Reading Time: 4 minutesWhat is a trial balance, the types, who uses it, and for what purpose?

In a news organization, there are news writers and editors. An editor checks the stories of reporters to ensure cohesion and comprehensiveness.

A trial balance acts as an editor of your financial statements.

So,

What is a trial balance?

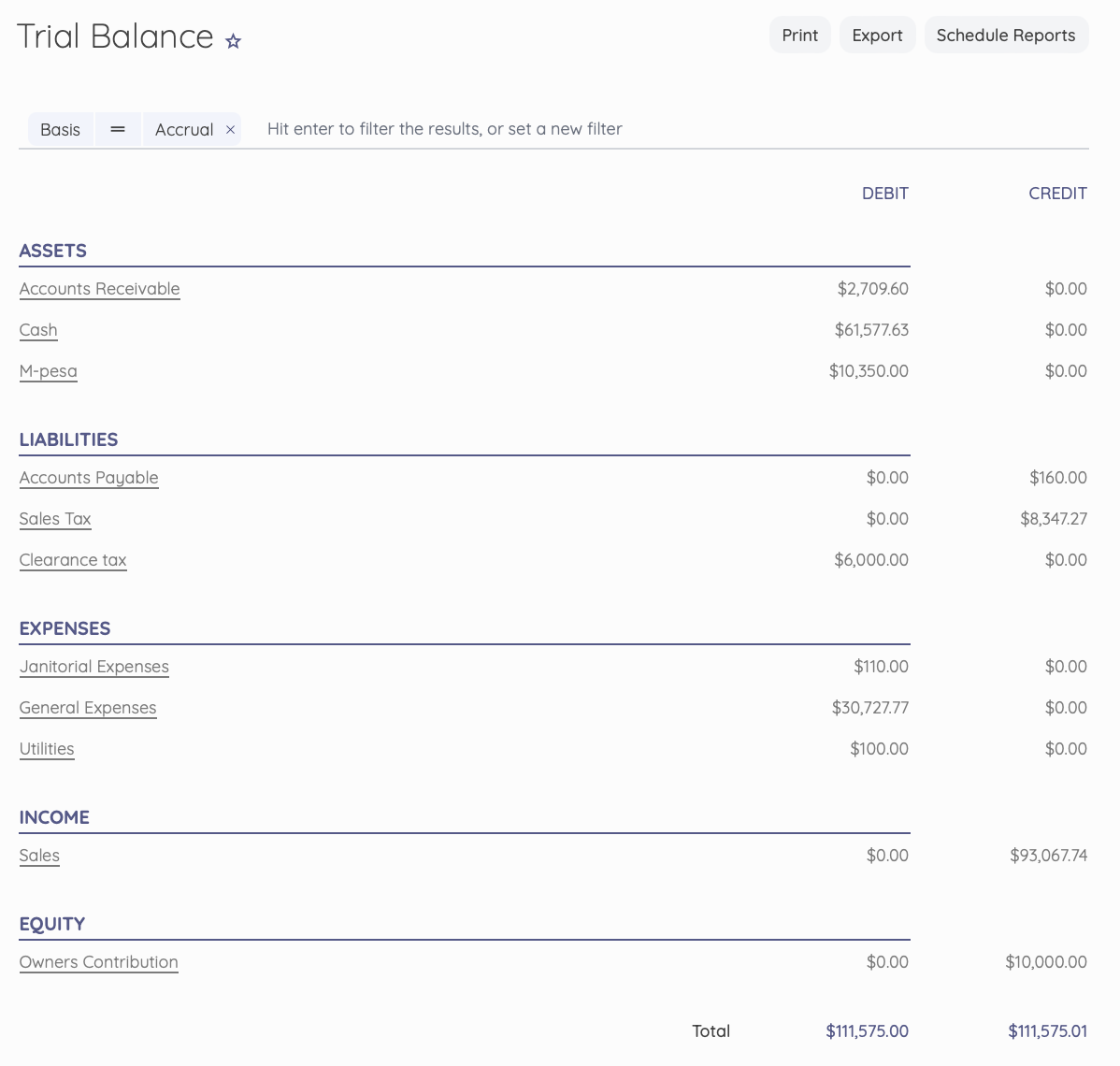

It is an internal report that ensures all credit and debit accounts in the general ledger are accurately recorded or balanced.

All debit accounts are reported in one column, while the credit accounts are in another. However, both balances should be equal.

An initial report you prepare is called Unadjusted. It is Adjusted after the records have been proven error-free or adjustments made to the documents.

The Adjusted is what your company uses to prepare other financial statements in double-entry accounting.

One thing to note is,

It’s common for small businesses to record errors on the trial balance when using a manual accounting system for journal entries; however, accounting software limits such errors.

Trial balance 101: A trial balance is a financial report that shows all accounts and their closing in the general ledger within an accounting period.

Types of trial balance

There are three types

- Unadjusted

- Adjusted

- Post-closing

Unadjusted Trial Balance

It is a report that hasn’t been checked for mathematical errors. Small businesses use the unadjusted to list all the business accounts that will appear on the financial statements before making any adjustments to the journal entries.

Adjusted trial Balance

The adjusted is the reverse of the unadjusted.

You list the closing balances of all accounts in the general ledger after making adjustments to correct any errors.

Adjustments could be for prepaid, accrued expenses, or non-cash expenses.

The Adjusted ensures that the total amount of debt equals the total amount of credit.

Post-closing

A post-closing is one of the last steps in the accounting cycle.

It is a general ledger summary at the end of an accounting period after closing all entries and preparing the financial statements.

The post-closing does not have records of income or expenses, you close all those out and move them into retained earnings for the next accounting period.

What is the purpose?

It is an essential part of the double-entry accounting system.

It’s advised to use accounting software for your accounting processes to limit errors in computations.

However, for those who use manual processes, it ensures that debit and credit accounts are equal and without errors.

Your total debits should equal total credits for the trial balance to be correct.

Any difference in the total balances indicates some missing records, which you should sort out before transferring them to the official financial statements.

Although the trial balance helps to highlight mathematical errors, some may go unnoticed.

Accounting errors a trial balance can’t solve

While it can help you trace errors on the general ledger, some mistakes cannot be detected:

- The error of omission: When you fail to record a transaction or enter it into accounting software.

- Wrong data entry: When you enter the incorrect amounts on both sides of the double-entry accounting system.

- Wrong entry of credit/Debit data: When you enter a debt amount in credit and vice-versa.

- Principle error: The credit/ debit side is correct with the right amount, but the type of account is wrong. An example is recording a liability account in the income account.

- Commission error: The transaction amount is correct, but the account debited or credited is wrong.

Let’s examine some advantages and disadvantages.

Advantages

- It ensures that the total balance of debits equals credits

- It helps you find the errors in posting accounts and journal entries

- It forms the base for preparing financial statements

- It helps with the listing of accounts for an easy view of all business account

- You can tell the ending balance of each account at a glance

Disadvantages

- There is no way to show that you recorded all transactions

- You can’t verify the authenticity of a ledger

- It can’t identify some accounting errors; hence numerous errors may exist even though the debit and credit balances agree.

- If there are missing entries for the journal or ledger, you can’t find them with the trial balance.

- It cannot prevent errors of principles, commission, or wrong debit/credit data entry.

Final thoughts

The trial balance report is quite essential to your business. It provides insights into your income and expenses over an accounting period.

The information on a trial balance can assist in making informed decisions on how to allocate business resources.

The report also assists with internal auditing, which can help you compare your listed assets with the physical assets and check for possible inconsistencies.

Accounting software simplifies entering your debit/credit accounts into the trial balance report. Try Akaunting for free and enjoy unlimited access to error-free manage your basic bookkeeping needs.

Trial Balance Frequently Asked Questions (FAQs)

- What is not included in the trial balance?

You should not include accounts with zero balances because they don’t reflect anything.

- When should the trial balance be completed?

Within 21 days after the end of each named month or accounting period.

- Is the Adjusted the same as the Post-closing?

The Adjusted acts as a base for the Post-closing balance. However, they are not the same.

- What’s the difference between a balance sheet and a trial balance?

A trial balance is an internal document prepared by the accounting team to track debit and credit balances. In contrast, the balance sheet is a company’s financial disclosure to the public.