6 Ways Subscription Businesses Can Optimize Cash Flow

Reading Time: 7 minutesCompared to other business models, subscription-based businesses tend to have higher retention rates.

Traditional one-time-purchase businesses rely on repeat marketing to get customers back, so retention can often be lower.

But subscription models create built-in recurring engagement, so it’s easier to keep customers.

Still, you need to get strategic about optimizing your cash flow, so you can keep the money moving.

Here are the top six ways you can support your business to bring in more steady revenue, so the money’s always flowing in.

1. Reduce Subscription Cancellations

Give customers a reason to stay by following through on your promises. If you guarantee them minimal down time, their experience must reflect that. If you market your excellent customer service team, customers need to get top-tier support every time they call or email in.

Another way to reduce cancellations is to stay committed to solving their problems. Be sure to stay in the loop about this because their needs can change.

Send monthly or quarterly customer satisfaction surveys, and conduct interviews with some of your top customers.

Listen to what they complain about and address the issue as soon as possible.

When you do this consistently, you encourage better customer retention. And most importantly, you pour into your customer relationships. (This is one of the best ways to set yourself apart from the competition.)

2. Encourage Longer Subscriptions

Make it a no-brainer to choose an annual subscription instead of a monthly plan. This is one of the best ways to encourage a higher customer lifetime value.

For example, offer an annual discount.

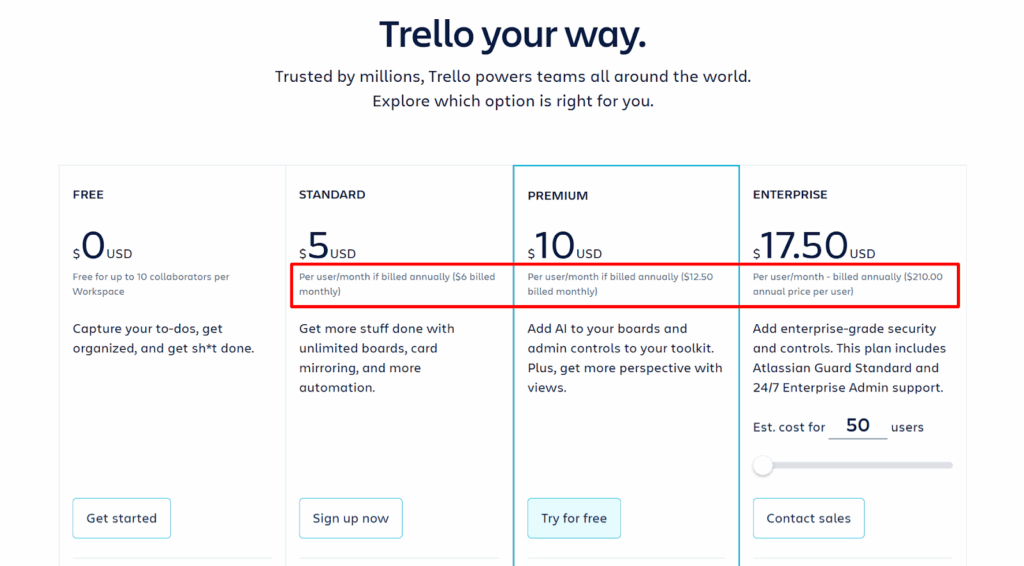

Trello, for instance, offers a $5 or $10 per user/month option if billed annually. (Its enterprise plan requires an annual subscription, which is super common for large businesses.) If users choose to get billed monthly on the standard or premium plan, they’ll pay $6 or $12.50 per user/month. 👇

When you encourage annual subscriptions, you’ll get immediate cash flow, and your customers will get lower billing overhead.

The only caveat here is that you want to be choosy about how much of a discount you give. A generous discount is typically around 10-25% off, but you need to ensure your business can afford this.

A way to strike a happy middle is to offer a good discount on an annual plan during a select time period. (For example, during December and March only.) For the rest of the year, new subscribers can still receive a discount, but it will be less steep.

If you can afford a steep discount year-round and it’s bringing in new, loyal customers, keep it.

To protect your business and get a feel for your annual versus monthly subscription cash flow, pay attention to:

- – The percentage of new signups on annual plans during steep annual discount campaigns. (Versus during regular annual discount campaigns.)

- – How long subscribers tend to stay with you on a monthly plan.

- – Do they continue month after month? For how long?

- – How long subscribers tend to stay with you on an annual plan.

- – Do they sign up every year?

- – Your Customer Acquisition Cost compared to your Customer Lifetime Value when implementing annual discount plan campaigns.

- – Specific churn differences (annual churn vs monthly churn).

3. Optimize Your Pricing Plans

Get strategic with how you price your subscriptions.

Not all customers need everything you’ve listed in a pricing plan.

While it may not be super convenient for you to let customers pick and choose features, it could be the reason they stay or choose you.

Imagine looking into a project management tool, and the simplest plan has seven different view styles, endless board customizations, custom field options, and dedicated client portals. (But you only need two view styles, Kanban and Gantt. And you don’t need endless customization options. Or client portals.)

In this case, you might opt for a simpler tool that offers basic features, rather than overpaying for add-ons you don’t need.

In other words …

Put yourself in your customers’ shoes.

What do they really need? Consider giving them simpler plans with the option to add custom, paid features.

Tiered plans are a great way to give customers what they need while maximizing revenue.

4. Offer Tiered Plans

Implement tiered pricing to give customers only what they need, with the option to scale up when they’re ready. They get a plan that fits their current needs, and you have the opportunity to upsell them as their business or personal needs evolve.

It’s a win-win.

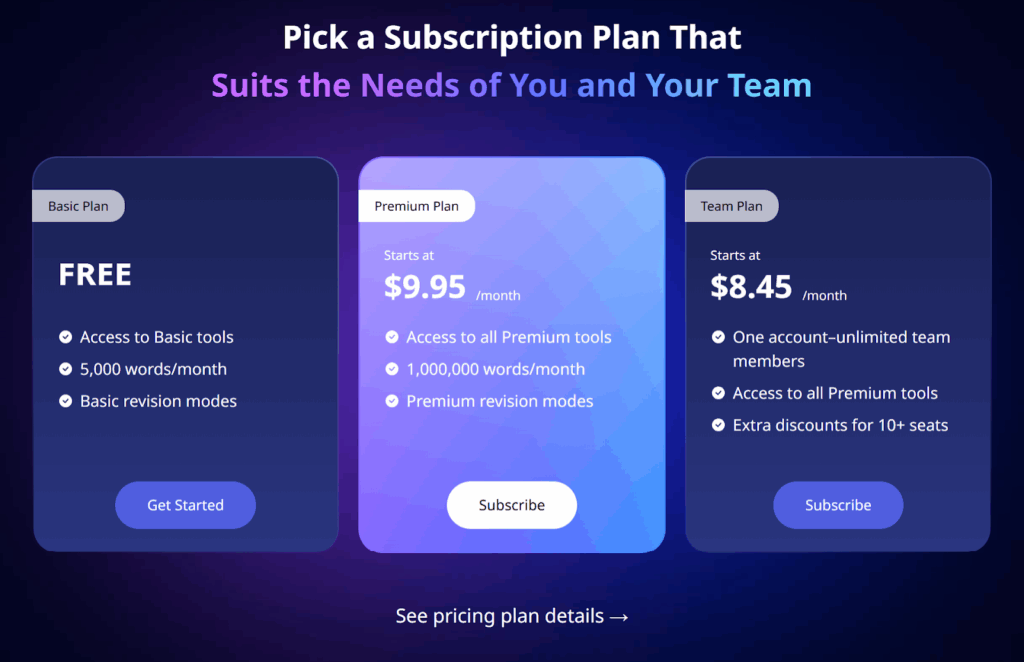

Here’s a great example by Wordvice. 👇

It offers a free grammar checker on its basic plan for up to 5,000 words a month, and simple tools and revision models. Users can upgrade to its premium plan if they’d like more words per month. Or its team plan if they need multiple “seats.”

Users aren’t forced into using its pro features.

5. Optimize Billing Cycles

Consider offering more flexible billing cycles.

Users’ financial restraints may vary monthly or annually. So, having the option to choose or change a payment date may be the reason they continue doing business with you.

For example, you might let them choose between monthly, quarterly, or annual billing.

Or you might let them change their due date from the first of the month to the 15th of the month. (Be sure to set boundaries, so you don’t end up juggling too many variations! Plus, you have your own monthly costs to consider.)

That said, we also need to address failed payments.

Every subscription business faces them. But the way you handle payment retries can make or break your cash flow and customer morale.

Long story short, never make a customer feel bad for missing a payment.

Stay away from language like …

- – “If you don’t update your payment, your subscription will be canceled today.”

- – “Update your card before you lose all of your work.”

- – “Your payment just failed.”

Aggressive collection messages like these can hurt your brand and drive people to cancel voluntarily.

Instead of chasing customers (which only pushes them away), create a smart retry system. Start with a small card validation when they sign up. If a payment fails, retry at three days, seven days, and 14 days.

When the retries fail, send a polite message like …

- – “We’d love to keep you on board. Update your card with one click to continue enjoying your subscription, Mary.”

- – “Hey, Lacey! Looks like your payment didn’t go through. No worries, you can update your info here.”

- – “Hi, John. Your payment details need a quick update to keep your subscription active. 🙂”

Also, switch up your channels.

Maybe start with an email, then SMS, then a quick phone call. Test different sequences out to see which channels and messages help you collect payment best.

(Pay attention to your payment success rate on the first attempt, how much revenue you recover through retries, and how long payments stay outstanding. Adjust your approach as needed.)

*Pro-Tip: Make it easy for customers to fix the issue. A one-click payment link in your dunning emails can work wonders.

6. Let New Customers Test The Waters With a Trial Offer

You might not think that offering something for free could help you stimulate cash flow, but sometimes it’s the smartest move.

(This usually works best for established subscription businesses, since the upfront cost won’t hurt their bottom line as much.)

The best thing about this approach is you’ll immediately get new customers in the door.

If you wow them and follow through on your promises, they’re more likely to stick around.

Also, some users can’t see the value in what you offer unless they take your service or product out for a test spin, first.

Still, you need to be strategic to stimulate cash flow and protect your monthly recurring revenue.

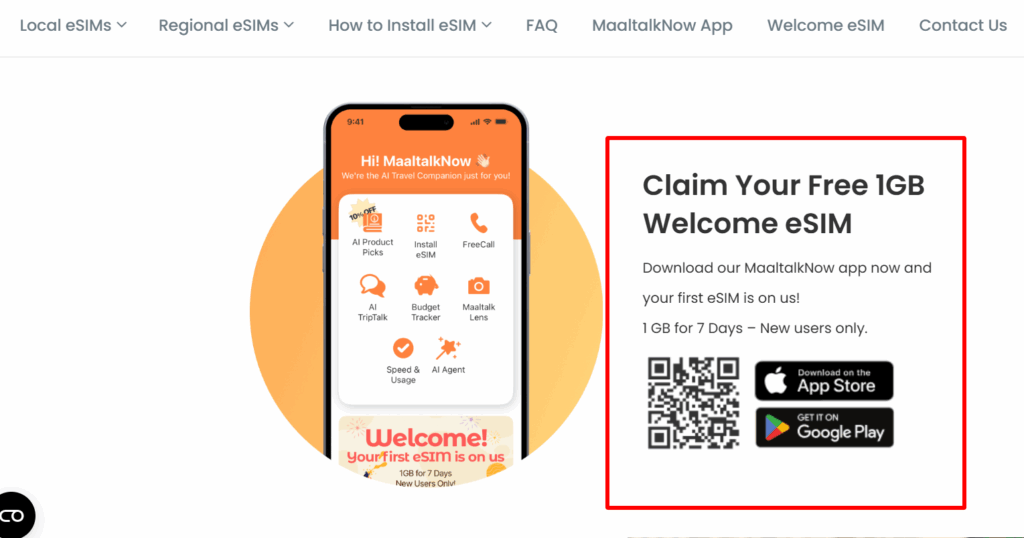

While some subscription businesses offer generous 30-day plans, you don’t have to take it that far. For example, new MaaltalkNow app users get a free Maaltalk eSIM and 1GB for seven days. This lets users connect to mobile data immediately, even without purchasing a full plan.

But to keep using it after seven days, they’ll need to choose and purchase a paid plan.

If users have a positive first experience, free trials will naturally turn into recurring revenue. 💅

Wrap up

Building cash flow in a subscription business requires control and clarity. Small, smart moves like these keep money flowing and customers engaged.

- 1. Reduce subscription cancellations

- 2. Encourage longer subscriptions

- 3. Optimize your pricing plans

- 4. Offer tiered plans

- 5. Optimize billing cycles

- 6. Let new customers test the waters with a trial offer

Need a tool to make it easier?

Akaunting helps you see exactly what’s coming in and going out, so you can manage revenue without guesswork.

GET STARTED WITH AKAUNTING NOW.

FAQs about subscription businesses

1. How do subscription business models make money?

Subscription models make money by charging customers recurring fees (monthly, quarterly, or annually). These are typically to access products/services.

They’re often supplemented with upsells, add-ons, or usage-based billing.

2. What is a good churn rate benchmark?

A healthy churn rate depends on your business model and growth goals. Many SaaS companies aim for around 5%, but what’s acceptable can vary by industry and strategy.

3. How do you price a subscription?

To price a subscription, you’ll need to factor in:

- – Willingness-to-pay testing.

- – Competitor benchmarks.

- – Your cost-to-serve.

- – Market research.

Tiered packages with add-ons can also help you increase sign-ups.

(Free trials work best once you’ve built brand trust or secured funding. You’re welcome to test these as a newbie, too, though.)

4. Should I offer a free trial or freemium?

You should offer a free trial or freemium plan if you can afford to do so. Established brands or well-funded subscription based companies may offer trials to lower friction (and let customers experience value before committing).

Make sure you have conversion automations in place, seamless onboarding, and time-limited access. This may or may not be the right move for your subscription business.

5. How do you reduce subscription churn?

To reduce subscription churn, conduct testing to uncover why your subscribers are churning.

You may need to use behavioral intelligence tools to diagnose why customers are leaving. You can also send out surveys to dig deeper into their pain points.

(It’s also important to create a seamless user experience, make sure onboarding is a breeze, and personalize your retention outreach.)

6. How do subscriptions complicate accounting?

Subscriptions make accounting tricky because revenue comes in over time, not all at once. You must follow certain rules, so revenue is recognized as services get delivered.

Renewals, cancellations, and plan changes make tracking even trickier. Be sure to ask an experienced accountant for support.

About the Author

Kelly Moser is the co-founder and editor at Home & Jet, a digital magazine for the modern era. She’s also the content manager at Login Lockdown, covering the latest trends in tech, business and security. Kelly is an expert in freelance writing and content marketing for SaaS, Fintech, and ecommerce startups.