The Financial Side of Being a Creator: Tools to Track, Bill, and Budget

Reading Time: 7 minutesTracking expenses, billing clients, and sticking to a budget isn’t always fun, but it’s essential if you’re a creator looking to work long-term.

Without the right tools, your cash flow can quickly become a blur, and that’s a problem.

You might be great at content creation, but still struggle to keep your marketing costs and personal expenses separate. Or maybe billing clients feels slow, or chasing payments is exhausting. If this sounds familiar, you’re not alone. Many creators face these challenges.

And luckily, there’s a solution.

Let’s take a closer look at why you need financial tools for better peace of mind when running your business. We’ll also give you a quick overview of some options that can help you track, bill, and budget like a pro.

Table of Contents

- Why Creators Need Financial Tools

- 8 Financial Tools for Creators to Track Expenses, Bill Clients, and Budget

- Wrap Up

- FAQs

Why Creators Need Financial Tools

You create content, but you also run a business. That means you must track every marketing dollar spent, manage invoices, and plan ahead. Without financial tools, you risk losing control over your cash flow.

Financial tools are pivotal for content creators because you can:

- – Track expenses accurately. Marketing budgets include ad spend, software subscriptions, equipment, and sometimes personal expenses. Financial tools keep all of this organized.

- – Bill clients efficiently. Whether you work with brands or freelance, you need fast, professional invoicing that gets you paid on time.

- – Plan your budget. Content creation involves many content formats, like videos, blogs, and social media posts. Each has costs. Finance tools help you budget to keep marketing strategy on track.

- – Manage irregular income. Your earnings can spike or dip based on projects or influencer marketing campaigns. Budgeting tools can help smooth out the bumps.

- – Understand profitability. Find out which projects or channels deliver the best conversion rates or cost per click, so you can optimize spend.

- – Stay tax ready. Track and categorize expenses throughout the year to make tax time less stressful.

(Use these tools to focus more on content marketing and less on chasing numbers.)

Top benefits of financial tools for creators

With financial tools that fit your unique needs, you can look forward to wins like:

- – Simplified project management with expense tracking

- – Accurate budgeting that supports your business plan

- – Insights to improve your content marketing budget

- – Better cash flow management to avoid shortfalls

- – Clear visibility into where your money goes

- – Faster billing with automated reminders

- – Reduced risk of missing tax deadlines

These benefits let you grow your brand without the financial guesswork many creators face.

8 Financial Tools for Creators to Track Expenses, Bill Clients, and Budget

Below you’ll find some of the best tools that can help you manage your finances as a creator. Each option has unique strengths, so you can identify the one that aligns best.

*Pro-Tip: Audit your current accounting needs before choosing your financial tools. Have a list of non-negotiables by your side when you’re reviewing options so you can easily check off the ones that don’t hit the mark.

Now, on to the tools:

1. Akaunting – Best Open-Source and Self-Hostable Option

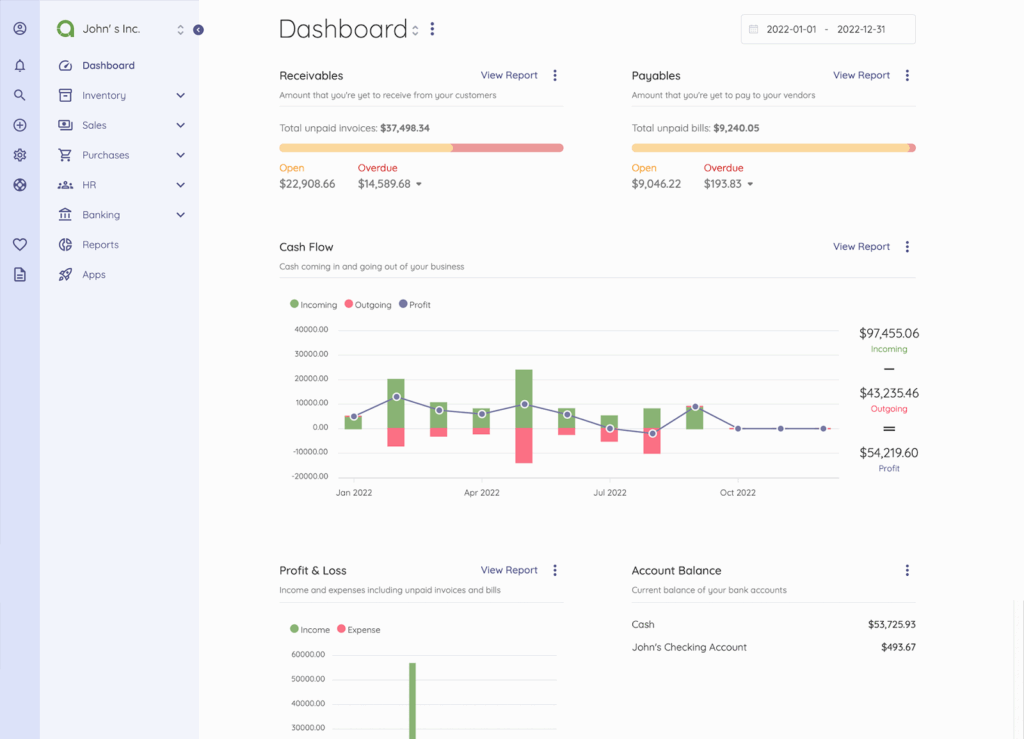

Akaunting is great if you want full control over your finances and customization.

Since it’s open-source and self-hosted, you decide how and where to use it. You can track expenses, bill clients, and manage your budget both on desktop and mobile. It also supports multiple currencies and connects with payment gateways like PayPal and Stripe. (If you manage clients abroad, this is a great feature.)

Akaunting also goes beyond basic features by letting you add contracts and budgeting tools that fit how you work. And when it comes to understanding your money, its reporting tools break down income and expenses in a clear, easy way.

Additionally, regular updates and a supportive user community contribute to the platform’s security and ongoing improvements. Akaunting also offers a cloud version that allows you to manage your finances online.

For tech-savvy creatives, Akaunting is a fantastic financial tool.

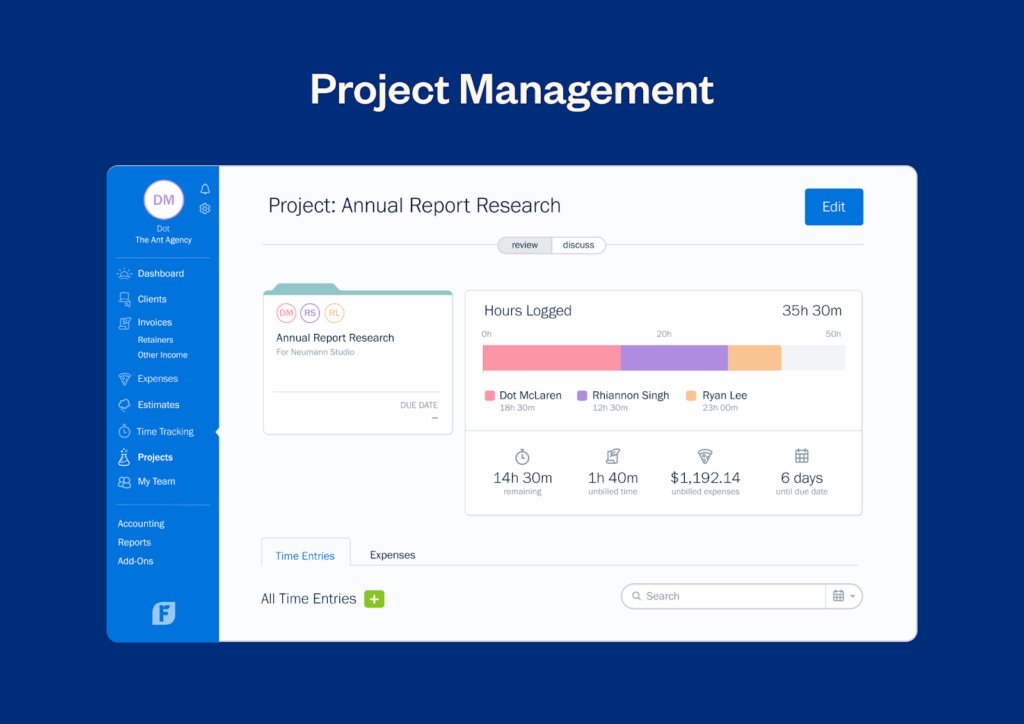

2. FreshBooks – Best for Freelancers

FreshBooks is designed with freelancers in mind. It offers easy invoicing, time tracking, and expense management. You can also automate billing and send professional invoices in seconds. FreshBooks also includes project management features.

It’s a great fit if you’re a freelancer that juggles multiple clients and wants to simplify billing and tax prep.

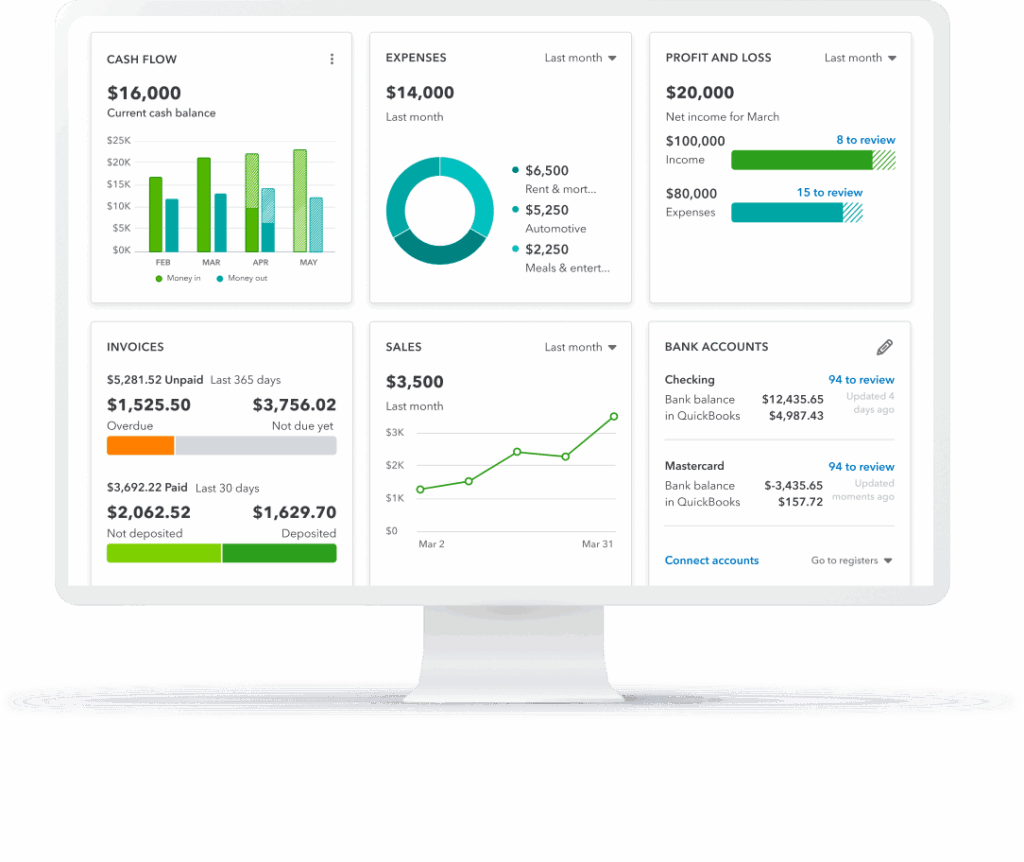

3. QuickBooks Online – Best for Scalable Small Business Accounting

QuickBooks Online is a good option for creators ready to scale.

It covers accounting, invoicing, payroll, and tax filing. You’ll get detailed reports on cash flow and profit. And its integration with tools like Google Analytics helps you understand marketing costs and conversion rates better.

QuickBooks is ideal if you plan to grow your content business into a full-fledged operation.

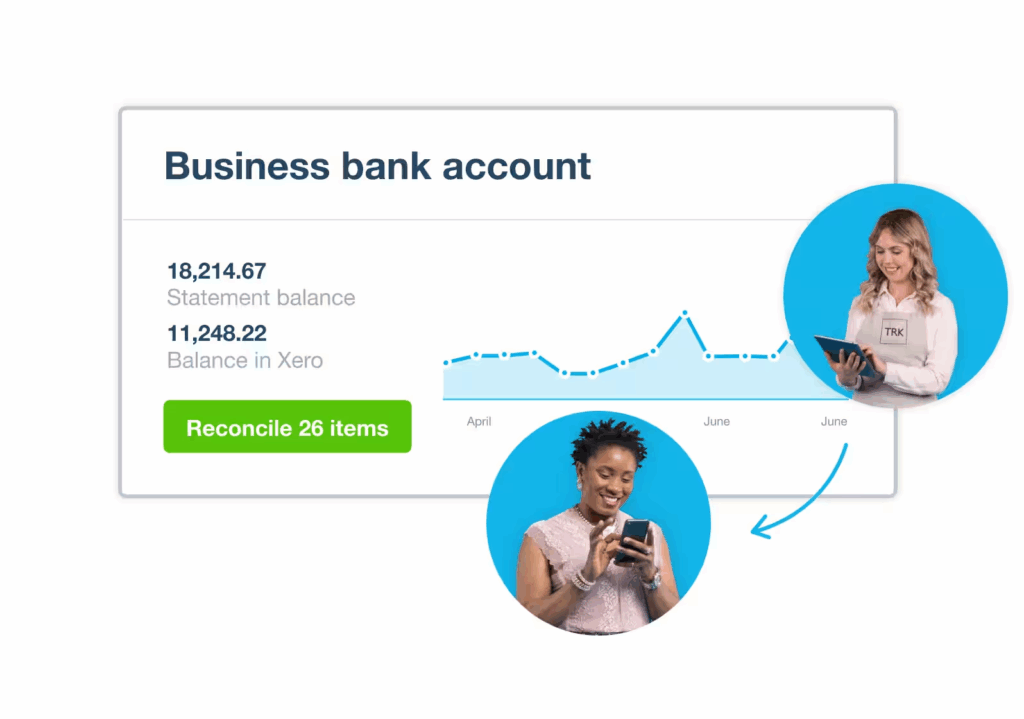

4. Xero – Best for Ease of Use

Xero stands out for its user-friendly interface. (It makes accounting approachable, even if you’re new to finance.)

You’ll get invoicing, expense tracking, and bank reconciliation.

Xero’s real-time dashboard also helps you monitor your content marketing budget at a glance. It’s a good choice if you want simple and effective financial management.

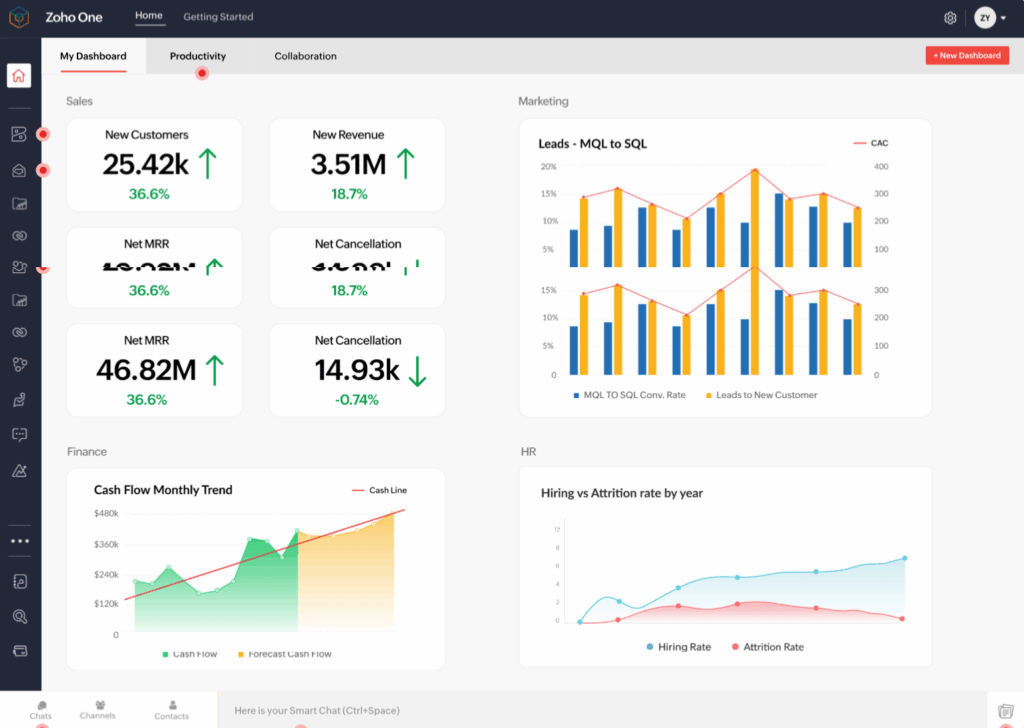

5. Zoho One – Best for All-in-One Business Management

Zoho One goes beyond accounting. It also offers CRM, email marketing, project management, and more. For creators, it streamlines social media management, email marketing, and finance in one platform.

In other words, Zoho’s broad features can help you manage your entire content business — from lead generation to billing.

This is perfect if you want an all-in-one solution for marketing and accounting without juggling multiple apps.

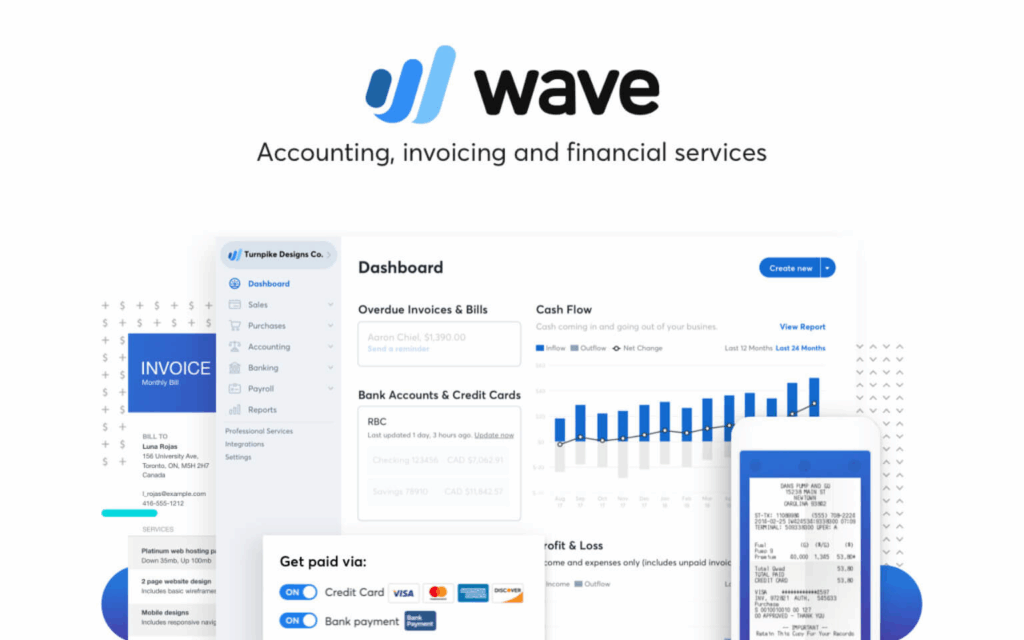

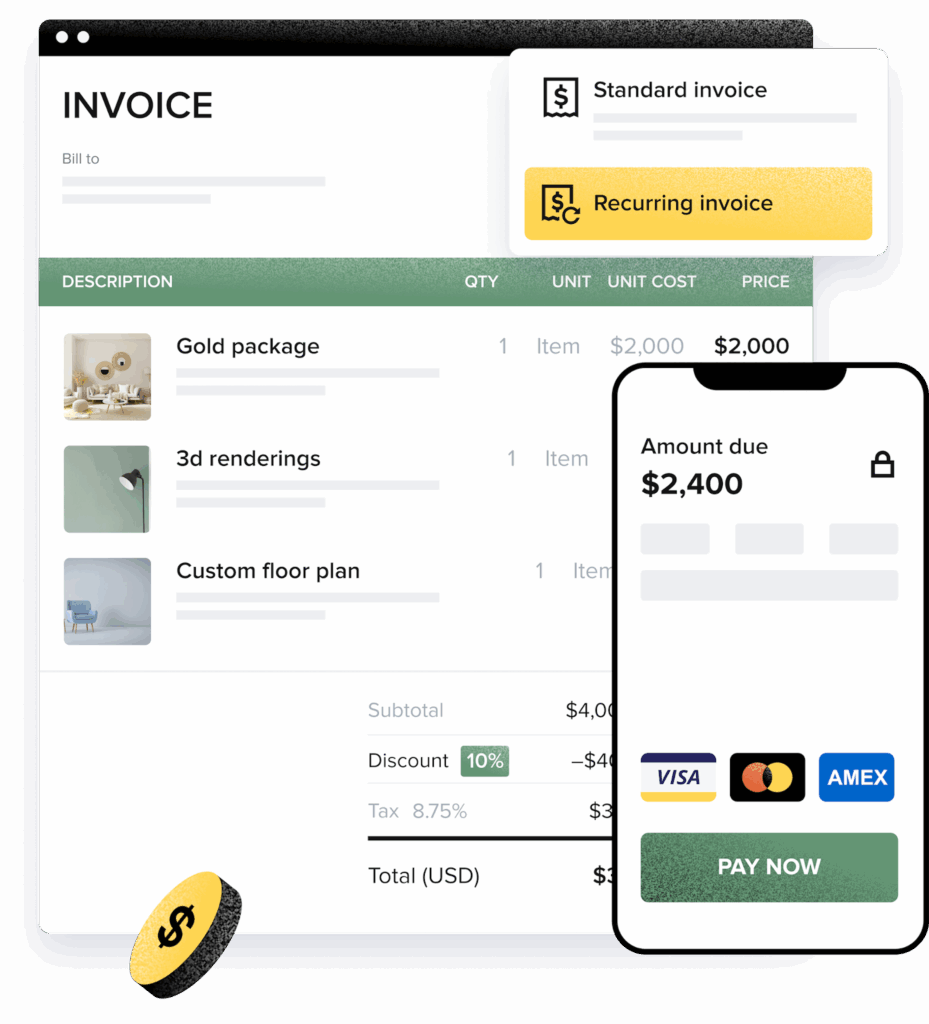

6. Wave Accounting – Best for Free Accounting and Invoicing

Wave is a solid free option for creators on a tight budget.

It offers accounting, invoicing, and receipt scanning. You can track your marketing costs and generate reports at no cost. Wave also integrates with bank accounts to automate transactions. (It’s ideal if you want to keep expenses low while managing finances effectively.)

Wave also lets you collect credit and debit card payments for a per-transaction fee — a rare option in free accounting software.

Many competitors either don’t offer payment processing or charge extra for it. So, Wave stands out for creators wanting free accounting plus easy payment collection. Additionally, as businesses grow, adding solutions like insurance app development can help manage financial risks associated with various transactions.

7. HoneyBook – Best for Client-Facing Creatives and Service Providers

HoneyBook focuses on managing client projects, contracts, and payments. It’s popular with influencers, photographers, service providers, and coaches.

The platform helps you send proposals, get contract signatures, automate billing, and keep track of essential client information like email and phone number for seamless communication.This one’s a great option for if you’re looking to reduce admin time, so you can spend more time creating content.

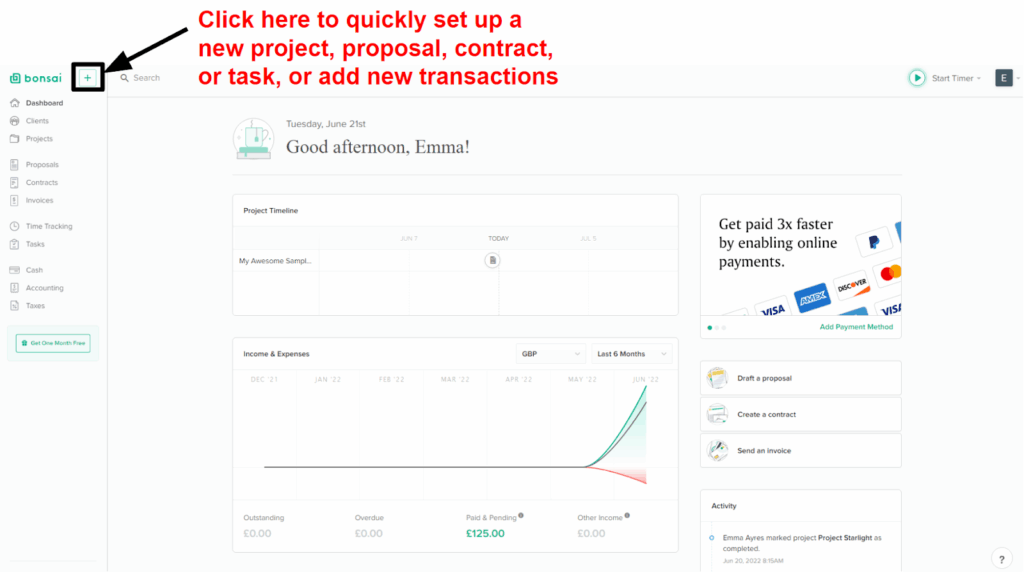

8. Bonsai – Best for Freelancers Needing Contracts, Proposals, and Invoicing

Bonsai is tailored for freelancers who want easy contract management alongside invoicing.

It includes tax estimates and expense tracking. You can also use its intuitive tools to manage projects, payments, and taxes all in one place.

It’s great if you want professional-looking proposals and quick invoicing without the extra apps.

Wrap Up

Managing money as a content creator can be simple with the right tools. From tracking expenses to billing clients and budgeting marketing costs, these platforms keep you organized.

Pick the one that fits your unique business style and needs.

Here’s a quick tool recap:

- 1. Akaunting – Best Open-Source and Self-Hostable Option

- 2. FreshBooks – Best for Freelancers

- 3. QuickBooks Online – Best for Scalable Small Business Accounting

- 4. Xero – Best for Ease of Use

- 5. Zoho One – Best for All-in-One Business Management

- 6. Wave Accounting – Best for Free Accounting and Invoicing

- 7. HoneyBook – Best for Client-Facing Creatives and Service Providers

- 8. Bonsai – Best for Freelancers Needing Contracts, Proposals, and Invoicing

Master your financial tools, and focus on what you love — creating great content.

PS: Looking for an open-source, self-hostable option? Try Akaunting now.

FAQs

1. What financial tools do content creators use to manage income?

Creators use tools like Akaunting, FreshBooks, and QuickBooks to manage income. Tech-savvy users or those wanting a free, self-hosted alternative, choose Akaunting.

2. How do content creators budget their money?

They separate business and personal accounts, track project costs, set aside 25–30% for taxes, and forecast cash flow at least three months ahead.

3. Do creators need invoicing software?

It’s a great idea to use invoicing software as a creator. Billing tools with automated reminders and contract integration can help reduce late payments and streamline getting paid.

4. How can creators track expenses easily?

Use apps like Dext or Expensify to snap receipts and sync them to accounting software. These categorize expenses immediately. Wave also offers receipt scanning.

5. What’s the best way for creators to handle irregular income?

Build a cash reserve, forecast earnings, and use budgeting tools that project future inflows and expenses instead of solely tracking past data. Creators should also propose long-term partnerships for steady income.

6. Are there tools that combine contracts, payments, and budgeting?

Yes. Platforms like Akaunting, Bonsai, and HoneyBook bundle or have add-ons for invoicing, contracts, and expense tracking to cut admin time and errors.

Author Bio:

Kelly Moser is the co-founder and editor at Home & Jet, a digital magazine for the modern era. She’s also the content manager at Login Lockdown, covering the latest trends in tech, business and security. Kelly is an expert in freelance writing and content marketing for SaaS, Fintech, and ecommerce startups.