How To Calculate Profit Margin?

Reading Time: 4 minutesIt’s essential for small business owners who want to improve efficiency, compare financial performance, and secure investment(s) to know how to calculate profit margin.

“What is your profit margin” is a common question for small businesses seeking investments. Without a solid, convincing, and informed answer, your chances of securing an investment grow slimmer.

This article will address the things you need to know about profit margin.

- What is a profit margin?

- Types of profit margin

- How to calculate profit margin

- How to calculate profit margin in Excel

- What is a good profit margin?

- Importance of understanding profit margin

- How to increase profit margin

What is a profit margin?

Profit margin is the money your business retains after accounting for the Cost of goods sold and paying off all expenses.

A high-profit margin shows that a business generates a lot of profit from its sales, while a low-profit margin indicates a challenge in generating profit.

Investors and analysts often use the profit margin to evaluate your business’s financial health and make informed investment decisions.

Types of profit margin

The three main types of the profit margin are:

- Gross profit margin

- Net profit margin

- Operating profit margin

All three have similar ways of calculating them – dividing the profit figure by the company’s revenue and multiplying the result by 100. But differ in their exact method.

Gross profit margin is the most basic level of calculating the profit margin. The Net profit margin is the most comprehensive as it factors all possible expenses and payments.

The Operating profit margin measures how much a business makes in revenue after paying for operating and non-operating expenses.

So, let’s figure out…

How to calculate profit margin

To calculate the profit margin, divide your company’s net income by its revenue, multiply by 100 and express the result as a percentage.

Profit margin formula

Revenue – Cost of goods sold (COGS) / Revenue * 100

For example, if a business has revenue of $200,000 and the Cost of goods sold is $150,000, your profit margin would be 25%.

The business made a 25% profit on sales, or $50,000, after accounting for the Cost of goods sold.

How to calculate profit margin in Excel

Using online accounting software simplifies the calculation of profit margins.

However, if you are still stuck on manual processes, Excel with a few inputs of formulas can help with the calculation.

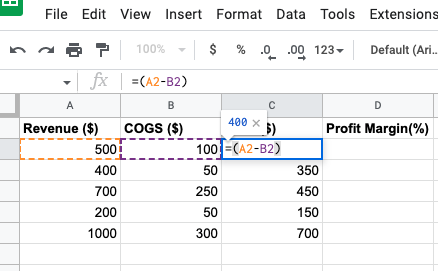

Step 1 – Enter revenue and COGS prices.

Populate cells A and B with your venue and COGS prices in the Excel sheet.

Step 2 – Calculate the profit.

Before calculating the profit margin, you need to calculate the profit. Input the formula “=(A2-B2)” in the cells of column C, then press ENTER.

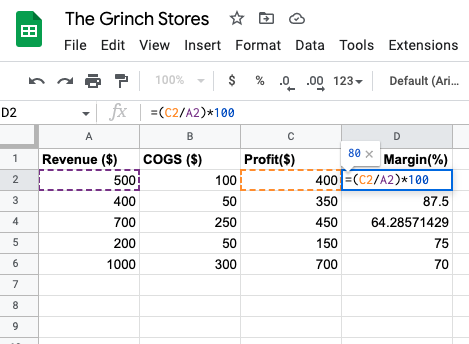

Step 3: Calculate the profit margin.

Using the Profit margin formula “=(C2/A2)*100”, you can calculate the percentage value of the Profit margin.

Once you enter the formula in cell D2, drag it down to auto-calculate other cells in column D.

While calculating profit margin in Excel seems straightforward, it’s susceptible to human errors.

There are free accounting software that can save you time on manual processes, improve efficiency, and help to scale your business.

Now, you are probably thinking…

What is a good profit margin?

Good profit margins may vary depending on the industry, company size, and other factors. However, a profit margin over 10% is considered good, while a 10% margin is healthy.

You should note that a high-profit margin (+20%) may seem like the best thing to happen to a business; however, it doesn’t necessarily mean a healthy or successful business.

Generating high profits in an accounting period but gradually losing marketing share could lead to a downtrend in earnings over time.

It is always best to balance maximizing profits and remaining competitive.

Importance of understanding profit margin

Understanding your profit margin is essential in planning growth and sustainability.

- Know how much your business generates from the sales of services or goods.

- Identify areas where you can improve efficiency and reduce costs.

- You can better communicate your business’s financial health and value to potential investors and stakeholders.

- Compare the financial performance of your business with competitors and identify opportunities for improvement.

How to increase profit margin

There are several ways to improve your profit margin. One of the vital steps is tracking expenses.

You need to know what you’re spending money on and work around cutting costs to improve your profit margins.

Other ways of increasing profit margin are:

- Increasing the prices of your products or services: Be careful and study your market and competition before implementing a price hike, as it could lead to a decrease in demand.

- Reducing operating costs: Find cost-effective ways of production or offering services. This could mean exploring other suppliers, negotiating better rates with vendors, or streamlining internal processes.

- Improving efficiency: Consider automating specific processes, investing in new technology, or training employees in more efficient ways of working.

- Expanding into new markets: Improve your marketing efforts, build partnerships or make acquisitions.

- Diversifying business revenue: You can research the market, find new niches, and introduce new products or services with high demand.

Final thoughts

The profit margin is a significant financial metric that helps keep track of expenses and improves efficiency for businesses of all sizes.

You can also understand profitability and identify opportunities for improvement, growth, and sustainability.

Calculating your profit margin is simple on Akaunting.

Frequently Asked Questions

Why is my profit margin so low?

- A couple of factors could be the reason. One is that your company needs to use more effective costing or pricing strategies. You can try streamlining your operations and reducing operating expenses.

What profit margin is best?

- As a rule of thumb, 5% is a low margin, 10% is a healthy margin, and 20% is a high margin.

What industry has the highest profit margin?

- According to Polymersearch, the industries with the highest profit margins are Finance – 32%, Software (entertainment) – 29.04%, Transportation – 28.90%, Tobacco – 20.58%, Software (System and Application) – 19.66%, Computers and Peripherals – 18.72% and Information Services – 16.92%.