Invoicing Best Practices for Private Practice Providers: Virtual and Hybrid Models

Reading Time: 7 minutesGetting the right invoicing system down is one of smartest moves you can make in your private practice.

You want clients to feel taken care of by offering easy payment options. And you also need a reliable way to keep track of your finances.

But it’s challenging when some clients meet with you online, while others see you in person.

Let’s take a closer look at how private practice providers across industries can handle invoicing smoothly in virtual and hybrid settings. I’ll break down what you need to know, what to watch out for, and the best tools and tips to keep your payments flowing.

Table of Contents

- Understand Your Industry’s Invoicing Needs

- Key Invoicing Challenges In Virtual and Hybrid Models

- 6 Best Practices for Invoicing in Virtual and Hybrid Private Practices

- 1. Choose cloud-based invoicing and payment systems

- 2. Automate recurring invoices and payment reminders

- 3. Customize invoices by service type and delivery method

- 4. Communicate payment terms clearly upfront

- 5. Offer multiple payment options for client convenience

- 6. Secure client data and ensure regulatory compliance

- Tools and Software Recommendations

- 3 Quick Tips For Reducing Late Payments and Improving Cash Flow

- Wrap Up

- FAQs about Invoicing for Private Practice Providers

Understand Your Industry’s Invoicing Needs

Every industry has its own invoicing quirks. Knowing them is how you make informed decisions about your billing practices.

For example, if you’re in healthcare, you need to comply with HIPAA rules. You’re billing patients and often working with insurance claims, which come with strict documentation requirements. (Your invoices might need to include specific insurance policy codes, insurance payers IDs, and detailed insurance verification descriptions.)

On the other hand, if you’re a lawyer, invoicing revolves around retainers, billable hours, and managing trust accounts. Social security disability advocates need clear, detailed invoices that explain charges and build client trust. (With the average case taking 23 months from start to finish — and appeals stretching 3 to 5 years — this is a serious must.)

Financial advisors face different challenges. Client confidentiality is top priority, especially when sending invoices remotely. Plus, you may have recurring fees, like monthly management charges, that need automated billing. You also have to provide documentation for taxes, which means your invoicing system must generate clear, accurate reports.

For coaches and consultants, invoicing is usually based on session packages or milestones. Perhaps you offer a block of five coaching sessions or charge at key project milestones. Your invoices should match these payment structures and reflect whether sessions happened virtually or in person.

In the auto transport industry, companies like Outbound Auto Transport rely on accurate, detailed invoices to coordinate long-distance vehicle deliveries and ensure timely payments. They use digital tools to streamline invoicing, keep up with insurance rules, and keep all parties informed.

Creators and wellness professionals often juggle project-based billing, hourly session rates, and product sales. A yoga instructor might invoice for classes, private sessions, and merchandise like mats or apparel. Being able to itemize these different charges clearly helps keep clients informed and happy.

TL;DR: Understand the nuances of your field now and tailor your invoicing process accordingly.

Key Invoicing Challenges In Virtual and Hybrid Models

Virtual and hybrid practices add layers to your billing process.

First, handling remote client payments can feel tricky. You might be used to cash or card payments in person, but now you need secure online options. (This requires integrating payment gateways or e-wallets that your clients trust.)

Also, you’ll have to track multiple service delivery formats and billing codes.

Some clients will see you face-to-face, others online, and a few might do a mix of both. Your invoices need to clarify which services you provided virtually and which were in person.

If you work with clients across borders, international payments add another wrinkle.

Currency conversions, different payment methods, and tax regulations can slow things down.

Then there’s security. Invoicing involves sensitive client data, especially in healthcare, finance, and legal fields. You must protect all information and comply with industry-specific privacy rules.

➜ Finding solutions to these challenges is an important step to smoother invoicing and faster payments.

6 Best Practices for Invoicing in Virtual and Hybrid Private Practices

So how do you nail invoicing when you’re running a virtual or hybrid practice?

First, always ask your accountant or financial advisor what data you need to include on your invoices. (This helps you avoid missing important details and keeps your records accurate and compliant.)

Then:

1. Choose cloud-based invoicing and payment systems

Test and choose cloud-based invoicing and payment systems. These platforms let you create, send, and track invoices from anywhere. You can access your records on the go,which is perfect for the flexible work you’re doing.

2. Automate recurring invoices and payment reminders

Automating recurring invoices and payment reminders saves you time and keeps payments on track.

Imagine setting it once for monthly coaching fees or subscription services and never having to chase clients manually. Automation handles the follow-ups without being pushy.

3. Customize invoices by service type and delivery method

Reduce client questions and speed up approval with custom invoice details.

For example, if you’re a physical therapist who does telehealth sessions, your invoice might specify “virtual session” versus “in-office treatment.” Or “merchandise” versus “treatment services.”

4. Communicate payment terms clearly upfront

Inform clients about payment due dates, accepted payment methods, and any late fees or early payment discounts. This transparency builds trust and helps you avoid surprises down the line.

5. Offer multiple payment options for client convenience

Offering multiple payment options makes paying easy for clients. Include credit cards, ACH transfers, e-wallets like PayPal or Venmo, and even mobile payment apps if you can. The more choices you give, the fewer the delays.

6. Secure client data and ensure regulatory compliance

Protect your client data and make sure your invoicing tools comply with any industry regulations you’re up against.

This may mean:

- – Ensuring your software meets HIPAA or GDPR standards

- – Encrypting your invoices

- – Using secure portals

Tools and Software Recommendations

Choose software that matches your industry’s needs and integrates smoothly with your workflow to save time and reduce errors.

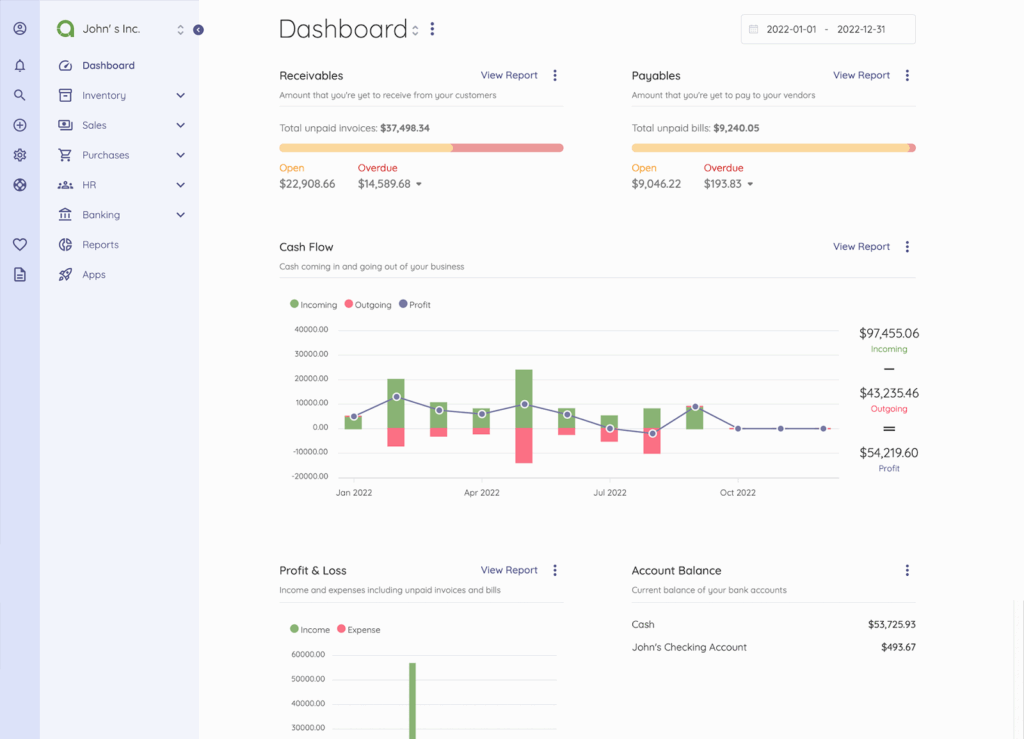

For a general solution, platforms like QuickBooks, FreshBooks, and Akaunting work well across industries.

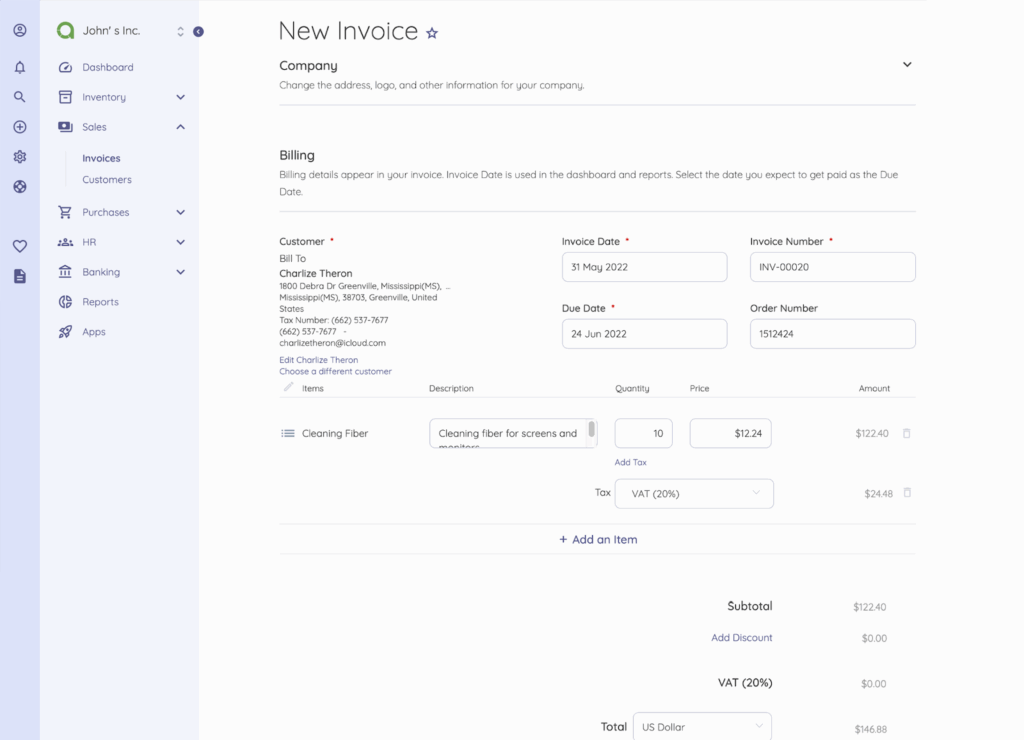

Akaunting is cloud-based, easy to navigate, and integrates with popular payment gateways like PayPal and Stripe, so you don’t need a developer to use it. You can create and send invoices right away without technical setup, and customize them if your practice has unique needs.

If you have a developer, they can extend its capabilities even further through its modular, open-source design and app store integrations.

If you’re in healthcare, specialized software like Kareo (now Tebra) or SimplePractice offers features tailored to patient billing, patient data, insurance claims, and compliance.

Lawyers can look into Clio or MyCase, which track billable hours, manage retainers, and keep client trust accounts organized.

➜ You can also streamline your hybrid workforce by using an employee app like Blink that centralizes schedules, communication, and task updates. This helps keep invoicing tasks aligned across in-person and remote billing teams at your private practice.

Remember that integrating payment gateways is key for virtual payments. Tools like Stripe, Square, or PayPal let you accept payments online securely. (Some invoicing platforms include these integrations natively, so check before you buy.)

3 Quick Tips For Reducing Late Payments and Improving Cash Flow

Late payments are a reality sometimes, but you can reduce them.

- 1. Start with clear invoice formatting and detailed client billing line items. (When clients see exactly what they’re paying for, they’re less likely to hesitate.)

- 2. Also, send timely follow-ups. Automated reminders work best because they’re consistent and polite. Waiting too long to follow up gives clients the wrong impression.

- 3. Consider offering incentives for early payments, like small discounts. On the flip side, establish penalties for late payments to encourage promptness. Just make sure your policies are fair and clearly communicated upfront.

These small steps add up to a steadier cash flow and less stress.

Wrap Up

Invoicing in virtual and hybrid private practices requires a thoughtful approach.

You need to understand your industry’s specific needs, tackle the challenges remote work brings, and implement smart, technology-driven solutions.

The right invoicing system improves your client’s experience, helps you get paid on time, and keeps your practice running smoothly. Staying adaptable and regularly reviewing your process will help make sure you keep up with changes and optimize revenue.

TL;DR: Focus on clarity, automation, and security. When you do, invoicing becomes less of a hassle and more of a tool to grow your private practice.

FAQs about Invoicing for Private Practice Providers

What’s the easiest way to accept payments from both in-person and virtual clients?

Use a cloud-based invoicing system that integrates with multiple payment gateways like Stripe, PayPal, or Square. This lets you accept credit cards, ACH transfers, and e-wallets easily, no matter how your clients meet with you.

How do I keep client data secure when invoicing online?

Choose invoicing software that encrypts data and complies with privacy rules like HIPAA or GDPR. Use secure portals for sharing invoices and avoid sending sensitive information via unsecured email.

Can I automate invoicing for recurring clients?

Yes! Most cloud invoicing platforms let you set up automatic invoices and payment reminders for recurring fees. This saves time and helps keep payments on schedule without manual follow-up.

How should I handle invoices for mixed service types (virtual and in-person)?

Clearly label each service on your invoice, specifying whether it was virtual or in-person. This transparency reduces client questions and keeps your records accurate.

What if my clients pay late? How can I encourage on-time payments?

Send automated, polite reminders before and after payment due dates. Consider offering small discounts for early payments and clearly communicating any late fees upfront to encourage promptness.

Do I need different invoicing tools for healthcare, legal, or coaching services?

Specialized industries often benefit from software tailored to their needs — like Kareo for healthcare or Clio for legal work. But general platforms like Akaunting can work well if you customize invoices properly.

About the Author

Kelly Moser is the co-founder and editor at Home & Jet, a digital magazine for the modern era. She’s also the content manager at Login Lockdown, covering the latest trends in tech, business and security. Kelly is an expert in freelance writing and content marketing for SaaS, Fintech, and ecommerce startups.