Job Costing: How To Go About It

Reading Time: 7 minutes“Job costing is only necessary for large businesses or complex projects” is a common misconception by many small business owners and freelancers.

They mistakenly believe job costing is too complicated or time-consuming for their operations.

In reality, job costing is valuable for businesses of all sizes and can be especially crucial for smaller entities with tighter profit margins.

Even simple jobs can benefit from accurate cost tracking, helping to ensure long-term profitability and saving you from being shortchanged.

This blog post will provide a comprehensive guide on achieving precise job costing, helping you track project expenses and profitability effectively.

Table of Content

- What is Job Costing?

- Setting Up Your Job Costing System

- Analyzing and Reporting

- Common Errors

- Conclusion

- Frequently Asked Questions

What is Job Costing?

Job costing calculates the total expenses of a specific job or project. It involves tracking all costs directly and indirectly associated with a job, including labor, materials, and overheads.

This system is essential for businesses where work is customized, and costs can vary significantly between projects.

Job costing differs from process costing, which is used in industries where production processes are standardized and costs are spread evenly across units. In contrast, job costing requires meticulous tracking of individual job expenses to ensure accurate billing and profitability analysis.

So, why does job costing matter?

- Financial Control and Profitability: Knowing the exact cost of each project allows you to set appropriate prices, ensuring that all costs are covered and profits are realized.

- Budgeting and Forecasting: Understanding historical costs allows you to create more accurate budgets and forecasts, leading to better financial planning and stability.

- Client Billing and Transparency: Precise job costing enables transparent billing, where clients can see a detailed breakdown of costs, fostering trust and ensuring timely payments.

Setting Up Your Job Costing System

While costing can be captured using Excel sheets, working with software that makes data capturing easy and compact is advisable.

But how do you decide on the right software for job costing? Project management, invoicing, and accounting softwares generally have features that aid with accurate costing.

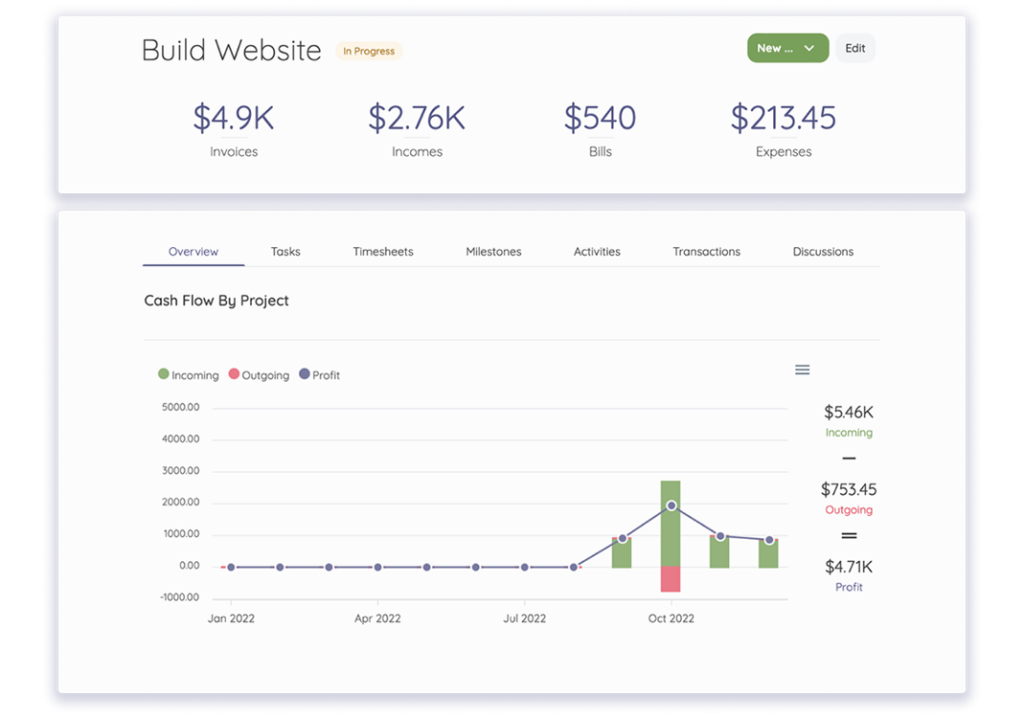

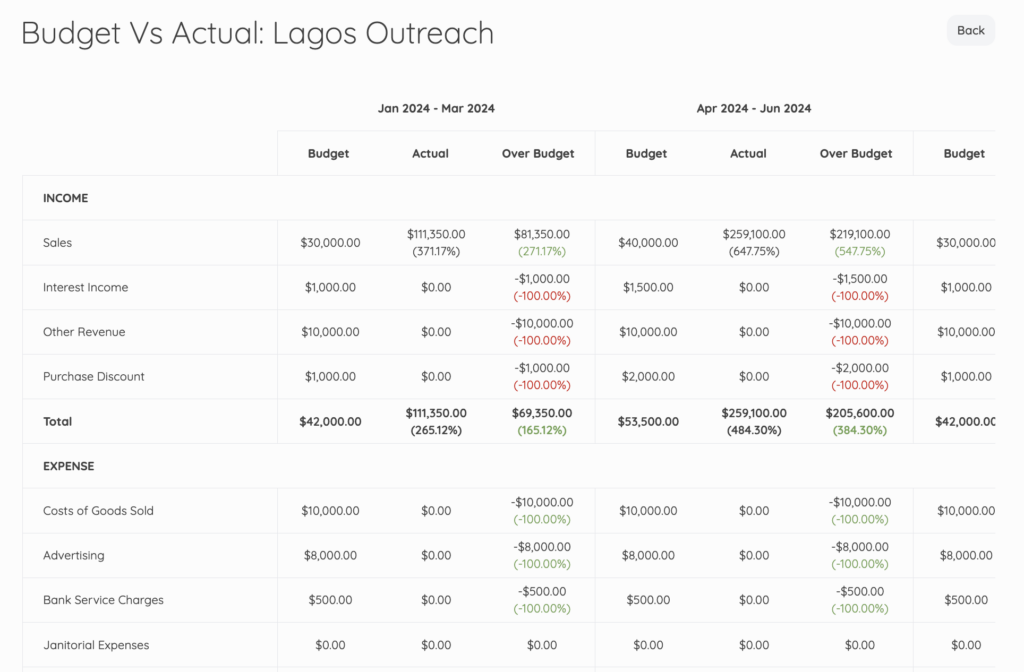

However, accounting software offers a comprehensive solution, including budgeting, sending and converting quotes to invoices, project management, and time tracking for each job.

Selecting the right accounting software is the first step toward accurate job costing.

Keep a detailed track of hours spent on each project task and invoice clients accordingly.

A well-structured job costing system is essential for accurately tracking the costs associated with different jobs. It allows you to allocate expenses correctly and analyze profitability more effectively.

Knowing where you spend more funds helps with informed decisions about where to cut costs or time.

Let’s break down the specific steps for costing a job or service:

Define the Scope Of Work

This involves outlining all the tasks and deliverables expected from the project. Detailing every aspect of the job ensures nothing is overlooked.

Following this, it is equally important to identify any constraints or special requirements. These could include time limitations, specific materials needed, or any other unique conditions that could impact how the job is executed.

Outlining these factors upfront will help create a more accurate and comprehensive cost estimate.

Estimate Labor Costs

Estimating labor costs is important when breaking down the specific steps for costing a job or service.

This involves several critical steps to ensure accuracy and reliability in cost calculation. Initially, it’s vital to determine the required skills and roles to complete the job. This step helps understand the type and level of expertise required, directly impacting the labor cost.

Once the skills and roles are identified, the next step is to estimate the hours needed for each task. This estimation should be as accurate as possible to avoid under- or overestimation, which can lead to budget discrepancies.

After estimating the time requirements, applying appropriate hourly rates for each role is crucial. These rates will vary based on the expertise level, market demand, and geographical location, among other factors.

Send Estimates of Job Costing with Estimates feature.

Calculate Material Costs

List all the required materials or tools for the project. Then, the price of each identified material will be based on current market rates.

For projects that require logistics, factor in any associated costs, such as shipping or delivery fees, to ensure the budget is comprehensive and accurate. This thorough approach guarantees that unforeseen expenses do not catch one off guard.

Determine Overhead Expenses

This involves allocating indirect costs such as utilities, insurance, and administration.

These expenses can be calculated in relation to the direct costs either as a percentage or by employing an activity-based costing method. The choice between these two approaches depends on the complexity and nature of the job or service being costed.

Consider Subcontractor Costs

When considering the specifics of costing a job or service, one crucial aspect is the costs associated with subcontractors.

It’s essential to obtain quotes for any work that will be outsourced. This helps understand the financial implications of subcontracting certain tasks and allows for a more comprehensive budget plan.

Gathering multiple quotes can also leverage negotiations, ensuring you get the best possible price.

Additionally, including the time required for subcontractor management is vital. This aspect often gets overlooked but can significantly impact a project’s overall cost and timeline.

Managing subcontractors requires coordination, communication, and oversight, all of which demand time and, consequently, money. Factor this into your job or service costing to ensure a realistic and thorough estimate.

Account for Travel and Other Expenses

These can significantly impact the overall cost of a job, especially for services that require on-site presence or activities in different locations.

It’s important to estimate transportation costs, whether it involves fuel for a vehicle, airfare, or other means of travel. Additionally, if the job requires overnight stays, lodging and meal expenses should also be factored into the cost.

Moreover, each job will have its own unique expenses outside the standard scope of work. These can range from specific materials needed for a project to special permits or licenses that might be required.

Including these job-specific expenses in the total cost ensures neither party is surprised. While the client may not necessarily need to see these costs listed, it’s important to factor them in.

Add Profit Margin

Determine the desired profit percentage, which is crucial for ensuring that you not only cover costs but also make a profit.

Once the desired profit percentage is determined, this percentage should be applied to the total costs. This method ensures that the final price not only recoups all the expenses involved in delivering the service or job but also achieves the targeted profit margin.

Factor in Contingencies

Conduct a thorough assessment of potential risks that could impact the job. Identifying these risks early on can help devise strategies to mitigate them, ensuring that the project is realistic and achievable.

Additionally, a buffer for unexpected issues must be added. Typically, this buffer ranges from 5 to 15%. This extra margin helps ensure the project remains on track financially, even when unforeseen challenges arise.

This proactive approach to costing provides a more reliable and resilient plan for executing any job or service.

Review and Adjust

Following a structured approach helps ensure accuracy and competitiveness when costing a job or service.

One of the key steps in this process involves reviewing and adjusting your initial cost estimates. This is where you take the time to carefully compare your numbers against both industry standards and the costings from past jobs similar to the one you’re currently evaluating.

Examining these comparisons critically is important, identifying where your estimates may be too high or too low. The goal is to align your costs as closely as possible with the industry standards while also considering the unique aspects of the job at hand.

As you refine your estimates, make adjustments as necessary. This might mean increasing the allocated budget for certain parts of the job or service you initially underestimated or finding cost-saving measures for areas where your estimates were too generous.

Prepare Final Cost Proposal

Breaking down the specific steps for costing a job or service is essential to ensure accuracy and clarity for both the service provider and the client.

One of the final and most crucial steps in this process is preparing the final cost proposal.

The final cost proposal must be presented in a clear and itemized format. This clarity helps convey the details of each cost component convincingly and transparently to the client.

Summarizing all the cost components and presenting them neatly is not just about transparency but also professionalism. It reflects the service provider’s meticulousness and diligence, setting the stage for a successful partnership.

Analyzing and Reporting

Job cost reports provide a detailed breakdown of costs associated with each job. These reports are essential for analyzing profitability and identifying cost-saving opportunities.

Types of Reports

- – Job Cost Summary: Provides an overview of each job’s total costs, revenues, and profitability.

- – Profitability Report: Details the profit margins of each job, highlighting areas of high or low profitability.

- – Variance Analysis: Compares estimated costs with actual costs, identifying discrepancies and areas for improvement.

Interpreting job cost reports is crucial for making informed decisions. Focus on identifying cost overruns and underestimates and understand the key cost drivers that impact profitability.

Common Errors

Ensuring precise costing and planning within a project or a business operation requires a thorough understanding of common pitfalls and developing strategies to avoid them.

Some of the significant errors are:

Inaccurate time tracking

Reliable time-tracking systems are essential, and it’s imperative that you accurately record time for each task.

Inaccuracy in this area can lead to the misallocation of labor costs, significantly affecting a project’s budget and overall profit.

Misallocation of indirect costs

Review and adjust overhead allocation methods regularly to ensure that they reflect current activity costs.

Failure to allocate indirect costs accurately can distort job profitability.

Recognizing and avoiding these common mistakes are crucial steps in ensuring precise costing and planning.

Conclusion

It is crucial for both businesses and freelancers to have accurate job costing for profitability.

Following the steps and best practices outlined in this blog post, you can establish a reliable job costing system that provides valuable insights into project expenses and profitability.

Akaunting provides a comprehensive accounting solution that ensures accurate job costing. You can utilize budgeting, project, and estimate features for efficient and complete costing.

Frequently Asked Questions

Can job costing help with tax preparation?

Yes, job costing provides detailed records of income and expenses, which can simplify tax preparation and ensure you claim all eligible deductions.

What should I do if actual costs exceed budgeted costs?

If actual costs exceed budgeted costs, it’s important to communicate with the client as soon as possible to explain the situation.

Providing a detailed explanation of the additional costs is crucial in maintaining transparency. The next step is to negotiate a solution, which may include a revised budget or additional charges to accommodate the unforeseen expenses.

How should I invoice clients based on job costing?

When invoicing clients, it’s important to include a detailed breakdown of costs in your invoices.

This breakdown should clearly separate labor, materials, and other expenses to ensure transparency and accuracy.

Additionally, you should ensure that the total amount invoiced matches the agreed-upon terms with the client to maintain trust and avoid any discrepancies.