What is Recurring Billing vs Invoicing?

Reading Time: 6 minutesIf you regularly offer services to a customer and have bills that require payment within intervals (weekly, monthly, etc.), setting up recurring billing and invoicing is the way to go.

Recurring billing and Invoicing are methods of automating your billing process for customers. While they both seem similar, their uses differ.

In this article, we will discuss recurring billing vs invoicing.

Let’s start with understanding the terms recurring billing and recurring invoicing.

What is Recurring Billing?

Recurring billing automatically charges your customers for goods or services regularly and on a predetermined basis.

Businesses that provide ongoing services, such as utility companies (electric, gas, internet, etc.), software-as-a-service (SaaS) companies, and subscription-based businesses, use recurring billing.

With recurring billing, you bill customers automatically for services without requiring them to initiate each transaction manually.

Check out: How Do I Bill a Recurring Payment?

This saves you time and reduces the risk of errors, and it can also help your business to maintain a predictable revenue stream.

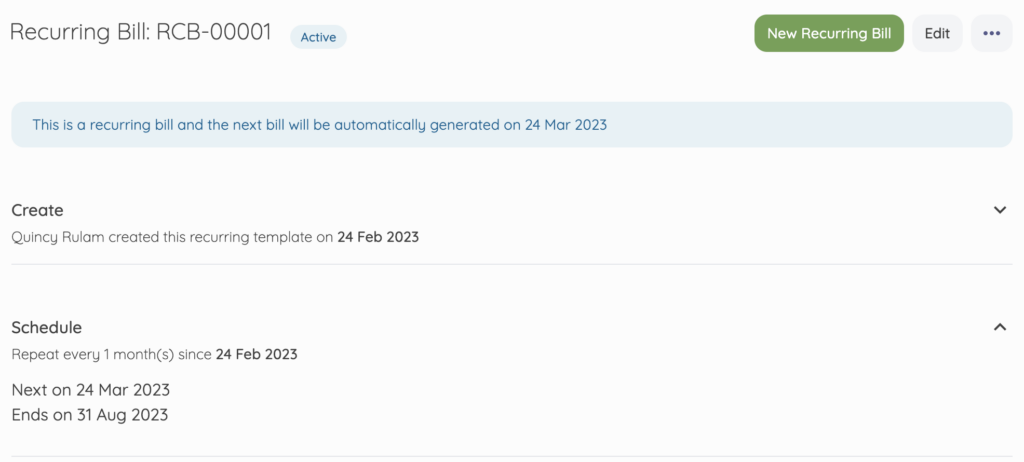

On Akaunting, recurring bills create regular payment obligations your business owes to vendors.

To settle your recurring bills, you sometimes need to set up recurring payments or manually approve payments for bills.

What are recurring payments?

Payments that you repeatedly or regularly make to a vendor for a product or service are recurring payments.

Recurring payments are usually set up by the customer, who authorizes a business to charge their bank account or credit card on a predetermined schedule, such as monthly or annually.

This type of payment method can be beneficial to businesses and customers. Recurring payments can improve cash flow, revenue predictability, customer loyalty, and efficiency for businesses. While for customers, it can provide convenience, security, and value-added services.

Example of recurring payments

Some common examples of recurring payments include:

- Subscription services: Netflix, Hulu, Disney+, Spotify, or Amazon Prime. They are usually paid monthly or annually.

- Utility and internet bills: Electricity, water, or gas bills. Internet subscription to Verizon, T-Mobile, Vodafone, Sky, MTN, etc. These payments are made regularly to ensure uninterrupted services.

- Insurance: Health, auto, or home insurance payments made monthly or yearly.

- SaaS subscriptions: Cloud-based software services, Accounting and project management tools, or CRM systems. These services are usually charged on a monthly or annual basis.

- Gym memberships: Many gyms offer recurring payments on a monthly, quarterly, or annual basis.

- Loan payments: Car loans, personal loans, or mortgages. These payments are usually made every month until they are paid off.

- Charity donations: Many charities offer recurring donation options for supporters who wish to donate regularly.

What are the benefits of recurring payments?

Recurring payments offer several benefits for both businesses and customers. From convenience to the predictability of revenue flow, below are the six benefits of recurring payments.

Flexibility and Convenience

Recurring payments save customers time and effort; they don’t have to remember to make the payment each time it’s due.

This is particularly useful for regular bills like subscription services or utility payments.

It also provides flexibility, allowing businesses to offer different payment options, such as credit cards, PayPal, or bank transfers, and customers to choose their preferred payment frequency, method, and amount.

Customers may even be able to use a virtual credit card, which is a credit card that doesn’t have a physical component. This virtual credit card comparison article can help you determine which virtual credit cards are best for your business.

Save time

You can save time with recurring payments by automating and streamlining the payment process. It reduces the administrative burden of businesses/customers manually processing payments each time they are due.

You don’t need manual data entry, invoice creation, payment reminders, or worry about inaccuracy in payment.

Predictability

You can plan your expenses more effectively, knowing when a payment will be due and how much it will cost your business.

Lower transaction costs

Because recurring payments have their processing fees spread out over several payments rather than just one, you often get lower transaction costs than one-off payments.

Improved cash flow

You can improve cash flow and revenue predictability as recurring payments ensure prompt and consistent customer payments.

They also help you track and reconcile transactions, manage inventory, and forecast income, making planning and managing finances easier.

Improved customer retention

Recurring payments can improve customer retention by making it easier and more convenient for customers to continue using your products or services.

They also increase customer loyalty and retention by offering value-added services like notifications, reminders, receipts, and reports.

That sums up recurring billing. Let’s get into understanding recurring invoicing.

What is Recurring Invoicing?

Recurring invoicing allows your business to create and send invoices to customers on a regular, predetermined schedule, such as weekly, monthly, or quarterly.

Businesses that provide ongoing services, such as subscription-based services, membership organizations, or maintenance services, use recurring invoices.

With recurring invoicing, you can set up automatic invoices to be sent out to customers without manually creating and sending each invoice. This can save time and reduce the risk of errors in the invoicing process.

Check out: How Do I Create Recurring Invoices?

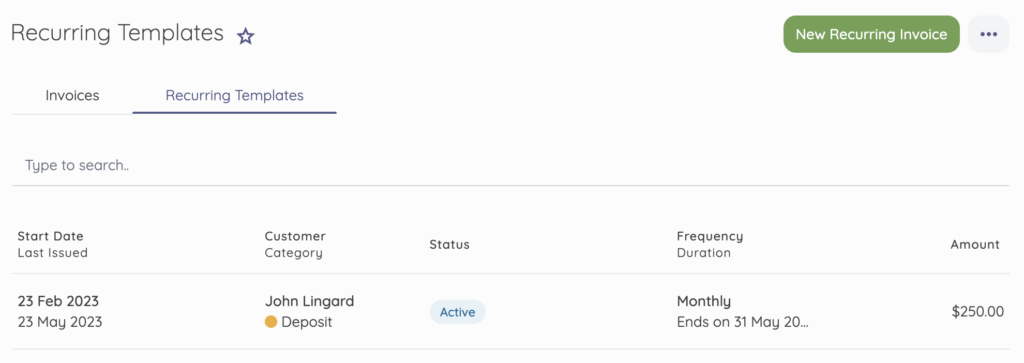

On Akaunting, recurring invoicing transactions are recorded as journal entries and posted to the appropriate accounts. You can also see them in accounts receivables under the chart of accounts.

This helps you to maintain an accurate and up-to-date record of invoicing and payment processes.

What are the types of Recurring Invoices?

There are two types of recurring invoices.

- Fixed recurring invoice

- Variable recurring invoice

Fixed recurring invoice

You use the fixed recurring invoice when you bill customers for the same amount every payment cycle.

For example, Netflix charges its users a premium fixed amount of 19.99 USD every month.

The fee doesn’t change. It most likely uses a fixed recurring invoice to automate the billing process.

Variable recurring invoice

You use this when you bill clients different amounts for a service every payment cycle.

For example, if you charge your clients based on their usage or consumption of a product or service, you can generate a variable recurring invoice based on the actual data.

Typical businesses that use this type of invoicing are utility companies, such as electricity, gas, water, or internet providers, and consulting firms, such as IT support, legal advice, or coaching services.

Recurring billing vs invoicing

Recurring billing and recurring invoicing are both methods of automating the billing process for recurring customers, but they differ in how they charge and invoice customers.

Process and Uses

Recurring billing automatically charges customers for goods or services on a regular, predetermined basis. It is often used by businesses that provide ongoing services, such as Utility, SaaS, and subscription-based companies.

Recurring invoicing automatically generates and sends invoices to customers on a regular, predetermined basis. It is often used by businesses that provide variable or usage-based services, such as IT support, landscape maintenance, or consulting.

Payment

Recurring billing typically involves automatic payment processing, with funds transferred directly from the customer’s account to the vendor’s account.

Recurring invoicing often requires the customer to initiate payment for the goods or services by paying the invoice directly or using a payment method specified by the vendor.

Charges

Recurring billing is often used for fixed charges that occur regularly. In contrast, Recurring invoicing may be used for variable or one-time charges that do not happen regularly.

Timing

Recurring billing occurs on a regular, predetermined schedule (such as weekly, monthly, or annually). In contrast, Recurring invoicing may occur at any time depending on when the services or goods are delivered.

Final thoughts

Recurring billing and invoicing benefit businesses that provide their customers with ongoing or recurring products or services. These automated billing processes can help your business save time and money, improve cash flow and revenue predictability, increase efficiency and accuracy, provide flexibility and convenience, and improve customer relationships.

Akaunting eases creating, sending, and tracking your recurring bills and invoices. Let’s help you start.

Frequently Asked Questions

What is a recurring payment called?

You can also call recurring payments regular, periodic, or automatic payments.

What are the three types of recurring transactions?

There are no specific three types of recurring transactions. Businesses may use several types of recurring transactions to manage their finances and automate their accounting processes.

The types of recurring transactions a business may use depend on their specific needs and the nature of their business. Some common types of recurring transactions include recurring payments, invoices, journal entries, purchase orders, sales orders, and bank transfers.

Depending on the criteria, you could also classify recurring transactions. One possible way to categorize recurring transactions is by the payment method. In this case, there are three types of recurring transactions: Credit and debit card recurring transactions, Direct debit recurring transactions, and Digital wallet recurring transactions such as PayPal or Apple Pay.

What is recurring vs automatic payment?

The recurring payment is charged regularly, such as weekly, monthly, or annually. The customer typically initiates this payment, which may be for a fixed or variable amount.

Conversely, automatic payment is automatically processed without needing any action from the customer. The vendor or service provider typically sets up this payment and is for a fixed amount.