How Do I Bill a Recurring Payment?

Reading Time: 5 minutes“When you bill a recurring payment, the only thing better than getting paid once is getting paid on autopilot.”

Billing recurring payments is essential for many small businesses that rely on regular revenue sources.

Whether you provide subscription-based services, ongoing maintenance or support, or other recurring payments, automating your billing process can help you save time, decrease errors, and ensure continuous cash flow.

But how do you bill a recurring payment, and what steps must you take to establish a dependable and effective system?

This post will discuss the following;

- Recurring payments

- Recurring billing

- Billing recurring payment

- Billing a recurring payment on Accounting software

You’ll find plenty of valuable tips to help you streamline your billing process and improve your revenue cycle.

First,

What are recurring payments?

Recurring payments are transactions between a customer and your business that occur regularly, usually at defined periods.

Examples of these transactions are subscription-based services, re-orders of products, continuous maintenance or support, and other expenses.

Payment processors typically set up recurring payments by storing the customer’s payment information and charging their account regularly.

Assume you subscribe to an internet service provider that charges $30 monthly for its data services.

You register for the service and enter your payment information on their platform.

Using a payment processor such as Stripe or PayPal, you set up a recurring payment plan that charges the monthly service cost of $30 from your account.

As long as you maintain the subscription, the payment processor will charge your account on the specified schedule, with no additional action necessary by either party.

Recurring payments can help you save time, avoid service disruption, and save you the challenges of manually initiating each payment.

Check out: What is Recurring Expenses?

Examples of recurring payments

Some common examples of recurring payments include:

- Utility and internet bills: Electricity, water, or gas bills. Internet subscription to Verizon, T-Mobile, Vodafone, Sky, MTN, etc. These payments are made regularly to ensure uninterrupted services.

- Insurance: Health, auto, or home insurance payments made monthly or yearly.

- Subscription services: Netflix, Hulu, Disney+, Spotify, or Amazon Prime.

- SaaS subscriptions: Cloud-based software services, Accounting and project management tools, or CRM systems.

- Gym memberships: Many gyms offer recurring payments on a monthly, quarterly, or annual basis.

- Loan payments: Car loans, personal loans, or mortgages. These payments are usually made every month until they are paid off.

- Charity donations: Many charities offer recurring donation options for supporters who wish to donate regularly.

What does recurring billing mean?

Recurring billing is the gift that keeps giving to your business, making your customers happy and your cash flow steady.

It enables your business to charge consumers on a recurring basis.

Because it eliminates manually creating a bill and payment processing, recurring billing is a convenient payment method for small businesses and customers.

On Akaunting, you can use recurring billing to record payment obligations your business owes to vendors.

Check out: How to Write, Send Invoice, and Payment Reminders.

How do I bill a recurring payment?

To bill a recurring payment, you need to set up a system that charges your consumer on a regular basis. The following are the general steps for billing a recurring payment:

Choose a payment processor

Select a payment processor that accepts recurring payments, such as PayPal, Stripe, or any of your choice.

Examine each processor’s prices, features, and integration options to identify the one that best meets your requirements.

Set up a recurring payment plan.

After you’ve decided on a payment processor, you’ll need to set up recurring payment plans for each customer. Setting a schedule (such as weekly, monthly, or annually), determining the amount to be charged, and receiving the customer’s payment details are usual steps.

Obtain customer consent

Get the customer’s approval of the recurring payment plan before billing their account. You can achieve this by having the buyer sign a consent form or gaining their consent online via a payment portal.

Test the payment plan.

Before going live with the recurring payment plan, test it thoroughly to ensure it works correctly, and the charges are processed accurately.

Monitor and manage payments.

Once the recurring payment plan is set up, monitor it regularly to ensure that payments are processed correctly and that any issues are promptly addressed.

On your accounting software, billing a recurring payment works differently.

You can set up bills for your recurring payments on Akaunting.

Akaunting allows you to create recurring bills for payments, keep records for accurate financial reporting, and small business account balancing.

Check out: What is Recurring Billing vs Invoicing?

To create recurring bills…

You’ll need to update the information:

- Vendor’s contact information (including email address)

- Payment due date.

- Order number

- Bill items – product/service you are selling.

- Quantity and price of products (with discount/tax if applicable).

- Billing frequency – weekly, monthly, yearly, or custom date.

- Start and End dates of recurring bills.

- Automatically send emails to vendors.

Billing Recurring Payment on Accounting Software

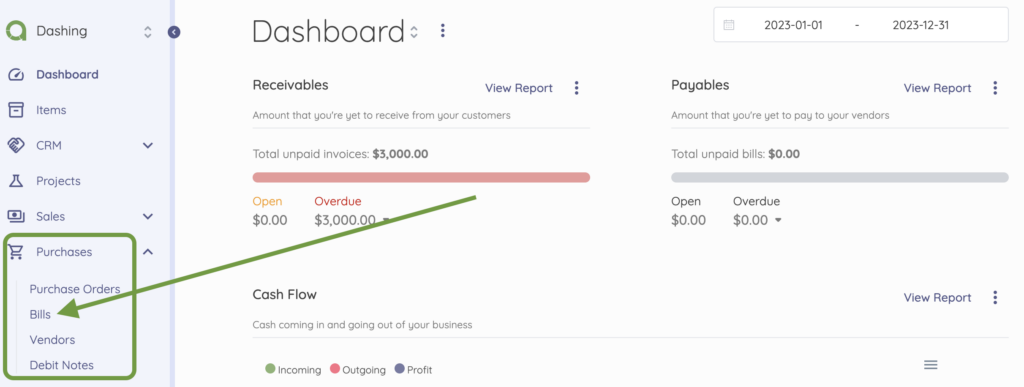

- Login to your company’s dashboard.

- Go to Purchases on the Navigation Menu and select Bills from the dropdown options.

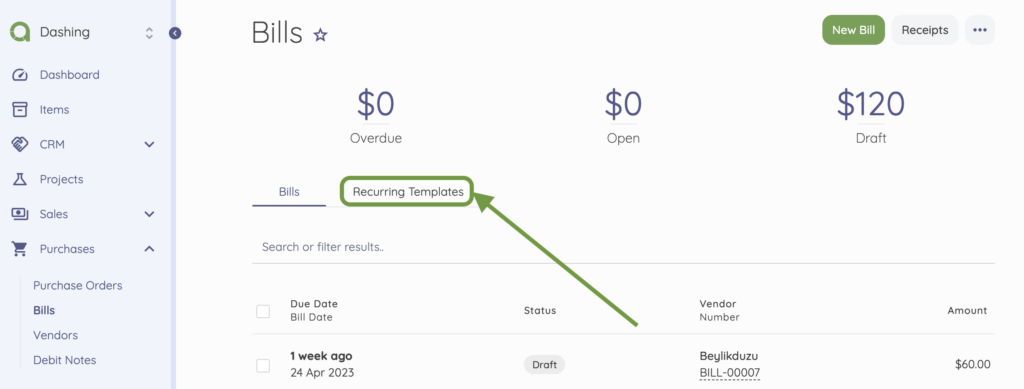

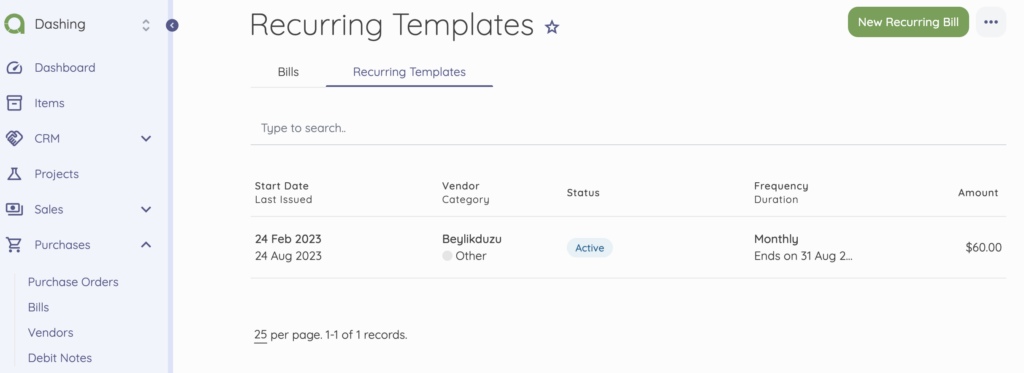

- On the Bills page, switch tabs from Bills to Recurring Templates.

- Click New Recurring Bill.

- Enter the required Vendor and Billing details.

- Scroll down the page to the Schedule section to define the following:

- Repeat this Bill: This is the frequency with which the Bill will be generated. The options are Daily, Weekly, Monthly, Annually, or Custom.

- Create first Bill on: Choose the date you want to generate the first Recurring bill.

- And end: Here, you can define the date you want the last Bill generated. There are three options – After, On, and Never. If you select Never, the recurring Bill will continue to be generated for the defined customer/client until you manually discontinue it.

- Send email automatically: Switch the Toggle button to Yes to activate sending emails to the client at the set date.

- Then, Save.

To see a list of recurring Bills:

- Going to Purchases on the Navigation Menu

- Select Bills from the dropdown

- Switch the tab from Bills to Recurring Templates.

Final thoughts

Billing recurring payments can be beneficial for optimizing your business revenue cycle and providing consumers with a comfortable payment alternative.

You can save time, decrease errors, and maintain continuous cash flow by automating the billing process on Akaunting.

When setting up recurring billing, you need to select the best payment method, frequency, and amount for your company and customers. You must also adhere to best invoicing, communication, and compliance practices.

With the appropriate method, billing recurring payments can be a dependable and effective way to manage continuing costs and ensure your company’s financial health. Start billing recurring payments here.