Understanding LLC Taxation: A Comprehensive Guide for Small Business Owners

Reading Time: 8 minutesTaxes can be confusing for LLC owners. There are different tax classifications, deductions, and filing requirements for each type of LLC.

But ignorance isn’t an excuse. If you miss a deadline or misreport business income, you could face penalties.

This is why it’s so important to understand LLC taxation.

In this guide, we’ll break down LLC tax filing options. We’ll explore default tax treatment, alternative classifications, and strategies to reduce tax while staying compliant.

What’s an LLC?

A Limited Liability Company (LLC) is a business structure. Business owners tend to choose this option for limited liability protection. This means that business owners aren’t personally responsible for business debts or lawsuits.

In contrast, sole proprietorships and partnerships don’t have limited liability protection.

An LLC separates personal assets from business obligations. A clear division of assets protects business owners from personal liability. If the company faces a lawsuit, debt, or bankruptcy, the business owner won’t be personally liable.

How LLCs Are Taxed: The Basics

LLCs offer flexible tax classification. This means that LLC businesses aren’t automatically taxed like corporations. LLC is not liable for the corporate tax rates and stricter filing requirements that corporations face.

In addition, many LLC owners may also be eligible for the Qualified Business Income (QBI) deduction, which lets qualifying pass-through businesses deduct up to 20% of their qualified business income from federal income taxes. Recent legislation has made this deduction permanent, making it a key element of tax planning for LLCs.

An LLC is taxed as a pass-through entity. This means that profits “pass through” to the owners’ personal tax returns instead of being taxed at the business entity level.

The Internal Revenue Service (IRS) looks at single-member LLCs as disregarded entities.

In basic terms, this means the IRS disregards single-member LLCs since the owner reports business income on their personal tax return. Instead of corporation taxes, the owner pays self-employment taxes. In other words, single-member LLCs are taxed like sole proprietorships.

For multi-member LLCs, the default tax treatment follows partnership tax rules.

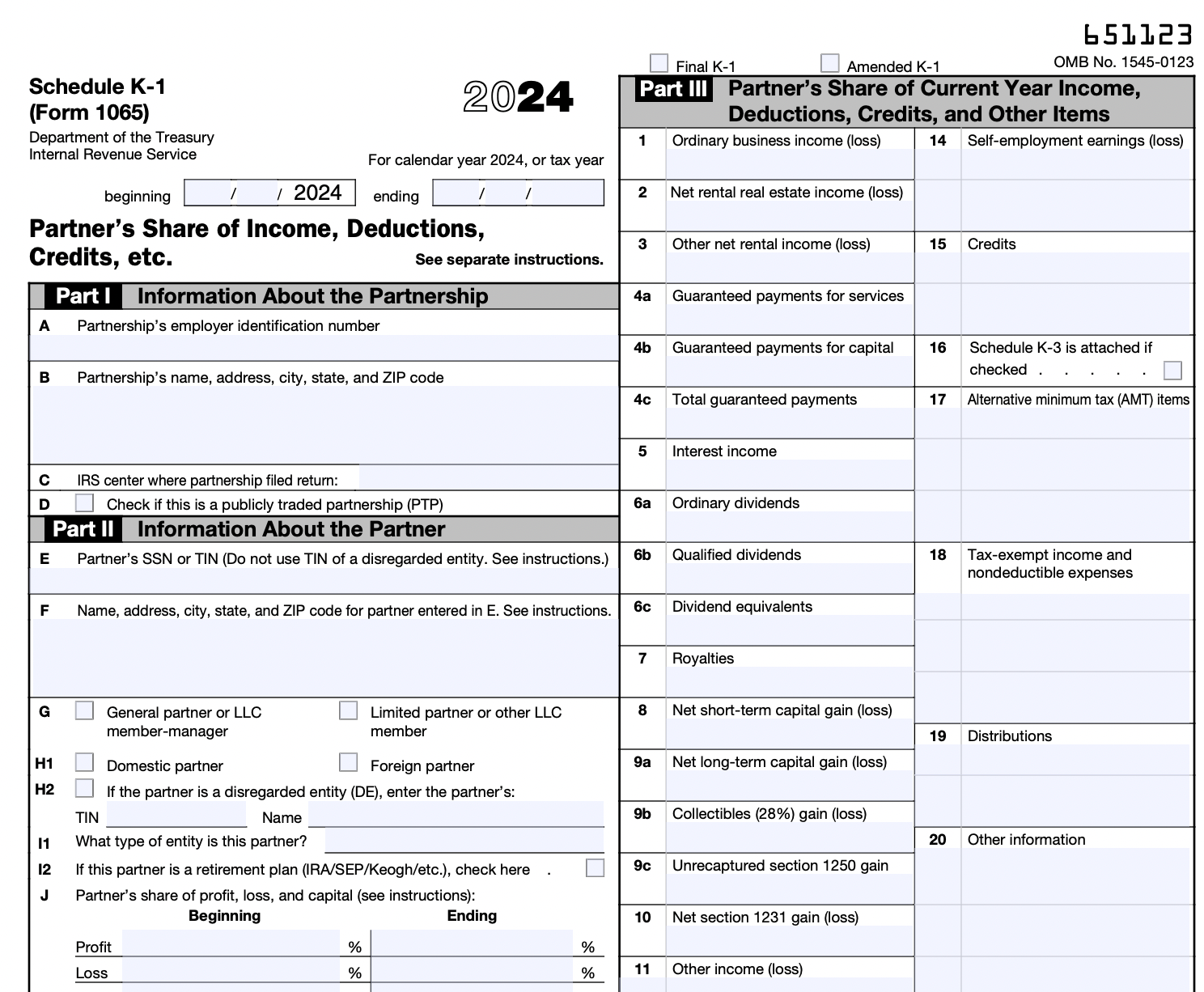

The LLC doesn’t pay federal income taxes. Each member uses Schedule K-1 to report their share of business profits on their individual tax return.

Default Tax Treatment of LLCs

LLC tax filing treatment depends on whether the LLC has more than one owner.

Here’s the difference between how single-member LLCs and multi-member LLCs are taxed.

Single-Member LLCs (Sole Proprietorship Taxation)

A single-member LLC is a disregarded entity for federal tax filing purposes. The IRS doesn’t recognize the LLC as separate from the owner.

Instead, all business income and expenses go through the individual. The owner uses Schedule C to report all revenue and expenditures on their personal income tax return.

Since there’s no distinction between the LLC and its owner, the owner must pay self-employment taxes on their business income. This covers tax liabilities, Social Security, and Medicare.

For example, a freelancer or consultant might operate as a single-member LLC.

Unlike sole proprietors, they get limited liability protection. But, just like sole proprietors, they report their earnings and deductions on their individual tax return.

Multi-Member LLCs (Partnership Taxation)

A multi-member LLC is taxed as a partnership.

The LLC must file Form 1065 (U.S. Return of Partnership Income) to report its income instead of filing a federal income tax return. The form is available on the IRS website. Instead of printing it, fill it out online using a PDF editor. It’s more legible than writing it by hand and easier to submit a copy digitally.

The LLC itself doesn’t pay federal income taxes.

Instead, each member receives a Schedule K-1. This details their share of business profits and losses.

Each owner reports these amounts on their individual tax returns.

Unless structured otherwise, multi-member LLC owners pay self-employment taxes on their earnings. This default tax classification gives LLCs flexibility. (But some businesses choose to elect corporate tax status.)

Businesses make this choice if corporation status reduces their tax burden or qualifies them for different tax treatments.

Speaking of which …

Electing Alternative Tax Classifications: S Corp vs. C Corp

LLCs can choose to be taxed as an S Corporation or C Corporation.

The decision will depend on factors like business size, tax liability, and long-term goals.

Here are the options:

S Corporation Election

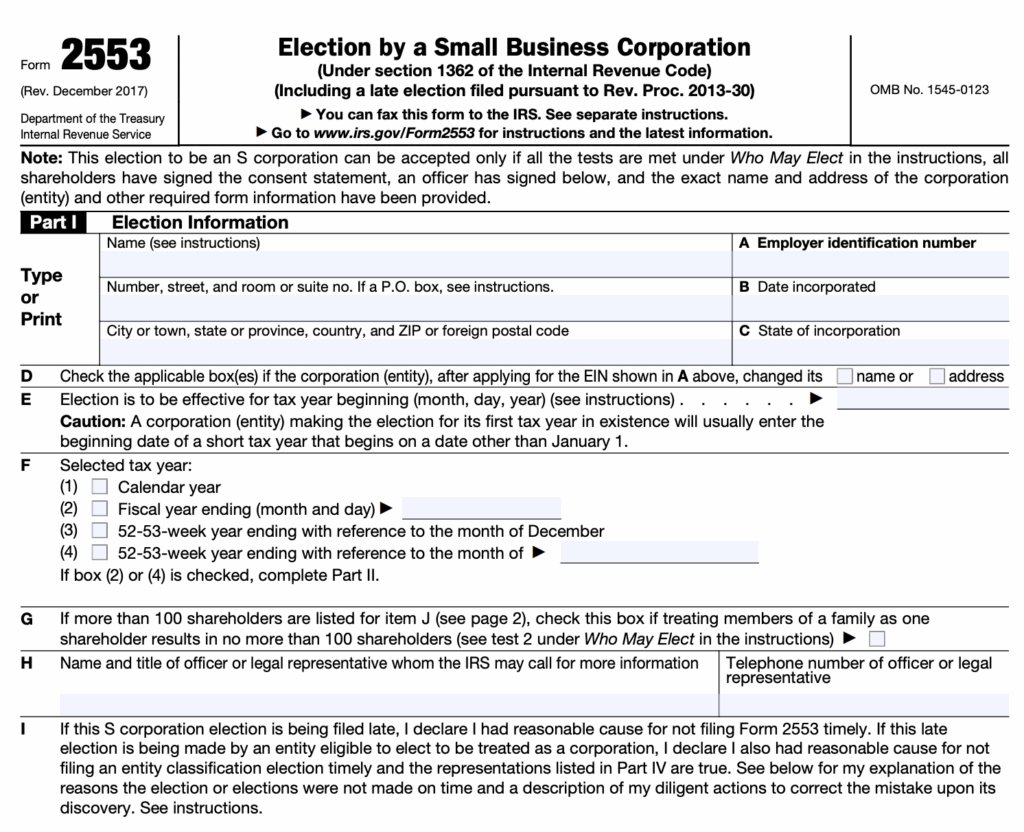

LLCs can file Form 2553 with the IRS to elect S Corp taxation.

This option reduces self-employment taxes.

Instead of paying self-employment taxes on all business profits, owners take a reasonable salary and pay payroll taxes.

The remaining profits pass through to the owners without self-employment tax.

This structure usually makes sense once your LLC earns consistent profits in the mid-five figures or higher (for many businesses, $60K+). At that point, the self-employment tax savings can outweigh the extra complexity and compliance costs.

C Corporation Election

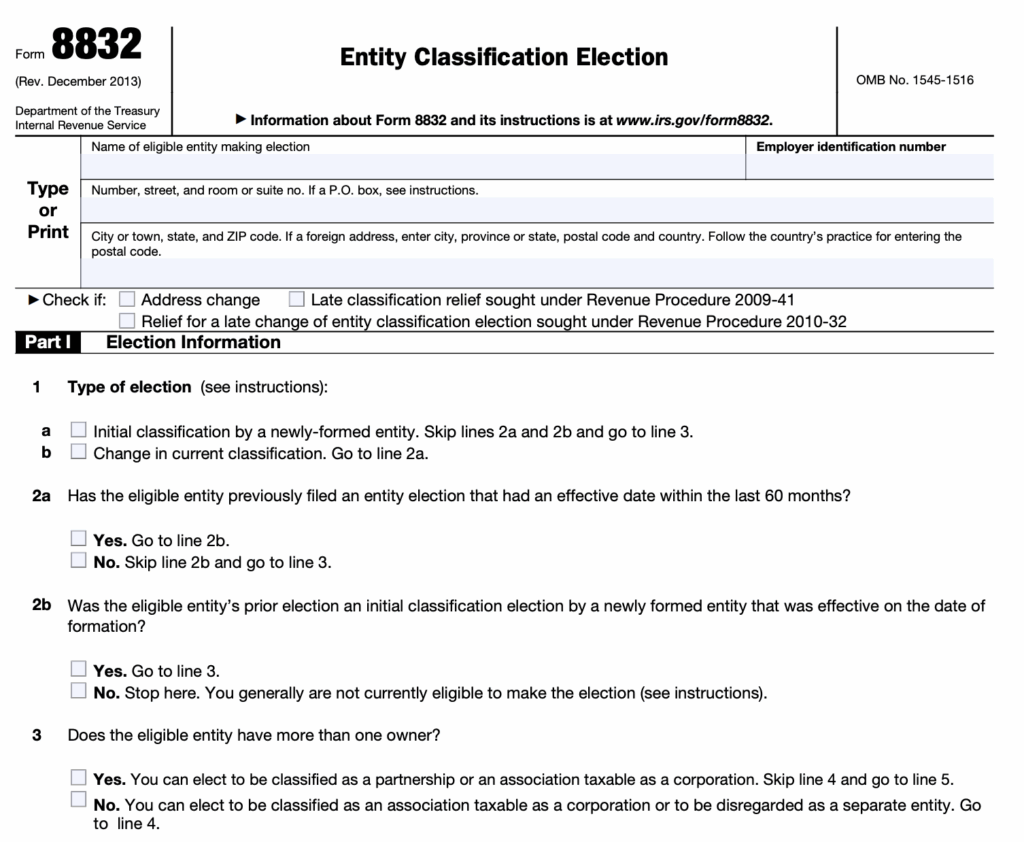

LLCs that want to be taxed as a C Corporation need to file Form 8832.

Unlike an S Corp, a C Corp is taxed separately from its owners. It’s subject to a 21% corporate tax rate.

Instead of passing profits straight to the owners, the company retains earnings. Profits stay in the business to fund growth, operations, or future expansion. They’re not immediately taxed as personal income.

Owners can still take money out in two ways:

- – They can take a salary. Salaries are subject to payroll taxes, but work as tax-deductible business expenses for the company.

- – Or they can take dividends from the company’s profits. But these are taxed again at the individual level, leading to double taxation.

While double taxation seems unappealing, there are benefits.

The 21% tax rate is often lower than the combined personal income tax and self-employment tax of high earners.

It’s the best structure for businesses that plan to reinvest profits, expand, or attract investors. It also allows for stock issuance, which is ideal for large or fast-growing companies.

Key LLC Tax Obligations and Deadlines

LLC owners need to stay on top of their tax obligations and ensure filing before the deadline. Otherwise, they may face non-compliance penalties.

Payments and deadlines depend on your tax classification and location.

Here are the different types of taxes and fees that might apply:

- – State taxes: Some states have specific tax obligations for LLCs. You may have to pay franchise taxes, business taxes, or annual report fees.

- – Quarterly estimated taxes: If you expect to owe more than $1,000 in federal taxes, you need to make estimated tax payments each quarter.

- – Self-employment taxes: Owners of pass-through LLCs pay self-employment taxes at a rate of 15.3% on their share of business income.

- – Payroll taxes: If your LLC has employees, you withhold and pay payroll taxes under the Federal Insurance Contributions Act (FICA).

- – Annual LLC Fees: Some states charge an annual LLC tax or renewal fee.

Remember, each state has different LLC laws, so be sure to check local requirements.

Some states, like California, charge an $800 annual LLC tax. Others, like Texas and Florida, have no state income tax at all.

If your LLC operates in multiple states, you’re subject to nexus rules. This means you may need to pay state taxes in every location where you have a taxable presence (nexus).

Nexus is triggered by factors like having:

- – A physical office

- – Significant sales

- – Employees

LLC Tax Deductions and Strategies to Reduce Tax Liability

Tax deductions subtract business expenses, which lowers taxable income. Strategic tax planning helps reduce overall tax payments.

Some common tax deductions for LLCs include:

- – Home office deduction: If you use a home office exclusively for business, you can deduct a portion of your rent, utility bills, and internet costs.

- – Health insurance: Self-employed LLC owners may deduct health insurance premiums when filing tax. This includes coverage for spouses and dependents.

- – Business expenses: LLCs can deduct the costs of office supplies, marketing activity, travel, and other necessary operational expenses.

- – Retirement contributions: You can reduce taxable income by contributing to SEP IRAs or Solo 401(k) plans.

To lower tax liabilities, consider these strategies:

- – Elect S Corp taxation: If your business earns over $50K, S Corp taxation lowers self-employment taxes by splitting income into salary and distributions.

- – Use tax credits: Claim any relevant and available tax credits, such as the Research and Development (R&D) credit for innovation.

- – Hire family members: When you employ family members, you can shift taxable income into a lower tax bracket.

- – Maximize deductions: Tracking all eligible expenses can lead to lower taxable income.

- – Use the QBI deduction where available: Many pass-through LLCs can claim up to a 20% QBI deduction on qualified business income, subject to income thresholds and business type limits. This is now a permanent feature of the tax code and should be part of your annual planning.

How to File Taxes for Your LLC

To avoid penalties, LLCs need proper record-keeping and the right tax forms. You need to pay on time and make sure your tax classification is correct.

Here’s how to submit LLC taxes:

1. Track Income and Expenses

Keep accurate records. Categorize all transactions and track deductible expenses.

*Pro-Tip: Try using an all-in-one accounting software like Akaunting to keep track automatically.

2. Determine Tax Classification

If you’re a single-member LLC, you will need to file Schedule C. If you’re a multi-member LLC, file Form 1065 and distribute Schedule K-1.

Electing S Corp or C Corp status? You must file corporate tax forms.

3. Pay Self-Employment and Estimated Taxes

Pass-through LLCs need to pay self-employment taxes. Owners must make quarterly estimated tax payments if they owe over $1,000 in taxes per year.

4. Check State Tax Requirements

Some states impose franchise taxes, business taxes, or annual LLC fees.

(Check your tax liabilities in all of the states you operate in.)

5. File the Right Tax Forms

Use the correct IRS and state tax forms for your LLC’s classification.

File before deadlines to avoid penalties.

How Akaunting Helps with LLC Taxes

Akaunting simplifies LLC tax filing.

- – As an all-in-one accounting platform, it tracks income and expenses automatically. This gives you an accurate record of tax deductions and compliance.

- – It also generates financial reports, including profit and loss statements and balance sheets. This gives you a clear view of your taxable income.

- – If you operate internationally, Akaunting supports multi-currency transactions. This makes it easier to report taxes in different countries.

- – To streamline accounting, Akaunting integrates with payment providers. All taxable business income gets recorded directly at the source.

With Akaunting, tax filing errors are a thing of the past. You have the right data at your fingertips, organized in an easy-to-read way, making it easier to complete tax returns on time.

Wrap up

LLCs give business owners flexible tax options while providing limited liability protection.

But it’s vital to understand the tax requirements related to your classification and location. (Make sure you file correctly and on time to avoid fines.)

Staying organized is key to this.

That’s why we recommend automating your finances with Akaunting. It’s a free tool that helps you track income and expenses and create tax reports. Sign up today to simplify your accounting.

Author Bio:

Kelly Moser is the co-founder and editor at Home & Jet, a digital magazine for the modern era. She’s also the content manager at Login Lockdown, covering the latest trends in tech, business and security. Kelly is an expert in freelance writing and content marketing for SaaS, Fintech, and ecommerce startups.