What is a tax return for Small Businesses and Freelancers in 2026?

Reading Time: 11 minutesMany small business owners in the U.S. would agree that the financial side of things can be a bit taxing. But here’s one thing you can’t avoid: the annual tax return.

It’s more than just a task to check off your list—it’s your official declaration of income, expenses, and the taxes you owe (or, fingers crossed, the refund you’re due).

Understanding tax returns is crucial for complying with IRS regulations and your business’s financial health and sustainability.

In this post, we’ll explain what a tax return is, its significance, and the process involved in the U.S.

So, let’s go into the details.

Table of Contents:

- What is a tax return?

- Why do I need to file a tax return?

- Who Needs to File a Tax Return?

- Key Differences for Small Businesses and Freelancers

- Common Forms and Schedules

- The Filing Process

- Common Tax Return Mistakes

- Keeping Up with Recent Changes and Updates

What is a tax return?

A tax return is a formal document submitted to the Internal Revenue Service (IRS) that details income, expenses, and other pertinent financial information from the tax year.

It is a comprehensive report that calculates the tax owed to the government or the refund due to the filer. It includes detailed financial information such as earnings, salaries, tips, interest, dividends, and other sources.

Taxpayers also report expenses such as mortgage interest, state and local taxes, charitable contributions, and other deductible items.

Businesses must report their revenues, costs, and other financial details.

Legal Basis

The legal basis for U.S. tax returns is the Internal Revenue Code (IRC), a comprehensive set of tax laws enacted by Congress.

The IRC outlines the types of income subject to taxation, allowable deductions, credits, and return filing procedures.

Specific sections within the IRC states the obligations for filing tax returns:

- – IRC Section 1401: Freelancers and small business owners are classified as self-employed by the Internal Revenue Service (IRS). They are subject to a tax on their self-employment income, which covers Social Security and Medicare contributions. This tax is reported on Schedule S.E. (Form 1040).

- – Internal Revenue Code (IRC) Section 6011(a): This section mandates that every person liable for any tax imposed by the IRC must file a return or statement according to the prescribed forms and regulations. It establishes the fundamental obligation for taxpayers to report their financial activity to the IRS.

- – IRC Section 6012: This section details the criteria for filing returns, specifying who must file based on factors such as gross income, filing status, and age. For example, individuals who earn above certain thresholds, which vary depending on their filing status (e.g., single, married filing jointly, head of household), must file a tax return.

- – IRC Section 6072: This section sets forth the deadlines for filing tax returns, generally requiring individuals to file by April 15th of each year for the preceding calendar year. Extensions may be granted, but the initial filing deadline remains a critical compliance point.

- – Regulatory Framework: The regulations issued by the Department of the Treasury further elaborate on the statutory requirements, providing detailed instructions and guidelines for completing and submitting tax returns. These regulations are in Title 26 of the Code of Federal Regulations (CFR).

Requirements for Filing

If you’re self-employed in the U.S., there are specific requirements for filing your tax returns:

- – Net Earnings Threshold: You must file an income tax return if your net earnings from self-employment are $400 or more. Net earnings are calculated by subtracting your business expenses from your business income. If your net earnings are less than $400, you still need to file a return if you meet any other filing requirements listed in the Form 1040 instructions

- – Quarterly Estimated Taxes: Since you don’t have an employer to withhold taxes, you’ll likely need to make estimated tax payments quarterly. This is to cover your Social Security, Medicare, and income taxes. You can use Form 1040-ES to calculate and pay these taxes.

- – Annual Tax Return: Freelancers typically use the Schedule C form to report their business income and expenses as part of their personal tax return.

Remember, these are general guidelines, and your specific situation may vary. You can speak to a tax professional or refer to the latest IRS guidelines to ensure you meet all your tax obligations.

Why do I need to file a tax return?

This is an age-long question by many individuals and businesses. The thing is, Filing a tax return is essential, and here’s why. We’ll start with the most important reason:

- – Legal Requirement: The law requires most U.S. citizens and permanent residents who work in the U.S. to file a tax return if their income is above a certain level. Failure to file a required tax return can result in penalties, interest, and legal consequences, including potential prosecution for tax evasion.

- – Tax on Income: Income earned from self-employment, including gig work, is taxable. Filing a tax return allows you to report this income and pay the necessary taxes.

- – Eligibility for Benefits: Certain benefits, credits, and deductions are only available if you file a tax return. This can include deductions for business expenses, which can lower your taxable income.

- – Self-Employment Tax: Freelancers and small business owners are responsible for paying self-employment tax, which covers Social Security and Medicare taxes. This tax is separate from income tax and must be reported on tax returns.

- – Record Keeping and Financial Planning: It documents your income, expenses, and other financial activities for the year, providing a clear picture of your financial health. This information is helpful for future financial planning, applying for loans, and maintaining personal and business financial records.

- – Avoid Penalties: It’s important to file your taxes by the deadline to avoid facing penalties. Failure to file can lead to financial penalties, and intentionally not filing can result in more severe consequences, such as legal action.

Who Needs to File a Tax Return?

The requirements for filing a tax return can vary based on your business structure, income, and other factors. Here’s a breakdown of who needs to file:

Sole Proprietors & Single-Member LLCs:

- – Net Earnings: If your net earnings from self-employment (after deducting expenses) are $400 or more, you must file a tax return.

- – 1099-K Reporting: Even if your net self-employment earnings are under $400, you may still need to file if your total income is above the filing threshold or you receive information returns such as Form 1099-K, 1099-NEC, or 1099-MISC. For 2026, most third-party payment networks (PayPal, Venmo, Stripe, etc.) only have to issue a Form 1099-K if your payments for goods and services exceed $20,000 and you have more than 200 transactions for the year, but you’re still required to report all taxable income, whether or not you receive the form.

Partnerships & S Corporations

- – Informational Return: You must file an informational return (Form 1065 for partnerships or Form 1120-S for S corporations) to report income and losses, even if no tax is due at the entity level.

- – Individual Returns: Partners and shareholders receive a Schedule K-1, which they use to report their share of the business income or loss on their individual tax returns.

C Corporations

- – Form 1120: C corporations file Form 1120 to report their income and calculate their tax liability. They are separate tax entities from their owners and pay taxes on their profits.

Special Circumstances

- – Alternative Minimum Tax (AMT): If you’re subject to AMT, you must file regardless of income level.

- – Recipients of Advance Payments: If you received advance payments of the premium tax credit or health coverage tax credit, you must file a return to reconcile the payments.

Other Considerations:

- – Estimated Taxes: If you expect to owe $1,000 or more in taxes after subtracting withholding and credits, you may need to make estimated tax payments throughout the year.

- – State Taxes: In addition to federal taxes, you may need to file state tax returns, depending on your location and business activities.

Key Differences for Small Businesses and Freelancers

Small businesses and freelancers share some similarities in their tax situations, but there are also differences to be aware of:

Income Reporting

- Small Businesses

- – Small businesses often generate income through sales revenue, which includes the money earned from selling products or services.

- – They may also have additional income streams, such as interest income from business bank accounts or rental income if they lease out property.

- – Small businesses typically maintain detailed income records, including invoices, receipts, and sales logs.

- Freelancers:

- – Freelancers primarily earn income from providing services. This includes freelance writing, graphic design, consulting, or other specialized work.

- – Freelancers often receive payments directly from clients or through platforms like PayPal or other payment gateways.

- – They may also participate in the gig economy, earning money from short-term projects or freelance platforms (e.g., Uber, TaskRabbit).

Deductions and Credits

- Small Businesses:

- Small businesses can deduct a wide range of expenses from their taxable income. Common deductions include:

- – Business-related travel expenses: Flights, hotels, meals, etc.

- – Office rent or mortgage: If they have a physical office space.

- – Equipment and supplies: Computers, furniture, office supplies.

- – Employee salaries and benefits: Wages, health insurance, retirement contributions.

- – Marketing and advertising costs: Website development, social media ads, etc.

- Small businesses can deduct a wide range of expenses from their taxable income. Common deductions include:

Check out: Tax Deduction Cheat Sheet For Small Business 2026

- Freelancers:

- Freelancers can also deduct business expenses related to their work. Common deductions include:

- – Home Office Deduction: A portion of their rent or mortgage can be deducted if they work from home.

- – Professional Services: Fees paid to accountants, lawyers, or other professionals.

- – Software and Tools: Expenses related to software subscriptions, domain hosting, etc.

- – Health Insurance Premiums: Self-employed health insurance deduction.

- – Business-related travel: Similar to small businesses.

- Freelancers can also deduct business expenses related to their work. Common deductions include:

Check out: Home Office Tax Deduction 2026

Credits

- Small Businesses:

- – Small businesses may qualify for the Qualified Business Income (QBI) Deduction if they meet specific criteria. This deduction allows eligible businesses to deduct up to 20% of their qualified business income. Thanks to recent law changes, this 20% deduction is now a permanent part of the tax code. Check out Small Business Tax Deductions Checklist 2026.

- – Other credits may apply based on specific circumstances (e.g., hiring veterans, research and development).

- Freelancers:

- – Freelancers can benefit from the same QBI Deduction if they operate as sole proprietorships, partnerships, or S corporations.

- – Additionally, they may qualify for the self-employed health insurance deduction if they pay their own health insurance premiums.

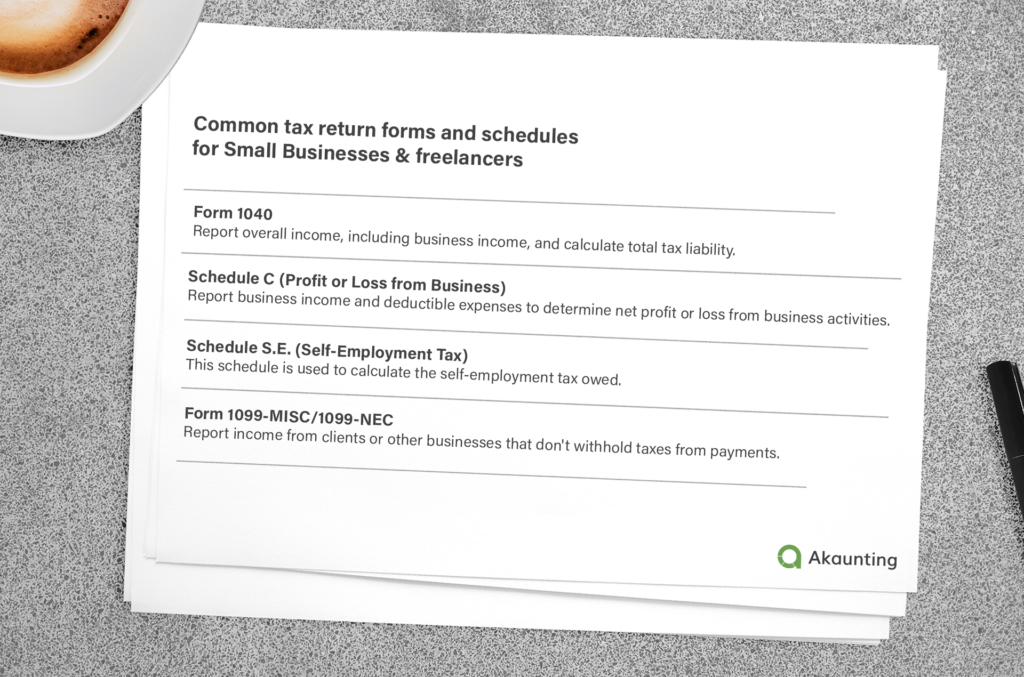

Common Forms and Schedules

Understanding the common forms of your tax return is crucial for accurate filing and maximizing your deductions. Here’s a breakdown of the essential forms and schedules:

Form 1040

Everyone files this standard individual income tax return form, regardless of their employment status. Small business owners and freelancers use this form to report overall income, including business income, and to calculate total tax liability.

Schedule C (Profit or Loss from Business)

This schedule is specifically for self-employed individuals and sole proprietors. It’s where you report your business income and deductible expenses to determine your net profit or loss from your business activities.

Schedule S.E. (Self-Employment Tax)

This schedule is used to calculate the self-employment tax you owe. Self-employment tax covers Social Security and Medicare taxes, which employees and employers typically pay. Since you’re both the employer and employee, whether you’re a small business owner or freelancer, you’re responsible for the entire amount.

Form 1099-MISC/1099-NEC

These forms report income you receive from clients or other businesses that don’t withhold taxes from your payments.

- – Form 1099-NEC (Nonemployee Compensation): This form reports payments for services you provided as an independent contractor. Check out what the 1099 NEC form is used for.

- – Form 1099-MISC (Miscellaneous Income): This form reports other types of income, such as rents, royalties, or prizes.

Forms 1040A and 1040-EZ were simplified versions of Form 1040 and were available for tax years before 2019. However, these forms have been discontinued. The IRS streamlined the process by consolidating all previous versions of the annual tax return into Form 1040.

Additional Records:

Depending on your business situation, you may need to file additional forms or schedules. Some common examples include:

- – Schedule K-1: If you’re a partner in a partnership or a shareholder in an S corporation, you’ll receive a Schedule K-1 showing your share of the business income or loss.

- – Form 1065 (for partnerships): Partnerships file this form to report their income and losses.

- – Form 1120S (for S corporations): S corporations file this form to report their income and losses.

- – State Tax Forms: You’ll likely need to file state tax returns in addition to your federal return. Check with your state’s tax agency for the specific forms required.

The Filing Process

Filing a tax return as a small business owner or freelancer requires understanding the process and choosing the most suitable method.

- – Self-Prepared: If your business is relatively simple, you might prepare your tax return yourself. However, it requires a good understanding of tax laws and forms.

- – Professional Help: Hiring a tax professional, such as an accountant or tax preparer, can be beneficial, especially if your business is complex or lacks tax knowledge. They can ensure accuracy, maximize deductions, and help you avoid costly mistakes.

- – Software Tools: Tax software, such as H&R Block or TaxAct, can simplify the filing process. It guides you through the necessary forms, performs calculations, and even offers tips on deductions. Some software, such as Akaunting, is designed for small businesses and freelancers.

Filing Options

- – Electronic Filing (e-filing): This is the most common and recommended method. It’s faster, more secure, and often comes with helpful features like error checks. You can e-file through the IRS website using their Free File program (if eligible) or tax software.

- – Paper Filing: While possible, paper filing is less efficient and can lead to processing delays. It’s generally only recommended if you’re ineligible for e-filing or have specific circumstances that require it.

Deadlines and Penalties

- Quarterly Estimated Tax Payments: Most small businesses and freelancers must make estimated tax payments four times a year. The deadlines are usually April 15th, June 15th, September 15th, and January 15th of the following year.

- Annual Tax Return Filing: The deadline for filing your yearly tax return is April 15th. However, you can file for an extension until October 15th if needed.

- Consequences of Late Filing or Errors: Failing to file a tax return by the deadline may result in penalties and interest charges. The penalty for late filing is typically 5% of the unpaid taxes for each month or part of a month that the return is late, up to 25% of the unpaid taxes.

Common Tax Return Mistakes

Small businesses and freelancers often have similar errors when filing tax returns. Here are some common mistakes and how to avoid them.

- – Mixing Personal and Business Expenses: Open a separate bank account and credit card for business transactions. Use accounting software to track business expenses separately.

- – Misclassifying Workers: Misclassifying employees as independent contractors can result in significant penalties and back taxes. Understand the IRS guidelines for classifying workers. If unsure, consult with a tax professional.

- – Not Keeping Accurate Records: Use accounting software to track all annual income and expenses. Keep receipts, invoices, and other documentation organized.

- – Incorrectly Deducting Expenses: Only deduct legally permissible expenses and keep detailed records to justify deductions.

- – Underreporting Income: This can trigger an audit and incur penalties and interest charges. Carefully track all income sources, including cash payments, 1099s, and online sales. Use accounting software to reconcile income with bank statements.

- – Not Paying Estimated Taxes: If you expect to owe $1,000 or more in taxes, make quarterly estimated tax payments. Consult with a tax professional to determine the correct amount.

- – Misunderstanding Form 1099-K rules: The reporting threshold for third-party payment networks is high again—generally $20,000 in payments and more than 200 transactions for 2026—but all business income is taxable, even if no form ever lands in your inbox. Don’t treat “no 1099-K” as permission to ignore income from PayPal, Stripe, Square, or other platforms; track and report everything inside your accounting software.

- – Filing Late: Mark tax deadlines in your calendar and set reminders. If you need more time, file for an extension before the deadline.

- – Not Seeking Professional Help: Tax laws are complex, and mistakes can be costly. A tax professional can help you navigate the complexities and ensure compliance. If you’re unsure about any aspect of your tax return, consult with a qualified tax professional. They can save you time, money, and stress.

Keeping Up with Recent Changes and Updates

Recent updates for small business and freelancer tax returns include:

- – Form 1099-K Threshold Reinstated: A new law rolled back the planned $600 threshold. For 2026, most third-party payment processors must issue a Form 1099-K only if your payments for goods and services exceed $20,000 and you have more than 200 transactions for the year. That’s a reporting threshold for the platform, not a tax-free allowance—you still have to report all taxable income, even if you never receive a 1099-K.

- – Lower E-Filing Threshold: The IRS now requires electronic filing if you file 10 or more information returns in total (W-2s, 1099-NEC, 1099-K, etc.) for the year. This rule took effect with the 2023 returns and continues to apply for the 2026 filing season, so paper filing is no longer an option for most employers and payers.

- – Residential Clean-Energy Credits Ending: The Residential Clean Energy Credit still allows a 30% credit for qualifying solar, battery storage, and similar systems, but only for expenditures made by December 31, 2025. You can’t claim this credit for new residential clean-energy spending in 2026, though unused 2025 credit can be carried forward to 2026 and later years.

- – Clean Vehicle (EV) Credits Phased Out: The federal Clean Vehicle Credit for most new and used EV purchases effectively ends for vehicles acquired after September 30, 2025. For the 2026 tax year, you generally can’t plan on a federal EV credit for a vehicle bought in 2026, even though credits can still show up on 2025 returns for cars purchased earlier under the old rules.

You can regularly look for updates on tax returns from the IRS Publications. It’s essential to stay informed about these updates as they can impact tax returns and overall tax strategy for the upcoming tax season.