Variable Expenses: How To Budget for Them

Reading Time: 6 minutes“Winter is coming!” warned Ned Stark on Game of Thrones. But for businesses, winter translates to variable expenses incurred when least expected.

But hey, that’s why we learn to adapt, right?

One of the most challenging aspects of financial management is dealing with expenses that change over time depending on sales, production, or other factors.

How can you budget for these unpredictable expenses and ensure that you have enough cash flow to cover them?

In this blog post, we will explain variable expenses, how to identify and track them and create a realistic budget for them to improve profitability and cash flow.

Table of Content

- What are variable expenses

- What are examples?

- How to Identify and track them

- How to calculate it

- How do you budget for a variable expense?

What are Variable Expenses?

Variable expenses are costs that change in proportion to business activities–sales volume, output, and other operational activities influence these expenses.

Unlike fixed expenses, which remain relatively constant regardless of business operations, these expenses rise or fall as the scale of operations changes.

Understanding them helps you maintain financial stability and make informed decisions about business resource allocation.

What are examples of variable expenses?

Effective management of variable expenses is crucial for maintaining profitability, as excessive spending on them can lead to a reduced profit margin and cash flow issues.

Here are examples:

- Sales and marketing

- Raw materials

- Shipping costs

- Manufacturing costs

- Travel

- Software subscriptions

- Credit card processing fees

- Commissions and sales incentives

- Overtime wages

- Hiring costs

- Utility costs

- Cost of packaging

Finding the optimal balance between spending, earning, and adjusting variable expenses according to business goals and performance is essential.

Track expenses and stay cash-positive with user-friendly expense management software.

How to Identify and Track Variable Expenses

It is advised to have accurate and up-to-date data on how much you spend on each variable expense category.

To do this, you can use the following methods:

Categorize expenses

One of the first steps to budgeting is to list all business expenses and categorize them into fixed or variable.

The table below shows an example of categorizing expenses

| Fixed Expenses | Variable Expenses |

| Rent | Raw materials |

| Insurance | Marketing |

| Depreciation | Travel |

| Utilities | Personnel |

| Amortization | Production supplies |

Listing all incurred and future expenses gives a clear picture of those that are essential, constant, and likely to change based on operations.

Utilize Existing Data

As data plays a vital role in every aspect of life, it is one of the best ways to track variable expenses.

Receipts data for all business purchases provide specific details such as the date, amount, category, and vendor, which help you track variable expenses.

Bank transactions are also important for collecting variable expense data. Analyzing bank transactions helps identify recurring and non-recurring charges related to variable costs, such as utility bills, software subscriptions, or travel expenses.

Using these data gives a clear and accurate picture of expenses, helping with informed decisions and budgeting business finances more effectively.

Accounting Software

Accounting software—such as Akaunting, Xero, or FreeAgent—removes the manual work and brainstorming processes with the auto-categorization of variable expenses.

For example, Akaunting lets you create custom categories for Expenses. When combined with connecting accounting software to bank accounts, it automatically imports your transactions/expenses while categorizing them.

This simplifies tracking expenses and reconciling transactions between the bank and the accounting software. Generating reports and charts to visualize variable costs and comparing them to revenue is easier.

How To Calculate Variable Expenses

You can calculate with three methods depending on the intended result.

Method 1: Total Variable Expenses

Here, you add up all identified variable expenses.

For example, If you spent $4,000 on raw materials, $2,800 on shipping, and $1,500 on freelance fees, your total would be $8,300.

Method 2: Variable Expenses per Unit

Divide total variable expenses by the number of units produced or sold.

For example, If you produced 500 units and incurred $8,300 in variable expenses, the variable cost per unit would be $8,300 / 500 = $16.60.

Method 3: Calculate Variable Expense Ratio

Divide total variable expenses by total sales.

For example, if total sales were $20,000 and variable expenses were $8,300, your variable expense ratio would be 41.5%.

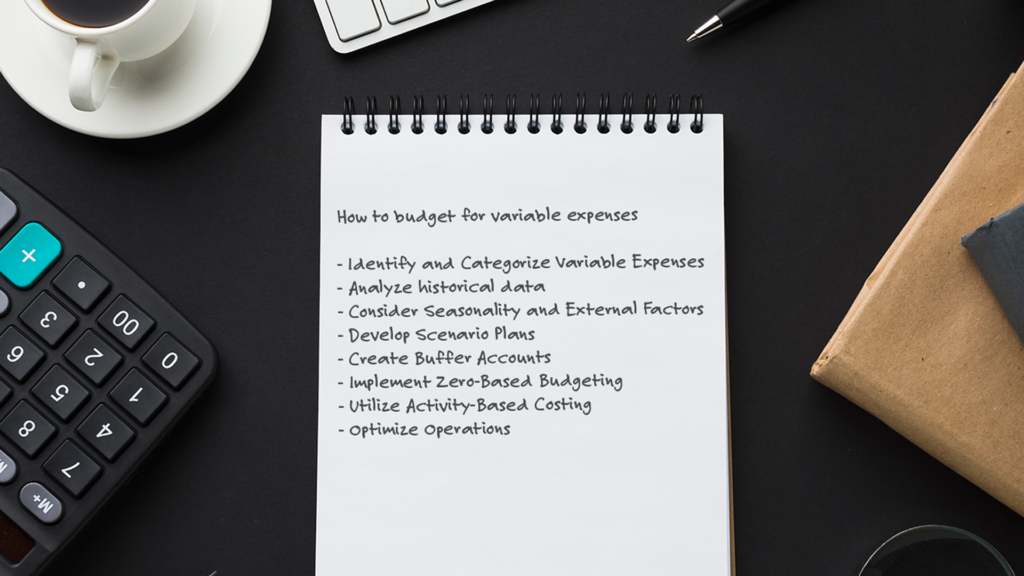

How do you budget for a variable expense?

Budgeting is a critical aspect of financial management. It helps to set realistic and achievable goals, allocate resources efficiently, and measure progress and performance. Here are viable things to consider.

Identify and Categorize Variable Expenses

As mentioned earlier, categorizing based on different aspects of business, such as production, marketing, operations, and personnel, clearly shows where your variable costs are concentrated.

Here is an example of categorizing:

- Production: Expenses related to raw materials, packaging, shipping, and manufacturing fees.

- Marketing: Examples are advertising, social media, content creation, agency fees, etc.

- Operations: Expenses include travel, office supplies, software subscriptions, and utilities.

- Personnel: Expenses related to wages, freelancer fees, and payroll taxes.

Analyze Historical Data

By examining previous financial records, you can identify the areas where spending is more than it should and whether the expense is necessary.

This analysis helps make more accurate predictions for future variable costs, enabling the allocating of resources efficiently and effectively.

Furthermore, it also assists in identifying the factors that may have contributed to any fluctuations in expenses, which can further help develop strategies to optimize financial performance.

Consider Seasonality and External Factors

This involves analyzing and anticipating peak periods, such as holiday seasons or events, and evaluating economic trends that may influence costs.

Additionally, be aware of competitor actions that might affect costs, such as price changes or promotional offers.

Develop Scenario Plans

Developing budgets for different growth scenarios is an essential aspect of financial planning. You need to analyze market conditions and anticipate potential fluctuations in activity levels.

Consider high, medium, and low activity levels, and create financial strategies for various market conditions.

This approach enables the effective allocation of resources. With a well-designed budget, managing expenses is more efficient and allows you to remain profitable and competitive.

Allocate and Prioritize Budget

Divide budget among variable expense categories based on importance and impact on business operations. Prioritize essential expenses that directly contribute to revenue generation.

For example:

Suppose a small online clothing store has a monthly budget of $10,000 with categories: production/inventory, marketing, operations, and personnel.

This is a possible budget allocation:

| Variable Expense Category | Estimated Cost | Budget Allocation | Priority |

| Production/Inventory | $5,000 | 50% | High |

| Marketing | $3,000 | 30% | High |

| Operations | $1,000 | 10% | Medium |

| Personnel | $1,000 | 10% | Medium |

By dividing budgets among expense categories based on their importance and impact on business operations and prioritizing essential expenses that directly contribute to revenue generation, you can manage these expenses effectively and ensure having enough cash flow to cover them.

Create Buffer Accounts

A buffer account collects and stores money to address unexpected expenses or emergencies. Buffer accounts can help avoid overdraft fees, late payments, or credit card debt and provide financial security.

Some examples of buffer accounts are savings accounts, checking accounts, or credit cards that can act as a cushion for unforeseen events or expenses.

Send and Track an unlimited number of Invoices

Implement Zero-Based Budgeting

In this approach, each dollar is assigned to a specific cost in a new budget.

This method requires you to examine each expense and determine whether it is necessary. Doing so, you identify areas where expenses can be optimized and potentially reduce costs.

Utilize Activity-Based Costing

Activity-based costing is a managerial accounting approach that helps track and analyze variable costs per output unit. This method considers the costs of each activity involved in the production process and assigns them to the products or services based on their actual consumption of resources.

It provides a more accurate understanding of the costs associated with each unit produced or service rendered, eliminating inefficiencies in production processes, reducing waste, and improving overall profitability.

Optimize Operations

It’s always beneficial to keep an eye out for opportunities to enhance operations and simplify processes, which can ultimately reduce variable costs without sacrificing quality.

These improvements can range from automating specific tasks to optimizing workflows and utilizing new technologies. For example, AI can help automate manual tasks like scheduling, data entry, and customer service, saving operations costs.

Continuously evaluating and refining processes can create a more streamlined and agile operation, significantly keeping these expenses low.

Final thoughts!

Managing variable expenses is crucial to maintain profitability and financial stability. By identifying and tracking them effectively, you can create a realistic budget that considers the unpredictability of these costs.

Akaunting provides an easy-to-use platform for tracking, analyzing, and managing expenses. Get started here.

Frequently Asked Questions

What type of expenses are variable expenses?

- Sales and marketing

- Commissions and sales incentives

- Overtime wages

- Travel

- Utilities

When should fixed and variable monthly budgeted expenses first be planned?

Planning fixed and variable expenses before starting a month is advisable to monitor budgeted and actual costs and adjust spending accordingly.

What is the formula for variable expenses?

TVE = Q * VC

- Where:TVE: Total Variable Expenses

- Q: Quantity of goods or services produced/rendered

- VC: Variable Cost per unit of output

Average Variable Cost:

Formula: AVC = TVE / Q

- Where: AVC: Average Variable Cost

How much should I spend on variable expenses?

Determining the ideal amount to spend is subjective and varies depending on one’s income, lifestyle, and financial goals. However, a popular budgeting method is the 50/20/30 rule, which suggests dividing your income into three categories: 50% for essential expenses like rent, utilities, and food; 20% for savings and debt repayment; and 30% for discretionary spending like travel, entertainment, and clothing.

Should variable expenses be included in a budget?

Including variable expenses in a budget is essential as they can affect overall spending and savings. However, budgeting for them can be challenging since they are not always predictable or consistent.