How to Write, Send Invoice and Payment Reminders?

Reading Time: 7 minutesInvoice and payment reminders function similarly to an alarm clock for your finances. They may sometimes irritate recipients, but they get you paid and keep your business running.

Sending invoices and payment reminders is critical in your company. It may not be the most fancy part of running a business, but it is essential to maintain a stable cash flow.

Despite the necessity of timely payments, many customers require a little encouragement to pay their bills on time. This is where invoice and payment reminders come in as a gentle reminder to ensure payments are completed on time.

In this article, we’ll discuss the following:

- What is an Invoice reminder

- How to write an invoice reminder

- How to send Invoice reminder

- Examples of an Invoice reminder

- What is a payment reminder?

- How do you write a payment reminder?

- Example of a payment reminder

Click on the sub-topics to navigate to specific sections.

Let’s get into the details.

What is an Invoice reminder?

An invoice reminder is a notice sent to a customer or client with an unpaid invoice past the due date.

A reminder usually includes the invoice number, amount owed, due date, and any relevant information such as incentives, late fees, or penalties.

Depending on the situation and the relationship between the business and the client, the tone of the reminder might range from warm and polite to firm and assertive.

Invoice reminders encourage your clients to settle their outstanding bills on time, which is essential for your business’s good cash flow and financial stability.

Reminders also contribute to customer trust and goodwill by communicating payment expectations in a straightforward and transparent manner.

Check out: Best Practices for Invoicing and Payment Management for Remote Team

Invoice and payment reminders are similar because they are communication tools your business uses to request payment for outstanding balances. However, there is a subtle difference between the two.

A payment reminder is sent after the invoice is due, while an invoice reminder is sent before or on the due date.

How To Write Invoice Reminders

Here are some tips for writing effective invoice reminders.

Be concise and clear

Include the invoice number, amount owed, and due date in the body of the reminder. Avoid using sophisticated words or legal jargon that may cause the receiver to become confused.

Be professional and polite

Maintain a professional tone while remaining polite and respectful in your messaging. Avoid accusing language and concluding about why the invoice has not been paid.

Offer payment alternatives

Make it simple for the recipient to pay the invoice by offering a variety of payment methods, such as online payment, bank transfer, or cheque. Include all required information for each payment option, including any applicable account or routing numbers.

Personalize the message

If possible, address the recipient by name and include any pertinent account or payment history information. This can help to establish a personal connection and boost the chances of receiving a timely response.

Consider offering incentives

To encourage quick payment, consider offering early payment reductions or waiving late fees for first-time late payers. Make sure that these incentives are adequately communicated in the reminder.

Follow up

If the invoice is overdue after the first reminder, send additional follow-up emails regularly. Adjust the message’s tone and urgency based on the recipient’s response or lack thereof.

How To Send Invoice Reminders

If you send reminders manually, you may set aside particular days to send invoice reminders based on the initial send and due date.

For example, you could set calendar notifications to send reminders a day or two after the due date.

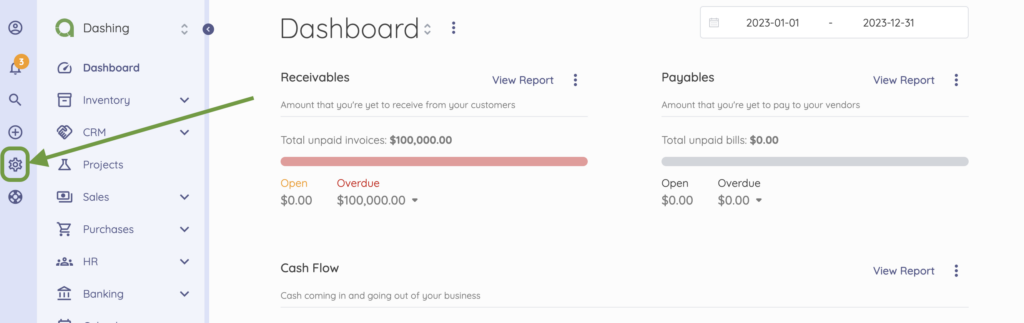

Accounting software solutions do this automatically, saving you time and effort. On Akaunting, the invoice reminder works as a payment reminder.

To send invoice reminders on Akaunting,

- Click Settings on Sidebar.

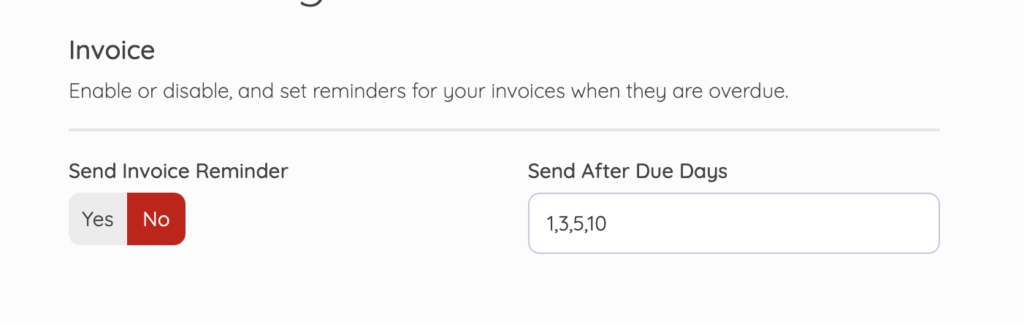

- Select Scheduling from the expanded Navigation Menu

- Choose Yes on the “Send Invoice Reminder” toggle button.

- Enter the days you want to send Reminders in the “Send After Due Days” text area.

- Then, Save.

Check out: How Do I Create Recurring Invoices?

Once completed, an Invoice reminder email will be sent to your customer when payment is past the due date.

You can also customize the reminder email template.

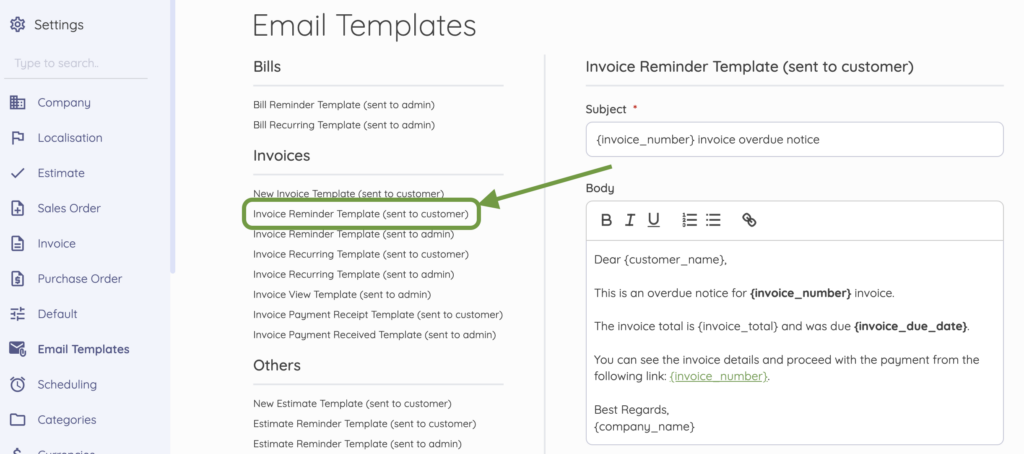

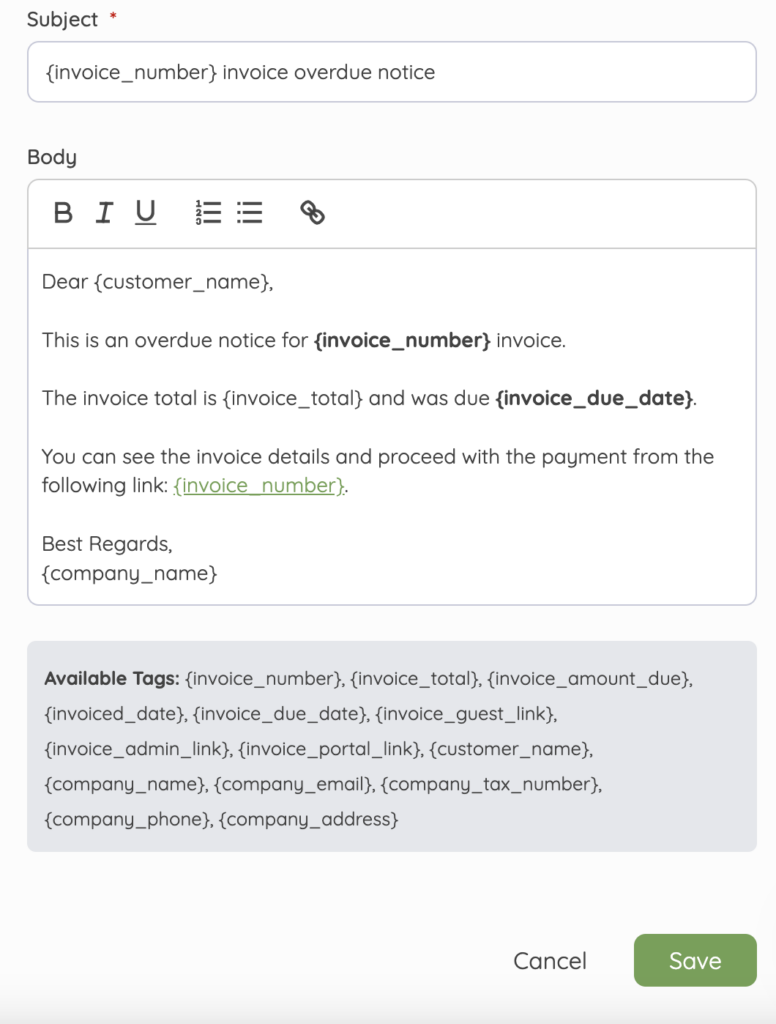

- Click Settings on Sidebar.

- Go to Email Templates from the expanded Navigation Menu

- On the Email Templates page, select “Invoice Reminder Template (sent to the customer).”

You can make edits to the email subject and body. Also, see available tags for better message personalization.

- Then, Save.

Once completed, the updated email message will be sent as an Invoice reminder to your customer.

What is an example of an invoice reminder?

Example 1 (Short Reminder Email)

Subject:

[Business Name]: {invoice_number} Overdue Notice

Body:

Hi {customer_name},

I just wanted to remind you that {invoice_amount_due} in respect of invoice {invoice_number} was due for payment on {invoice_due_date}.

You can see the invoice details and proceed with the payment via this link: {invoice_portal_link}. Payment within 48 hours gives you a 30% discount on your next order with the promotion code XINVOICE30.

If you have any questions or concerns, please let me know.

Regards,

{company_name}

Example 2 (Long Reminder Email)

Subject:

Friendly Reminder: Overdue Invoice {invoice_number}

Body:

Dear {customer_name},

We hope this email finds you in good health. We want to draw your attention to an outstanding invoice {invoice_number}, issued on {invoiced_date}, which was due for payment on {invoice_due_date}.

We recognize that you may have forgotten; therefore, we’d like to remind you to pay the outstanding sum of {invoice_amount_due} as soon as possible.

We provide many payment alternatives to make the payment procedure as simple and comfortable as possible. You have the option of:

- Pay online: Visit our secure payment portal at {invoice_portal_link} and follow the instructions to complete the transaction.

- Bank transfer: Transfer the amount due to the following account:

Bank Name: ******

Account Name: ******

Account Number: ******

Routing Number: ******

If you have already settled this invoice, kindly ignore this reminder.

Should you require any assistance or have questions regarding this invoice, please don’t hesitate to contact our dedicated customer support team.

Thank you for your attention to this matter.

We value your prompt action in settling this invoice and maintaining our strong working relationship.

Best regards,

{company_name}

{company_number}

What is a Payment Reminder?

You’ve completed the task, issued the invoice, and waited patiently for payment. However, the due date passes without indicating the money in your bank account. What are you going to do?

Do you make a phone call to the consumer and demand payment? Do you send a strong-worded email threatening legal action? Or do you give up and declare bankruptcy?

None of these alternatives seem particularly appealing, do they?

That is why you require a payment reminder: a friendly and professional approach to urge your consumer to pay what they owe you without ruining your customer relationship or wasting your time.

Check out: How Do I Bill a Recurring Payment?

Invoice and payment reminders serve the same purpose to your business: their primary goal is to get you paid and increase your cash flow.

How Do You Write a Payment Reminder?

Here’s how you can write a payment reminder:

Greet the customer warmly: Start the message with a courteous and friendly greeting to establish a positive tone.

State the purpose: Clearly explain the reason for the message and why you are contacting them. Let the customer know you are sending a payment reminder, mentioning the due invoice or account.

Provide details: Include all the relevant information, such as the payment amount, due date, and any applicable late fees or penalties. Be specific and clear about the amount owed and any possible consequences of late payment.

Be professional: Maintain a professional tone throughout the communication and avoid using accusatory or hostile language. Maintain a courteous but forceful tone in your communication.

Offer assistance: Provide relevant information or resources to the customer, such as a link to the payment site or instructions for setting up a payment plan. Make it simple for them to pay and address the issue.

Close with a call to action: Finish with a strong call to action, such as “Please complete payment as soon as possible” or “We appreciate your prompt response to this reminder.”

Include your contact information: Include your contact information so the consumer may contact you with any questions or concerns.

Example of a payment reminder

Subject:

Payment reminder: Dr. Strange Optical Clinic Invoice {invoice_number}

Body:

Dear {customer_name},

I hope this email finds you well and that you are satisfied with the glasses you received on {invoiced_date}.

This is a friendly reminder that your invoice {invoice_number} for {invoice_amount_due} is due today, {invoice_due_date}. You can view the invoice details and pay online by clicking this link: {invoice_portal_link}

If you have already paid, please disregard this email.

If you have any questions or concerns, please get in touch with me at {company_phone} or {company_email}.

Thank you for choosing Dr. Strange Optical Clinic. I appreciate your prompt payment and your continued trust.

Sincerely,

Dr. Strange.

Final thoughts

As stated earlier, writing and sending invoices and payment reminders may not be the fanciest part of running a business. Still, it is essential for keeping your cash flow healthy and your customers happy.

You can turn these reminders from boring communications to witty and engaging interactions with the right approach.

So, don’t be afraid to add a bit of humor or creativity to your next invoice or payment reminder. You might make someone’s day and motivate them to pay their overdue balance.

Do you need to start sending invoices and payment reminders? Get started on Akaunting.

Frequently Asked Questions

What is the difference between an Invoice and a Payment Reminder?

A payment reminder is a message you send to customers after the due date to urge them to pay quickly, providing a clear and direct reminder that the payment is late. An invoice reminder is a message you send customers before the due date to notify them of the approaching payment deadline.

How do you politely ask for payment in a sentence?

“Hi {customer_name}, I hope you are doing well and enjoying your new glasses. This is a gentle reminder that your invoice {invoice_number} for {invoice_amount_due} is due on {invoice_due_date}. You can pay online by clicking this link: {invoice_portal_link}