What is a VAT Number?

Reading Time: 5 minutesA VAT number is a unique ID that shows a business is registered for VAT. In the UK, it’s issued by HMRC and usually looks like a 9-digit number. You’ll often see it written with a country prefix like GB.

Having a VAT number means the business can charge VAT on taxable sales, reclaim VAT on eligible business expenses, and show customers and suppliers that it is VAT registered.

In Northern Ireland, VAT-registered businesses may need to use the XI prefix (in front of their usual VAT number) when dealing with EU VAT systems for certain goods movements between Northern Ireland and the EU.

Basically, a VAT number is how a business proves it is “in the VAT system” and following the rules.

Let’s get into the details of this special identification tag for businesses.

Table of content:

- Why is it important

- Who needs it?

- Where to find it

- How to get it

- Checking validity

- What countries require it

- Is a VAT number the same as a UTR number?

- Is an EIN the same as a VAT number?

Why is it important?

A VAT number matters for a few practical reasons:

- Tax compliance: If your business is required to register, your VAT number is part of meeting that legal obligation, including charging VAT correctly and submitting VAT returns. In the UK, mandatory registration is triggered by taxable turnover rules, not by an “annual tax year.”

- Business credibility: Many B2B buyers expect VAT invoices and require a VAT registration number. It signals you’re operating as a recognised VAT-registered business.

- VAT reclaim: VAT registration is what lets you reclaim VAT on eligible business expenses through your VAT return.

- International trade and imports: A VAT number is not required just because you import goods into the UK. However, VAT registration changes how you can handle import VAT. For example, delayed VAT accounting generally requires your business to be VAT-registered in the UK.

- MTD for VAT: In the UK, Making Tax Digital for VAT applies to VAT-registered businesses unless HMRC grants an exemption, and it shapes how you keep records and submit VAT returns.

Submit Your Tax Return Online on Akaunting’s MTD for VAT (UK)

Who needs it?

In general, businesses must register for VAT when they meet the registration rules in their country. In the UK, you must register if:

- 1. Rolling 12-month test (backward look): You must register if your total taxable turnover over the last 12 months exceeds £90,000. This is a rolling test, not a calendar year or “tax year” test.

- 2. Next 30 days test (forward look): You must also register if you expect your taxable turnover to exceed £90,000 in the next 30 days.

- 3. Non-UK established businesses supplying in the UK: If you’re not established in the UK but make taxable supplies in the UK, you may need to register even if you are below the threshold, depending on your situation.

Some businesses also register voluntarily even if they are below the threshold, for example, if reclaiming VAT on costs matters, or if customers prefer dealing with VAT-registered suppliers.

Note: If your taxable turnover drops and stays low, you can usually apply to deregister if you’re below the £88,000 deregistration threshold.

Where to find it

If you need a supplier’s VAT number, check:

- – Their VAT invoice (usually in the header or footer)

- – Quotes, contracts, and other official documents

- – Their website, often in the footer or legal section

In the UK, a proper VAT invoice includes the seller’s VAT registration number as part of the required details.

If you’ve been charged VAT but the invoice has no VAT number, contact the supplier quickly. For VAT reclaim, HMRC expects you to hold appropriate documentary evidence for input tax claims.

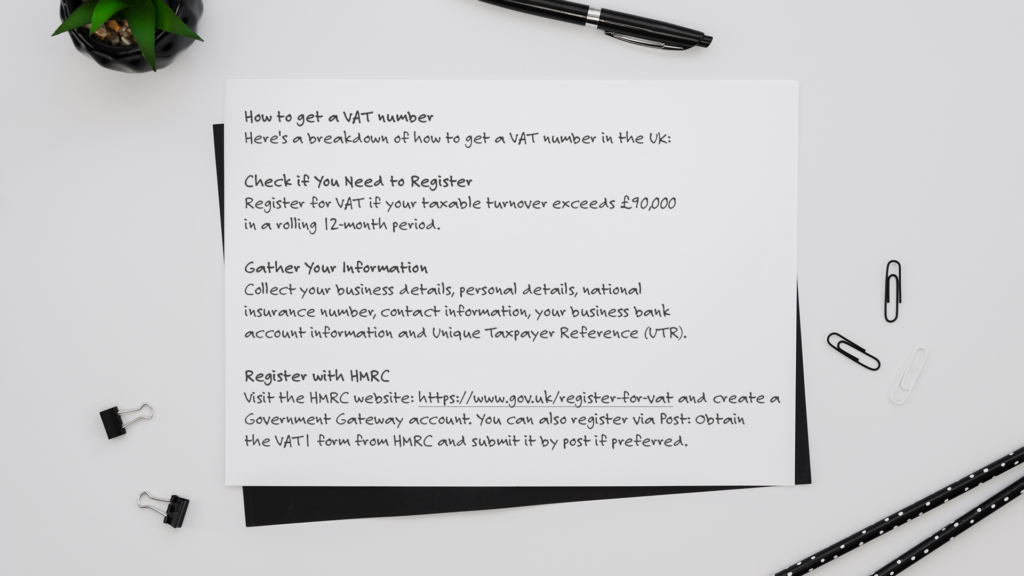

How to get it

Here’s a breakdown of how to get your unique nine-digit code in the UK:

1. Check if You Need to Register

You must register for VAT if your taxable turnover exceeds £90,000 in a rolling 12-month period.

Check out: How Much is VAT in the UK

2. Gather Your Information

You’ll need the following:

- – Business Details: Company name, address, nature of business activities, projected turnover.

- – Personal Details: National Insurance number, contact information.

- – Bank Details: Your business bank account information.

- – Existing Tax Numbers: Unique Taxpayer Reference (UTR), if applicable.

3. Register with HMRC

- – Online Registration: Most businesses register online through GOV.UK, using a Government Gateway account.

- – Register by Post: You can obtain a paper VAT1 form from HMRC and submit it by post if preferred. But it is mainly used in specific situations (or when you cannot register online).

4) Processing and your effective date of registration

HMRC will review your application and may ask for additional details. Once approved, HMRC will confirm your VAT number and your effective date of registration.

You’ll also receive:

- – Information on setting up your business tax account (if you don’t have one already).

- – Details about when to submit your first VAT return and payment.

- – Confirmation of your VAT registration details, including your VAT number and your effective date of registration. If you are registering because you exceeded the threshold in the last 12 months, the effective date is generally the first day of the second month after you exceeded the threshold (not the first day of the next month).

Check a VAT number validity

The UK government provides an online service to check if a VAT number is valid and to find a business’s registered name and address.

You can use this service to verify the date you checked it. Your own VAT number is required to utilise this feature.

For the EU, you can use the European Union’s VAT Information Exchange System (VIES) to check the validity of this number in EU member states.

What countries require a VAT number?

VAT registration rules depend on the country, your turnover, and whether you sell locally or across borders.

- – EU countries: EU member states run VAT systems, but not every business automatically needs a VAT number. Many countries have small-business thresholds and exemptions, and cross-border selling can create additional registration requirements depending on what you sell and where you sell it.

- – There is also an EU-wide SME scheme that can simplify cross-border treatment for eligible small businesses.

- – Non-EU countries: Many countries operate VAT or VAT-style taxes (often called GST). Registration rules vary widely by local law and thresholds.

- – United States: The US does not use VAT. It uses sales tax, set at the state and local levels, and is generally not reclaimed the way VAT is.

Is a VAT number the same as a UTR number?

No. A Unique Taxpayer Reference (UTR) and a VAT (Value Added Tax) number serve distinct purposes in the UK tax system.

The UTR is a 10-digit number HMRC provides when someone registers for Self Assessment for the first time. It Identifies taxpayers (individuals, businesses, organisations) for the Self Assessment tax system. This covers income tax, National Insurance contributions, and sometimes Corporation Tax.

VAT (Value Added Tax) number typically consists of 9 digits, often presented with a country code prefix (for example, ‘GB’ for the United Kingdom). It specifically identifies businesses registered for VAT (Value Added Tax). Unlike UTRs, VAT numbers are specific to VAT-related activities and do not cover broader tax matters.

Is an EIN the same as a VAT number?

No. An EIN (Employer Identification Number) is used in the United States for tax identification purposes. It serves a similar function but is a separate system and identifier from VAT numbers.