What is operating cash flow, and how to calculate it

Reading Time: 3 minutesWhat is operating cash flow, why is it essential for your business, and how do you calculate it? These are more of the subjects that this article will discuss.

One of the many problems of small businesses is maintaining a healthy cash flow required to handle day-to-day operations. Without cash, a company’s growth faces the risk of a downturn.

Understanding this is essential to a sustainable business.

What is operating cash flow (OCF)?

OCF is the amount of cash a business generates from its day-to-day operations within a specific time.

It also measures the ability of a company to generate the sufficient positive cash flow required to maintain and grow business operations, which include providing services, payroll, marketing, advertising, etc.

For small businesses, it can serve as a reliable indicator of the company’s financial health.

What is the formula for OCF?

To calculate cash flow, you need to consider the Net income, non-cash expenses, and working capital.

Operating Cash flow formula:

Operating Cash Flow = Net income + Non-cash expenses - Change in working capital

Let’s break down what is included in OCF:

- Net income is your revenue after all expenses have been paid.

- Non-cash expenses: these are expenses listed on an income statement that does not involve cash payments. Examples are depreciation and investment gains/losses.

- Change in working capital: This is the total current assets – total current liabilities.

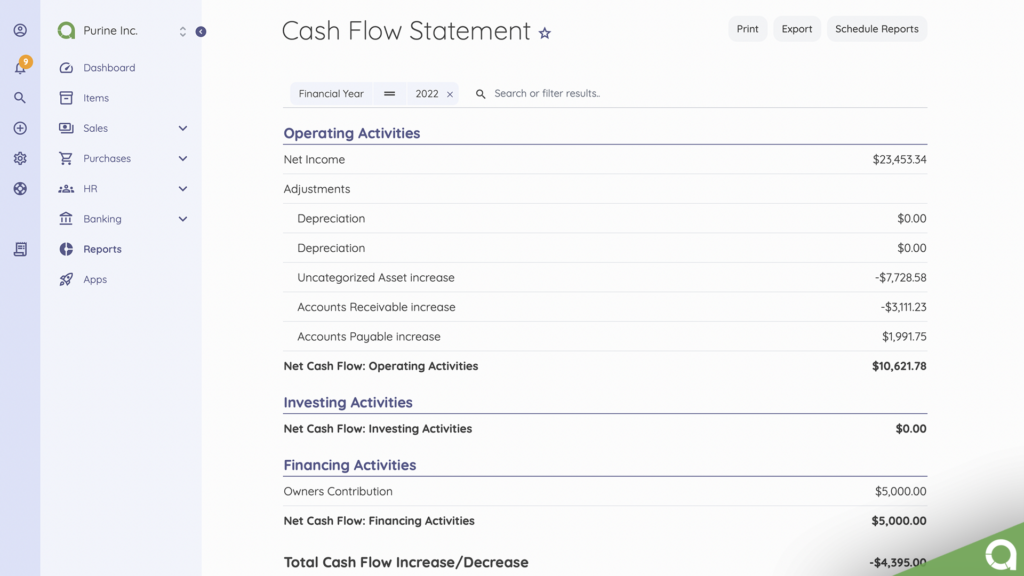

Below is an example of an OCF statement from the Cash Flow Statement app in Akaunting.

Check out how to calculate the operating profit margin.

Why is OCF Important to Small Businesses?

OCF helps you measure your company’s profitability and whether it makes more money selling a product than it spends producing it.

Investors, lenders, or creditors pay close attention to it as it provides vital information about the health and value of a company. A negative OCF indicates that a company is not generating sufficient revenues from its core business operations.

With these in mind, you should always have a clear picture of your cash flow, which helps make informed business decisions concerning inventories to stock up, investments, and prioritizing expenses.

The operating cash flow ratio

This measures the liabilities your company can pay off with cash flow generated from day-to-day business operations.

The formula for calculating the OCF ratio is as follows:

OCF ratio = Operating cash flow / Current liabilities.

You may ask,

What is a good operating cash flow ratio?

If your ratio is less than 1, it indicates that the company is not generating enough cash from operations to pay off short-term liabilities and signals short-term problems.

A ratio equal to or greater than 1.0 – indicates your company can cover its current short-term liabilities and is generally considered to be in good financial health.

Final thoughts!

OCF is a vital metric for every small business to monitor as it breakdowns the amount of cash you spend on operations while giving a clear picture of the company’s financial health.

If you’re looking for freelance accounting software to help you calculate your OCF, try Akaunting.

Operating Cash Flow Frequently Asked Questions (FAQs)

- What is included in operating cash flow?

The net income, non-cash expenses – depreciation and investment gains/losses, and change in working capital – inventories, accounts receivable and accounts payable.

- What is net operating cash flow?

Net OCF is the difference between gross OCF and the addition of financial expenses (loan interest) and corporate income tax.

- What is the difference between cash flow and operating cash flow?

Cash flow is the total amount of money being transferred in and out of business, while OCF measures the ability of a company to generate the sufficient positive cash flow required to maintain and grow business operations.

- What is the difference between free cash flow and cash flow?

Free cash flow is a company’s cash after paying its operating expenses and investing in capital expenditures. Cash flow is the total amount of money transferred in and out of business.

- What is a good OCF ratio?

Any value greater than 1.0 means a company can pay off its current short-term liabilities.

- Operating Cash Flow vs. Free Cash Flow

OCF is the amount of cash a business generates from its day-to-day operations within a specific time. Negative cash flow Positive indicates that a company faces the risk of not being able to manage short-term liabilities.

Free cash flow is a company’s cash after paying its operating expenses and investing in capital expenditures.

- Operating Cash Flow vs. Net Income

OCF measures the cash going in and out of a company’s day-to-day operations, while Net income is the s the amount of profit a company has after paying off all its expenses.