What Is Retained Profit? How Does It Affect Your Business?

Reading Time: 6 minutesProfit is the unsung hero of your business’s finances that accumulates quietly in the shadows. But what is retained profit, and how does it influence your company’s fortunes?

It’s crucial to understand that external investments should not be considered as profits. This is due to the fact that investors always have the option to withdraw their funds whenever they want. In case this happens, you might face challenges in sustaining the actual net profits and working capital if you have been working with overestimated figures.

Therefore, it’s essential to be realistic while estimating your profits and never assume that external investments are a guaranteed source of income.

For accurate financial statements, it’s imperative to compute your retained profits. It represents what’s left of your business’s earnings after paying off dividends. You’ll make more informed, prudent, and efficient decisions once you add retained earnings and profits to your financial statements.

This blog post will cover:

- What are retained profits and earnings

- Key Differences Between Retained Profits and Profits

- How Retained Profits Affect Your Business

- How to Maximize Your Retained Profits

What Are Retained Profits and Earnings?

Retained profits, or retained earnings (RE), are the amount left from your company’s net profits after paying dividends to shareholders. The variables affecting your RE depend on your business type.

Private and Public LLCs compute how much equity their shareholders have, while private investors consider their investors’ expected Return On Investment (ROI).

There are several ways to compute your retained profits. If you’ve been in business for some time now and need an exact figure of your earnings, follow this formula:

RP = (BP + NP) – (C + SD)

- Retained Profits – RP

- Beginning Retained Profit – BP

- Net Profit – NP

- Cash Dividends – C

- Stock Dividends – SD

Let’s say company ABC made $300,000 in retained profits last year and $400,000 in net profits this year. For its payables, it owes $100,000 in dividends and shelled out 100,000 for expenses.

The computation will look like this:

RP = ($300,000 + $400,000) – ($100,000 + $100,000)

$700,000 – $200,000

RP = $500,000

For business owners who just started taking investments, ignore the Beginning Retained Profit but follow the same formula.

Also, note that this is a simple retained profit sample computation. You’ll need to calculate the variables in this formula beforehand. Make sure you double-check all the figures—any errors with the variables you use will skew your computed retained profit.

Check out Net Profit Margin and How To Calculate It

Key Differences Between Retained Profits and Profits

When business owners collect external investments for the first time, they often confuse the terms retained profits and net profits. They may group all incoming funds under one category, which might appear harmless at first. However, this approach can actually increase the risk of overcapitalization and overestimation.

To safeguard your finances, study the differences between retained and net profits. Adjust your balance sheets accordingly before finalizing your plans to work with third-party shareholders and investors.

Here are ways to differentiate between Retained Profits and Profits:

Financial Statement and Balance Sheet Positioning

Although retained and net profits measure earnings, they have different positions in company financial reports. Net profits reflect receivables during specific periods—they’re highlighted in financial statements.

Meanwhile, retained profits represent long-term earnings. They measure a company’s worth in case of liquidation, although total buybacks only happen during dissolution.

Jim Pendergast, Senior Vice President at altLINE Sobanco, advises business owners to differentiate between retained and net profits in their reports.

According to him, while financial statements reflect the current earnings (net profits), balance sheets measure company assets (retained profits). Therefore, it is essential to know which reports to present and represent in specific scenarios when computing external investments.

Function

When calculating immediate profitability, use net profits. Deduct tax liabilities, working capital, loan repayments, and other daily expenses from your gains and losses. It’s a simple equation.

Andrew Pierce, the CEO at LLC Attorney, says that retained profits have more complex applications. He says, “Business owners, CFOs, and accountants refer to them when assessing an entity’s ability to scale business operations while paying out dividends. Even high-earning companies could go bankrupt during partial buyouts if they solely rely on external investments.”

Factors Considered

Different variables affect retained profits and net profits. The former typically revolves around daily receivables and payables, like daily earnings, working expenses, profit margins, cost management, ad spend, and tax dues. You’re basically computing the money that comes in and out of your business.

Meanwhile, retained profits cover a broader list, including dividend policies, issued shares, business structure, and shareholder percentages.

Unless your business is a sole proprietorship, you should treat it as a separate entity. Think of your retained profits as the money that it holds after buying back all the shares of its executives and shareholders.

Check out: What is the difference between gross profit and net profit?

How Retained Profits Affect Your Business

Retained profits refer to your business’s net income minus any external investments, e.g., crowdsourced funds, shareholder dividends, and investor shares, it owes. At a basic level, it’s the true financial worth of your business.

That said, please note that the implications of high and low retained profits vary on a case-by-case basis. High figures don’t automatically equate to a successful venture.

Anthony Martin, the founder and CEO of Choice Mutual, advises business owners that high retained profits don’t always indicate good performance.

He says, “Computing for retained earnings isn’t black and white. A high retained profit only indicates good business health if you’re paying out enough dividends, scaling your business steadily, and making enough profits to combat inflation rates. Otherwise, you might have to reconsider your dividend policies.”

While a healthy retained profit implies a positive cash flow, it could also mean you’re:

- Withholding dividends from shareholders

- Overinvesting in daily operations

- Sourcing too much external funds

- Prone to overcapitalization

- Forgoing better business loan interest rates for longer terms

Meanwhile, a low retained profit could imply that your business is:

- Losing more money than it’s sourcing from investors

- Paying dividends or buying back shareholder shares prematurely

- Losing public and private investors

- Not investing enough funds into business expansion

Send Invoices and Manage your expenses

How to Maximize Your Retained Profits

Now that you know what retained profits measure and how to compute them, you can plan your utilization strategy. You should handle external investments carefully.

It’s not uncommon for businesses to go bankrupt after haphazardly reinvesting their funds into non-performing offers, marketing campaigns, and promos.

1. Review Your Dividend Policies

Review your dividend policies to ensure you’re neither underutilizing external investments nor withholding payouts.

Firstly, it’s important to determine a reasonable dividend that not only keeps shareholders happy but also attracts new investors. Successful ventures that offer appealing payouts are more likely to retain and acquire investors.

Adjust your capital allocation to your dividend rates; payouts should come from net profits, not working capital.

And assess your policies for sustainability. They should help you get through weak, low-income months and scale operations during high-income, lucrative periods.

2. Periodically Assess Company Scalability

Periodically assess company scalability when managing external investments. Aim to reinvest in products and services that are projected to perform well. Of course, not all estimates are accurate. But note that every failed ad campaign, promotion, new service, or product launch eats up your working capital, making it harder to hit an ROI.

Jesse Galanis, the content marketer at Furm, encourages entrepreneurs to test the waters before going all in on any project.

He says, “You can only make informed business decisions through extensive, in-depth research—stop relying on hunches and trends. And even after researching, you should adopt a prudent approach to new projects. Test the waters by running target ad campaigns, collecting insights from your customer base, and doing affordable soft launches.”

3. Practice Conservative Financial Forecasting

Conservative financial forecasting is imperative when handling external investments. A careful approach encourages realistic financial projections, prevents excessive spending, minimizes cash flow issues, and combats overcapitalization. Only take on funds that you can wholly utilize. Your shareholders’ investments will quickly run dry if your daily income doesn’t exceed the amount you put into your business, regardless of whether you used internal or external funds.

Ryan Zomorodi, the co-founder and COO of RealEstateSkills.com, says overestimating your profits often leads to unfavorable outcomes.

He says, “Business owners who overestimate their projected returns tend to make overly ambitious decisions. They might overspend on inventory, scale operations prematurely, and hire too many workers without securing adequate cash flow. These financial misjudgments will eventually tank your capital. In worse cases, shareholders might even lose trust in your business and pull out their investments.”

Scale Business Operations While Keeping Shareholders Happy

Retained profit can have a positive impact on your business in many ways, such as increasing your assets, improving your cash flow, enhancing your credit rating, attracting investors, and boosting your market value.

However, retained profit also comes with some challenges, such as tax implications, opportunity costs, dividend expectations, and legal restrictions. Therefore, you need to balance your retained profit with your other financial obligations and goals.

You also need to monitor your retained profit regularly and make sure it aligns with your business strategy and vision.

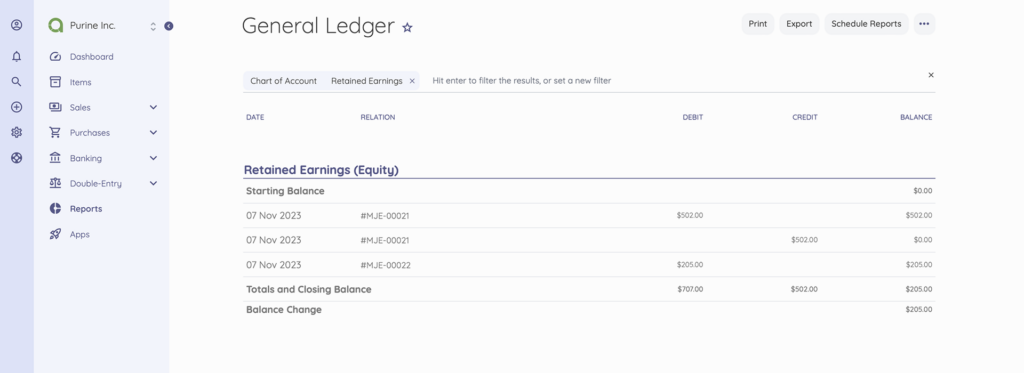

By using accounting software like Akaunting, you can accurately track your retained profits, send invoices, and track expenses, earnings, and receivables, among other business finances.s.