How to Create and Stick to a Business Budget

Reading Time: 6 minutesYour business budget (and you sticking to it) is non-negotiable. It’s the foundation for every financial decision, from daily expenses to long-term investments.

Without a clear plan, money can slip through the cracks and growth stalls.

TL;DR: Creating and following a budget gives you the control, clarity, and confidence to run a healthy, sustainable business.

Let’s take a closer look at what a business budget is, the core principles of a business budget, and 10 steps to financial planning — and sticking to your budget. 👇

Highlights

- – Your business budget helps you better manage your operational spending, cash flow, tax payments, and investments.

- – Make sure to have a specific plan for every dollar (this is called zero-based budgeting).

- – Use automation to track your profit and expenses so you always know exactly where your money is going and when it’s coming in.

What Is a Business Budget? And Why Use One?

A business budget lays out how much money is coming in, what’s going out, and where it’s all being spent. Instead of guessing or reacting when bills pile up, a budget gives you a clear picture of your finances so you can plan with confidence.

Why use one?

Because running a business without a budget is like driving without directions. You might eventually get somewhere, but you’ll waste time and probably a lot of money along the way.

Cash flow keeps your business alive. A budget makes sure you can pay suppliers, cover payroll, handle taxes, and set money aside for growth without surprises. (Many small businesses fail because they don’t build this kind of financial plan.)

A budget also guides your decisions.

Without one, every expense feels like a guess. With one, you know where your money should go and can focus on investments that drive profitability and growth.

It also shows the bigger picture. A solid budget helps you see if you’re ready to expand, hire, or take on debt without putting the business at risk.

In short, a budget helps you stay in control instead of letting money control you.

Benefits of Creating and Sticking to a Business Budget

Here are the top benefits of making and sticking to a business budget:

- – Supports growth decisions. A clear budget shows you how much you can safely invest in hiring, marketing, or new products without jeopardizing your operations.

- – Controls spending. Without a budget, every expense is reactive. This can lead to overspending or misallocating resources. (A total nightmare, btw.)

- – Encourages team financial accountability. Teams and managers can better understand how to spend within your limits.

- – Prevents cash crises. Knowing your budget helps you pay suppliers, employees, taxes, and other obligations without surprises.

- – Reduces reactive decision-making. Budget clarity prevents panic spending or cutbacks when unexpected costs arise.

- – Improves financial predictability. Helps you forecast revenue, expenses, and cash flow.

Core Principles for Creating a Business Budget

Stick to these core principles when creating your business budget:

We’ll go over concrete steps in a bit.

- 1. Plan for income tax, debt, and contingencies first. Treat these as non-negotiable line items instead of residuals.

- 2. Base it on realistic revenue forecasts. Don’t overestimate your income. Instead, use historical trends, contracts, previous income statements, and pipeline data to encourage a more realistic forecast.

- 3. Categorize expenses rigorously. Create categories like fixed expenses (rent, salaries), variable expenses (materials, commissions), and semi-variable expenses (utilities, marketing).

- 4. Use zero-based budgeting when possible. Assign every dollar a clear purpose. Including what’s left over after paying yourself, your team, taxes, and expenses.

- 5. Separate operating expenses and growth funds. Track the money you use to run the business and the money you use to scale it separately.

Okay. Let’s get to those steps!

10 Steps to Planning and Sticking to a Business Budget

Here’s what you need to do to create and stick with your business budget. Consider printing this out and checking off the steps to make it more actionable! 👇

1. Forecast Realistic Revenue

Plan revenue with numbers you can rely on. Pull from past sales patterns, signed contracts, and pipeline opportunities. Adjust for seasonal swings and planned campaigns so revenue projections reflect reality.

*Pro-tip: Include a 5–10% variance so you have room to adapt when the unexpected happens. Be sure to also have a contingency fund.

2. Categorize Expenses Clearly

Organize expenses into fixed, variable, and semi-variable categories to see where money goes.

- 1. Fixed costs, such as rent and insurance, stay steady.

- 2. Variable costs, like raw materials, tend to rise as sales climb.

- 3. Semi-variable costs, like utilities or hourly pay, have a fixed part and a part that changes with use.

Once you separate these costs, it’s easier to see where you can adjust as things change.

3. Prioritize Essential Obligations

Cover the essentials before allocating resources elsewhere.

Taxes, payroll, loan payments, and supplier invoices keep the business moving. Treat these as locked-in commitments that come first.

(When you pay employee salaries and vendors promptly, production flows without interruption, and relationships stay strong. Everything else builds on that foundation.)

4. Use Zero-Based Budgeting

Assign every dollar a job at the start of each budget period. This helps you better focus your spending and prevents you from wasting money on old priorities.

For example, if you have unused travel funds left over from last month, you might move that money into marketing or product development. Or whatever goal you currently have for the month.

5. Separate Operating Budget vs. Growth Funds

Track your daily operations separately from your growth initiatives.

Operating funds cover essentials like rent, payroll, and utilities. Growth funds might be for new hires, product launches, or market entry. This separation shows you what keeps the business running versus what helps it grow.

(For example, a SaaS startup would keep its hosting and support costs separate from its dedicated fund for feature development.)

If your business has multiple locations, products, or investments, group your assets

— and track operating and growth funds for each area. This shows you which asset groups are performing well and where to invest next. A must for complex businesses.

If you need help with this, look into working with an asset management business, like Abacus Asset Group.

6. Automate Expense Tracking

Streamline expense tracking by syncing accounting software to your bank accounts and credit cards.

This automation gives you real-time visibility into your spending and can help reduce blind spots. (Akaunting, QuickBooks, or FreshBooks can help you categorize transactions instantly.)

7. Review the Budget Weekly

Check your numbers weekly, not only monthly.

Frequent reviews keep you close to the data and prepare you in case you need to pivot quickly.

For example, a construction company tracking fuel and labor weekly may notice that prices have spiked. The accounting team can then suggest a cost reduction in another area before the high costs drain the budget.

8. Set Thresholds for Overspending

Create spending checkpoints that trigger a closer look at the budget. For example, if a department exceeds its allocation by 5%, require a review before any new spending can happen.

This promotes accountability, while also leaving room for flexibility. A marketing team might request extra ad dollars once campaign results prove strong, for instance.

9. Integrate Cash Flow Planning

Running out of cash can stall your business. Keep a close eye on when money comes in and goes out so you can operate without stress.

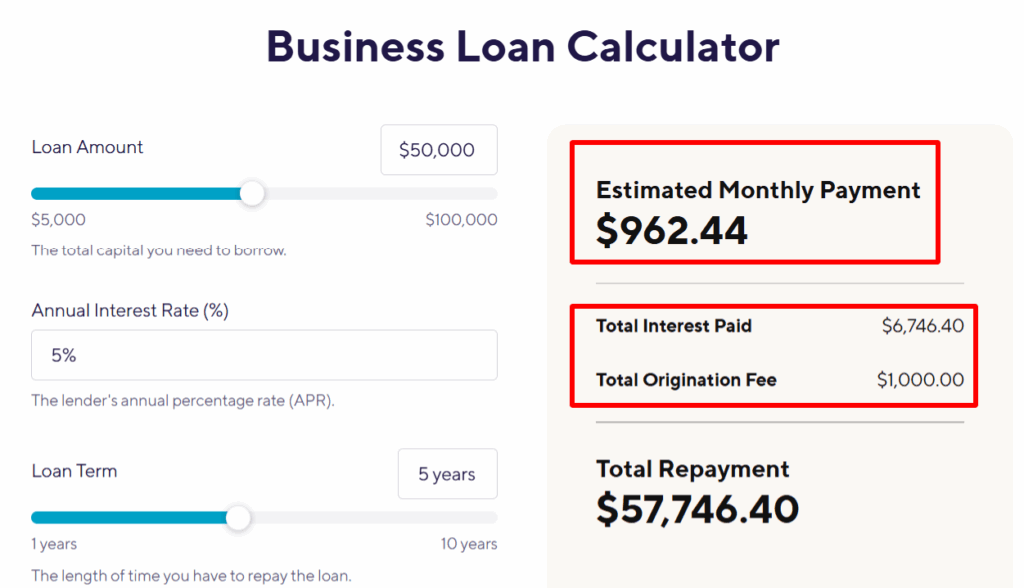

Startup business loans or credit lines can be helpful if you’re a new business with growth goals that exceed your current cashflow. Just remember to plan for the full cost (principal, interest, fees, and reserves).

10. Perform Monthly Variance Analysis

Compare your budget projections with actual results every month. Study the differences and ask why they occurred.

Did revenue shift because sales slowed? Or because collections are dragged? Did expenses rise due to higher demand or because of supplier increases?

This helps you sharpen future planning and makes the next budget cycle stronger.

Wrap Up

Creating and sticking to a business budget gives your business control and clarity. It helps you keep your spending in check and guides your growth decisions.

Start building your business budget today and see the difference it makes in running a healthy, sustainable business.

And if you need an automated budgeting tool, try Akaunting.

Get started with Akaunting now.

FAQs: Business Budgets

What is a business budget?

A business budget is a financial plan that estimates revenue, expenses, and cash flow over a set period.

Why create a business budget?

You should create a business budget because it helps control costs, cover obligations, guide growth decisions, and make finances more predictable. It’s also pivotal to proper cash flow management.

What are common mistakes in business budgeting?

Common mistakes in business budgeting include overestimating revenue, ignoring small recurring costs, skipping regular reviews, and failing to link budgets to strategic financial goals.

How to start a business budget?

You can start a business budget by forecasting realistic revenue. Be sure to categorize expenses as fixed, variable, or semi-variable. And allocate funds to essential obligations first.

How often do you review a business budget?

You should review your budget weekly for operations, monthly to track differences, and quarterly for strategic adjustments.

What is zero-based budgeting?

Zero-based budgeting assigns every dollar a purpose during each budgeting period.

About the Author

Kelly Moser is the co-founder and editor at Home & Jet, a digital magazine for the modern era. She’s also the content manager at Login Lockdown, covering the latest trends in tech, business and security. Kelly is an expert in freelance writing and content marketing for SaaS, Fintech, and ecommerce startups.