Securing the Capital: A Guide to Small Business Loans and Financial Tracking for the Construction Industry

Reading Time: 7 minutesRunning a construction company is a constant balancing act. You buy materials and pay your crew weeks before you see a dime from the client.

This gap between spending cash and getting paid puts massive pressure on your bank account. It is why managing cash flow is just as important as pouring concrete.

Many builders look for outside funding to bridge these gaps. But getting approved isn’t easy. Lenders want proof that your business is healthy. So it comes down to one simple truth. You can’t separate your borrowing strategy from your bookkeeping habits.

This guide will help you navigate small business loans and financial tracking. We will explore how to secure the capital you need to grow and stay profitable. We’ll show you how to evaluate loan options, avoid cash flow pitfalls, and support profitable growth.

Understanding Small Business Loans for Construction Companies

Construction isn’t like retail, where customers pay at the register. You have huge upfront expenses before you can bill for the work. You need lumber, steel, and concrete. You have to meet payroll every week. Meanwhile, your invoices might sit unpaid for months.

This creates a serious need for working capital.

In fact, the demand for funding is historic. According to recent SBA data, construction became the leading industry in the SBA’s 7(a) loans program from 2023 to 2024. This shows contractors are actively seeking capital access to handle expansion.

Growth requires cash. You might need heavy machinery for larger jobs. Or you need to hire more employees for a new contract. Without proper financing, these opportunities slip away. Specialized construction loans bridge the gap between your expenses and your income.

Common Types of Loans and Financing Options

There are several ways to fund your operations. SBA 7(a) loans are popular because they offer long repayment terms and lower rates. They are great for buying equipment or covering working capital needs. However, the application takes time.

Lines of credit work well for daily cash flow. You draw funds to buy materials and pay them back when the client pays you. Equipment financing uses the machinery itself as collateral. This often makes it easier to qualify for than an unsecured loan.

Invoice factoring is an option for slow-paying clients. You sell unpaid invoices for immediate cash. It costs more, but it solves immediate cash flow problems.

Securing capital in the construction industry goes beyond landing projects. It requires smart borrowing and disciplined financial tracking. From managing fluctuating material costs to financing new equipment, builders must make informed decisions that protect cash flow and profitability.

That’s why using a small business loan calculator helps estimate repayments, interest impact, and loan affordability before committing to funding. When paired with accurate expense tracking and real-time budgeting, it empowers contractors to balance growth with stability.

The Financial Tracking Challenge in Construction

Cash flow is the biggest killer of construction companies. Because it’s rarely about a lack of profit, it’s usually about timing. You pay for labor and materials now, but the money comes in later. This mismatch can leave you without cash to pay bills.

In fact, a report from Construction Dive reveals that subcontractors wait an average of 56 days for payment. Yet, about 43% lack the working capital to cover unexpected costs during that wait.

This creates a dangerous cycle where you are always chasing money just to keep the lights on.

The Cost of Poor Financial Tracking

If you don’t track your numbers, you’re flying blind. You might think a project is profitable because the bid is high. But if you don’t track every hour and receipt, you might actually lose money. Poor tracking leads to inaccurate bids and surprise tax bills.

Delays in collecting money make this worse. Contractors often increase their bids to offset slow payments. But if you don’t know your actual costs, even a higher bid might not save you.

You need to know exactly where your money goes. This includes categorizing every dollar that comes in. Proper classification of your revenue is a necessity. You need to continuously monitor your expense and income accounts in accounting to track your cash flow and estimate accurate taxes.

Evaluating Your Loan Options: What Construction Businesses Should Know

Lenders check specific things when you apply. Typically, they want to:

- – See a steady history of income

- – Review your credit score and existing debt

- – Look at your backlog of signed contracts

- – Tax returns for the past two years

Your financial statements are the most essential part of your application. You need clean profit-and-loss statements and up-to-date balance sheets. Lenders need to trust your numbers. If your records are messy, they might deny your request.

Also, many smaller contractors must provide a personal guarantee. This means you are personally responsible if the business cannot pay. You might also need to pledge collateral like real estate.

Comparing Interest Rates and Terms

It’s easy to just look at the monthly payment. But you need to look closer at interest rates and terms. A lower monthly payment might mean you pay more in interest over time.

SBA loans usually have the best rates, but take longer to get. Traditional bank loans are competitive but need excellent credit. Alternative lenders are faster but often charge higher rates.

Check for hidden fees, including origination fees or prepayment penalties. These add up fast. Always compare the Annual Percentage Rate (APR) to see the true cost.

Calculating True Loan Costs and Affordability

Ensure the loan payment fits your cash flow. Can you make the payment during your slow season? Construction income often fluctuates.

To answer this, calculate your debt-to-income ratio across all seasons. This helps you see if you are taking on too much. Forecast your future cash needs and don’t just plan for today. Think about the expenses you will have six months from now.

Essential Financial Tracking Systems for Construction Companies

Tracking just what comes in and goes out isn’t enough. You need job costing. This means assigning every labor hour and material purchase to a specific project. It helps you see which jobs make money and which don’t.

You also need to track change orders. Scope changes happen often. If you don’t document and bill for them, you lose profit. Retention is another key area. This is money clients hold back until the job is done. You need to track when that cash is due.

Good systems manage these details. Look for tools that handle these needs. For a deeper dive, check out this guide on construction accounting software features that simplify your workflow.

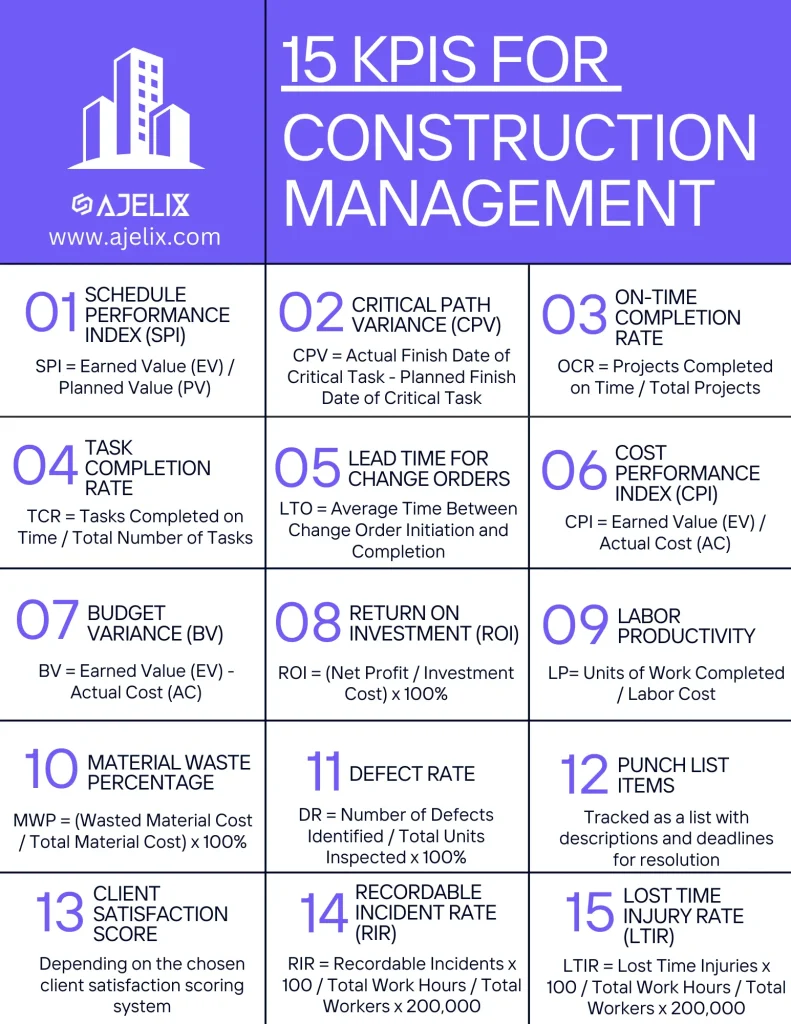

Fifteen KPIs construction managers should track (Image Source)

Tools and Software That Make Tracking Easier

Pen and paper are too slow for modern construction. You need specialized accounting platforms to show your numbers in real time. These connect to your bank account to import transactions automatically.

Plus, mobile apps are great for field crews. They snap photos of receipts and upload them instantly. This prevents lost paperwork and speeds up billing.

Some of these accounting platforms also integrate with field operations software that your workers can use to create work orders, standardize inspections, and take photos or reports on the jobsite.

Implementing Financial Tracking Without Disrupting Operations

Start small when changing your system by picking one project to test new tracking methods. This lets you work out kinks before rolling it out to everyone.

Then, train your team on why this matters. Explain that better tracking means the company is more stable. This helps secure their jobs. Make the process simple for them. If it’s easy, they will do it.

Set a weekly review routine and don’t wait until the end of the month. Weekly checks help you catch mistakes early. This keeps your financial statements clean for any lender.

Why Construction Loan Applications Get Rejected (And How to Fix It)

Lenders view construction as a “high-risk” industry. When a bank officer reviews your application, they are actively looking for reasons to say no.

Understanding these red flags helps you clean up your financials before you ever walk through the door.

Common Financial Red Flags Lenders Hate

The fastest way to get a rejection is to create confusion. Lenders dislike seeing personal expenses mixed with business accounts. If your truck payment and your grocery bill come out of the same pot, it signals a lack of discipline.

Another major issue is inconsistent revenue recognition. If you record income when you send the invoice one month, but wait until the check clears the next month, your books will look chaotic.

Lenders need to see consistent accounting principles. They also scrutinize your “Work in Progress” (WIP) report. If you have too many under-billed jobs, it looks like you are financing projects out of your own pocket, which is a massive credit risk.

The “Packaged” Application Strategy

Don’t just hand over a stack of receipts and tax returns. Instead, treat your loan application like a bid proposal. Include a clear executive summary that explains exactly what the capital is for and how it will generate profit.

Attach current financial statements generated by your software, not handwritten notes. Show them your cash flow projection for the next 12 months.

When you present organized, professional data, you stop looking like a risky gamble and start looking like a solid investment. This preparation proves you have the management systems in place to handle the debt.

Conclusion

Securing the right capital and tracking every dollar are the twin pillars of a successful construction business. You need money to start projects, and data to finish them profitably. Small business loans and financial tracking work hand in hand to build a stable future.

Don’t let cash flow gaps slow you down. Use the tools available to take control of your finances. Look at available loan options, but most importantly, track and monitor your financials like a hawk.

Ready to get a handle on your construction finances? Akaunting gives you job costing, cash flow tracking, and clear reports to help you grow with confidence.

Author bio

Kelly Moser is the co-founder and editor at Home & Jet, a digital magazine for the modern era. She’s also the content manager at Login Lockdown, covering the latest trends in tech, business and security. Kelly is an expert in freelance writing and content marketing for SaaS, Fintech, and ecommerce startups.