How Early Math Skills Help Kids Grow Into Financially Confident Entrepreneurs

Reading Time: 6 minutesThe US has a problem with financial literacy, and there is a widening gap between generations.

A recent survey has shown that, on average, Americans can answer only 49% of finance questions correctly. The situation is even worse for Gen Z, who answered only 38%. This is backed up by a 2024 study that showed only half of US adults are financially literate.

Financial literacy is essential to independence and economic security in adulthood, as well as future career aspirations. If your child is an aspiring entrepreneur, they’ll need to understand how to manage budgets and business finances.

Building financial confidence begins at school; basic number sense skills are key to understanding and managing finances effectively. Specific math learning that focuses on money and currency further brings that to life.

How early math learning supports financial literacy

Children build math skills that are key to financial independence from a young age. Math foundation skills like number sense and basic arithmetic abilities are key to managing both personal and business finances, but there are many other skills that entrepreneurs need to be successful.

Here, with expert commentary from a math tutor, we discuss how building math skills for kids at an early age can create a generation of financially literate and confident adults.

Over time, these abilities grow into practical financial habits, like planning budgets, tracking spending and making informed decisions, the same habits entrepreneurs later apply when working with accounting and finance tools.

Learning key budgeting skills

Business management, especially in the early days, needs strong budgeting to succeed. Entrepreneurs need to understand where their finances are best used, prioritising return on investment and limiting spend that doesn’t improve their operations.

Once children are introduced to money in the math classroom, they begin to understand its value through role-playing exercises. They act as shoppers and shopkeepers, exchanging money for goods and working out change. These key early activities help children understand the importance of budgeting before moving on to more complex budgeting education.

Check out the blog post: How to Create and Stick to a Business Budget

Building mental math abilities for fast decision-making

Mental math, aka the ability to solve math problems without the need for additional tools, is key for successful entrepreneurs. Being able to carry out sums quickly in their head allows entrepreneurs to make fast, informed decisions; a non-negotiable skill when leading a business.

From an early age, mental math skills help kids grow in confidence and talent. Children will learn mental math skills like breaking down numbers, rounding and compensating, which all allow for faster mental problem solving. This enhances decision making, creating confident entrepreneurs who can make the right choices for their business.

Understanding growth and profits

Businesses can’t stay stagnant, which is why it’s vital for entrepreneurs to have the skills required to continually grow. This comes in the form of building new revenue streams, cutting unnecessary costs and boosting profits.

Role-playing continues to be a strong way for children to learn about these key business elements and build an interest in entrepreneurship for kids. Acting out the running of a shop or business helps kids understand how their business makes a profit, and analyzing their pretend grocery store prices teaches them about profit margins.

Supporting data analysis skills

Data literacy is becoming more important than ever to the workplaces of the future; 86% of business leaders say it’s an essential for day-to-day work. The ability to read and analyze data is another key way entrepreneurs can make confident, informed decisions. Forecasting is another essential ability that relies on data literacy; entrepreneurs should be able to predict future success based on current numbers.

As children progress through school, they will be introduced to education that supports data analysis and literacy. Algebra allows students to use linear equations and variables to predict future growth or challenges, while statistics and data classes support their ability to read, organize and find insights in data.

From Personalized Math Learning to Real Business Decisions

All children have different strengths and weaknesses in math, and they aren’t always accounted for in school. That’s why budding entrepreneurs may find that personalized math learning supports their future prospects.

By focusing on the early math skills necessary for entrepreneurship, from budgeting to forecasting, they can be well-prepared for a future in business. Let’s see how personalized math classes for kids help create a highly skilled future workforce.

Diagnostic tests to determine the curriculum

Before any tutoring takes place, students take a diagnostic test to determine their strengths and weaknesses. Tutors then use this to create a highly personalized curriculum addressing their shortcomings.

While there are many specific math skills that make a successful entrepreneur, they cannot be successful without mastering the basics first. This diagnostic test ensures that children have no gaps in their math learning, which helps with confidence and skills in later life.

Once they have mastered the basics and filled in their knowledge gaps, children can begin to explore learning that aligns with their future aspirations. This can include specific tutoring on budgeting, forecasting and business growth, creating a future entrepreneur.

Gamified learning

Financial skills can seem complex on the surface, especially for pupils who aren’t confident in their math abilities. Gamified learning offers a stress-free way to learn, because it doesn’t feel like learning.

Learning platforms are hinged on gamification, with tutors using interactive puzzles and games to make math concepts easier to understand and fun to engage with. It simplifies even the most complex concepts required for entrepreneurship, like data analysis and financial forecasting.

Studies show that gamification not only improves learning outcomes in math but also helps keep students more engaged in the material. Both of these elements are key to children’s future success both in school and business.

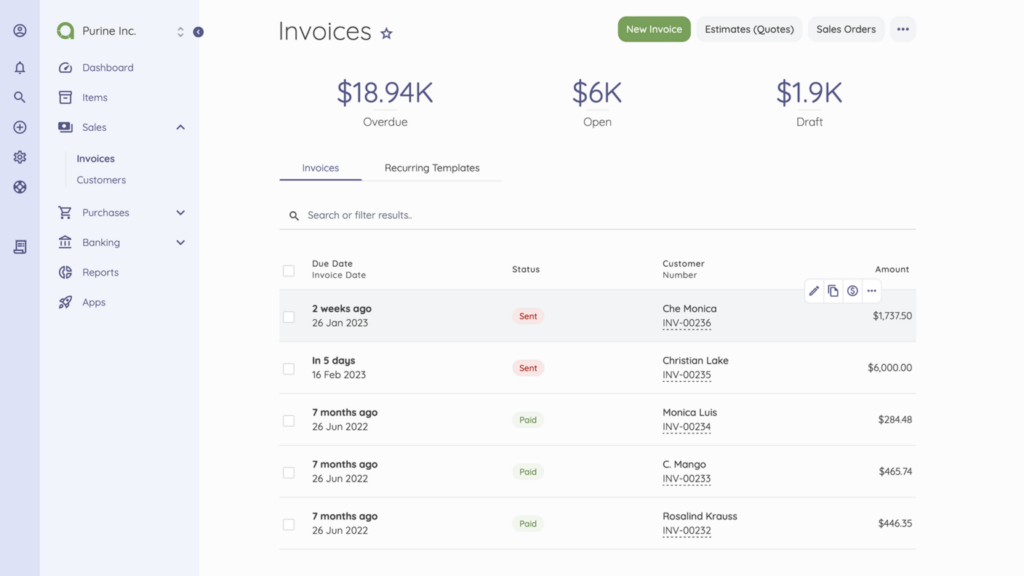

However, the transition from “game” to “real-world” business is where professional tools come into play. Once a child understands the logic of cash flow through a game, parents can show them how this looks in a professional environment using Akaunting.

As a comprehensive financial management platform, Akaunting allows users to manage invoices, track expenses, and generate reports. By seeing their math lessons reflected in such a business tool, children can bridge the gap between classroom theory and the actual workflow used by modern entrepreneurs.

Building confident learners

Ultimately, aspiring entrepreneurs need more than just math and business skills to succeed. They need to have confidence. Creating and starting businesses is a huge challenge, requiring a lot of hard work and coming with a lot of risks. Confident entrepreneurs are more likely to succeed, so this personal attribute is required for prosperity.

This is why it’s so important to place an emphasis on self-belief as well as math knowledge and abilities. By giving children the tools to overcome their math troubles and improve their skills, tutors can show them that they aren’t inherently bad at the subject.

As a nation, we are not confident in our math abilities, so overcoming this self-doubt is a key step in entrepreneurial success.

Creating future entrepreneurs starts in the classroom

Entrepreneurs wear many hats in business, and they’ll need a range of skills to succeed, especially when their businesses are in the early stages. Math skills are integral to business performance, as entrepreneurs must ensure their organizations are financially viable and profitable. They may also take on additional roles in the early stages, like invoicing clients.

To equip your child for a successful future in business, it’s important to stress the importance of their early math education. Parents looking for how to teach kids about money can support a love of math and finance by incorporating it into their home environment, considering personalized tutoring, and carrying out homework with them.

A strong mathematical foundation builds the necessary mindset, and professional accounting software helps reinforce it. With its help, parents can show their children how these skills function in a professional environment.

By aligning educational growth with real-world financial management solutions, you provide your child with a complete toolkit. This combination of tools ensures that today’s students become tomorrow’s confident entrepreneurs, ready to manage their businesses!

Author Bio

Jessica Kaminski is a certified math tutor at Brighterly with extensive tutoring experience and a passion for writing. She has written dozens of blog articles, sharing her expertise to make learning fun and engaging for kids.