7 Best Practices for Invoicing Clients for Same-Day and Rush Delivery Services

Reading Time: 7 minutesWhen you’re offering a same-day or rush delivery service, time is your most valuable asset. But it’s also your biggest liability.

Orders drop at the last minute, traffic reroutes your driver, deliveries stack up, and invoices are due the moment wheels stop turning.

The problem? Most invoicing processes can’t keep up.

Manual spreadsheets. Lost proof of delivery. Clients “forgetting” to pay until the end of the month. It all adds up to missed payments, slower cash flow, and hours lost to chasing paperwork instead of new business.

Here’s the good news. Invoicing doesn’t have to be the bottleneck.

With automated, centralized systems and smart invoicing tools, courier businesses can send invoices in real-time, allowing you to get paid faster and keep operations running smoothly.

Let’s take a closer look at why invoicing for same-day and rush delivery services is so challenging and the best practices that help fix it.

Why Invoicing for Same-Day and Rush Delivery Services is So Challenging

Couriers and delivery businesses already know how to invoice. The real struggle is doing it fast and accurately in an environment that never stops moving.

But that’s not always easy when you’re doing everything manually.

Does this sound familiar?

A rush job drops at 4 PM. The driver reroutes mid-run, dispatch scrambles to keep up, and proof of delivery (POD) gets buried in a group chat. Hours later, someone updates the wrong job in the system with a route ID that doesn’t match the delivery, so the invoice goes out late and wrong.

What should’ve been a quick bill turns into a refund request and another round of admin clean-up.

Errors, messy hand-offs, communication breakdowns, and a race against the clock. All these issues add friction to invoicing when you can least afford it.

Here’s what you’re really contending with:

- – Disconnected systems that don’t talk to each other: When dispatch, drivers, and accounting use separate tools, you get information siloes. These gaps lead to duplicate work and more time spent fixing errors than billing clients.

- – Errors caused by constant change: Rush deliveries don’t leave room for mistakes, but it’s easy for details like route IDs, rush surcharges, or delivery timestamps to get lost in the shuffle. Even one missing field can trigger a client dispute or delay payment.

- – After-hours reconciliation: Delivery teams are still updating systems long after they park their vans, trying to catch up on proof-of-delivery uploads and client follow-ups. It’s time that should be spent planning tomorrow’s routes, not cleaning up today’s chaos.

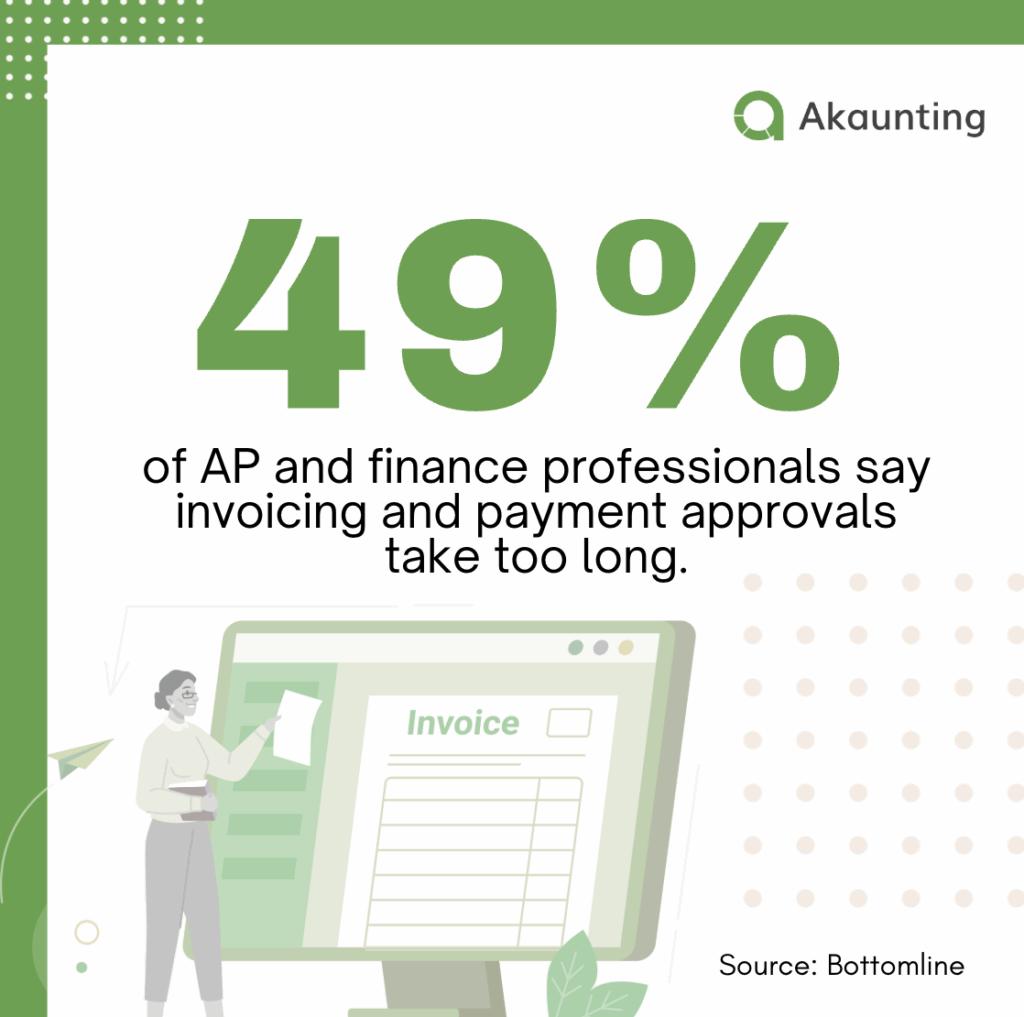

- – Slow, manual workflows: According to Bottomline, 49% of AP and finance professionals say invoicing and payment approvals take too long. In the same-day world, that kind of lag means cash gets trapped in unpaid invoices instead of supporting new jobs.

(Image by Ioana)

That’s why so many courier and last-mile delivery services are turning to automation.

When your delivery management and invoicing systems work together, billing stops acting like a chokepoint and starts running in real time without mistakes.

7 Best Practices for Invoicing Clients for Same-Day and Rush Delivery Services

In a business built on speed, slow invoicing is the one thing you can’t afford. When jobs move fast, automation is the only way to guarantee accuracy and scale operations without getting buried in paperwork.

Here are the invoicing best practices that automate billing so it stays in sync with your deliveries:

1. Automate Invoices to Release Upon Delivery Confirmation

Every minute counts in same-day delivery. The faster you send the invoice, the faster you get paid.

Automation makes this speed possible.

Rather than manually typing out each job, connect your delivery data to your invoicing tool. For example, with Akaunting, invoices can trigger automatically when the driver logs proof-of-delivery (POD).

When you don’t have to wait for admin staff to “get to it later”, you’re more likely to get paid on time every time.

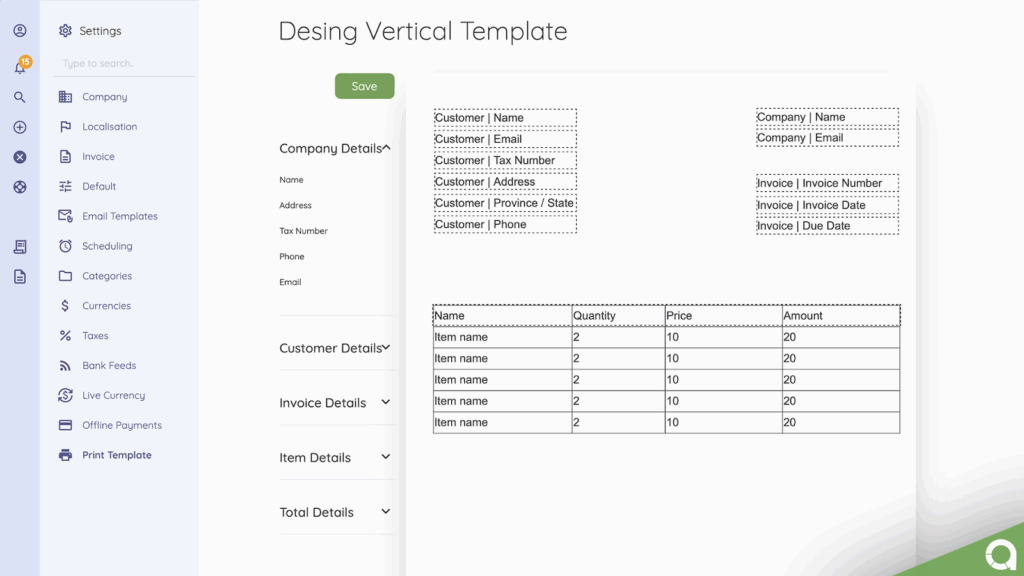

2. Standardize Your Invoice Templates

You’re in a rush-based business. For things to keep pace, clarity is essential.

Clients don’t want to guess what “priority route surcharge” means or why there’s a second line for packaging.

That’s why every invoice should follow the same structure, with clear wording and consistent line items. Because when each invoice looks different, clients hesitate. That hesitation turns into dispute emails and slower payments.

Imagine one invoice says “priority surcharge,” the next says “rush fee.” Suddenly, you’re stuck on the phone explaining the difference instead of getting paid.

Standardization removes the guesswork and speeds up approvals so your cash keeps moving.

And when all your invoices follow the same structure, automation can finally start doing the heavy lifting.

Tools like Akaunting pull delivery data straight into your templates, filling in client names, fees, route information, and timestamps automatically. Every invoice goes out polished and accurate.

No late admin nights, keyboard marathons, or second-guessing the math.

And the results speak for themselves.

Integrātz recently shared a case where a B2B distributor cut its invoice disputes by 60% after switching to standardized digital templates, saving more than $840,000 a year.

Ultimately, when everything is clear upfront, there’s less to argue about later.

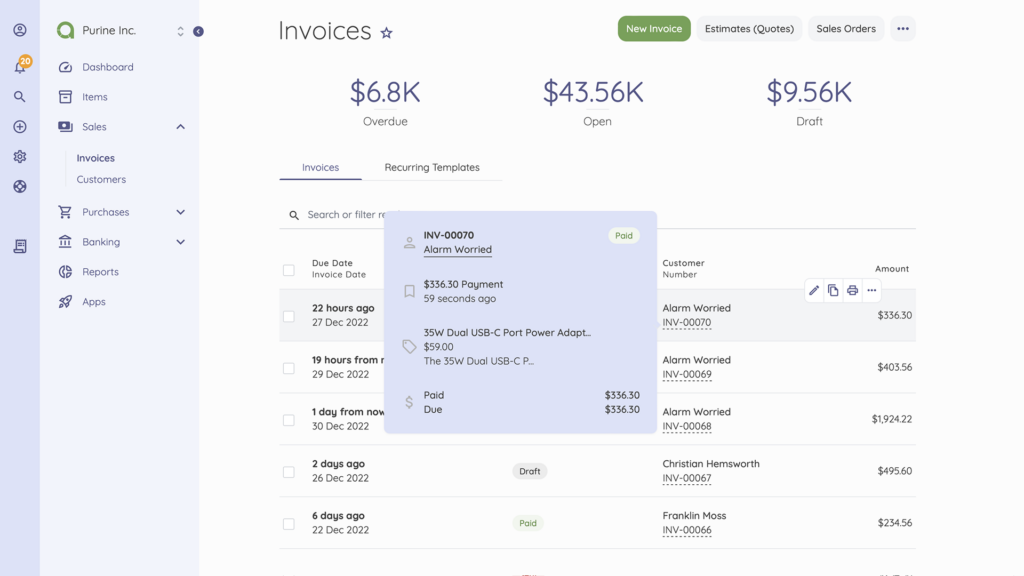

3. Centralize Delivery, Payment, and Invoice Data in One System

If dispatch, accounting, and customer service all use different systems, details fall through the cracks. A driver updates a delivery note, but accounts receivable (AR) never sees it. The sales team promises same-day invoicing, but the spreadsheet version is three revisions behind.

Centralization fixes that.

A tool like Akaunting acts as your financial hub. It syncs data from delivery or transportation management software into one unified dashboard.

This helps you see pending invoices, incoming payments, delivery routes, and client histories in real time.

And what makes it easier to avoid mix-ups? Keeping everyone in the loop.

➜ Pair your invoicing and delivery management tools with internal communications software. With this in place, dispatch can flag a late pickup, sales can confirm the surcharge, accounting already knows the invoice is ready to go — and the whole team stays on the same page.

4. Attach Proof of Delivery to Every Invoice

Few things kill client trust faster than missing proof. In rush delivery, where orders move fast and expectations are sky-high, attaching POD to every invoice is a non-negotiable.

Whether it’s a digital signature capture, a photo, or a GPS-verified timestamp, proof backs up every line item. It’s especially important for sectors like medical equipment, pharmaceuticals, and perishable goods, where compliance and chain of custody are extremely important.

When invoicing clients for same-day freight, attach clear documentation to prevent disputes and nurture client trust.

5. Offer Flexible Online Payment Options

In the age of real-time tracking and contactless delivery, nobody wants to print an invoice and mail a check.

People expect to pay online, and they expect to do it their way.

Some clients prefer a quick card payment. Others like bank transfers because they can add an internal reference. (A few still use PayPal for record keeping, and your e-commerce partners might prefer paying straight through an integrated API.)

The point is, there’s no one-size-fits-all when it comes to digital payments.

If you only offer a single method, you slow everything down. The client who doesn’t use that platform puts the invoice aside “for later.” But “later” turns into two weeks.

That’s why it pays to use invoicing software that lets you offer choice without adding admin chaos.

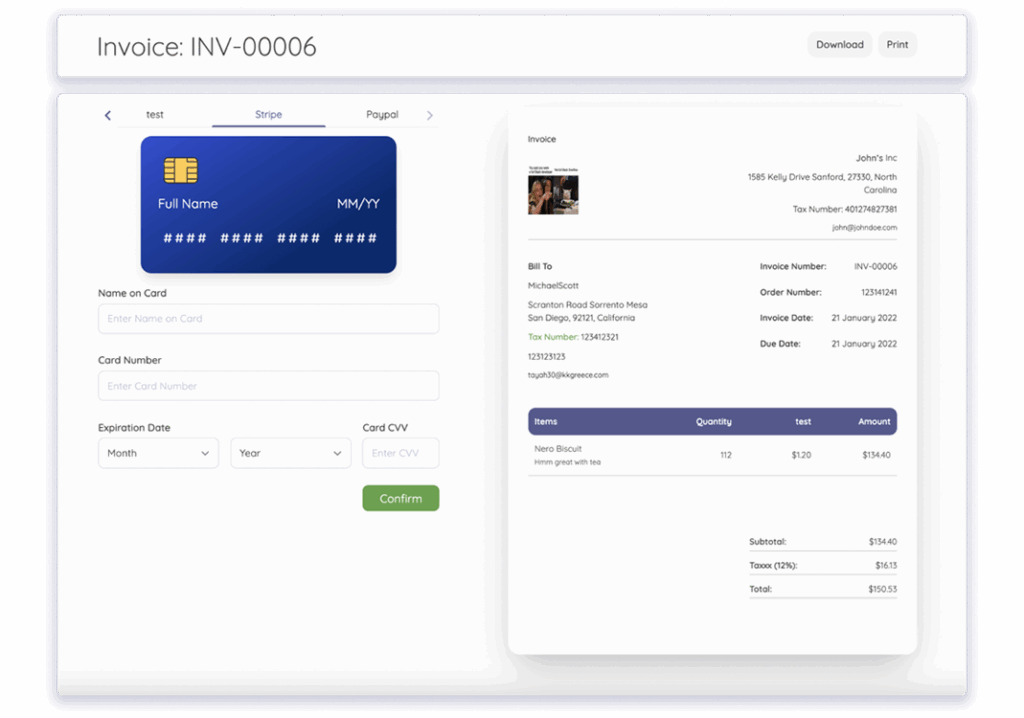

For example, with Akaunting’s built-in payment gateways, clients can pay however they like: credit card, bank transfer, PayPal, and beyond.

And they can do it right from the invoice or customer portal.

The best part?

Funds hit your account immediately. No waiting for someone to open mail, process checks, or manually match receipts. Cash comes in as fast as your deliveries go out, so you can reinvest in what keeps you moving.

6. Automate Reminders for Overdue Invoices

Even the most organized courier service ends up chasing payments.

One late client turns into three, and suddenly someone’s spending half their week sending just following up emails. It’s exhausting and it doesn’t scale.

Automated reminders fix that.

They handle the repetitive follow-up work that humans can’t keep up with once your delivery volume grows.Payment reminders go out automatically based on your payment terms, and they’re worded to be firm when they need to be, and friendly when it helps preserve the relationship.

As your client list expands, this kind of automation keeps cash flow steady without adding admin hours. Instead of juggling spreadsheets and inboxes, your team can focus on actual deliveries. And because every reminder goes out on time, payments land faster, and late accounts shrink.

7. Use Analytics to Spot Your Most Profitable Services

Sure, invoicing gets you paid. But it also helps you to understand what’s working.

Some routes, clients, or delivery types consistently bring higher margins than others. Digging into your analytics helps you see those golden geese clearly.

With the right reporting tools, you can track revenue by delivery type and pinpoint where profits are strongest. Maybe your cargo vans generate more revenue than your local messenger runs.

Or maybe perishable food deliveries carry high margins but higher risk.

Data turns guesswork into strategy, so you can switch up your services based on what’s best for your bottom line.

Wrap Up

Invoicing for same-day and rush delivery services doesn’t need to feel frantic. With clear templates, proof-of-delivery attachments, flexible payment options, and automation at every step, your billing process can move as fast as your couriers do.

The trick? Start small.

Pick one area, like automated reminders or real-time invoicing, and let the time savings prove themselves. Then scale it up.

Ready to simplify your invoicing and get paid faster? Start using Akaunting for free today.

About the Author

Kelly Moser is the co-founder and editor at Home & Jet, a digital magazine for the modern era. She’s also the content manager at Login Lockdown, covering the latest trends in tech, business and security. Kelly is an expert in freelance writing and content marketing for SaaS, Fintech, and ecommerce startups.