How to Handle Taxes & Compliance in Multiple Jurisdictions for Subscription & Rental Businesses

Reading Time: 6 minutesAs your subscription-based business or rental company expands, borders become blurry. But tax authorities don’t see it that way.

Each jurisdiction has its own set of rules, filings, and penalties.

For growing businesses, this means that what works in one location may fail in another, creating hidden risks as you scale.

This guide covers taxes and compliance for subscription and rental businesses. You’ll learn the key rules, records, and strategies you need to stay organized and avoid costly mistakes as you grow across multiple jurisdictions.

Understanding Multi-Jurisdiction Tax Challenges

Expanding into new regions can appear to be a significant revenue gain, but every new market presents its own unique tax landscape. To see how quickly this can get complicated, consider a real-world scenario.

Take the example of a speech-to-text software company offering subscriptions worldwide. Customers in the US can expect straightforward monthly billing with state sales tax, while subscribers in the EU must comply with VAT rules and digital service regulations.

Expanding further into markets like India or Australia adds new layers of GST and invoicing requirements. For businesses like these, staying compliant is not just about calculating taxes, but about building trust at scale, ensuring every transaction reflects local rules while maintaining a seamless subscription experience.

These differences exist because each jurisdiction has its own priorities and frameworks:

- – United States: Sales tax is handled at the state and local level. And each state and city sets its own rates and rules. Some jurisdictions don’t tax digital services at all, while others treat them like tangible goods.

- – European Union: Value-added tax (VAT) is applied consistently across member states, but rates vary from country to country. Digital services are taxed where the customer lives, not where the business operates.

- – Australia and India: Both countries use Goods and Services Tax (GST), but their compliance requirements differ. In Australia, businesses are required to register once they exceed a specified revenue threshold. On the other hand, in India, filing can be more frequent and involves detailed invoice reporting.

Compliance for Subscription & Rental Businesses: What You Need to Know

There’s more to compliance for subscription and rental businesses than just charging the right tax rate. You need to stay aligned with a variety of obligations that differ depending on where you operate and the services you provide.

Some of the most common requirements include:

- – Licensing and permits: Many jurisdictions require special licenses for rental businesses, such as vehicle registrations, short-term rental licenses, or local business authorizations.

- – Consumer protection laws: Automatic renewal rules for subscriptions or disclosure requirements for rental contracts vary by region. Failing to follow them can lead to fines or disputes.

- – Tax registration: If you cross nexus thresholds in a U.S. state or expand internationally, you may need to register for state and local sales tax, VAT, or GST before you can legally bill customers.

- – Reporting obligations: Some regions demand detailed transaction-level reports, while others focus on quarterly or annual filings.

On top of these compliance factors, managing capital is another major hurdle. Rental businesses, in particular, often require the purchase and maintenance of expensive equipment.

Use heavy equipment financing to cover costs for machinery, vehicles, or other large assets, manage cash flow, and support industries like construction, farming, logistics, and so on.

Financing allows you to meet tax obligations on time, renew permits, and pay for insurance and compliance fees without putting your resources to the test.

The Records That Keep You Audit-Proof

Good recordkeeping is the backbone of compliance. Without it, even the most accurate tax calculations can fall apart under scrutiny. The challenge multiplies when you operate across several states or countries, where each jurisdiction expects slightly different documentation.

Handling taxes and compliance becomes exponentially harder when your rental or subscription business operates across state lines. Cruise America, one of the largest RV rental providers in the United States, manages fleets in multiple states, from RV rental in Seattle to locations across Arizona, Texas, and Florida.

Each state has its own tax requirements, reporting standards, and compliance rules, making uniform operations a challenge. For businesses in this space, understanding these regional differences and building robust systems for tax management is not just about staying compliant. It’s about ensuring scalability and financial stability.

This makes uniform operations difficult. You need a system that captures and categorizes every transaction according to the rules of the jurisdiction where it occurred. That means:

- – Storing signed contracts and rental agreements by location

- – Maintaining detailed sales invoices that clearly list tax amounts charged

- – Reconciling bank deposits against individual rentals for accuracy

- – Archiving permits, licenses, and renewal documents that prove compliance

The stronger your record-keeping, the easier it becomes to expand into new markets, knowing you can prove compliance at any time. You’ll also create a foundation of trust with investors, lenders, and customers who value transparency.

Automating Taxes Across States and Countries

Manually managing taxes across multiple jurisdictions might work when you’re small. But it quickly becomes overwhelming as you scale. Each state, province, or country has its own filing rules, deadlines, and reporting formats. Trying to keep track of them in spreadsheets is a recipe for errors. And errors can mean penalties.

That’s why automation is essential. Modern accounting and compliance tools can:

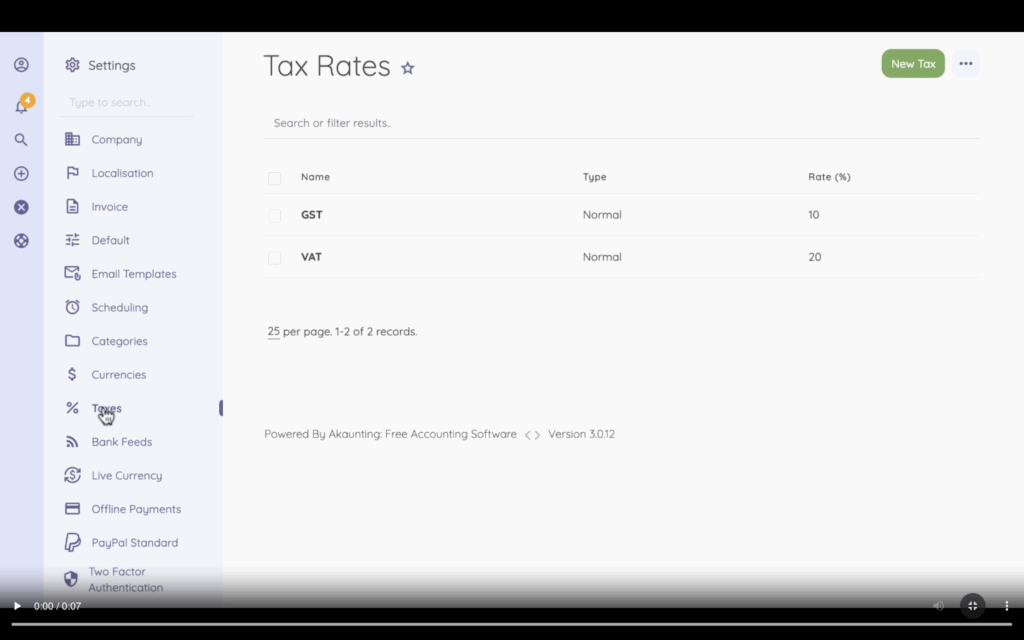

- – Calculate local tax rates automatically: Whether it’s applicable sales tax in the U.S., VAT in Europe, or GST in regions like Australia and India, software can apply the correct rate based on customer location.

- – Monitor sales tax nexus thresholds: Many jurisdictions set revenue or transaction thresholds that trigger tax obligations. Automated systems alert you when you reach those thresholds, so you can register before penalties are incurred.

- – Generate compliance-ready reports: Instead of scrambling to format data for different agencies, automation produces reports in the exact layout tax authorities require.

- – Integrate with billing and subscription platforms: Automated tools sync directly with your invoicing system for recurring payments, ensuring every invoice includes the right tax amount and customer location details.

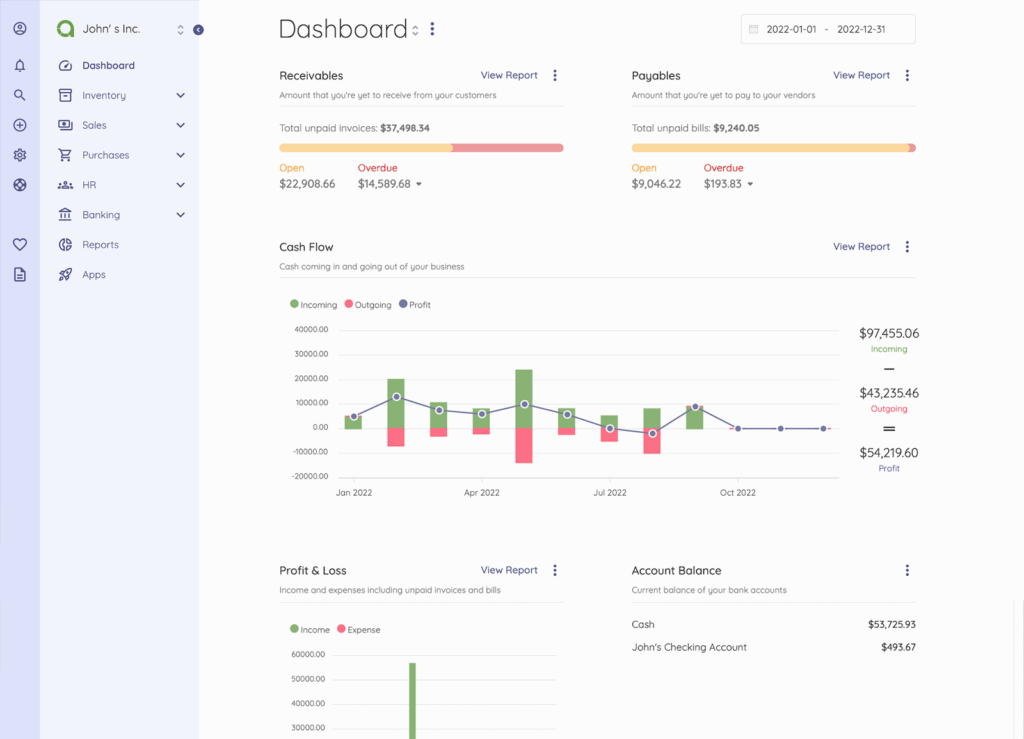

- – Centralize multi-jurisdiction data: Having all your business records in one dashboard makes it easier to review performance, reconcile accounts, and spot inconsistencies early.

How to Stay Ahead of Regulatory Changes

Tax compliance rules don’t stay the same for long. What kept your business in line last year may already be outdated this year. Governments regularly adjust tax rates, introduce new digital service laws, and update filing requirements.

To stay ahead:

- – Subscribe to updates from tax authorities: Many countries and states publish newsletters or alerts. Setting up email notifications keeps you informed of changes before they take effect.

- – Join industry associations: Trade groups often track regulatory shifts that impact subscription and rental businesses specifically, giving you early warnings and resources.

- – Review compliance quarterly: Check for new filing obligations or updated rates every few months, not just at year-end.

- – Consult experts when entering new markets: Local accountants or tax advisors can explain rules you might overlook, like region-specific consumer protection laws or hidden fees.

Smart Systems for Year-Round Compliance

Taxes and compliance shouldn’t be an annual fire drill. Businesses thrive across multiple jurisdictions when they treat compliance as part of their daily operations.

Building systems that work year-round saves time, reduces errors, and keeps your business audit-ready.

A smart accounting system often includes:

- – Centralized recordkeeping: Store contracts, invoices, and receipts in one digital hub, organized by jurisdiction and date. Cloud tools make it easy to access documents at any time.

- – Monthly reconciliations: At the end of each month, match your bank deposits to invoices and categorize expenses. This keeps your books clean and prevents surprises during filing.

- – Automated reminders: Use calendars or software alerts to flag filing deadlines, license renewals, or quarterly tax payments.

- – Role-based access: If your team is growing, assign permissions so staff can update records or upload receipts without risking sensitive financial data.

- – Regular backups: Store duplicate copies of records on secure cloud platforms to protect against data loss.

The goal is to create a repeatable process that doesn’t rely on one person remembering every deadline. Tools like Akaunting make this easier by giving you a single platform to track income, expenses, and taxes across multiple jurisdictions.

With a centralized dashboard, you can spend less time chasing paperwork and more time focusing on growth.

Final Thoughts

Managing taxes and compliance across multiple jurisdictions can feel overwhelming, but it doesn’t have to slow down your growth.

With the right systems, accurate record-keeping, and intelligent automation, subscription and rental businesses can expand confidently while staying compliant with every regulation.

Instead of scrambling at tax time, build habits and tools that keep you compliant year-round. When your processes are organized, audits become less stressful, penalties are easier to avoid, and scaling into new markets becomes a realistic opportunity rather than a compliance nightmare.

Ready to simplify your compliance strategy? Try Akaunting today and see how easy it can be to track income, expenses, and tax obligations in one platform.

About the Author

Kelly Moser is the co-founder and editor at Home & Jet, a digital magazine for the modern era. She’s also the content manager at Login Lockdown, covering the latest trends in tech, business and security. Kelly is an expert in freelance writing and content marketing for SaaS, Fintech, and ecommerce startups.