What is an Invoice: How and When to Send One

Reading Time: 9 minutes“What is an invoice?” is a common question many business professionals consider general knowledge. However, 18,000+ monthly searches suggest it may not be a basic question as assumed.

Understanding how invoicing works is essential for individuals offering services or selling products to customers. It is a simple financial document that connects your business with customers, ensuring payment and steady cash flow.

The thing is, many freelancers and small businesses send invoices; however, they do not understand why they aren’t getting paid on time or at all.

This blog post discusses invoices, what should be in them, templates, how to use them, and when to send them.

Table of Contents:

- What is an Invoice

- What should it include

- How to write an invoice

- How to send an Invoice

- When to send an invoice

- Invoice payment reminder – email template and when to send them

- How to make an invoice template

- Next steps

- Frequently asked questions

What is an Invoice?

It is a document issued by a seller or service provider to a buyer that specifies the quantities and costs of the products or services provided.

It serves as a request for payment and includes the transaction details, such as the description of what’s being charged for, the transaction date, the prices and totals, and payment terms.

Invoices are used in accounting to keep track of sales, manage inventory, and record revenue. They are also important for tax and legal purposes, as they record the sale of goods and services.

Example

Below is an example of a typical invoice with the necessary information.

Moving on to…

What should an invoice include?

The common mistakes freelancers or businesses make when sending an invoice are excluding clear payment terms, lacking a professional format, or, even worse,being vague or incomplete in itemization.

Without clear information, clients may be confused or have questions, which can lead to payment delays or a perception of unprofessionalism.

Invoices should be detailed with specific payment terms, such as due dates, acceptable payment methods, and late payment penalties, to ensure timely and correct payments.

Here’s what should be included to make it effective:

Header

1 – Your Business Information: Business name, Email

, Contact number and Logo for brand recognition.

2 – Title and subheading that informs the recipient of the overall purpose.

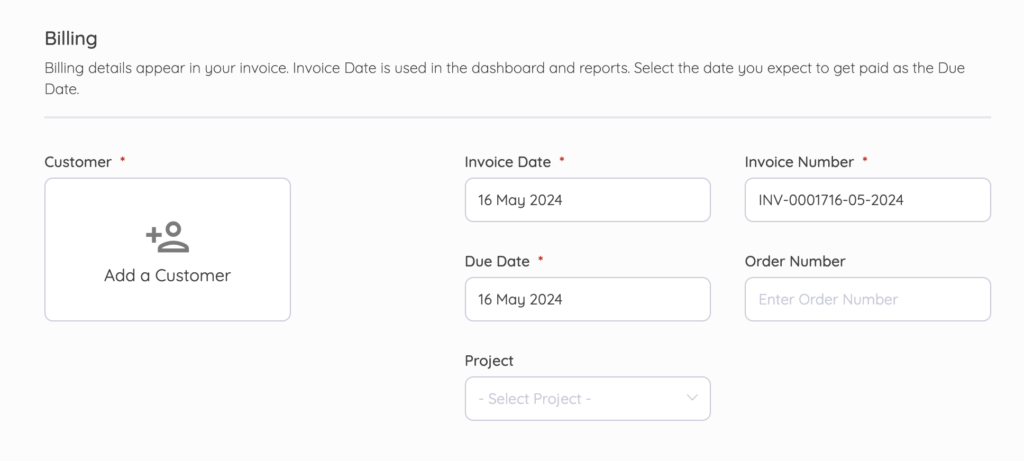

Billing

1 – Customer’s name and contact information

2 – Invoice number for tracking and tax purposes

3 – Date of issue and Due date

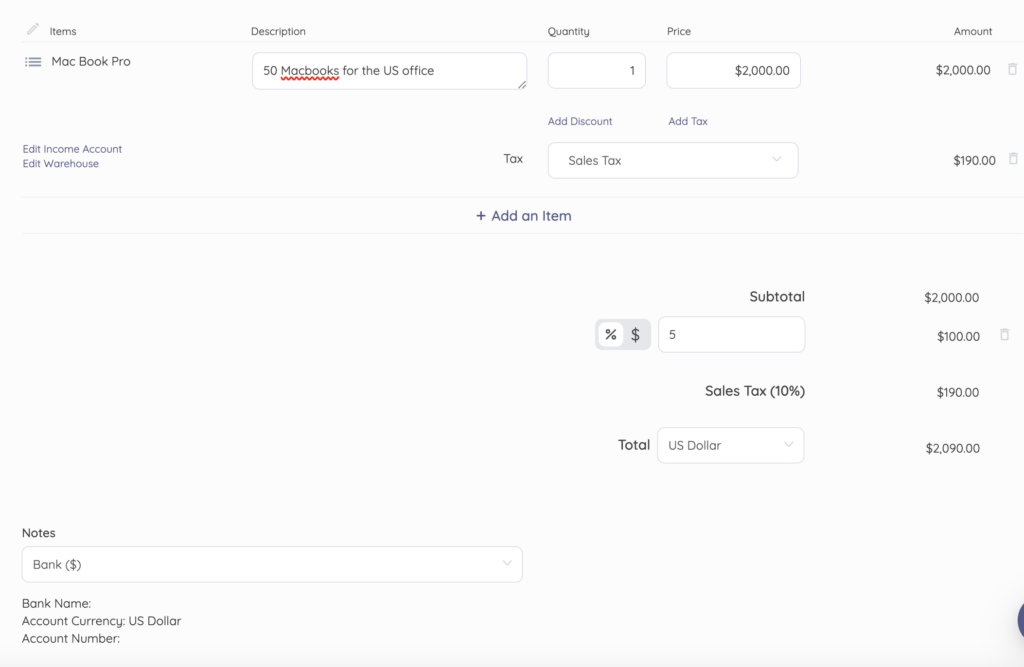

Products or services

1 – List of goods or services you offered the clients

2 – Detailed description of goods or services provided

3 – Quantity of the goods or service

4 – Price of each good or service

5 – Amount of the good or service

6 – Tax: enter the tax for each item if applicable.

7 – Sub total amount due

8 – Discount if applicable

9 – Total amount the recipient is to pay

10 – Notes section for any additional information such as payment terms, method of payment, and penalties for late payment past due date.

All these elements allow you to create a professional and comprehensive document that minimizes confusion and encourages prompt payment.

How to write an invoice

You could either use invoicing software or free invoicing platforms to give your business a professional perception from clients.

To do it manually or use a spreadsheet, answer all the invoicing requirements listed in the “What should an invoice include” section.

Doing that gives your invoice a professional look and increases your chances of getting paid.

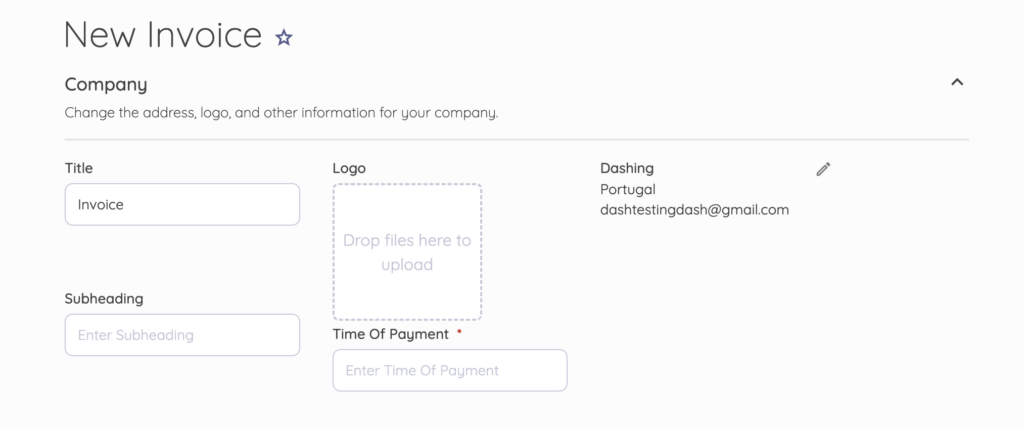

However, if you opt for an easier and more convenient way—invoicing software—here’s a step-by-step guide.

Using Invoicing Software:

– Click on Sales on the Navigation Menu to reveal expanded options.

– Select Invoices.

– From the Invoices dashboard, click New Invoice.

– Enter the required details. Check out the “What should be included in an invoice” section.

– Then, Save.

Remember, an invoice should be clear, professional, and contain all necessary information for the client to process the payment.

How to send an Invoice

Here’s a simple guide:

Prepare the invoice

Before sending, ensure it includes all necessary details. This typically includes your name or company name, contact information, a unique invoice number, the date, a description of the products or services provided, the amount due, and the payment terms (e.g., due upon receipt, net 30 days, etc.).

Check out: Net 30 Payment Terms: What is it?

Choose the right channel

Depending on your relationship with the client and their preferences, you can send an invoice via Email, postal mail, or an online invoicing service.

Email is the most common and efficient method, but make sure to ask your clients what they prefer.

Emailing

If you choose to email an invoice, write a clear subject line with the word “Invoice” along with the invoice number or a reference to the project.

In the body of the Email, briefly explain what it is for and attach the document. You might also want to include the invoice details in the body of the Email to ensure they see the important information even if they don’t open the attachment.

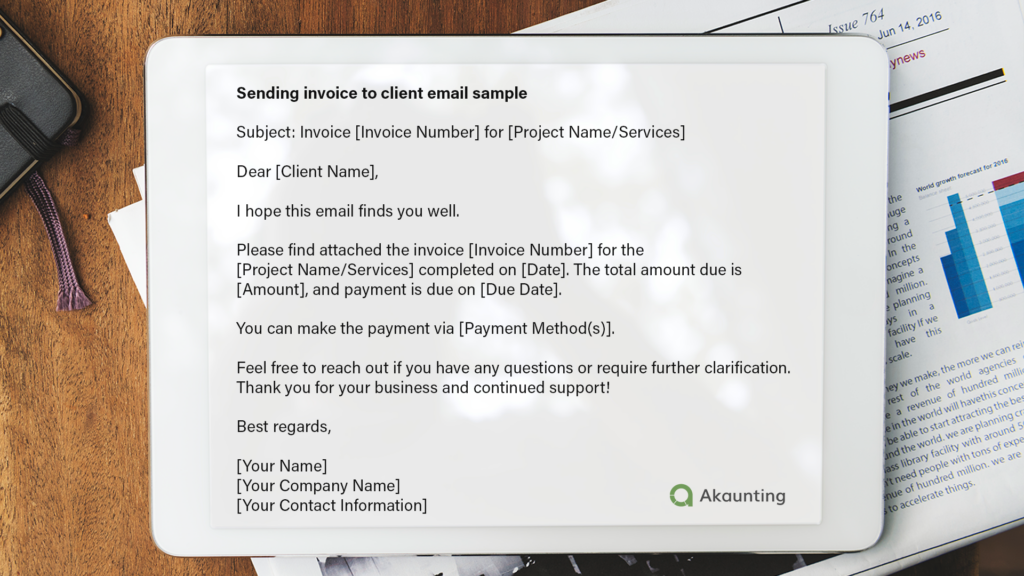

Sending an invoice to client email sample

If you opt for Invoicing software, sending an invoice is relatively easy and convenient.

- After entering the necessary details, click Send To. A pop-up window prompts you to send an email.

- Enter the email address of the recipient and subject, and write details in the email body.

- If preferred, you can check the box to send yourself a copy of the Email.

- Then, click Send.

When to send an invoice

This is a common question most freelancers ask, and the simple answer is immediately.

It’s a common mistake to wait until the end of the month before sending all invoices for services or goods delivered during the project.

The best time to send an invoice is immediately upon completion of the project or delivery of the goods.

Waiting until the end of the month can result in payment delays, as clients may not prioritize invoices received long after the work has been completed.

Sending an invoice promptly reinforces the value of your work in the client’s mind and increases the likelihood of timely payment.

Invoice payment reminder – email template and when to send them

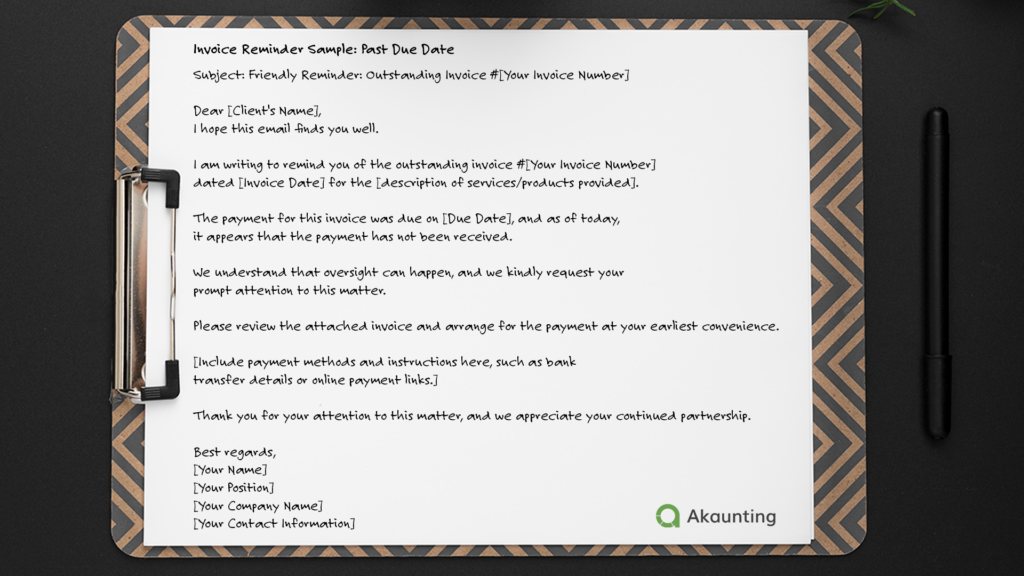

While adhering to all the necessary invoicing details and processes is aimed at ensuring timely payment, it’s common to encounter clients who consistently delay payments.

For these, you need to send invoice payment reminders.

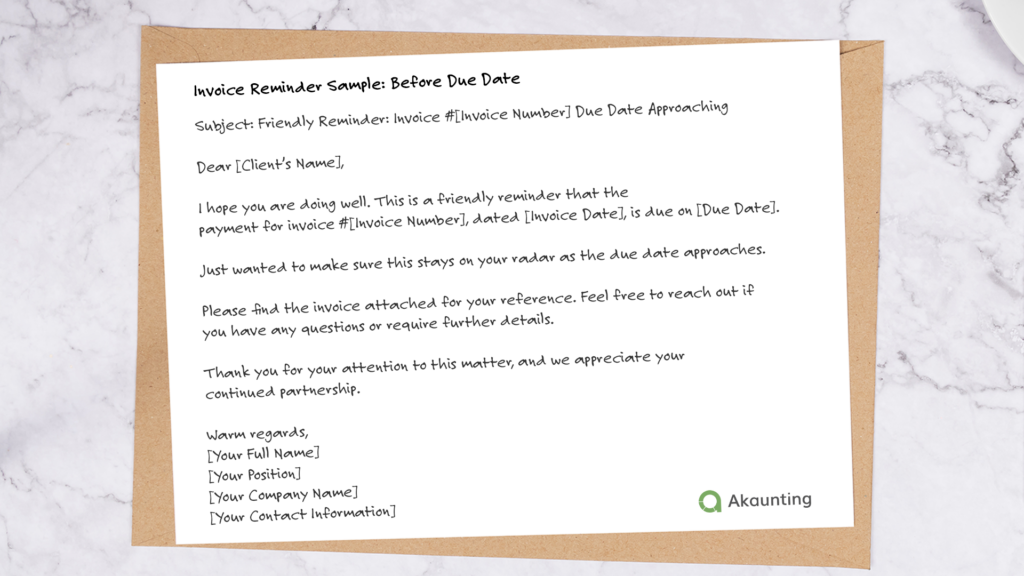

Contrary to common belief, an invoice reminder should be sent a few days before the payment due date.

Sending a reminder before the due date is beneficial because it:

- Alerts the client to upcoming payments, ensuring your invoice is on their radar.

- Reduces the risk of the payment being forgotten or overlooked.

- Provides an opportunity for the client to clarify any questions or issues with the invoice before the payment is due.

- Demonstrates professionalism and attention to detail in your business practices.

- Encourages prompt payment, which is essential for maintaining healthy cash flow.

Here’s a sample of an invoice payment reminder email:

Invoice Reminder Sample: Before Due Date

Invoice Reminder Sample: Past Due Date

Check out: How to send ınvoice reminder using Invoicing Software

How to make an invoice template

Making template is the fastest way to organize your invoicing process. It will save you time and effort while maintaining a professional image.

Templates ensure that all invoices have a uniform look and feel, reinforcing your brand identity.

How to Create an Invoice Template in Spreadsheet:

1 – Set up the Header:

- Company Information: In the top left corner, enter your company name, logo, address, phone number, and Email.

- Invoice Details: Add fields for the invoice number, date, and due date in the top right corner.

- Client Information: Below your company information, create fields for the client’s name, company (if applicable), address, and contact details.

2 – Create the Itemized List:

- Columns: Create columns for description, quantity, unit price, and amount.

- Rows: Leave enough rows for multiple items/services.

3 – Add Calculation Formulas:

- Amount: In the “Amount” column, enter the formula:

=Quantity * Unit Price. This will automatically calculate the total cost for each item. - Subtotal: Below the itemized list, create a “Subtotal” field. Use the formula

=SUM(Amount range)to add up all the individual item amounts. - Sales Tax: Create a “Sales Tax” field and enter the formula

=Subtotal * Tax Rate. Replace “Tax Rate” with your local tax rate (e.g., 0.08 for 8%). - Discount: If applicable, add a “Discount” field and use the formula

=Subtotal * Discount Rate. Replace “Discount Rate” with the discount percentage (e.g., 0.1 for 10%). - Total: Finally, create a “Total” field and calculate it with the formula:

=Subtotal + Sales Tax - Discount.

4 – Include Payment Terms and Additional Notes:

- At the bottom, add sections for payment terms (e.g., net 30 days), accepted payment methods, and any additional notes or instructions.

5 – Format the Template:

- Adjust font sizes and styles to enhance readability.

- Use borders to separate sections and create a visually appealing layout.

6 – Save as a Template:

- Go to “File”> “Save As” and choose “Excel Template (*.xltx)” as the file type. This will allow you to reuse the template easily for future invoices.

Creating an Invoice Template in Google Sheets:

Set up the Structure:

- Create a header section with your business name, logo, address, contact information, and a space for the invoice number and date.

- Designate a “Bill To” section with fields for the client’s name, company, address, and contact information.

- – Create a table with columns for: Item Description

- – Quantity

- – Unit Price

- – Amount (calculated as Quantity * Unit Price)

Add Formula:

- Amount: In the “Amount” column, enter the formula:

=C2*D2(assuming Quantity is in column C and Unit Price is in column D). Drag this formula down to apply it to all rows. - Subtotal: At the bottom of the “Amount” column, use the formula

=SUM(E2:E)(where E is the “Amount” column) to calculate the Subtotal. - Sales Tax: In a separate row, label it “Sales Tax” and enter the formula

=F2*0.08(assuming the Subtotal is in cell F2 and the tax rate is 8%). Adjust the tax rate as needed. - Discount (Optional): If applicable, create a “Discount” row and enter the formula

=F2*0.1(assuming a 10% discount). - Total: Create a “Total” row and enter the formula:

=F2+G2-H2(assuming Subtotal is in F2, Sales Tax is in G2, and Discount is in H2).

Format for Clarity:

- Apply currency formatting to cells containing monetary values.

- Add borders and shading to visually separate sections.

- Choose a professional font and size.

Save as a Template:

- Go to “File”> “Make a copy.”

- Rename the copy as “[Your Company Name] Invoice Template.”

- Every time you need to create a new invoice, make a copy of the template and fill in the client-specific details.

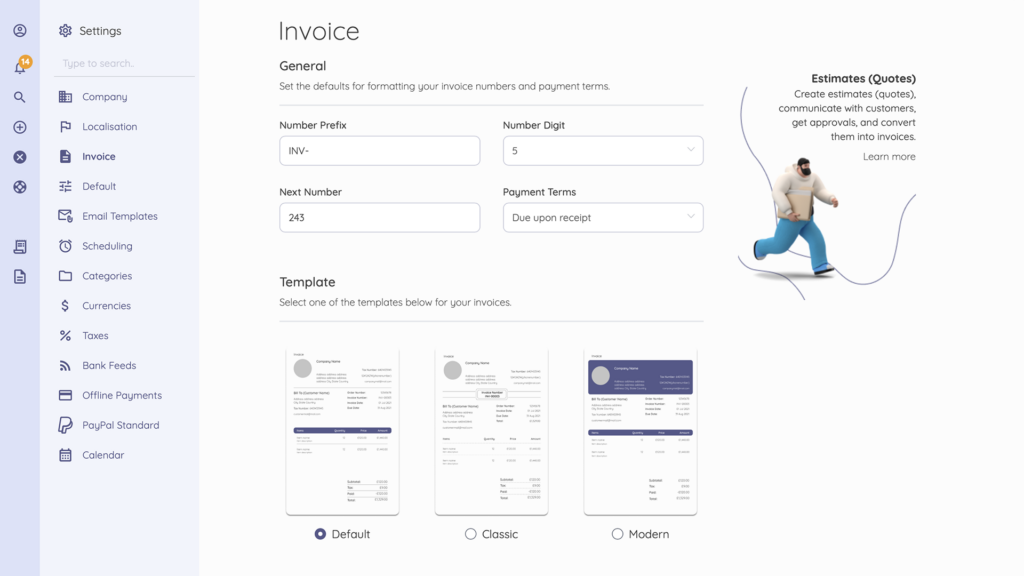

Using Invoicing Software to Create an Invoice Template

Many invoicing software offers the ability to design custom templates for your invoices.

They often come with various sample templates that you can select and then personalize to align with your brand’s identity.

This feature allows you to create professional and consistent invoices that reflect your company’s image.

Akaunting’s templates allow you to customize colors and headers. Learn more here.

Next Steps

As you’ve read through the invoicing process in our blog post, it’s clear that understanding the what, how, and when of invoicing is crucial for your business’s success. Now, it’s time to put this knowledge into action.

Take the first step towards receiving the client’s first payment. Create a customized invoice template, set clear payment terms, and establish a routine for sending invoices and reminders. Remember, consistency and clarity in your invoicing can lead to faster payments and a healthier cash flow. Start sending invoices for free.

Frequently Asked Questions

What is an invoice payment?

An invoice payment is the act of settling an outstanding bill or invoice issued by a seller to a buyer for goods delivered or services rendered. It involves the transfer of funds from the buyer to the seller to fulfil the financial obligation specified in the invoice. The payment typically covers the agreed-upon price for the products or services, along with any applicable taxes, fees, or discounts.

What is a proforma invoice?

A proforma invoice is essentially a preliminary bill of sale sent to buyers before a shipment or delivery of goods. Typically, it gives a detailed breakdown of the products or services yet to be delivered. It includes information such as the items’ description, quantity, value, and other essential transaction details like shipping weight and transport charges. However, it’s important to note that a proforma invoice is not a true invoice; it’s more of an estimate or a declaration of intent to sell goods or services at specified prices and terms. Check out Estimates Software for Small Businesses.

What is an invoice number?

An invoice number is a unique identifier for an invoice. It is typically used for tracking and managing invoices within a financial or accounting system. It helps distinguish one invoice from another and is crucial for record-keeping, payment tracking, and resolving any discrepancies that may arise.