7 Invoicing Best Practices for Freelancers to Get Paid Faster

Reading Time: 7 minutesIf you’re a freelancer, you probably love the freedom and flexibility your business offers. However, if you don’t have a solid invoicing process, you can face serious financial issues, regardless of your level of success or income. In this article, we discuss invoicing 7 best practices for first-time freelancers.

These should also be handy if you’re an experienced business owner but struggling to track invoices and get paid on time.

Let’s dive in.

Table of Contents

- Set Clear Payment Terms From The Start

- Use Professional Invoicing Software

- Send Invoices Promptly After Project Completion

- Offer Multiple and Convenient Payment Options

- Follow Up Professionally

- Know the Value of Your Work and Charge Accordingly

- Include All Key Details on Every Invoice

1. Set Clear Payment Terms From The Start

Before pitching to potential clients, outline your payment terms in writing. As a freelancer, you must ensure that you receive timely payments to maintain a steady cash flow and stay on track with your business goals.

For example, Abacus Global, a leader in financial and tax advisory, can help you optimize your invoicing process to get paid faster. Some best practices include:

- – Clearly stating payment terms (for example, if payment needs to be processed within 15 or 30 days)

- – Using professional invoicing software

- – Including late fee policies for overdue payments

- – Sending invoices promptly after completing a project

Additionally, to simplify transactions, consider integrating payment options such as credit cards or PayPal. Abacus Global also advises freelancers to keep track of their invoices and offer incentives for early payments, such as a 5% discount on upfront payments, to attract high-quality clients. All while ensuring compliance with tax regulations. (We’ll discuss these strategies further soon.)

We know that for first-time freelancers, creating the freelance contract payment section can be daunting. However, when you adopt these practices, you enhance efficiency, reduce payment delays, and demonstrate your commitment to professionalism.

2. Use Professional Invoicing Software

Many people who are new to freelancing often begin with manual spreadsheets or downloadable templates. These methods are prone to data-entry mistakes and miscalculations. Plus, you must manually track your invoices. This can be time-consuming, as you will need to check who has paid on time and if there are any overdue payments in your queue.

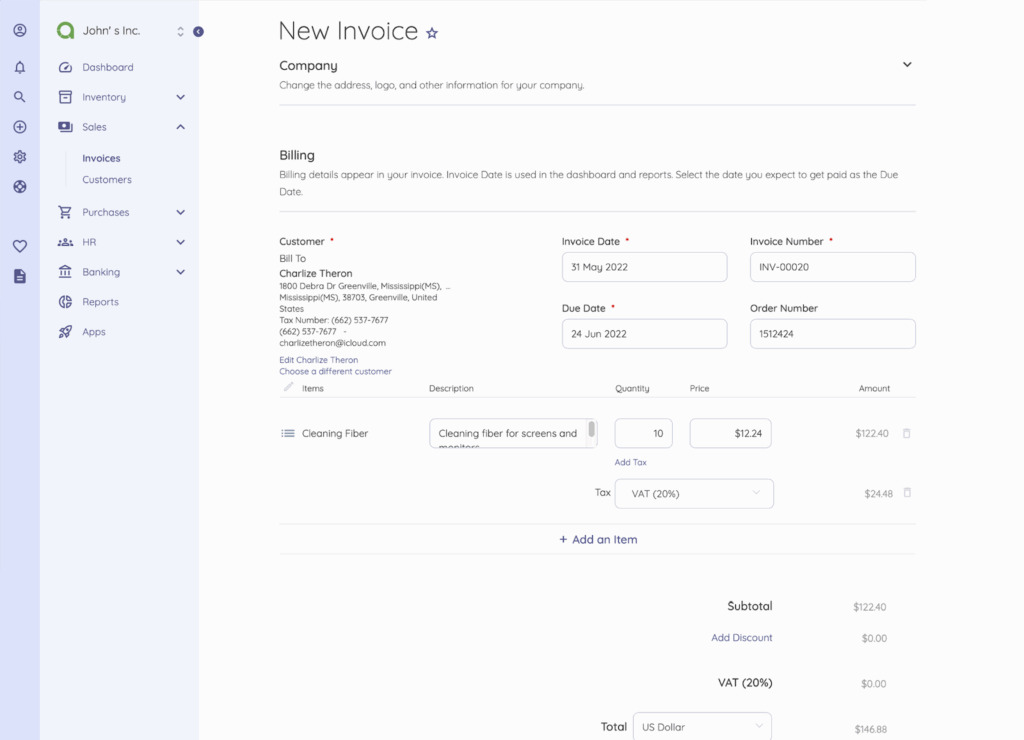

Consider using a professional invoicing software, such as Akaunting. It’s a free bookkeeping tool equipped with all the features you need to manage your freelance business’s income and expenses. It lets you:

- – Keep track of paid invoices and overdue payments for every client individually

- – Create professional-looking invoices and share them with your clients

- – Create invoices and bills for recurring projects with one tap or click

- – Monitor your finances on any device

- – Receive payments in any currency

Many small businesses overlook digital compliance, especially when using cloud-based accounting software. Taking the time to understand cloud compliance can help you prevent data exposure risks that may result in legal or financial setbacks.

For example, Akaunting Cloud protects your data with 256-bit SSL encryption, two-factor authentication, and hourly, daily, and monthly backups, ensuring your financial records remain secure.

3. Send Invoices Promptly After Project Completion

As soon as you meet your project deadline, send your invoice so that you receive payment on time. This is also something you should clarify in your freelance business contract, as it ensures that both you and your client agree on the timing upfront.

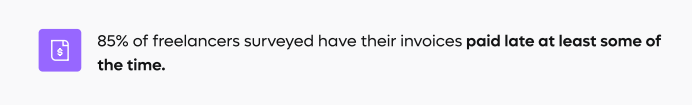

When you delay invoices, you significantly increase the risk of late payments. According to a recent report by Remote, 85% of freelancers have experienced late payments at some point in their lives. Additionally, more than 21% of payments are made late or not received at all. The report also found that only 15% of freelancers receive timely payments.

This can happen if there are payment issues between international banks. For example, your bank account may not be able to process payments in Euros (€). Or, you might need to pay an additional fee to have your client’s Euro (€) payment converted into US dollars ($).

Set a reminder to issue your invoices once a week or after project completion, as agreed upon with your client. Otherwise, if your rent and health insurance contributions are due, but your clients have not paid, and you cannot make any payments, you could end up in debt.

4. Offer Multiple and Convenient Payment Options

Keep in mind that not everyone uses the same payment method. For example, U.S. clients may prefer to pay via bank transfer, while those residing in Europe may use PayPal as their preferred payment method. This approach can be beneficial as it:

- – Boosts your professionalism, so other businesses see you as a successful freelancer who understands client needs

- – Speeds up cash flow as the client can make a payment right away without encountering any issues at checkout

- – Improves client satisfaction by matching their preferred payment method

- – Reduces late or missed payments

5. Follow Up Professionally

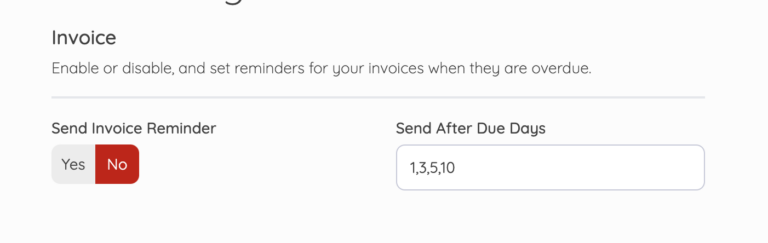

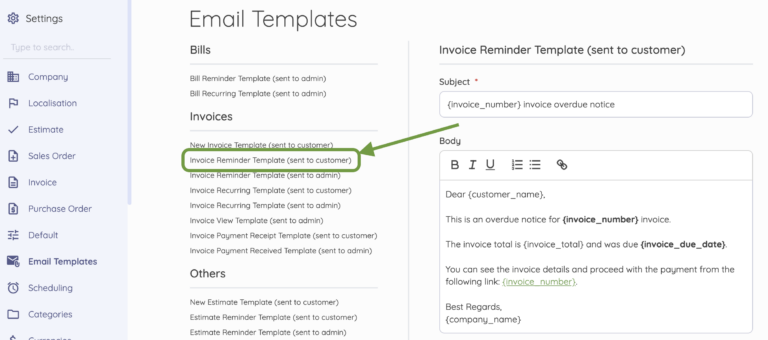

If a client misses a payment deadline, don’t hesitate to follow up. If you’re using an automated tool, you can still personalize your message by addressing your client by their name and including the original invoice number and amount due. In brief, mention the rendered service.

You could write something like “Just checking in on Invoice #2025‑015 for the April blog post, amounting to $750, due May 5th.” A personalized touch increases response rates without sounding desperate.

For example, on Akaunting, you can create an email template and customize it as needed.

6. Know the Value of Your Work and Charge Accordingly

It’s time to set your hourly rate or project fee. Ensure that this accurately reflects your experience, niche expertise, and market demand.

If you’re still not sure what to charge, visit freelancing platforms like Upwork to see what other freelance writers or graphic designers (for example) are charging. The hourly rate is usually available on freelancers’ profiles.

You can also review client testimonials and gain insight into what potential clients are willing to pay for similar services, if this information is available online.

But don’t just rely on that. Consider other factors, like taxes, health insurance, and vacation leave.

As a freelancer, you don’t have access to any full-time employee benefits. Through your freelance income, you need to save some funds for your taxes and days when you might not be working, in case you’re not feeling well.

If you need more help, a tax advisor can advise on best practices for freelancers to manage finances more effectively.

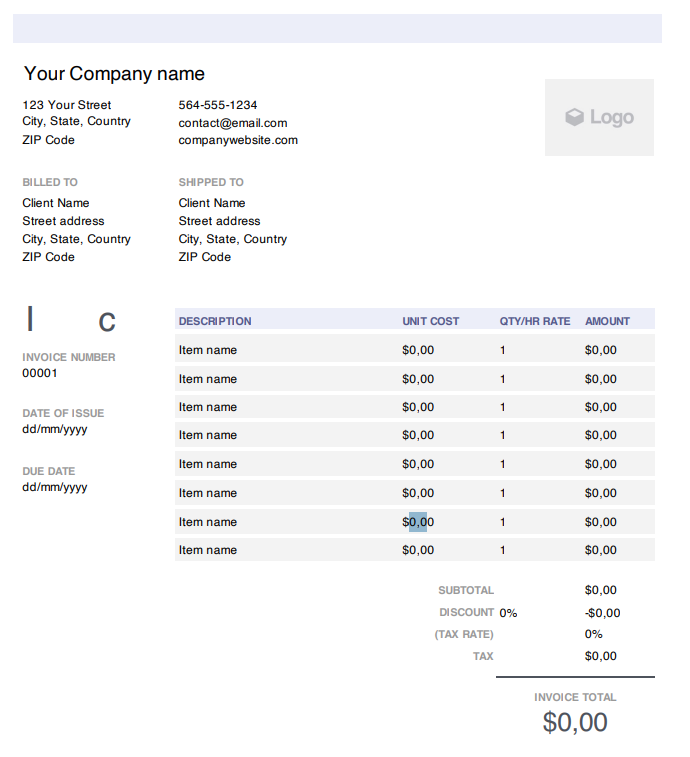

7. Include All Key Details on Every Invoice

A complete invoice is a roadmap to prompt payment. It should include all key details related to your business project. These include:

- – Business and client information: Add your business name, registered address, email, and phone number. This makes it easier for clients to reach out if they encounter any issues with their payment. Also, list your client’s legal name or business name, billing address, and primary contact person. Always ensure that your invoices reach the right person (or department, if you’re working with a large company).

- – Invoice number and date: Assign a unique invoice number, like “4012” or “ABC4012.” This helps both you and the client track payments. Add the invoice data to indicate when you’ve issued the document and the payment due date to avoid any confusion about payment timelines.

- – Description of services and project scope: Break down each line item with a concise description of the work performed. You could write something like “Blog post 1: How to write a blog post”, so that clients can easily match their payments to the deliverables. If you’re billing by milestone, note the project phase or deliverable. Write something like “Milestone 1: Blog outline”.

- – Hourly rate or project fee: This is where you list your rate (for example, “$40 per hour) alongside the number of hours worked. For flat fees, display the project total, including any partial payments.

- – Project deadlines: For each line item (or maybe a separate section), indicate when you’ve submitted the project, like “Article submitted on April 15, 2025”, so there’s no question about when work was completed.

- – Payment terms and accepted methods: We’ve already discussed these. However, these details should be included in every invoice you create. For example, you could write “payment can be made via bank transfer or PayPal” or “Accepted payment methods: Bank transfer and PayPal.”

- – Tax identification and compliance: If you’re freelancing from the European Union and VAT registered, you have to include your VAT identification number and the tax rate and amount applied per line item. An example would be “VAT 20%: $35” to comply with regulations. If you’re a U.S. contractor, list your EIN or TIN if requested to ensure your account is credited properly.

Final Words

A thriving freelance career is more than just delivering stellar work. It requires building an invoicing system that is both reliable and client-friendly, so that you turn billing into a growth machine.

Automated reminders and real-time visibility cut payment cycles and eliminate errors. This frees you to focus on your craft rather than chasing invoices. Transparent terms and diverse payment options reduce checkout frictions, enhance client satisfaction, and strengthen long-term relationships.

Are you ready to optimize your invoicing process? Give Akaunting a try. Get started here for free.

Author bio:

Kelly Moser

Kelly Moser is the co-founder and editor at Home & Jet, a digital magazine for the modern era. She’s also the content manager at Login Lockdown, covering the latest trends in tech, business and security. Kelly is an expert in freelance writing and content marketing for SaaS, Fintech, and ecommerce startups.