Akaunting Update: January User Insight🎉

Reading Time: 4 minutesJanuary set the tone for the year: more teams joined Akaunting, more workflows were completed, and several countries posted standout growth across core accounting actions.

But before we dive into the numbers, a quick reminder for anyone paying contractors in the US (or selling through platforms like PayPal/Venmo/marketplaces):

- – Freelancers and independent contractors are now a standard part of how many small businesses operate. A widely cited LinkedIn datapoint often repeated in SMB guidance suggests around 70% of small businesses have hired a freelancer at least once—and in a Hiscox small-business survey, 45% of owners said they use freelancers/independent contractors. (Square)

- – That’s exactly why 1099 compliance matters: as soon as you pay non-employees, reporting rules (and penalties for getting them wrong) become operational risk—not “admin.”

If you need a clean starting point, here’s the guide we recommend: “What is the 1099-NEC form used for?”

Form 1099 in 2026: the one-minute compliance update (US)

Two changes are especially worth keeping on your radar:

- 1. 1099-NEC threshold moved to $2,000 (starting with payments made after Dec 31, 2025). (irs.gov)

- 2. 1099-K reporting reverted to the classic $20,000 and 200 transactions rule for third-party settlement platforms. Important nuance: this is a platform reporting threshold, not a “tax-free” threshold—taxable income is taxable even without a form. (irs.gov)

User Insight: What Happened In January?

We started the year strong: new users were up +99%. That kind of lift usually signals one (or more) of the following:

- – new people discovering Akaunting via search and community recommendations,

- – teams migrating tools at the start of the year,

- – and business owners tightening up reporting and tax workflows early.

Global community activity 🌍

The USA is still the largest country by total active users. But growth momentum is distributed—and that’s what’s interesting. Mature markets grew sharply, and several “rising star” countries crossed the 100 active users threshold.

Top growth: Established markets (100+ users)

To keep comparisons fair, this list includes countries that started January with 100+ active users:

| Country | Growth |

| South Africa | +107% |

| USA | +97% |

| Pakistan | +93% |

| Spain | +87% |

| India | +81% |

Rising stars 🚀 (newly crossed 100 active users)

These communities officially crossed the 100-user milestone this month:

| Country | Growth |

| Kenya | +118% |

| Nigeria | +116% |

| Bangladesh | +69% |

| Brazil | +60% |

| Mexico | +55% |

Special mention: Russia, Venezuela, and Ecuador are growing rapidly and are approaching 100 users each.

Biggest new user growth (where new signups accelerated most)

The biggest increases in new users came from:

- – Nigeria (+168%)

- – USA (+152%)

- – South Africa (+150%)

- – Spain (+140%)

- – UK (+121%)

🔎 What users did the most (and where those actions were most popular)

Here’s a quick “who did what” snapshot for January:

- – Create Expense: USA, Mexico

- – Create Invoice: Philippines, South Africa

- – Create Income: Germany, USA

- – Send Invoice: South Africa, Jamaica

- – Create Account: Philippines, Germany

“Most-used features” often vary by region depending on typical billing cycles, business models, and how businesses divide roles.

📈 Notable increases (workflow spikes worth noticing)

Some activities saw meaningful month-over-month jumps:

- – Reconciliations: +209% (highest activity: Saudi Arabia)

- – Printing invoices: +170% (highest activity: Canada)

- – Editing email templates: +119% (highest activity: USA)

These trends show what users are optimizing right now: closing books properly (reconciliations), sharing formal documentation (printing), and improving payment communication (email templates). If you copy these habits, you’ll reduce errors, speed up collections, and make month-end reporting less stressful.

🛍️ Top apps & subscriptions

Most purchased (January)

- 1. Standard Cloud

- 2. Premium Cloud

- 3. Customer Statement

Biggest growth in “Added to Cart.”

- BackUp & Restore (+1000%)

- Aged Receivables/Payables (+400%)

- Custom Fields (+200%)

- Import Pro (+133%)

Cart spikes reveal the next problems users are trying to solve: data protection (Backup), collections visibility (Aged Receivables/Payables), scaling setup (Import Pro), and customization (Custom Fields).

If you’re feeling similar pain, these are the add-ons most aligned with “growing up” your accounting system.

Save 50% this month (limited to two apps)

Use code 50FEBRARY2026 at checkout. Discount applies only to:

- – BackUp & Restore

- – Aged Receivables/Payables

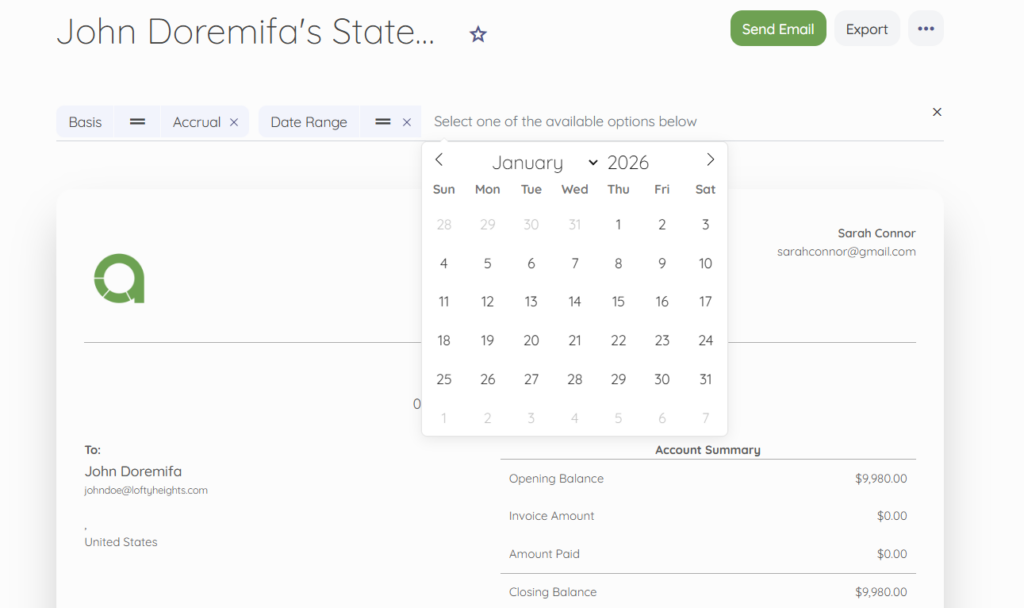

💡 Tip of the month: smarter customer statements in seconds

If you share customer statements regularly (or you want to stop chasing “what’s outstanding?” threads), this is an easy win:

- Apply dynamic filters inside your customer statement reports

- Generate a clean view for exactly what you need (date ranges, customers, status)

- Share statements with anyone, whenever needed—without rebuilding the report from scratch each time

Recommended reads (if you’re in “get organized” mode)

- Bridging the Gap Between Project Milestones and Profitability

- How Much is VAT in the UK?

- Do You Need to Pay Taxes as a Content Creator? Here’s What You Should Know

- Tax Return for Small Businesses and Freelancers in 2026

- How Early Math Skills Help Kids Grow Into Financially Confident Entrepreneurs

Wrap up

January’s story is simple: Akaunting usage is expanding globally, and the actions users take most often are those that keep a business financially clean—expenses tracked, invoices created and sent, income recorded, and books reconciled.

If you want to start 2026 with tighter numbers and fewer “where did the money go?” moments, this is the perfect time to:

- – standardize your invoicing and expense routines,

- – add the reporting tools you actually use,

- – and build a month-end habit around reconciliation and collections reporting.