Do You Need to Pay Taxes as a Content Creator? Here’s What You Should Know

Reading Time: 7 minutesContent creators must pay taxes on income from brand deals, platform payouts, affiliate links, and product sales. In most countries, creators are treated as self-employed, meaning they must report all taxable income and can claim eligible business deductions to reduce what they owe.

Many creators miss taxable income early because they focus only on large platform payouts. Small wins, such as a $500 AdSense check or a single-brand deal, can immediately change your status.

But the moment money enters your account for content work, you stop being only a creator. You become a sole proprietor in the eyes of the tax system. That transition happens earlier than most people expect.

Tax authorities like the IRS and CRA now use advanced digital tools to track every dollar.

New reporting rules for 2026 require platforms to send 1099-K or T4A forms more frequently. These agencies aggressively monitor digital revenue from merchandise sales and affiliate links.

Read on to map your income and expenses clearly. It won’t turn you into a professional accountant, but you’ll have a practical path to keep your business compliant.

What Counts as Taxable Income for Content Creators?

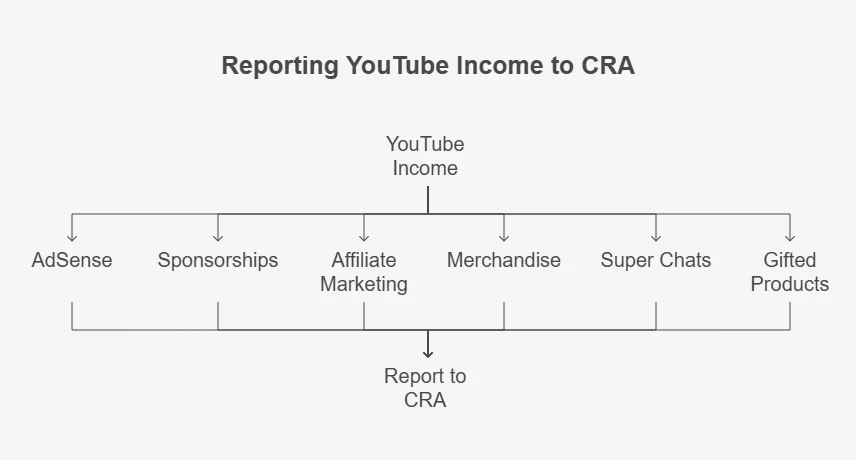

Taxable income follows value and not the format. Most of the independent creators focus exclusively on direct brand payments, but you need to track every revenue stream to avoid tax penalties.

Below, we’ve listed some significant examples of digital income that often leave a clear paper trail for tax authorities.

A. Brand deals, sponsorships, and online selling

Brand deals mean paid promotion tied directly to your primary revenue source. Payments may arrive before posting, after results are measured, or through contracts that involve direct payments for promotional content on your social channels.

- – Fixed-fee campaigns: They pay a set amount for a defined deliverable. For example, a reel video or blog post generates revenue the moment payment is received. Timing does not affect tax treatment.

- – Performance-based bonuses: These depend on clicks, views, or conversions, and payouts may be delayed. But the income still traces back to your content activity.

Selling your own products online is also a business activity. For instance, if you sell hoodies or hats with custom embroidery, the sale is taxable. So, if you sell 100 embroidered caps, you must report the full retail amount as gross income.

B. Merchandise and Product Sales

Income from physical or digital goods adds another layer to your total taxable revenue. For tax purposes, include all sales figures, even if a third party handles shipping, such as:

- – T-shirts, hoodies, or posters sold to followers generate taxable income.

- – Custom apparel and products sold through print-on-demand also count if you’re selling via platforms like Printful & Printify, which handle fulfillment.

- – Selling Notion templates or ebook presets constitutes high-margin revenue, as these assets are taxable in the year the customer makes the purchase.

C. Platform Payouts

Digital platforms can also act as your primary paymaster by distributing shares of advertising or subscription revenue. Report these earnings as gross business income before the platform takes its final cut.

For example:

- – Income from YouTube AdSense is taxable once paid. These amounts remain taxable regardless of whether you leave the funds in your digital account.

- – Instagram monetization payouts from bonuses or gift features represent direct business earnings. You should track these using the monthly statements provided in your professional dashboard.

- – Payments from the TikTok Creator Fund or for high engagement levels constitute regular income for independent creators. TikTok issues Form 1099-NEC (Nonemployee Compensation) for Creator Fund payouts and rewards.

D. Affiliate Income

Affiliate programs pay commissions when your audience purchases products through your unique digital links. You are responsible for reporting every cent earned from these referral activities.

Some of these incomes are:

- – Amazon storefront commissions from recommended gear or lifestyle products accumulate into a taxable total.

- – SaaS referrals that come through promoting software tools, resulting in recurring monthly commission checks.

- – Commission-based links, where individual brand links for clothing or tech accessories generate small but frequent payouts.

Brands pay you to create content for their own marketing channels. This arrangement makes you an independent contractor rather than a traditional influencer.

Check this video to learn more:

Breaking down taxes as a UGC Creator/Content Creator/Amazon Influencer

You are responsible for paying self-employment taxes on every dollar earned from these projects. Learn more about Accounting Tips for Content Creators: How to Stay Profitable and Organized.

Tax Deductions Content Creators Can Claim

Deductions reduce the income you pay tax on by allowing you to claim business expenses. For independent creators, these write-offs act as a reinvestment in your creative growth.

You must ensure every claim is ordinary and necessary for your specific niche to avoid legal scrutiny. If you’re registered as a business, then you can make claims based on this small business tax deductions checklist.

I. Courses and Education

Education is deductible only when it supports your current income activity. The skill must improve how you already earn.

- – Maintain or Improve Skills: You may deduct a Masterclass on CMS if you are currently learning content management systems to better organize your production workflow.

- – The New Business Barrier: A beauty creator cannot deduct the cost of a real estate licensing course because it qualifies them for a different profession.

- – Justification of Value: A course on advanced lighting is deductible for a YouTuber because it improves the quality of their current video products.

If you claim non-deductible personal courses, tax authorities can hit you with accuracy-related penalties. These fines often equal 20% of the underpaid tax amount plus compounding interest.

II. Team Development

Team education counts when it improves output quality or production capacity, as it is an important milestone that shifts your tax profile from an individual to an employer or a contractor client.

Training your staff ensures your production standards remain high as you scale your brand. This includes getting your team up to speed on emerging technologies such as text-to-video tools, which can significantly accelerate content production.

- – Upskilling Subcontractors: If you pay for your editor to master a new motion graphics style, this cost is a 100% deductible business expense.

- – Platform Training: Small teams often use specialized learning platforms to train community managers on crisis response or engagement tactics.

- – Building a Payroll: Wages paid to assistants or scriptwriters are fully deductible and reduce your net profit significantly.

Keep a learning log for every team member. This document should link each course to a specific improvement in video quality or a new revenue stream.

III. Equipment and Software

You may also require the tools to produce content. Purchasing these tools can result in an expense that serves ongoing creation work. The IRS and CRA allow you to recover the cost of these expensive assets through immediate deductions or long-term depreciation.

- – Section 179 of the Internal Revenue Code allows you to treat specific business property as an immediate expense. Under the One Big Beautiful Bill Act (2025), the Section 179 deduction limit increased to $2,560,000 for the 2026 tax year.

- – Monthly fees for editing suites, music libraries, and cloud storage are standard recurring business expenses.

- – Cameras, microphones, and lighting qualify for use in publishing. Partial-use rules apply to shared personal use.

Save digital copies of all hardware purchase receipts. A simple photo of a physical receipt provides a permanent record if the tax office requests proof of your business investment.

Hobby vs Business: How Tax Authorities Classify Creators

Tax authorities distinguish between hobby and business activities. For example, hobby losses are often disallowed, and deductions may be denied when the intent appears casual.

At the same time, these authorities do not care about your follower count or your viral status. What they see is your intent and your organization. The IRS and CRA use a Nine-Factor Test under Section 183 of the Internal Revenue Code to decide if you are running a real business or just enjoying a hobby.

Moreover, in the United States, the One Big Beautiful Bill Act (2025) made the suspension of hobby expense deductions permanent. This means a hobbyist pays tax on their gross revenue without subtracting the cost of gear or software. Avoid this by proving a Reasonable Expectation of Profit through your daily actions.

The following are the important indicators of you being a professional creator for taxation purposes:

- – Consistent Posting: A regular upload schedule proves you treat your platform as a commercial obligation rather than a casual pastime.

- – Business Bank Accounts: Mixing personal and business funds is a major red flag for auditors.

- – Intent to Profit: You must show active efforts to monetize through media kits, rate cards, or outreach emails.

- – Merchandise or Digital Product Launches: Releasing assets such as custom embroidered apparel demonstrates a diversified commercial strategy.

- – Expense Tracking: Track your expenses by keeping digital receipts and monthly ledgers, which indicates a professional approach to operations.

- – Reinvesting in the Team: Paying for subcontractors or training shows you are building an enterprise with long-term value.

In the United States, the IRS generally applies the presumption of profit. It means the agency presumes you are a business if you turn a profit in three out of every five consecutive years. If you consistently report losses, the burden of proof shifts to you.

Wrapping Up!

Once the financial structure is in place, you can identify all revenue sources and track legitimate business costs, giving you greater control. Often, the first step is to identify all business activities that are taxable as a content creator and the amount of deductions you can claim to bring down the tax liability. Managing these moving parts is easier with the right digital tools.

If you are a small business looking for a dedicated platform to handle your specific financial needs, Akaunting lets you categorize revenue from product sales to track education expenses for your team. Also, you can use the automated reports to see your exact tax liability at any moment.

Author bio:

Rushali Das is a Sr. SEO and Outreach Specialist at Ranking Bell. She helps B2B SaaS companies grow organically through performance-led link-building strategies. By earning high-authority backlinks to relevant content assets, she improves search performance, drives qualified traffic, and supports MRR growth. Connect with her on LinkedIn to chat about SEO-driven SaaS growth.