How to Track Expenses and Profits for Your Online Store: A Beginner’s Accounting Guide

Reading Time: 8 minutesYou’ve launched your shop. Sales are rolling in, and your products are gaining traction.

But while growing sales look good on paper, they can be misleading if you don’t know what’s going out. Overheads like shipping, software, or marketing can quietly eat into your margins if you’re not paying attention.

That’s why tracking your spending and profits is essential. Clear tracking shows you where to cut costs and what drives profit, so you can reinvest to grow with confidence.

Here’s a beginner-friendly guide to help you set up a simple system and keep your online store’s finances on track.

Highlights:

- – Expense tracking shows you whether you’re making a profit or burning money

- – You need to identify business expenses, track income, and review spending regularly

- – Budgeting and tracking tools make expense and profit tracking easier

Why Track Expenses in Your Online Store?

Strong sales look great at first glance. But they don’t tell you if your store is actually profitable.

Profit is what’s left after you cover expenses, not just the money that comes through the checkout.

If you’re not tracking those costs, you won’t know how much money you really keep versus how much you need to cover your overhead.

Without this clarity, you may underprice your products because you don’t account for all the costs behind each sale, like packaging, shipping, marketing, and platform fees.

When prices don’t reflect true costs, your margins shrink, and your cash flow gets tighter. Sure, money comes in from your sales, but when bills arrive, there isn’t enough left to pay them.

On top of this, you risk losing out on tax deductions. Expenses such as software, packaging, or even part of your home office may be deductible from your tax bill. But without a clear record of your expenses, you can’t prove these purchases, so you wind up paying more tax than you need to.

When you track income and business expenses, you see the full picture.

You understand …

- – Which products drive profit

- – What’s tax-deductible

- – Where to cut costs

- – Where to reinvest

With these insights, you can turn your numbers into a roadmap to scale while protecting your profit margins.

7 Steps to Track Expenses and Profits in Your Online Store

Tracking your finances is less complex than you might think. With the right steps, you can set up a system that shows exactly where your cash goes.

Here’s a guide to follow to track profits and expenses without feeling overwhelmed.

Step 1: Separate Business and Personal Finances

Draw a clear line between your personal and business money.

(That way, you won’t confuse your store’s outgoing funds with your Friday night takeout budget. 😑)

To do this, open a business bank account and sign up for a business credit card. This makes it easier to track deposits, expenses, and bills without having to dig through your personal transaction records.

Step 2: Identify and Categorize Your Expenses

Categorizing your overheads helps you understand which costs you can predict, which rise and fall with sales, and which quietly chip away at profits.

This knowledge helps you forecast sales and budget for growth, while setting prices at the right level.

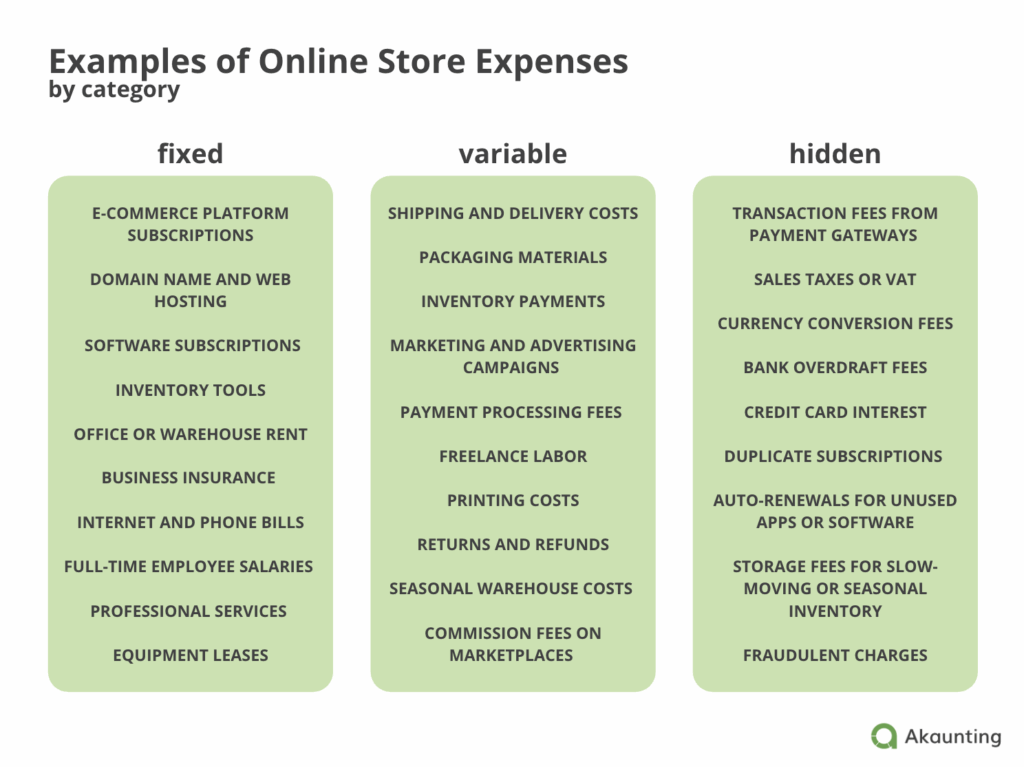

Divide your costs into three buckets:

- 1. Fixed expenses: Regular bills you pay no matter how many sales you make, such as software subscriptions, rent, or insurance.

- 2. Variable expenses: Payments that rise and fall depending on how much you sell. (Think shipping, packaging, and marketing.)

- 3. Hidden costs: These are sneaky expenses that don’t always make the budget sheet — like transaction fees, sales taxes, or subscriptions you no longer use.

(Image by Ioana)

Three columns show examples of online store expenses, organized by fixed, variable, and hidden costs.

For example, say you run an online store with carports for sale.

Here’s how these categories might look in practice:

- 1. Fixed expenses: Carport warehouse rent, insurance for high-value items, e-commerce platform fees.

- 2. Variable expenses: Raw materials, freight shipping, packaging for delivery, seasonal advertising campaigns.

- 3. Hidden costs: Credit card transaction fees, payment processing charges, seasonal storage during slower months, and wastage on returned units.

When you track each category separately, you know exactly where your money goes, and avoid mixing seasonal spikes with your everyday overhead.

Step 3: Choose Your Tracking Method

New store owners often turn to spreadsheets to track their finances. This works fine at the start. But as sales grow, they quickly get messy.

It’s better to use budgeting apps or cloud-based accounting software. These tools record your numbers while saving you time by automating repetitive tasks.

Look for features like:

- – Automated bank feeds and transaction imports so your expenses update in real time.

- – Custom categories so you can group costs in a way that makes sense for your store.

- – Mileage tracking if you use your car for deliveries or business errands.

- – Receipt capture to snap and store proof of purchases.

Popular options include …

- – QuickBooks

- – FreshBooks

- – Xero

But if you want a free, flexible alternative, Akaunting offers a cloud-based, open-source solution built for small businesses and online stores.

(Its mix of tools simplifies expense and profit tracking without needing accounting experience.)

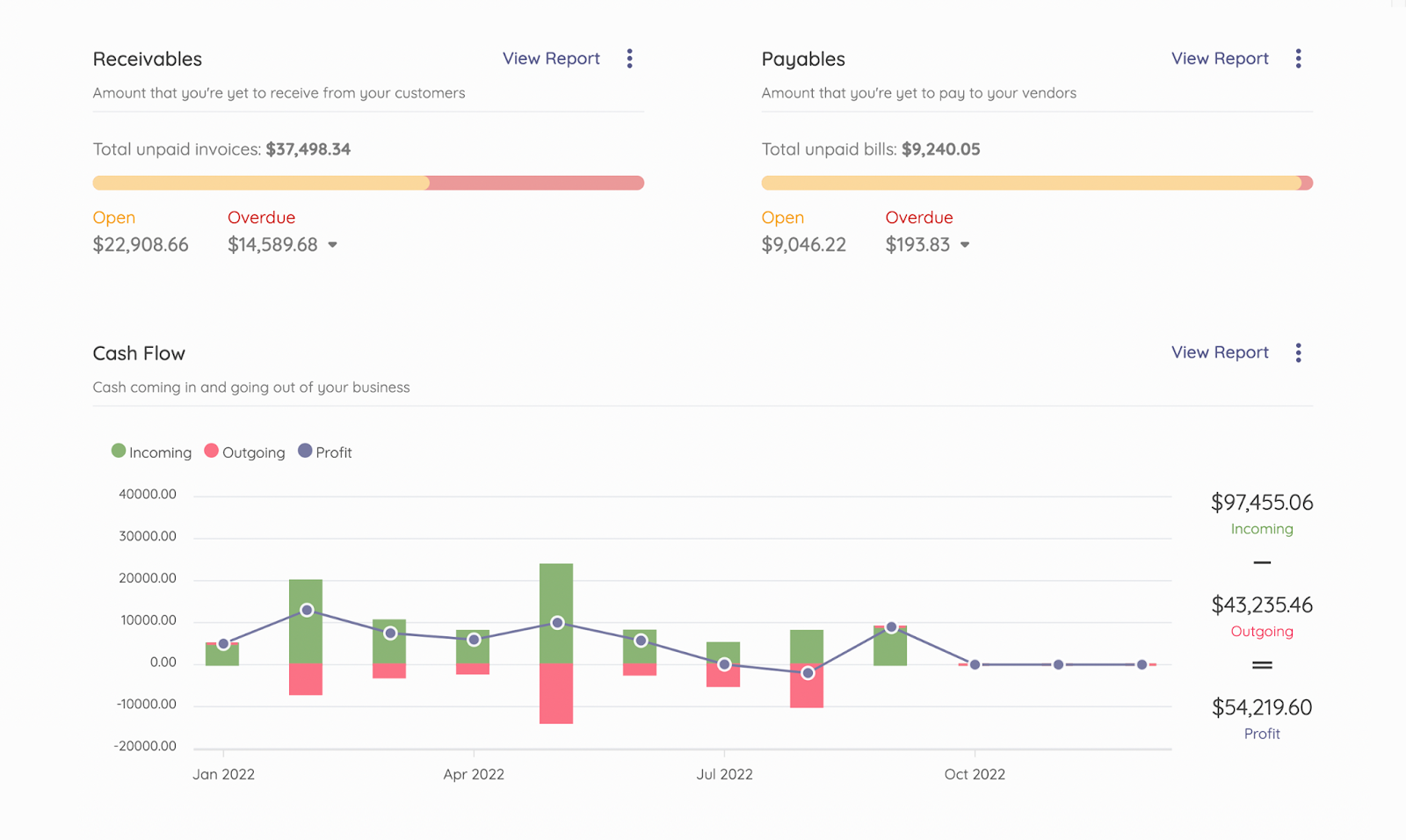

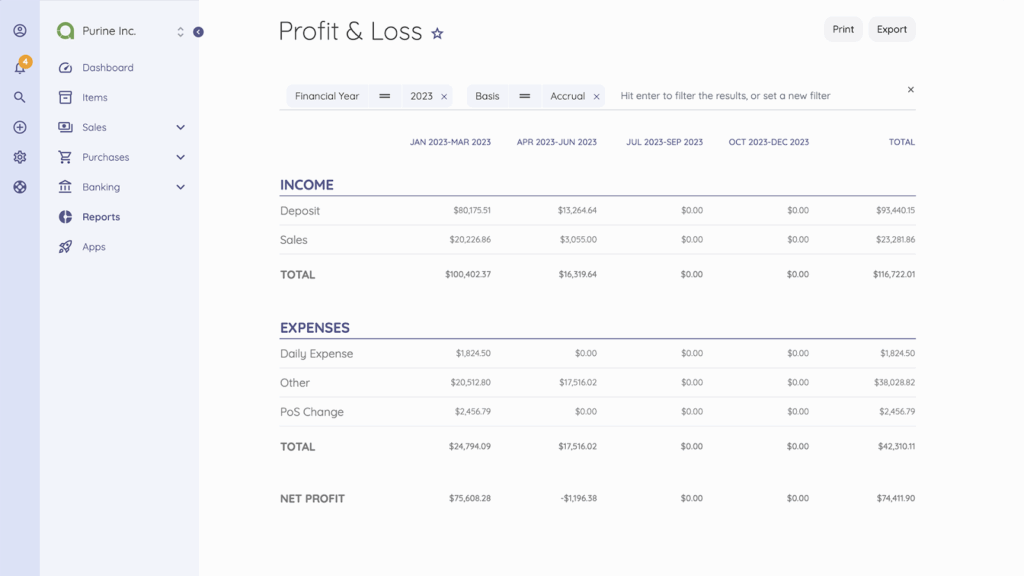

You can connect your bank accounts for automatic transaction imports, capture receipts to keep records organized, and run profit and loss reports to see if sales translate into profit.

It also creates tax reports to help you prepare for tax season.

Step 4: Track Income Alongside Expenses

Expenses are only half the story. To see if your store is profitable, you need to compare income against costs on two levels.

- 1. Overall profit and loss.

- 2. Per-product profit margins.

Overall profit-and-loss gives you the big picture.

A profit and loss report shows whether your total sales cover all costs. If the number is positive, your store is profitable overall.If not, you know your costs outweigh your revenue, so it’s time to adjust.

Per-product profit margins compare the earnings from each product.

Drill down into individual items to see what they make after costs. This breakdown gives you strategic insights on where to focus your resources.

For instance, a clothing brand might find its custom leather blazer brings in more sales than its cuff links and custom shoes.

This insight tells you to put more marketing spend behind the blazer and keep it well-stocked. At the same time, you may need to re-price the cuff links and shoes. Or bundle them with other items as upsells.

Step 5: Review Spending Habits and Patterns

The fastest way to increase profit margins?

Cut your outgoing funds.

First, look at your fixed costs, since they’re not actually fixed forever. The price of materials might rise, or your shipping provider may spike rates. That’s why it pays to regularly review your expenses and see what’s eating into your profit the most.

You’ll be surprised how much you can save by switching to a cheaper supplier or finding new tools that do the same job for less.

Next, look for wasteful spending patterns.

Here are a few of the most common spending traps:

- – Bank overdraft fees from poor cash flow management or delayed balance updates.

- – Express shipping costs due to poor inventory planning.

- – Duplicate subscriptions for the same tool.

- – Old stock taking up paid storage space.

- – Software you no longer use.

These quiet background expenses drain your earnings if you don’t keep them in check.

And then there’s fraud.

Suspicious charges or unauthorized payments are more common than you think.

Check your bank and card statements each month to identify losses that have nothing to do with your expenses.

Step 6: Budget for Growth and Stability

Budgeting gives you a plan for where your money goes next.

Some conventional budgeting methods include…

- – Zero-based budgeting: Start each month at zero and give every dollar a job covering expenses, savings, taxes, or reinvestment. If you have extra left over, assign it to growth, reserves, or strategic debt.

- – Envelope system: Allocate money into categories (like marketing, shipping, or product development) to keep your spending intentional.

- – 50/30/20 budget: Split income into needs, wants, and savings (or reinvestment).

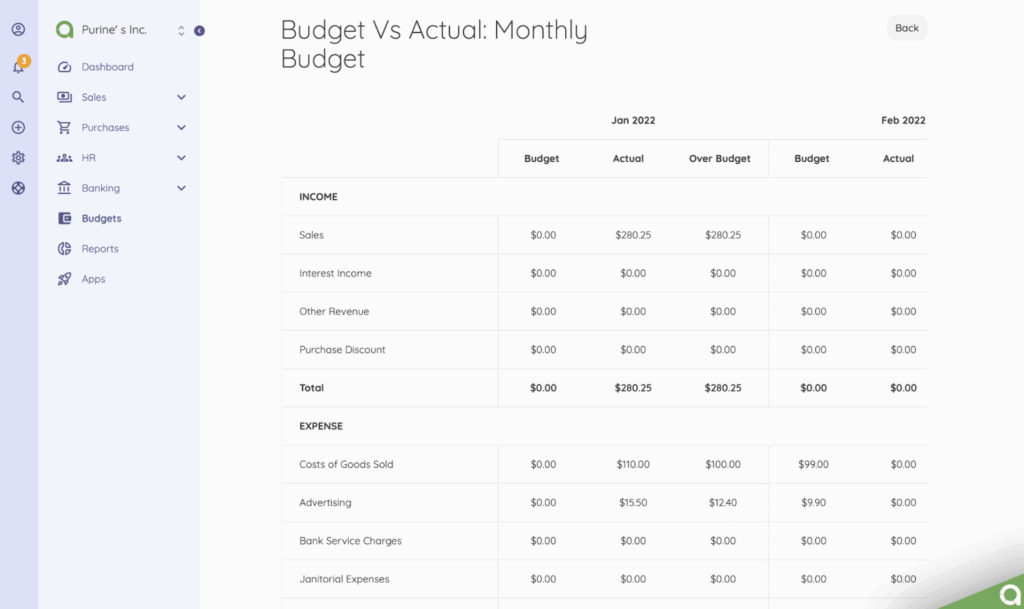

It’s much simpler to use budgeting tools rather than doing this by hand.

If you build a budget in a spreadsheet, it just sits there. You have to manually match your sales and expenses to the numbers, which takes time and is easy to get wrong.

With software like Akaunting’s budgeting app, you can create budgets and compare planned spending to real activity.

Sales and expenses feed in automatically. (The app categorizes your costs immediately to show you whether you’re on budget, and if not, where you’re overspending.)

Step 7: Always Be Ready for Tax Season

Tax season shouldn’t feel like a mad scramble. Instead of waiting until the deadline, treat every month as practice for filing. Track purchase orders, receipts, and expenses year-round so your records are always up to date.

And being proactive pays off. It prevents you from missing valuable tax deductions and filing becomes a straightforward task instead of a stressful rush.

Cloud-based accounting tools make this even smoother by:

- 1. Pulling in transactions automatically from your bank and payment gateways.

- 2. Organizing expenses so you know what each cost relates to.

- 3. Calculating taxes as you go.

- 4. Generating tax-ready reports you can hand straight to your accountant or file yourself.

Wrap Up

When you track profits and expenses clearly, you protect your business and spot opportunities for growth. Follow the steps in this guide to understand your cash flow and scale your operations (without running into nasty financial surprises).

PS: If you want a simple way to get started, use an expense tracking software like Akaunting. It gives you an all-in-one platform to track income, expenses, and profits without needing an accountant.

FAQs

1. Why are expenses important?

Business expenses show you the real cost of running your store. Without tracking them, you won’t know how your costs affect your profit margins. In other words, you won’t know if you’re actually making money. 🙃

2. What will tracking expenses help you do?

Tracking business expenses helps you price products correctly, avoid cash flow crunches, and plan for tax season.

Most importantly, it shows you which products and strategies bring the most profit so you can reinvest with confidence.

3. How can tracking expenses help me create a budget?

When you know exactly where your money goes, you can set realistic budgets.

Tracking your spending lets you see which costs vary and which are predictable, so you can budget better. It also shows you where you’re overspending so you know where to cut back.

About the Author

Kelly Moser is the co-founder and editor at Home & Jet, a digital magazine for the modern era. She’s also the content manager at Login Lockdown, covering the latest trends in tech, business and security. Kelly is an expert in freelance writing and content marketing for SaaS, Fintech, and ecommerce startups.