Securing the Capital: A Guide to Small Business Loans and Financial Tracking for the Construction Industry

Running a construction company is a constant balancing act. You buy materials and pay your crew weeks...

How to Ensure Accurate Payroll and Overtime Compliance Using Time Tracking and Accounting Software

Payroll mistakes hurt your bottom line. They can trigger compliance headaches, employee distrust, and even legal trouble....

2026 Small Business Tax Deductions Checklist

The 2026 small business tax deduction checklist is designed to help you lower your tax bill and...

Billing for Regulated Services: Adapting Your Accounting Workflow for Healthcare Compliance and Audit Readiness

Billing for regulated healthcare services can feel overwhelming. There are rules to follow, documents to organize, and...

How To Avoid Paying Taxes in 2026

This blog post has been updated with the latest 2026 tax rates "How to avoid paying taxes"...

Why ‘Financial Minimalism’ Is the Next Big Move for Small Businesses

You know exactly what the word "pressure" means as a small business owner. It comes from many directions:...

15 Key Factors Small Business Boards Need to Know About Financial Oversight and Transparency

You help small businesses make decisions that keep the company moving forward. You watch money flow and...

Beyond Antivirus: The True Financial Cost-Benefit of Cloud Security for Small Business Data

As a small business owner, you likely view cybersecurity as an IT issue for large businesses. However,...

7 Best Practices for Invoicing Clients for Same-Day and Rush Delivery Services

When you’re offering a same-day or rush delivery service, time is your most valuable asset. But it’s...

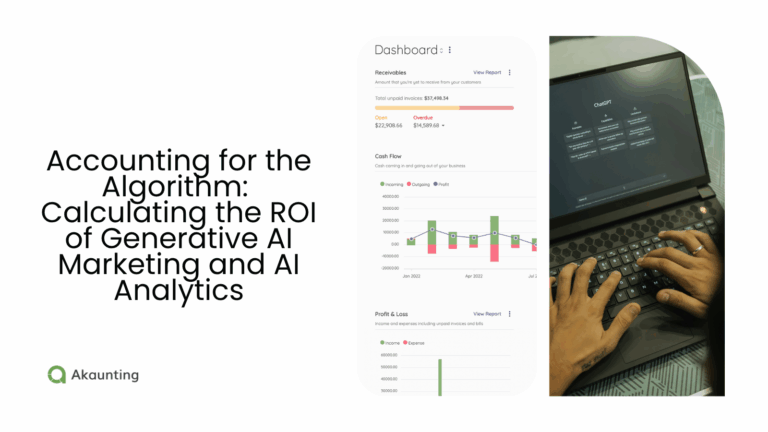

Accounting for the Algorithm: Calculating the ROI of Generative AI Marketing and AI Analytics

You’ve seen the buzz around generative AI. Marketers call it the next big thing. Analysts say it’s...

Securing the Capital: A Guide to Small Business Loans and Financial Tracking for the Construction Industry

Running a construction company is a constant balancing act. You buy materials and pay your crew weeks before you see a dime from...

How to Ensure Accurate Payroll and Overtime Compliance Using Time Tracking and Accounting Software

Payroll mistakes hurt your bottom line. They can trigger compliance headaches, employee distrust, and even legal trouble. And since labor laws shift by...

2026 Small Business Tax Deductions Checklist

The 2026 small business tax deduction checklist is designed to help you lower your tax bill and keep more money in your business....

Billing for Regulated Services: Adapting Your Accounting Workflow for Healthcare Compliance and Audit Readiness

Billing for regulated healthcare services can feel overwhelming. There are rules to follow, documents to organize, and auditors who want proof for every...